“Made in the USA” is a mantra increasingly heard in the textile and apparel industry — signaling a

turning of the tide that has sent so much sourcing offshore. Since its founding 111 years ago,

private-label knitwear and fabric manufacturer FesslerUSA has held fast to that mantra.

The company’s beginnings trace back to 1900, when Walter Meck, grandfather of current CEO

Walter Meck, left the family farm and founded Meck & Co., a cotton underwear manufacturer in

the Pennsylvania Dutch river port of Schuylkill Haven. After surviving two world wars, a depression

and two recessions, the company was sold in 1960 by Walter’s son, Charles, to H.H. Fessler Knitting

Co. In 1994, the Meck family reacquired the company and restructured it with the goal of keeping

manufacturing in the United States.

An employee sorts jersey knit T-shirts at FesslerUSA’s distribution facility.

Today, FesslerUSA remains a family-owned and -operated business, led by CEO Walter Meck; COO

and Chief Sustainability Officer Bonnie Meck, Walter’s wife; and their son, Brian, who serves as

vice president of sales and marketing. The company is a full-package supplier of knitted fabrics

and apparel for more than 100 brands and retailers, producing more than 100,000 garments a week at

its 150,000-square-foot Deer Lake facility — a state-of-the-art, vertically integrated

manufacturing plant in Orwigsburg, Pa. FesslerUSA also runs a sewing facility in Reading, Pa.; and

has a showroom in New York City where it meets with customers.

Vertically Integrated Manufacturing

FesslerUSA’s ability to produce its own fabric is one aspect that sets it apart from other

apparel manufacturers remaining in the United States. “We made a decision very early on to be

different from everyone else by being vertical and having fabric production. That’s been key to our

success and our ability to get through the economic downturn,” said Walter Meck.

A custom software program drives the entire manufacturing process. The company does all of

its design services, knitting, cutting, sewing, folding, packing and final processing in-house.

Dyeing and finishing is done by a local dyer with whom the company has done business for more than

40 years.

Yarn is purchased primarily from domestic manufacturers, including Buhler Quality Yarns

Corp., Jefferson, Ga.; Parkdale Mills Inc., Gastonia, N.C.; Unifi Inc., Greensboro, N.C.; and

RadiciSpandex Corp., Gastonia, N.C. Trims come from Key Manufacturing Textiles, Allentown, Pa., a

FesslerUSA subsidiary that also produces trims for 40 other manufacturers. Laces and elastics come

mostly from overseas sources, as there aren’t many U.S. manufacturers.

“As a domestic manufacturer, we have a big challenge from a supply chain perspective to be

able to offer all the different types of dyed-to-match trims and laces, zippers, and buttons that

our overseas competitors have access to in their local marketplace,” said Brian Meck. “There are

parts of a garment we still need to import, or we need to work within the limitations of what is

available domestically.”

Knitting is done on Vanguard and Monarch circular knitting machines. Brian Meck said that

while knitting technology hasn’t changed much, the machinery has become more efficient, and

FesslerUSA has switched from coarser-gauge to finer-gauge machines. Pattern-making, marker-making

and spreading and cutting equipment is supplied by Gerber Technology.

FesslerUSA utilizes Gerber Technology spreading and cutting equipment, such as the GT7250 shown

here, in its cutting facility.

Focus On Fabric

FesslerUSA knits a range of fabrics in various yarn qualities, including rib, jersey,

interlock, piqué, pointelle, thermal, heather and terry. The company runs a lot of Supima®,

Supima/MicroModal® and Supima/MicroTencel® blends; 100-percent MicroModal and MicroTencel; and

polyester/rayon blends. Currently, there is a lot of interest in wool fabrics and blends. The

company recently introduced Tencel®/cashmere, and it is developing several new fabrics including an

alpaca/wool blend.

“We’ve also added flat bed knitting and have developed a new collection of piqué fabrics so

we can make polo shirts with fashion colors and welts,” Brian said. “And we have quite a few

stretch performance and baselayer fabrics in different stages of development.”

The company offers more than 400 fabrics, and only 10 to 15 percent of production involves

use of fabrics customers might find from another supplier. In addition, FesslerUSA has been

designing its own garments for about 10 years. Customers use the styles as is or make adjustments

and add them to their lines.

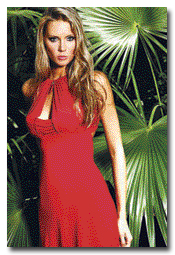

The company exports less than 5 percent of its production, and supplies the rest domestically

to brands and retailers mostly in the women’s and children’s fashion market, but also in the

outdoor and performancewear market. A major core customer is Nordstrom, whose relationship with

FesslerUSA spans more than 10 years. Michael Stars has been a customer for well over 20 years.

