November/December 2021

By Jim Borneman, Editor In Chief

By Jim Borneman, Editor In Chief

Trade shows, meetings, in person events — and even personal selling — are trying like heck to make a comeback. This time of year, eyes look forward, trying to plan the course for 2022. And it looks like it may be harder than first thought.

As the industry entered the second half of the year, there was good news. The Industrial Fabrics Association International (IFAI), Synthetic Yarn & Fabric Association (SYFA), and other organizations held in-person events and there was a feeling of “Hey! We are back in business!”

Things were a little different, with antivirus procedures and protocols now part of everyday life. But the strong desire for some sense of normalcy — not a full-blown return to the daily life of say, 2019 — but a life with face-to-face meetings, sharing ideas in person, running into old friends, and even making some new ones, sure felt better for many attendees who have grown tired of staring at the computer screen for another zoom meeting.

Then, just like the old “Jaws 2” movie tag line, “Just when you thought it was safe to go back in the water,” the new COVID-19 variant Omicron made news.

As of this writing, not much is known about the severity of the new variant or the effect of vaccinations and treatment options. But governments are applying new travel restrictions and considering new rules regarding testing and proof of vaccination.

There also is a strong inconsistency in reactions to the Omicron variant, and politicization of the early response — and response in general — is not helping the situation.

Emotionally there are many parallels between COVID and a war. Not to minimize armed conflict, but the emotions of the embattled population are somewhat similar. The general

population suffers real loss — personal, family and friends. Their world is smaller, and movements restricted. Daily life is very different with institutions like schools, law and order, and government shifting roles in society. And, after the initial shock of the foggy engagement and initial crisis subsides, a sense of adapting and finding a way through

the daily battles comes to bare.

There is a sense of optimism out there — one not stoked by just wishful thinking — that 2022 will have a path to a more normal daily life. There will noise from all corners, but many will find their way down the center.

As of this writing, the year 2022 has a host of in-person textile events on the calendar, and the current conditions don’t seem to be impacting those plans. However, shows early in the year are threatened.

As Omicron is studied and better understood, as new drugs are approved to treat COVID, and if lockdowns and travel restrictions are eventually relaxed, 2022 shows like IDEA® in Miami and Techtextil North America/Texprocess Americas in Atlanta will create some terrific opportunities for business, innovation and investment in U.S. textiles.

There are lessons learned from the COVID war, but maybe it is time to shout, “Hey! We are back in business!”

November/December 2021

Zoltek Companies Inc. — with production facilities in the United States, Hungary and Mexico; and a U.S. subsidiary of Japan-based Toray Industries Inc. — has announced a capacity expansion in its large-tow carbon fiber production in 2023. Large- tow carbon fiber is fiber with more than 40,000 filaments and is often used in industrial applications such as wind turbine blades. The $130 million investment will be used to increase capacity at a Zoltek facility in Jalisco, Mexico, by approximately 54 percent to more than 20,000 tons per year. Once the new capacity is up and running, combined annual production of Zoltek’s Mexico and Hungary plants will be 35,000 metric tons.

Zoltek Companies Inc. — with production facilities in the United States, Hungary and Mexico; and a U.S. subsidiary of Japan-based Toray Industries Inc. — has announced a capacity expansion in its large-tow carbon fiber production in 2023. Large- tow carbon fiber is fiber with more than 40,000 filaments and is often used in industrial applications such as wind turbine blades. The $130 million investment will be used to increase capacity at a Zoltek facility in Jalisco, Mexico, by approximately 54 percent to more than 20,000 tons per year. Once the new capacity is up and running, combined annual production of Zoltek’s Mexico and Hungary plants will be 35,000 metric tons.

Growing demand for alternative forms of energy, including wind power, are driving increases in demand for large-tow carbon fiber. Toray reports it expects the market for this fiber to continue to expand over the medium to long-term, and its investment will help stabilize supplies.

November/December 2021

Early bird registration is now open for next year’s Techtextil North America and Texprocess Americas, which will take place at the Georgia World Congress Center in Atlanta. The event takes place May 17-19, 2022, but anyone registering before February 18, 2022, has the opportunity to save on exhibit hall, symposium and special event tickets.

Attendees are encouraged to purchase all tickets in advance. Early registration also makes planning easier, reduces wait times to pick up badges and ensures attendees are able to attend all events. Some features, such as the symposium and Official Techtextil North America & Texprocess Americas Reception, have a capacity limit.

