P

olytetrafluorethylene (PTFE) is more commonly known by the trade name Teflon®. Consumers

identify the name with cooking pans treated with PTFE to provide non-stick properties. Over the

last 50 years, the fluorocarbon family of polymers has grown to include polymers used in a myriad

of forms and applications ranging from high-temperature filtration and gasketing to surgical

sutures and stain-repellent agents for fabrics.

PTFE is a vinyl polymer, and its structure, if not its behavior, is similar to that of

polyethylene. PTFE is made from the monomer tetrafluoroethylene (TFE) by means of free radical

vinyl polymerization.

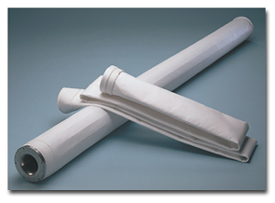

PLASTOLON™ filtration sewing thread from Plastomer Technologies also is suitable for

PLASTOLON™ filtration sewing thread from Plastomer Technologies also is suitable for

geotextile sewing and bagging for chemical products.

Discovery And Development Of Teflon®

Fluorocarbons is not a household word, but fluorocarbons have been an important part of

households for many years. In the 1930s, chemists at General Motors and DuPont collaborated on the

development and use of chlorofluorocarbons as refrigerants to replace ammonia, sulfur dioxide and

propane, which were hazardous. The chlorofluorocarbon Freon® gradually became the refrigerant of

choice for the Frigidaire and other household and commercial refrigerators.

In 1936, Roy Plunkett, who earned a Ph.D. from Ohio State University, was hired by DuPont at

its Jackson Laboratory in Deepwater, N.J., to develop new refrigerants using TFE gas as a starting

point. As a result of a serendipitous discovery by Plunkett and his assistant Jack Rebok, Teflon

polymer was developed and has led to Teflon and a family of fluoropolymers used in fibers, films

and plastics in a variety of high-performance applications.

Plunkett first produced several hundred pounds of TFE gas and stored it in small cylinders

at dry-ice temperatures prior to chlorinating the TFE. When he and his assistant prepared a

cylinder for use, none of the gas came out – yet the cylinder weighed the same. When the cylinder

was cut open, they found a white powder.

Plunkett was curious about the white powder and had the presence of mind to characterize the

material for properties other than its refrigeration potential. He found the material was

heat-resistant and chemically inert, and had very low surface friction so that other materials

would not adhere to it. Although it was thought at the time that the gaseous TFE could not be

polymerized, the exact temperature and storage conditions in Plunkett’s lab enabled PTFE, later

named Teflon, to be formed. This was truly a remarkable discovery. Plunkett’s work resulted in

patents for making Teflon that were assigned to DuPont, and in 1985, Plunkett was inducted into the

National Inventors Hall of Fame for his discovery of Teflon.

Plunkett moved on to other assignments at DuPont, and DuPont’s Organic Chemicals Department

experimented with ways of safely polymerizing TFE to make Teflon. During World War II, about

two-thirds of the TFE, then known as K-416, was made for the Manhattan Project and other military

uses. Teflon was trademarked in 1945. After the war, DuPont was able to concentrate on industrial

uses for Teflon products. Teflon tapes and sheets were sold for electrical insulation, as well as

gaskets and sealers for pumps and valves because of Teflon’s extreme chemical resistance. Teflon

was produced in fiber form in the early 1950s.

DuPont initially produced Teflon filament yarns at its Richmond, Va., rayon plant. PTFE is

insoluble in most solvents and decomposes before melting. The PTFE resin is dispersed in a viscose

rayon spinning dope and extruded into an acid bath, where the dispersion is coagulated and the PTFE

forms filaments. The fiber structure is then heat-treated, and then sintered and fused into a

coherent filament. The viscose carrier material is decomposed. The PTFE fibers are then drawn.

Modifications to the process were used to form multifilament, tow and staple fibers.

Copolymers of TFE with other fluorochemicals such as hexofluoropropylene were developed. These

produced a copolymer that was suitable for melt spinning.

DuPont’s Early Work With Teflon Fibers

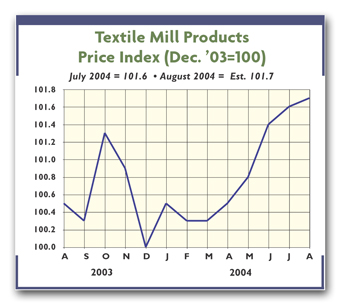

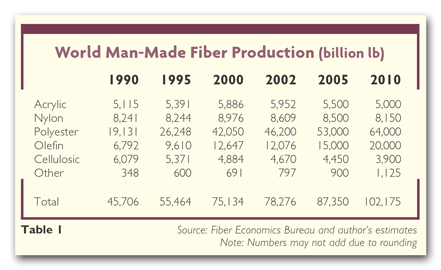

By the mid-1970s, DuPont developed an extensive line of Teflon fibrous products including

multifilament yarns from 200 denier up to 39,600 denier. These yarns also could be obtained in

bleached and impregnated forms. Teflon monofilament yarns were available from 4 mils to 60 mils,