Walter said good brands such as their largest and core customers don’t change much. Smaller or

startup brands may shift their product lines or designs and move away from what FesslerUSA offers,

but then, the company will pick up a new brand.

FesslerUSA’s 34,000-square-foot knitting facility includes more than 50 circular rib and jersey

knitting machines as well as a full testing lab.

Value-Added Services

While FesslerUSA’s customers range from small startups to high-end department stores, all

need some level of design support. The company’s Design Support Services team takes a customer’s

creative design request through the entire costing and sampling process, from pattern-making,

garment-engineering and sewing through quality-testing, and, finally, through fits and revisions

leading up to final approval and production. Brian noted that expectations of accuracy and quality

for sampling, and especially turn times, have changed dramatically over the past five to 10 years.

“People seem to be waiting closer to their ship dates and in-store dates to submit sample requests;

or they’ve come to know we can turn samples quickly and fill orders if needed. We get a lot of

sample requests that we need to turn in two to three days, whereas our average sample turn time

used to be two to three weeks.” Those shorter lead times are an advantage gained from working with

a domestic supplier, Brian emphasized, because it allows customers to quickly replenish styles

within season.

FesslerUSA also offers customer service and production planning services to help customers

create and manage their design and production time and action calendars. “Helping our customers

stay on time and on schedule is a big part of the service we provide. Our customers save a lot of

time and money not having to hire a production team to manage and oversee the process.”

A growing segment of FesslerUSA’s business comes through its Design Consulting Services,

which assists newer brands or startups that have ideas of something they want to bring to market,

but no production knowledge or expertise. The company assigns a team of people who, for a fee, help

with fabric and style development, brand strategy planning, financial planning and supply chain

development.

FesslerUSA also offers a range of value-added services post-production such as washing,

screen printing, transfer printing, pressing, bagging and tagging. “Pretty much anything that can

be done to a garment, we provide as part of our production process,” Brian said.

The Sustainable Vision

FesslerUSA’s sustainability program began several years ago, with two coinciding events: The

company began making garments from organic cotton and sustainable fibers, and it purchased the Deer

Lake building, which needed renovations.

“When we bought the building, it was very dark and dingy and had old, very inefficient

fluorescent lighting,” Bonnie Meck said. The company began renovating the building phase by phase,

replacing fluorescent bulbs with T5 and T8 lighting and painting the walls using highly reflective,

low-volatile-organic-compound paint, to reduce the amount of lumens needed to provide light.

“But we soon learned that there was more to sustainability than organic cotton and

energy-efficient lighting,” Bonnie said. “It was about the entire carbon footprint — having a

factory that sustainably minimizes electricity usage; responsibly reducing, then recycling our

manufacturing byproducts; minimizing the distance that garments move; using low-impact dyes and

sustainably produced fibers.”

The company invested in variable speed drives to lower its peak electricity usage and utility

costs. “We did that long before we put the solar power system in, because even though we knew we

were going to be generating electricity from the sun, we still wanted to be using less energy

overall,” Bonnie said.

FesslerUSA recently completed its solar power generation system, which consists of more than

1,600 solar panels covering about half of the facility’s roof. The 450-kilowatt system will

generate more than 540,000 kilowatt hours of electricity per year — enough to power 35 homes — and

will provide half to two-thirds of the facility’s electricity needs. A live Web-based monitoring

system is broadcast on a large flat-screen TV in the middle of the offices to increase employee

awareness of the energy savings being accomplished.

More than 1,600 solar panels are mounted on the roof of FesslerUSA’s Deer Lake

facility.

One future goal is to convert the company’s hot water system from electric to solar thermal

power, which Bonnie anticipates will make a difference in the company’s energy usage. “When we

started, it wasn’t with the goal of what the return on investment would be — but it does help to

keep us globally competitive. Most sustainability translates to the bottom line,” she said.

The next project in the works involves redoing the office space on a low-carbon basis using

solar tubes and lighting that adjusts according to outside sunlight. Bonnie said the company

actively seeks ways to reuse where it can, such as installing gently used cubicles instead of

purchasing new ones. Although neither the factory nor the office space are fancy, Walter said, “we

want them to make a statement and reflect our culture and the way we do business: simple, elegant,

with a low-carbon footprint.”

The Mecks have received extremely positive customer response to their sustainability efforts

– especially regarding the solar power system, which “makes them aware of the importance of their

carbon footprint, because as energy costs go up, the size of that footprint will directly affect

both brands’ and retailers’ competitiveness,” Walter said. And, as Bonnie stressed, “Most of what

we do never leaves the continental United States in terms of the supply chain. When we buy yarn

spun in Georgia with cotton grown in California, Texas or Arizona, and we bring that yarn to

Pennsylvania, and then we knit the fabric and do everything here under one roof, and then we ship

those garments to distribution centers all over the United States, there’s no way to compare that

to the carbon footprint of something you’re bringing in from China.”

