2003 Innovation AwardBy Jennifer Dennard, Assistant EditorSprings Industries’

Tradition Of Change

Springs Industries continues to evolve, from a gingham cotton cloth producer in 1887 to a

manufacturer of a wide variety of coordinated home textile products.As you groggily move from

bedroom to bathroom to kitchen in the morning, take a closer look at each of the home furnishings

you use. Chances are, the duvet cover and sheet you throw off when the alarm goes off, the window

shade you raise, the bath mat you step on, the shower curtain you pull, the towel you wrap yourself

in as you get out of the shower, the accent rug in the hallway, the kitchen towel you wipe up your

spilt orange juice with, and even the napkin ring you slip your napkin out of as you sit down to

breakfast came from Springs Industries Inc. These products may bear such names as Wamsutta®,

Springmaid®, Graber® and Bali®, to name just a few of the brands Springs has on the market today.

Springs Industries offers a wide variety of coordinated textile products for almost every

room in the home.You might not give them much thought, but Springs does. More than 17,000 Springs

employees in 40 manufacturing plants in 12 states, Canada and Mexico turn out a complete line of

coordinated home textile products each year.Over the past 116 years, Springs has grown from a

one-mill company to a multibillion-dollar corporation, merging, consolidating, focusing and

refocusing its corporate strategy in an effort to offer its retail customers the widest range of

home furnishings from a single supplier. In The BeginningThe first incarnation of Springs was known

as Fort Mill Manufacturing Co., founded in Fort Mill, S.C., in 1887 by a group of town leaders that

included Samuel Elliott Captain White, who was elected first president of the company.

Springs’ founder Samuel Elliott “Captain” WhiteThe establishment of Fort Mill Manufacturing

helped turn a small town of seasonal farmers into a larger town of mill workers. Although farming

had been the way of life for quite some time, the citizens of Fort Mill found the mills

construction brought with it a better way of living. The Fort Mill plant wove its first yard of

gingham cloth in early 1888. The company grew in the next few years, acquiring the charters of

Catawba Manufacturing Co., as well as the assets of Luna Cotton Mills, later renamed the White

Plant.A Time Of GrowthAnother yarn was woven into the fabric of Springs in 1895, when Lancaster

Cotton Mills was officially chartered in Lancaster, S.C., under the watchful eye of Captain Whites

son-in-law, local entrepreneur Leroy Springs.Lancaster Cotton Mills began ginning cotton and

weaving cloth a year later. After several expansions over the next 18 years, it was said by some to

be the largest cotton mill in the world under one roof.Springs had an eye for growth, acquiring the

Chester Manufacturing Co. in Chester, S.C., in 1904. He became president of the company, and

promptly changed its name to Springsteen Mill.Springs that year also was appointed president and

general manager of Fort Mill Manufacturings White Plant. He then became president of Fort Mill

Manufacturing upon Whites death in 1911. A year later, Springs was elected president of the Kershaw

Cotton Mill, an enterprise in Kershaw, S.C., in which he was a major stakeholder.

Leroy Springs

A 1913 schematic of Fort Mill Manufacturing Co.In 1914, Lancaster Cotton Mills acquired the

assets and assumed the name of Fort Mill Manufacturing Co. Springs took over Fort Mill

Manufacturing with the same desire for frenzied growth he had shown with Lancaster Cotton Mills. He

invested time and money into numerous expansions and acquisitions, an early indication of Springs

Industries modern-day business strategy.By 1919, Fort Mill Manufacturing was operating numerous

gingham cloth manufacturing mills in the area, including the Fort Mill Plant, White Plant,

Lancaster Plant, Kershaw Plant, Eureka Plant and Springsteen Plant.Company troubles hampered the

last years of Springs life. Cotton prices were dropping, leaving the company with a large supply of

cotton, but no demand for finished goods. Young men were leaving mill work behind and signing up

for the Armed Forces, as the United States entered World War I. An influenza epidemic in Lancaster

forced some mill production to stop because of lack of workers. And the first hints of the Great