To learn more about the show and purchase early bird tickets, visit the event’s joint website: techtextil-texprocess.us. messefrankfurt.com.

November/December 2021

VF Corp. has announced a $10.2 million investment in Martinsville, Va., to increase capacity at a 500,000-square-foot distribution center. The expansion includes 82 new jobs. A grant in the amount of $225,000 from the Commonwealth’s Opportunity Fund was approved by Governor Ralph Northam to assist Henry County with the project. The Virginia Economic Development Partnership worked with the Martinsville-Henry County Economic Development Corp. and the Virginia Office of Outdoor Recreation to secure the investment for the state, which was in competition with California and Pennsylvania.

“VF Corporation has thrived in Henry County for nearly 20 years, and we are thrilled to see the company continue to invest in the Commonwealth,” said Governor Northam.

“We’ve proudly operated our distribution center in Martinsville for 18 years and we know that continuing to invest in Martinsville is the right choice given its location and committed employees,” said Cameron Bailey, VF Corp. executive vice president, Global Supply Chain. “The planned investments in this facility, from enhanced technology to improved distribution equipment, as well as the 82 new full-time positions, will help deliver our products to our consumers in a more efficient and prompt manner.”

November/December 2021

Milliken & Company, Spartanburg, S.C., reports all of its flooring portfolio — including carpet, luxury vinyl tile and entryway tile products — are now carbon neutral. This means the company offsets carbon emissions in raw materials and manufacturing carbon footprint — as calculated and verified through an ISO 14025/ISO 14040-compliant life cycle assessment and published in a third-party environmental product declaration — using Verified Carbon Standard credits. The company is committed to a carbon-neutral initiative, M/PACT, led by its flooring business.

“A healthy future requires a commitment to big goals and developing world-class expertise,” shared Halsey Cook, president and CEO for Milliken & Company. “By utilizing our materials science expertise across a range of industries, we can develop sustainable products. We can also ensure that we are doing our utmost to manufacture those products in a responsible manner. It will be collaborations and collective efforts that move the needle on sustainability.”

“We are continuously working to remove unnecessary materials from our products, use recycled materials and reduce our dependence on oil,” said Jim McCallum, president, Milliken’s Flooring Business and executive vice president of Milliken & Company. “Our WellBac™ carpet products are Red List Free, containing no harmful chemicals, and all our flooring products have 100-percent transparency in materials to 100 ppm. We prioritize sourcing materials locally and manufacture our products regionally to decrease shipping distances.”

November/December 2021

By Jim Phillips, Yarn Market Editor

By Jim Phillips, Yarn Market Editor

Manufacturing activity increased in November as the overall economy continued to grow for the 18th consecutive month, according to the Institute for Supply Management (ISM) Report on Business®.

According to the December 1 ISM report, the 11 industries reporting growth in production during the month of November — listed in order — are: Petroleum and coal products; textile mills; furniture and related products; paper products; electrical equipment, appliances and components; computer and electronic products; machinery; chemical products; miscellaneous manufacturing; food, beverage and tobacco products; and plastics and rubber products.

The exports of textile and apparel from the United States increased by 20.15 percent in the first nine months of 2021, as compared to the same period a year ago, according to data from the U.S. Department of Commerce Office of Textiles and Apparel (OTEXA). Among textile mill products, yarn exports increased by 26.09 percent year-on-year to $2.902 billion, while fabric exports were up 15.79 percent to $6.451 billion and made-up and miscellaneous article exports grew 12.92 percent to $3.011 billion.

The value of exports stood at $16.75 billion during January-September 2021, compared to $13.941 billion in the same period last year, according OTEXA.

Category-wise, apparel exports increased by 28.94 per cent year-on-year to $4.385 billion, while textile mill products rose 17.31 per cent to $12.365 billion during the first nine months of 2021.

Mexico and Canada together accounted for nearly half of the total U.S. textile and clothing exports during the period under review. The United States supplied $4.726 billion worth of textiles and apparel to Mexico during the nine-month period, followed by $3.911 billion to Canada and $1.051 billion to Honduras.

Historically, textile and clothing exports have remained in the range of $22 billion to $25 billion per year. In 2019, for example, exports for the year totaled $22.905 billion. The effects of the global COVID-19 pandemic, however, caused the value of exports in 2020 to fall to $19.330 billion for the year.

