Since the invention of the spinning mule, or mule jenny, in 1779 by Samuel Crompton, the textile

machinery industry has worked to develop faster and more reliable and flexible spinning

technologies. Air-jet spinning is the latest answer in this endeavor.

Over decades and centuries, ring spinning became the cornerstone of spinning, accompanied by

open-end or rotor spinning. Both technologies have their own fields of end-uses, and ring spinning

has been boosted further with the development of compact spinning, resulting in much less yarn

hairiness thanks to its reduced, or compact, spinning triangle. In the 1990s, a new technology

appeared on the market: air-jet spinning, the so-called Vortex technology from Japan-based Murata

Machinery Ltd. In October 1997, Murata revealed its development of the Murata Vortex Spinner (MVS),

an air-vortex spinning frame for cotton.

Over time, Murata established a niche market for these special yarns and claimed success for

the technology. Modifications to the Vortex technology in the late 1990s resulted in significant

changes in yarn structure compared with first-generation yarn structures. These modifications

enabled twist to be imparted more effectively to the outer surface of the yarn, which,

consequently, increased yarn tenacity. They also made it possible for the first time to process

shorter staple lengths, such as 100-percent cotton, in addition to man-made fibers and blends. In

September 2008, Murata introduced Vortex yarns at the Expofil yarn fair in Paris. Murata

communicated that “the functionality and fashionable features of the Vortex yarns met the

expectations of the textile professions around the world.” Nevertheless, as spinning is a

conservative industry, the technology wasn’t, and isn’t yet, that successful compared to ring or

rotor spinning, but Vortex yarns maintain their place in a niche market.

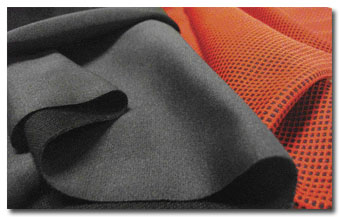

In ComforJet® spinning, the fiber is spun in the spinning nozzle.

Rieter Air-jet Spinning

In 2003, the Rieter Group, Switzerland, challenged the markets by introducing its own air-jet

spinning technology, beginning with the development of the J 10 air-jet spinning machine. The

technology’s market launch has continued since June 2008. The main development criteria included,

to name just a few: high productivity; flexible, simple machine settings; ease of operation; and

low downtimes for maintenance and lot changes. These criteria determined the machine concept and

the individual components.

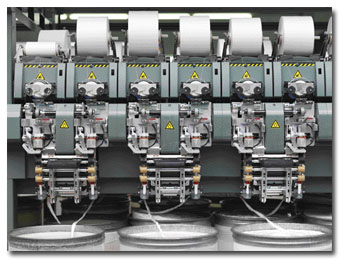

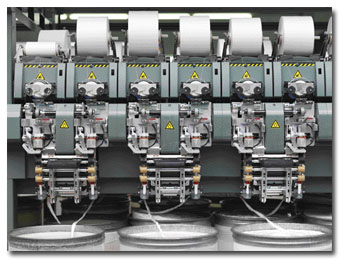

At the heart of Rieter’s second-generation J 20 air-jet spinning machine is a spinning unit

driven by individual motors, without central gears and driving shaft, across the entire machine

length. Individual spinning positions can be switched off, and the rest of the machine continues

production. Such spinning unit settings as drafts, bobbin speed, winding tension, cross-angle and

spinning pressure are performed centrally via the machine operator panel. Also, in evaluating

machine data, flexibility is the top priority. Separate production and shift reports are available

for each article.

In Rieter’s air-jet spinning technology, a fiber arc is created by means of an air current,

and the yarn produced in this way is taken off via a fixed spindle. The twist factor in the

covering yarn corresponds more or less to that of a ring-spun yarn. The air-jet-spun yarn structure

consists of core fibers without significant twist and covering fibers with a genuine twist, which

ultimately produces the corresponding yarn tenacity. The specific yarn structure results in yarn

tenacity between that of a ring-spun yarn and that of a rotor-spun yarn. According to Rieter, the

very high yarn tenacity of a compact yarn cannot be achieved by any other spinning system. The

air-jet system virtually totally integrates the fibers into the yarn strand and into the

simultaneous, complete twisting of the fibers.

Due to their yarn structure, air-jet-spun yarns display good yarn elongation values equaling

those of ring-spun yarns, depending on yarn count and raw material. The elongation in air-jet-spun

yarns is also reflected in the yarns’ good processing behavior.

The J 20 air-jet spinning machine has 120 spinning units and is equipped with four robots,

with two on each side of the machine.