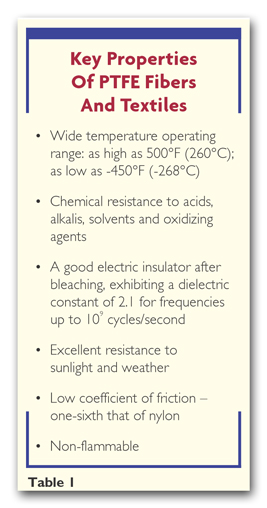

and Teflon flock and staple fiber were made in 6.67 and 7.50 denier. The high price of the Teflon

fibers ($27 per pound for a 200-denier/30-filament yarn in 1974) was a limitation to early

widespread use of the fibers and dictated their use only in applications that required some of the

properties described in Table 1. Staple-type yarns of Teflon were made by direct spinning from tow

because of the difficulty of carding the slippery fiber. Multifilament yarns also were processed by

air-jet texturing for filtration fabrics and other applications.

Early Successful Teflon Fiber Applications

Braided packings made of Teflon fibers proved cost-effective for pumps and valves. The hard

packing made with Teflon fibers impregnated with Teflon dispersed resin give excellent service in

high-pressure pump and valve applications. The soft packing material, in addition to the dispersed

resin, incorporates a high-temperature inert lubricant for high-speed pumps.

Bearings of Teflon in fiber form are successfully used in high-load, low-speed areas and

require no lubrication. The coefficient of friction of Teflon fiber can be as low as 0.01 depending

upon surface speed, load and temperature. Since the static coefficient of friction for the fiber is

only slightly higher than the dynamic value, it does not exhibit stick-slip. Stern & Stern

Industries Inc., New York City, developed a line of fabrics woven of Teflon yarns for bearings that

are used on highway bridges. Other applications for Teflon-bearing fabrics include: agricultural

equipment, where non-lubrication and impact resistance are important; steel rolling mill bearings,

where high load-carrying ability and impact resistance are required; and aircraft and missiles,

where lack of stick-slip resistance under extreme temperature is required.

Filtration is an important application for Teflon fibers and yarns in woven fabrics and in

needlefelts, particularly for filtering products such as titanium dioxide; carbon black, where

temperatures as high as 500°F (260°C) are encountered; and where corrosive products like acids have

to be filtered.

Tapes and narrow fabrics of Teflon fibers have extensive use in the aerospace industry,

where they are used for wrapping and splicing of wire and cables because of Teflon’s favorable

dielectric properties, heat resistance and low flammability.

A relatively new application for Teflon yarns is Blister Guard® socks made from this

material from Friction Free Technologies Inc., New York City. The use of these socks reduces

blisters, hot spots and abrasion, and keeps the skin cooler and drier than conventional socks. Wear

tests by the US Army Rangers, Marines and Navy Seamen of socks containing Teflon showed that

calluses, blisters and hot spots are reduced by 80 percent.

Toray Acquires

DuPont’s Teflon® Fiber Business

In June 2002, Toray Fluorofibers (America) Inc. was formed after the company purchased the

exclusive rights to the Teflon brand of fluorofibers from DuPont. DuPont sold this fiber business

in order to further reduce its dependency on the textile fibers business and to permit the company

to invest in newer businesses.

Toray will produce the Teflon product in Decatur, Ala., at a new plant estimated to cost $30

million. Equipment from DuPont’s Teflon fiber manufacturing operation in Wilmington will be moved

to Decatur.

W.L. Gore And GORE-TEX®

For some years after Teflon’s discovery, DuPont was the primary company working with

fluorocarbon chemistry. From 1945 to 1957, William L. “Bill” Gore worked on PTFE while serving on a

task force at DuPont’s research center. Since PTFE could not be extruded like nylon and other

thermoplastic resins, the only technique for making Teflon tapes and tubing was by “ram” extruding.

In 1957, Gore’s task force was disbanded. Gore continued to work with the PTFE resin in his

home workshop. He and his son Bob, who was then studying chemical engineering at the University of

Delaware, were trying to develop PTFE for computer wiring insulation. They succeeded in making a

PTFE ribbon that could be used for such insulations. Bill Gore tried to interest DuPont in further

developing the product, but at the time, DuPont was not interested in pursuing downstream products

of PTFE.

In 1958, Bill Gore left DuPont after 17 years with the company to pursue making PTFE ribbon

cable, forming W.L. Gore & Associates Inc. After two years of hard work and frustrations, he

received an order for about $100,000 of the ribbon as part of a system that monitored pressure in

water mains. By 1963, Bob Gore had received his Ph.D. in chemical engineering, and the company

occupied a new plant in Newark, Del. By 1969, sales at Gore had reached $6 million, most of which

were to the wire and cable business. Bob Gore experimented with techniques to expand PTFE by

heating and drawing techniques. This work led to making PTFE membranes in wide sheets. A surgeon

used the PTFE membrane in a vascular graft on a pig and found it was successful. It took four years

to develop GORE-TEX® vascular grafts for humans, and they now are used throughout the world for

treating cardiovascular disease. Later improvements were made to the Gore-Tex material for vascular

grafts to improve its rupture tolerance.