Yarn Market first reported on the eventual need for sustainability and traceability programs more than a decade ago. Back then, conversations about those issues were primarily concentrated in the agriculture and consumer products segments. But, even in the mid-2000s it was becoming clear that sustainability and traceability would eventually become priorities for any industry that manufactured components for products that would eventually be sold to consumers.

Today, the United States has become a world leader in sustainability.

In late November, Unifi Inc. announced a major milestone. The company has now transformed more than 30 billion post-consumer plastic bottles into its REPREVE® recycled performance fibers that are used by hundreds of the world’s leading brands.

“Our brand and mill partners helped us achieve this ambitious goal,” said Unifi CEO Eddie Ingle.

“By making the switch to sustainable by choosing to use Repreve, we’ve been able to keep more than 30 billion plastic bottles out of landfills. We want to thank consumers for choosing to buy products — ranging from apparel to home furnishings to shoes — made with Repreve. Together, we are working today for the good of tomorrow.”

Unifi began setting recycling goals in 2017 after hitting the 10 billion bottle milestone. The company pledged to transform 20 billion bottles by 2020 and 30 billion bottles by 2022. However, the company reached its 30-billion- bottle goal a year early.

To put this achievement into perspective:

November/December 2021

People excited to return to “live” events and Nashville deemed a success both in terms of the show and the location.

People excited to return to “live” events and Nashville deemed a success both in terms of the show and the location.

By Jim Kaufmann, Contributing Editor

IFAI Expo, held recently in Nashville, Tenn., saw a continuation of the industry’s reemergence from a year-and-a-half of pandemic-induced hibernation. Judging by the reactions of exhibitors and attendees alike, the 100th anniversary edition of the show — with its corresponding special events and technical programs — was a pleasant success.

“We had lowered expectations coming into this show, but are very happy with our booth traffic and the discussions held,” said Ted Fetterman, vice president, sales and marketing, Bally Ribbon Mills, Bally, Pa. “I think people are ready to come out of hibernation. I know I am! And this industry has always been look, touch and feel, which is very hard to do by email or on a Zoom call.”

Other attendees agreed with those sentiments. Uli Tombuelt, CEO of Sattler USA, said: “Obviously this year’s attendance is less than in previous years, but we’re still having a very good show. There are a lot of interested buyers here and there is a lot of buying going on!”

IFAI reported there was a total of 3,173 attendees on site with 218 exhibitors on the expo show floor.

The Advanced Textiles (AT) Conference kicked off the first day of expo activities with a lunch and plenary session on innovation titled “A More Perfect Union — Advancing Textile Manufacturing Through Collaboration.” This session was followed by speakers discussing innovations in e-textiles, medical textiles, Industry 4.0, advanced manufacturing and sustainability, among other topics. One highlight from the AT conference was e-textile sessions presented by Dr. George Sun, CEO, Nextiles, and Clare King, president of Propel LLC. The somewhat astonishing fact was presented that currently “there exists over 2 billion more ‘connected electronic devices’ then there are people in the world” as part of the reason for the continued interest in e-textile wearables. King drew praise from several attendees by suggesting that “we need to build a bridge between technology and textiles, and to do that we would benefit from a textile/electronics engineering discipline being offered.” She added that “textile engineers are undervalued and really need to be paid more,” which was nice to hear openly expressed, because plenty of industry veterans already knew that.

Day two began with IFAI’s Annual Meeting where outgoing Chairman Kathy Schaefer, CFO of Glawe Awning & Tent Co., reviewed IFAI’s metrics validating that the organization had been able to manage well through the pandemic, its membership remains strong and that IFAI continues to be a solid and thriving industry organization. She also announced several member awards, including an Honorary Life Membership to Dennis Bueker of Miami Corp., before formally handing off the position to incoming Chairman Amy Bircher, founder and CEO of MMI Textiles Inc. Bircher, IFAI’s 53rd chair, acknowledged that the industry is experiencing numerous challenges related to supply chain and labor issues similar to other industries, but that IFAI’s board would be working to rebrand the organization going forward to emphasize collaboration across its different divisions and within the various industry segments in order to strengthen the organization as a whole and strengthen its future (See “Amy Bircher: New IFAI Chairman,” TW, this issue).

Then, following keynote speaker Steve Rizzo’s entertaining presentation on the powers of optimism — where he offered that “we create our own realities” and “need to get out of our own way so that we can live the life we deserve” — for expo attendees, it was either on to more of the AT conference sessions or out to the show floor to create some new realities.