Depression in the late 1920s caused the people of Fort Mill Manufacturing to wonder what the future

would hold.A Time Of LegendUpon Leroy Springs death in 1931, his son, Colonel Elliott White

Springs, inherited six cotton mills, 5,000 employees, 7,500 looms and 300,000 spindles.The legend

of the Colonel began while he was still alive. He took over the company with the same zeal his

father had shown. He made it his business to know every piece of machinery and every employee on

each of the mill floors. He also made it his business to bring the company back to profitability by

cleaning up the companys financial troubles, reorganizing the mills, upgrading the machinery and

streamlining management. Efficiency was, and still is, the word of the day at Springs. In 1933, the

Colonel changed the companys name to Springs Cotton Mills. A new era in the history of Springs had

officially begun. Boom TimeUnder the Colonels direction, Springs Cotton Mills became a manufacturer

of not only carded greige goods, but also towels, sheets, pillowcases, bedspreads, spun rayon

fabrics and dress goods, among other products. The Colonel wanted to lead Springs into the finished

goods market, and so invested in numerous expansions during the 30s. His dream was put on hold,

however. War would have to come first.

Colonel Elliott White SpringsWartime production took over Springs totally by 1943. Fine yarns

were no longer produced. Coarse yarns went into a wide range of military fabrics, including cloth

for raincoats, gas masks, nurses uniforms, mattress covers, sheets and pillowcases.Almost 25

percent of Springs workforce went to war, even the Colonel. The World War I ace fighter pilot

returned to active service and attained the rank of lieutenant-colonel. And yet, despite his

absence, the company met all government contracts issued from 1941 to 1943. The Springs plants were

awarded the Army-Navy E Award for Excellence at the end of 1943 for this exemplary service.In 1945,

Springs experienced a post-war boom. The Colonel was finally able to commence turning the company

into a full-fledged producer of finished goods. The mills were once again expanded and upgraded.

Grace Bleachery and Finishing Plant was built. Springs Mills Inc., a New York City-based selling

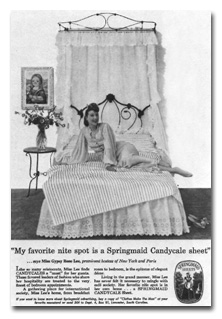

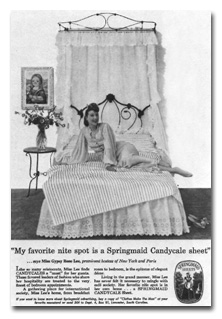

house, was established, and Springs first national Springmaid advertising campaign got

underway.Under the Colonels leadership, Springs became an even more active participant in its plant

communities. The company initiated employee benefits and profit-sharing programs. And the Springs

Foundation, a general welfare fund for local communities, was established to provide money for

healthcare, welfare, public schools and scholarships a precursor to Springs modern-day

philanthropic work.

Springs Mills Inc., the New York City-based sales headquarters, was established in

1945.Nonstop ExpansionUpon the Colonels death in 1959, Springs Cotton Mills had seven greige mills

and a finishing plant, 12,000 employees, no debt, $50 million safely in the bank, $184 million per

year in sales, and a large chunk of the marketplace, thanks to the success of the Springmaid

line.Hugh William Bill Close, the Colonels son-in-law and successor, took over when the Colonel

passed away. Close realized that even though Springs seemed to be on top, further modernization,

efficiency and an updated product line would be needed to truly transform the company.

Hugh William “Bill” CloseHe set about achieving this goal at a furious pace, investing $230

million over the next 10 years. A new sales and marketing headquarters was built in New York City,

a reflection of Closes decision to turn Springs into a marketing-oriented, rather than a

manufacturing, company. Under Closes direction, the company built a cotton warehouse in Fort Lawn,

S.C., and decided to build a finishing plant in Laurinburg, N.C. The Elliott and Frances plants for

combed apparel fabrics and sheeting were built, as were the Crandall Finishing Plant and Leroy

Plant for polyester/cotton apparel fabrics. The Patricia Plant was built and then expanded for the

production of towels. The Katherine Plant was constructed for polyester/cotton sheeting.