Hairiness, Abrasion And Wear Resistance

Compared to yarn spun using other spinning processes, air-jet-spun yarn displays the lowest

hairiness. The spinning process and the yarn structure obtained as a result create new,

complementary possibilities in downstream processing of the yarn. The advantages of low hairiness

range from cost savings in the knitting process to unique advantages in the textile product in

terms of abrasion, wear resistance, pilling and washfastness.

Yarn abrasion is directly related to yarn hairiness and the integration of the fibers in the

yarn strand. One advantage of air-jet-spun yarn is clearly apparent: Lower abrasion will result in

significantly less soiling and less fiber fly during downstream yarn processing, thereby extending

cleaning intervals on the machines. The abrasion resistance of the yarns is a further important

criterion in subsequent downstream yarn-processing stages and the yarn’s serviceability properties

in the textile fabric.

The spinning units on the J 20 air-jet spinning machine are configured in an open

duo-drafting arrangement that is suitable for spinning all fiber types.

A Second Generation

A number of innovations incorporated in the J 20 air-jet spinning machine allow it to achieve

delivery speeds of 450 meters per minute (m/min). By comparison, normal ring-spinning delivery

speeds are 15 to 27 m/min, and rotor spinning speeds are 130 to 250 m/min. The Rieter air-jet

spinning machine has a construction similar to that of a rotor spinning machine. Between the drive

frame and the end frame, there are six sections, each with 20 spinning positions, for a total of

120 positions, compared to five sections on the J 10 machine — making the J 20 the longest air-jet

spinning machine in the world, according to Rieter. In addition, there are four robots — two on

each side — in operation for the formation of yarn piecings, bobbin change and cleaning.

Yarn produced by the J 20’s spinning unit features high strength and a low number of

imperfections. The duo-spinning unit’s drafting arrangement can be precisely and reproducibly set.

Controlled fiber guiding results in good yarn quality and a low number of quality cuts and natural

thread breakages. Operator involvement is significantly reduced. Furthermore, bobbin tension can be

set over the entire bobbin, which, in tandem with the image interference device, ensures perfect

bobbin building, Rieter reports. The J 20 machines are equipped with the USTER® Quantum Clearer 2

yarn clearer that can include, per customer requirements, capacitive or optical sensor and optional

foreign fiber detection.

Automation

As mentioned above, the J 20 is equipped with four robots, with two on each side of the

machine. In addition to cleaning the spinning position and automatically piecing the yarn after a

thread break or a clearer cut, the robot changes full bobbins and threads up the empty tubes. It

also features a fan that cleans fiber-fly from the spinning positions. The robot is based on

rotor-spinning automation technology. The entire piecing process is electronically controlled. The

machine is designed so that both machine sides are optionally entirely independent of each other.

Blends

The duo-spinning unit expands the J 20’s field of application, and it can process viscose,

Modal® and blends of these fibers with cotton. Ideally, a somewhat coarser and shorter cotton fiber

can be chosen for raw material blends on economic grounds. A corresponding reduction in noil can be

achieved when combed cotton is used.

During development of the machine, care was taken to enable as many fiber materials as

possible to be processed using the same top roller cots.

Drafting

The drafting arrangement technology adopted for the air-jet spinning machine has been adapted

to high speeds. In order to achieve the extremely high drafts, the 3-over-3 drafting arrangement

was further developed to a 4-over-4 arrangement, allowing a gentle fiber drafting in three stages.

The robust arrangement features a unique, patented traversing system. The feed sliver and the yarn

produced as a result are laterally traversed — thus extending the lifecycle of the top rollers,

cots and aprons threefold, which considerably reduces long-term maintenance and spare parts costs

and ensures consistent yarn quality over time, Rieter reports.

Lower Energy, Space Needs

For most applications, Rieter claims that the air-jet spinning technology consumes less

energy per kilogram of produced yarn than other spinning processes. Shutdown of individual spinning

units thereby pays off. During development, the dimensions of the J 20 were also considered, to

ensure that the machine could be installed in existing spinning rooms.

Space needs for the J 20 are 25-percent less than for ring-spinning equipment producing the

same capacity, thereby reducing building costs. Also, the smaller area requires less climate

control, resulting in further substantial savings.

New Markets

The new air-jet spinning technology produces new yarns with new yarn characteristics, and

opens new market opportunities for spinning plants. Yarn formation is achieved by turbulence with

an airflow in a spinning nozzle, which creates a quite different yarn structure. Yarn produced by

the J 20 is marketed under the ComforJet® brand.

Since ITMA 2011, Rieter has begun marketing the J 20 worldwide. The company claims that “the

J 20 is a production miracle with smallest space requirements. With its high operating speed of up

to 450 m/min and 120 spinning units, the J 20 air-spinning machine heads the productivity scale.”

This technology is certainly an attractive alternative to all other existing spinning

processes. However, its market acceptance will show if this assessment is true.

March/April 2012