DÜSSELDORF, Germany — October 17, 2024 — To fulfill Envalior’s sustainability aim, to be a global leader in sustainable high-performance engineering materials, the company announces its new Sustainability Ambitions and that it has joined the United Nations Global Compact, the world’s largest corporate sustainability initiative.

DÜSSELDORF, Germany — October 17, 2024 — To fulfill Envalior’s sustainability aim, to be a global leader in sustainable high-performance engineering materials, the company announces its new Sustainability Ambitions and that it has joined the United Nations Global Compact, the world’s largest corporate sustainability initiative.

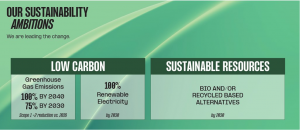

Envalior’s sustainability ambitions focus on reducing its greenhouse gas emissions and extending its circular portfolio by:

- Achieving 100% renewable electricity by 2030.

- Reducing greenhouse gas emissions by 75% by 2030*.

- Reducing greenhouse gas emissions by 100% by 2040*.

- Offering an entire portfolio of bio-based and/or recycled based alternatives by 2030.

“Sustainability is a key priority in our strategy, and we want to make that visible to the world,” said Günter Margraf, Director of Sustainability for Envalior. “Meeting these ambitions will enable us to realize the huge transformation that is ahead of us and help our customers on their sustainability journey.”

“Sustainability is a key priority in our strategy, and we want to make that visible to the world,” said Günter Margraf, Director of Sustainability for Envalior. “Meeting these ambitions will enable us to realize the huge transformation that is ahead of us and help our customers on their sustainability journey.”

The United Nations Global Compact

Another commitment Envalior has taken towards sustainability is becoming a participant of the United Nations Global Compact, the world’s largest corporate sustainability initiative. Based on 10 universal principles, the UN Global Compact pursues the vision of an inclusive and sustainable global economy and focuses on topics such as human rights, labor, environment, and anti-corruption. As a signatory Envalior commits to operating in accordance with these fundamental rights and will report annually on its progress.

CEO of Envalior Calum McLean stated: “It is exciting to confirm that Envalior supports the United Nations Global Compact and its principles. Making it part of the strategy, culture and day-to-day operations of our company, and to engage in collaborative projects, which advance the broader development goals of the United Nations.”

The United Nations Sustainable Development Goals

The 2030 Agenda for Sustainable Development provides a vision for peace and prosperity for the people and the planet. At its core are the 17 Sustainable Development Goals (SDGs) that address global challenges, such as inequality and climate change and that provide guidance for businesses. Envalior is committed to supporting the implementation of the SDGs and has evaluated where Envalior’s business activities have the greatest direct impact on:

- SDG 7: Affordable and Clean Energy

- SDG 12: Responsible Consumption and Production

- SDG 13: Climate Action

- SDG 17: Partnerships for the Goals.

Envalior’s goal to achieve 100-percent renewable electricity by 2030 has a positive impact on SDG 7. Envalior has implemented various initiatives, including renewable power purchase agreement and solar panel installations that make electricity consumption cleaner. At the same time these measures relate to SDG 13 “Climate Action” as also greenhouse gas emissions are decreasing. Other measure that enhances Envalior’s emissions consumption is its nitrous oxide reduction plant in Antwerp, Belgium, that saves roughly 450,000 t CO2eq on a yearly basis. These are only some of several steps that Envalior is taking to become a frontrunner in sustainability.

Envalior was established in 2023 through the merger of Lanxess Performance Materials and DSM Engineering Materials

Posted: October 17, 2024

Source: Envalior