The IFAI Expo show floor was markedly smaller than in years past with numerous companies opting for smaller booths. That said, most on the show floor were resolutely upbeat. “It’s just nice to see people in person again instead of the numerous emails, calls and Zoom calls we’ve all been juggling throughout the pandemic,” stated Juliana Wilson, a technical sales representative for Warwick Mills. “Warwick has shown before, but this is my first time at IFAI and I’ve felt very welcomed. We’ve had several very good meetings and have made numerous strong connections.” Zoe Newman, a graduate student at the Wilson of Textiles at NC State University, was also a first-time visitor to IFAI Expo. “It’s been great to be here and see the diversity of the textile industry and its wide-reaching applications,” Newman said. “It’s also been nice to actually put a face with the names of companies, products and people that we’ve come in contact with or learned about through our studies.” Tony Ehrbar, owner and CEO of American Tent, added: “It’s been a good show and we’ve had a steady stream of traffic throughout. We didn’t know what to expect but it feels like the attendees are not just tire kickers, they’re actual decision makers.”

The show floor was also a good place to be for those looking for innovation. “You can’t really look for innovation while sitting behind your desk,” Fetterman suggested. “You need to get out and see concepts, ask questions and have the discussions. Then think a bit and maybe ask more questions, all of which is hard to do from behind a desk.”

Innovation was definitely found at a number of different booths. Advanced Functional Fabrics of America (AFFOA) — an industry organization “working to enable a manufacturing-based revolution by transforming traditional fibers, yarns and fabric into highly sophisticated, integrated and networked devices and systems” — had several innovative concepts on display in its booth and a constant flow of curious people. Alpha Systems, a manufacturer of straight drop motor systems for awnings and window treatments was one of several companies receiving this year’s IFAI Show Stopper awards for its innovative products. “The show and networking events have been really good for us,” said Alpha Systems’ Samuel Alamsyah. “Angie from IFAI has been great to work with and we’ve had really good discussions with our customers and partners this week.”

Renegade Plastics, founded only a few months ago to commercialize and further a new plastics-based technology, used the show floor to present a soft introduction of its products that should be available in early 2022. According to Curran Hughes, Renegade’s president, the plastics technology, available in films and scrims, will be lighter, yet with the same performance of heavier polyethylene fabrics and films used in the agricultural space. “The polymers used are expected to be food safe, so no off-gassing concerns, will have long life and will be fully recyclable,” Hughes said. “It presents an alternative to vinyl that can perform similarly, yet without as many environmental concerns.” Initial product introductions in Asia and Europe have already garnered acceptance. “Our long-term goals are essentially to make upstream plastics more sustainable, while building a closed loop plastics economy for upstream industries,” Hughes added. “We want to change ‘plastics as usual.’”

It should also be noted that Nashville received rave reviews from attendees. “Nashville is a great location for trade shows,” offered Jim Briggs, global market leader, Mehler Engineered Products. “The conference hall is nice and conveniently located close to hotels and the entertainment districts where there are lots of options to entertain and be entertained.” “Nashville just creates a great environment for an industry event like this,” Warwick’s Wilson added. “There’s the city’s history, good food, plenty of live music, and all easily accessible, which allows you to venture out with new and old friends alike and have some fun.”

“Nashville was a wonderful location for IFAI Expo and we’ll be back!” said Steve Schiffman, IFAI president. “The industry was excited to be back together, and we were delighted to provide the venue to help people reconnect. We’re already well into planning and looking forward to IFAI Expo 2022, October 12–14, 2022 in Charlotte, N.C.”

Hopefully, the industry’s reemergence endures unabated and life in general is able to continue its way back to some semblance of normalcy.

Read about the 2021 IFAI International Achievement Award Winners here.

November/December 2021

After hosting a successful fall conference — SYFA’s first in-person event in two years — the association looks to 2022 and its 50th anniversary.

After hosting a successful fall conference — SYFA’s first in-person event in two years — the association looks to 2022 and its 50th anniversary.

TW Special Report

After back-to-back-to-back cancellations of its 2020 meetings and also its spring 2021 meeting because of “continued effects of the Covid-19 virus,” the Synthetic Yarn and Fabric Association (SYFA) was excited to gather in person for the fall 2021 meeting held recently at the Sheraton Charlotte Airport Hotel, Charlotte, N.C.