The first Springmaid advertising campaign was launched in 1945.Weathering The StormIn 1966,

three years after its 75th anniversary, another era began in the history of Springs. The company

consolidated manufacturing and selling operations into one organization, Springs Mills Inc. This

latest corporate incarnation went public that same year.By 1969, Springs had 22 plants; a

state-of-the-art customer service center, dedicated the previous year; almost 20,000 employees; and

a larger offering of apparel and home furnishings. Merchandising and marketing had become Springs

No.1 priority.The unrelenting growth and change in business strategy soon took its toll on the

company. A depressed economy and high inflation caused by the Vietnam War, labor shortages and the

energy crisis, coupled with foreign competition, caused a textile industry slowdown in the 1970s.

Consumer demand dropped, while prices went up. Springs weathered the storm by divesting its less

profitable plants and recent acquisitions, and reducing its energy consumption.Consolidated

GrowthSprings emerged from these crises a little worse for wear, but intact. The company rounded

out the end of the decade in typical Springs style, with the acquisitions of Lawtex Industries, a

bath rug manufacturer; and window-products producer Graber Industries.The 1980s was a decade in

which Springs corporate strategy came sharply into focus. Under the direction of Walter Y. Elisha,

after Closes death in the early 80s, the company refocused its efforts, changed its name to Springs

Industries Inc., and looked for opportunities to expand towards textile home furnishings.Springs

added to its product line with the purchase of Custom Designs, a waterbed accessories company; and

the significant acquisition of M. Lowenstein Corp. which produced the Wamsutta and Pacific® home

textile brands and Lowenstein subsidiary Clark-Schwebel Fiber Glass Corp.Successful advertising

campaigns launched in 1986 and 1987 reflected an ever-widening, more specialized range of goods,

including the first easy-care cotton sheet introduced just a few years before.Elisha helped Springs

continue to grow throughout the late 80s and early 90s, and led the company to sales of more than

$2 billion in 1994. He laid the groundwork for his successor, Crandall Close Bowles Bill and Anne

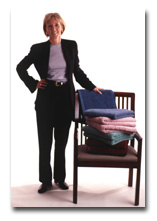

Closes oldest child.Modern-Day SpringsTaking the helm of Springs Industries as president in 1997

and chairman and CEO in 1998, Bowles committed to following the same pattern of smart growth and

smart investment her ancestors did. She believes an organizations accomplishment is based on the

execution of successful strategies.

Crandall Close Bowles, current chairman and CEO,Springs Industries Inc.Like her father, she

has not been afraid of the strategy of nonstop growth, even in uncertain times, nor of the need to

make difficult decisions. Bowles also has overseen the divestiture of several divisions and the

closing of several plants in an effort to keep Springs competitive.She has not been afraid of

change, either. Bowles and the rest of the Close family took the company private when they

completed a recapitalization merger between Springs and the private equity firm Heartland

Industrial Partners LP in 2001. Looking ForwardBowles grandfather, Colonel Elliott White Springs,

spent almost a quarter of the companys capital on Grace Finishing Plant, which helped move Springs

from an apparel manufacturer to a finished goods producer. Her father, Hugh William Close, spent

millions expanding and upgrading existing plants, and acquiring and building new facilities. Bowles

predecessor, Walter Y. Elisha, began to narrow the companys focus onto home textile consumer

products.The groundwork laid for Bowles by her predecessors and her own modern-day business savvy

have helped bring the products of Springs now a multibillion-dollar corporation into almost every

room in the American home.A keen business strategy, coupled with continued investments in

state-of-the-art technology and facilities, timely product innovations, and strategic acquisitions,

should keep Springs at the forefront of the textile industry for the next 116 years.

June 2003

Radio

Radio