A Culture Of Sustainability

When the company implemented its sustainability plan, Bonnie said, “we learned that

sustainability is a journey, not a destination — a journey that requires everyone to be on board —

from every employee, to vendors, and, most importantly, our customers. As a family and a business,

we chose to personalize and adopt the pursuit of sustainability for FesslerUSA.”

The company’s volunteer employee Sustainability Team has helped develop corporate initiatives

including a sustainability Bulletin Board; a Sustainability Corner in each of the company’s

newsletters; a Swap Shop for employees to swap gently used clothing; a lending library for

exchanging books; and coupon boxes in the lunchrooms. Sustainability Awards are given to employees

who go above and beyond expectations.

“We are trying to create that spirit in our employees, even encouraging them to be more

sustainable in their personal lives,” Bonnie said. “We want them to be proud and involved in what

we’re doing. It takes time, but it becomes a thought process, a way of life.”

Bonnie noted that sustainability awareness has increased significantly in the apparel

industry in the last few years. When FesslerUSA began the process, a few companies in the industry

that were further along in the journey were willing to share their advice and experience. “I found

that to be very refreshing, because we’re in a very competitive industry where people typically

don’t share information,” she said. “I want to be generous with our knowledge so we can keep

promoting the culture of sustainability.”

It’s All In The Family

Although FesslerUSA has built a reputation as a family-owned and operated business, Walter

emphasizes that “when we say ‘family,’ we mean more than just immediate family; I consider every

one of my employees to be part of my family. We think the key to running a successful business is

not just making money, but making sure the needs of our employees — our family — are being met.

Employee welfare is a very important part of sustaining a company.”

The company’s health and wellness committee implements various initiatives to encourage its

150 employees to live a healthy lifestyle. Initiatives have included a contest in which pedometers

were given out to see who walked the most steps; weight-loss competitions; smoking cessation

programs; and an annual health fair that offers skin cancer testing, chair massages, blood pressure

checks, and healthy lunches supplied by local vendors.

The committee currently is working on a project to put a fitness trail around the building’s

perimeter. Naturally, to stay in line with its focus on reuse, the sustainability committee is

looking for a way to make the markers out of something recycled from the factory.

All About Adaptation

In order to survive, a company must be flexible, Walter said. “I tell our people, the one

thing I can promise them is constant change. We continually look for opportunities — whether it’s

in a different market, looking at different brands, acquiring a brand, or partnering with a

retailer — we are always actively open to considering alternatives.”

In the past, most if not all of FesslerUSA’s fabric production was used for garments, but the

company recently started to sell fabric directly to customers. “That has become one of our most

rapidly growing segments,” Walter said. “Another thing we did during the downturn was ask how else

we could use our facility for niches inside or outside the apparel market.”

One such niche is the outdoor performancewear market, which is growing, is custom, and fits

right into FesslerUSA’s “sweet spot,” as Walter said. “We’ve even taken on a few customers that do

some very unusual things, but that our equipment is uniquely set up to produce, such as non-apparel

items in the medical industry.

“To be a U.S. vertical apparel manufacturer, you have to recognize that you can’t compete

with China on the lowest landed cost and you can’t compete at the big-box store level,” Walter

said. “Where we compete is when a customer, retailer or brand needs something more, something they

can’t get overseas; and when they understand the value of taking time, overhead and/or carbon

footprint out of the sourcing cycle.”

While the company was affected by the recent economic downturn and lost customers that

couldn’t survive or decided the grass is greener in China, Walter said, “we’ve seen some come back,

who decided the service we provide is more important than the slight premium in cost that comes

from being Made in the USA.”

Walter also said that people have finally adjusted to the fact that the market has

contracted. “After almost two years of ordering on a trial-and-error basis, customers are more

confident in placing purchases six months out. The uncertainty is slowly but clearly going away,

and the market has adjusted to the new realities of the economy.”

Though competing as a U.S. manufacturer in the global marketplace certainly has its

challenges, Walter said FesslerUSA receives a lot of support from retailers and other suppliers who

serve the apparel industry. “Everyone wants to see apparel Made in the USA, and the support that we

receive from all sides is not only refreshing, but it keeps us focused and keeps us from giving

up.”

“We’re constantly moving forward, looking to do better, remaining a leader in our industry,”

Bonnie said, “and that’s the best we can do — keep moving along that path.”

“Life is adapting to the situation,” Walter added. “We’ve adapted, and we’ll continue to

adapt.”

September/October 2011