The event focused on the industry’s current supply chain challenges under the title, “Identifying Solutions for Growth Amidst A Disruptive Supply Chain.” Presenters came from companies including Kuehne + Nagel International, Accelerating Circularity, Gap Inc., Hire Dynamics and Wood Mackenzie, as well as the Hohenstein Institute, Manufacturing & Textile Innovation Network and Kennesaw State University.

While attendance was slightly lower than for a typical SYFA conference, overall turnout was good and things look promising as SYFA looks to 2022 when it celebrates its 50th anniversary.

“It was encouraging to see the strong in-person attendance, and so good to be back together as a group,” said SYFA President Daniel P. Sistrunk. “Think of what we’ve all been through over the last 18 months — a global pandemic, labor issues, a shipping crisis, supply chain disruption and more! Yet we, the SYFA and its members, are still going strong, which is a testament to the value of the organization and its importance to the industry. As we prepare for our next conference and the 50th anniversary of the organization in 2022, we are positioning ourselves to provide even greater value through our publications and conferences and continue to move forward in support of our members and the textile industry.”

Conference sponsors included Gold Sponsors Premiere Fibers Inc., Unifi Inc. and Jomar Softcorp International Inc.; Silver Sponsor Pulcra Chemicals LLC; and Bronze Sponsors Goulston Technologies Inc. and Polyspintex. Patrons included Avient, the Association of the Nonwoven Fabrics Industry (INDA), Milliken & Company, Measured Solutions Inc., and the Furniture Manufacturing Expo.

SYFA will hold its next conference April 21-22, 2022, at the Sheraton Charlotte Airport Hotel.

November/December 2021

Reasons for upward trend in cotton prices and future outlook not entirely clear.

Reasons for upward trend in cotton prices and future outlook not entirely clear.

By Jon Devine

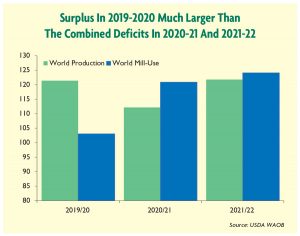

To say the least, it has been an interesting couple of years for the cotton market. With COVID, an initial effect was a large overhang in supply. Before the pandemic, the expectation was that cotton production and mill demand would be virtually even in the 2019-20 crop year. When the virus shuttered spinning mills around the world, it caused a yawning surplus. At nearly 20 million bales, it represented the second-largest addition to global supply on record, only behind the addition made to stocks in 2011-12, after the 2010-11 spike, according to market and trade data from the United States Department of Agriculture (USDA) Foreign Agricultural Service (FAS).

Since then, a global production deficit occurred in the 2020-21 crop year — 5 million bales — and a small deficit is expected for the world in the current 2021-22 crop year — 2 million bales. The net result expected after these three crop years is the addition of more than 10 million bales to global stocks, according to the USDA FAS.

Before COVID, the world was not facing a shortage of cotton. With supplies swollen, a persistent question is why cotton prices have been able to continue to climb.

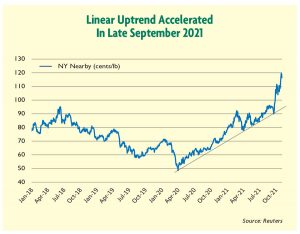

Part of the reason may be that cotton prices have simply been unable to break lower. Since April 2020, cotton prices have moved only in one direction. This has happened despite the emergence of the COVID delta variant, recurring lockdown orders around the world, persistent shipping challenges, inflation, and concerns about the future trajectory of Chinese economic growth.

Cotton’s undefeated uptrend may be partly due to what has been called the “everything rally” that has spanned financial markets. An illustration is the correlation between cotton futures and the S&P 500. Both tracked a nearly linear trend line since April 2020. Relative to their averages in January 2020 — pre-COVID — nearby cotton futures were down 31 percent at the start of April 2020 and the S&P 500 was down 25 percent. By the end of August 2021, nearby cotton futures were up 37 percent versus their January 2020 average and the S&P 500 was up 38 percent, according to data from Reuters and calculations by Cotton Incorporated.

One common thread shared among cotton and other seemingly unrelated financial markets was the rising macroeconomic tide in place since the worst of the shutdown period. Relatedly, another shared connection is exposure to the unprecedented stimulus measures that were unleashed to counter the effects of shutdowns and other restrictions on economic activity.

Among other efforts, the Federal Reserve has been pumping $120 billion of new money into the economy each month since the spring of 2020. The Fed has been doing this to prevent the collapse of asset values. In this regard, it appears to have been succeeding, with prices across many asset classes rising together.

This economic effort plus other stimulus measures, has left many U.S. consumers better off than before the pandemic. Direct payments and reduced spending lifted consumer savings rates to level nearly double those before the pandemic, according to the U.S. Bureau of Economic Analysis. On top of that, the value of consumers’ largest assets, including their homes and retirement accounts, have risen sharply according to Federal Reserve data.

Rebound In Consumer Demand

Rebound In Consumer DemandWith travel and other recreational services still affected by COVID-related regulations and concerns, this has translated into spending growth on physical goods like clothing. Relative to the same period in 2019, consumer spending on apparel has been up 25 percent over the past six months. U.S. Bureau of Economic Analysis data shows normal rates of spending growth for apparel are 2 to 3 percent, so consumer demand is well beyond what could have been expected without the virus.

Even with port congestion and rising costs, retailers and brands have been ramping up imports of finished textiles. In terms of raw cotton equivalence, U.S. imports of apparel are set to post their highest volume since 2010, and U.S. imports of home textiles are on pace to set a new record according to the USDA Cotton and Wool Outlook and Cotton Incorporated calculations.

Demand pull from other countries has not been as strong, but the world has collectively pulled out of recession. During recessions, companies commonly seek to conserve cash to survive. This generally means pulling back on orders and inventory. When demand resurfaces during the recovery, a common result is a wave of orders to refill pipelines. The scramble to secure capacity can bid up costs for materials and manufacturing.

U.S. Supplies Tight

U.S. Supplies TightWhile stimulus and the everything rally may help explain the linear growth in prices from the spring of 2020 through the summer of 2021, desperation to secure cotton to meet near-term needs may help explain the acceleration in cotton price increases since late September.

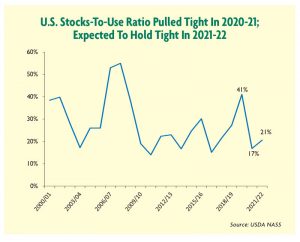

Compounding the difficulty of getting cotton shipped to mills in a timely fashion is that the world’s largest cotton exporter, the United States, experienced significant tightening last crop year. The combination of adverse weather conditions and strong demand from China caused U.S. cotton stocks to drop by more than 50 percent between the start and end of 2020-21, according to the USDA FAS.

The current stocks-to-use ratio estimate for the United States in 2021-22 is below 20 percent. This ratio has fallen below that level just a handful of times over the past couple decades. In 2021-22, the United States is expected to collect a healthy harvest. However, strong import demand from China and other markets is expected to keep U.S. stocks at relatively tight levels through the end of the 2021-22 crop year, according to USDA FAS data.

Heavy speculator investment likely has been another factor in the recent price surge. Among other possible factors, speculators could have been attracted to the cotton market due to the tightness in U.S. supply, strong Chinese purchases of U.S. cotton, and memories of what happened to cotton prices after the last recession. The Commodity Futures and Trade Commission (CFTC), the government agency that oversees all U.S. futures markets, reports positions in futures according to participant type. Between September 21 and October 5, the CFTC reported that speculator bets that cotton prices would increase grew 48 percent. That surge of money on the long side of the market could have contributed to volatility.

An old saying in commodities markets is that the best cure for high prices is high prices. The reason is that higher prices motivate producers to increase supply while they simultaneously depress demand.

One decade ago, cotton prices rose to levels much higher than they have currently. Record prices in 2010-11 resulted in a new record for global acreage in 2011-12. Those record prices also caused a seven-year depression in cotton demand, with it taking until 2017-18 for world mill-use to recover back to its 2009-10 level.

The everything rally pulled corn and soybean prices higher alongside those for cotton. However, the latest surge in the cotton market has made cotton more favorable and three-digit cotton can be expected to boost cotton acreage in the next crop year. The outlook for demand is less clear, but a slower pace could be expected to follow the initial push to refill supply chains. If forecasts for 2022-23 call for a significant surplus in the United States and globally, they could prove to be the challenge that finally upend the uptrend.

Editor’s Notes: Jon Devine is a senior economist with Cary, N.C.-based Cotton Incorporated. The information contained herein is derived from public and private subscriber news sources believed to be reliable; however, Cotton Incorporated cannot guarantee its accuracy or completeness. No responsibility is assumed for the use of this information and no express or implied warranties or guarantees are made. The information contained herein should not be relied upon for the purpose of making investment decisions. This communication is not intended to forecast or predict future prices or events.

November/December 2021