By 1973, the company could stretch Gore-Tex wide enough for lamination to textile fabrics.

One of the company’s objectives was to produce a breathable waterproof tent material. In the

beginning of 1976, Gore still generated 90 percent of its sales and profits from its basic wire and

cable business. Only $2 million of its sales came from microfiltration, industrial filter bags,

joint sealants and medical products. This situation was to change in 1976, when, led by a surge in

the medical products division, sales within the whole company took off and started growing at 75

percent per year. During this period, the Gore-Tex fabric division’s products were used in a

commercial tent.

In 1974, the company started working with Bill Nicolai, Early Winters Co., currently a

division of Norm Thompson Outfitters, Portland, Ore., to incorporate a Gore-Tex microporous fabric

laminate into a tent. Nicolai, an experienced mountaineer, christened the resulting tent “Light

Dimension” and it became a successful product. Gore later sold its laminates to other portable tent

makers such as Sierra West, Banana Equipment and Recreational Equipment Inc.

By 1978, Gore was selling its laminates for use in parkas and other outdoor apparel. That

year, a major crisis developed with the Gore-Tex laminates – body oils from perspiration were

clogging the microporous membrane. Gore recalled more than $3.5 million worth of apparel while it

redesigned the microporous membrane to make it more oleophobic.

Gore’s REMEDIA™ catalytic filter system is designed to destroy dioxin and furan

Gore’s REMEDIA™ catalytic filter system is designed to destroy dioxin and furan

emissions.

Gore Continues To Grow

Gore is still a privately held company; and now has sales of $1.35 billion, and 6,000

associates in 45 locations around the world. Filtration is an important business for the company. A

microporous Gore-Tex expanded membrane is applied to woven or nonwoven filter media to improve

filter efficiency and to improve filter cake removal in shaker-type baghouses.

Gore recently introduced its AMAZON™ filter bags, which have a hydrolysis treatment to

improve durability. These bags incorporate a Gore-Tex membrane with an aramid needlefelt. They are

designed for pulse-jet baghouses and can perform well in an acidic environment.

Gore’s REMEDIA™ catalytic filter system is designed to destroy dioxin and furan emissions.

The system is designed for use in baghouses for applications such as incinerators,

pyrometallurgical processes and cement kilns.

Gore has been producing Gore-Tex cleanroom garments for about 15 years. They are designed to

meet the requirements of ultra-clean (non-sterile) Class 1 to Class 100 environments. These

garments are flame- and chemical-resistant and have built-in static dissipation properties.

The development of microporous membrane for desalination units and the separation of other

liquids and gases is a future goal of the company.

Donaldson Tetratex®

Tetratec Corp., Ivyland, Pa., was started about 20 years ago and recently was acquired by

Donaldson Co. Inc., Minneapolis, a leading manufacturer of filtration equipment and filter media.

Tetratec manufactured Tetratex®, a microporous semi-permeable membrane film. The film repels water

while allowing air and moisture vapor to freely permeate the membrane. Product applications include

filtration, fire-fighting apparel, medical drapes and gowns, recreational tents, and apparel and

industrial garments.

Donaldson’s Tetratex will be competing in many of the same markets as Gore. This competition

should result in many new and improved products, since both companies invest heavily in their

capable research and development efforts.

Plastomer Technologies

Houston-based Plastomer Technologies produces expanded PTFE (ePTFE) monofilament for

industrial and consumer applications. One of its major products is PLASTOLON™ filtration sewing

thread. This thread has high tenacity, low shrinkage, high chemical resistance and high resistance

to ultraviolet (UV) light and sunlight. In addition to filtration applications, it is useful for

geotextile sewing and bagging for chemical products. Plastolon supplies its ePTFE sewing thread in

nominal deniers of 600, 800, 1,200, 1,800 and 3,600 on various packages.

The Plastolon product range also includes Plastolon Outdoor Fiber.

Fluorocarbon Treatments

The invention of Scotchgard™ represents another serendipitous discovery involving

fluorocarbons. In 1953, Patsy Sherman, a researcher with 3M Corp., St. Paul, Minn., was working on

a project to develop a rubber material that would be resistant to deterioration from jet fuels. An

assistant in her laboratory spilled an experimental compound on her new tennis shoes and was unable

to remove the material with soap, alcohol and other solvents. Sherman and fellow 3M chemist Sam

Smith became fascinated with the properties of the experimental compound and initiated work to

enhance the liquid repellency and the cost of this compound. As a result of this work, Scotchgard

Fabric and Upholstery Protector was launched in 1956.

In mid-2000, 3M discontinued Scotchgard Protector manufactured using C8-type fluorocarbons

because of environmental concerns over the persistence of C8 products. Since then, 3M Scotchgard

products have been reformulated with a different type of fluorocarbon material.

Coating Of Fabrics With Fluorocarbons

In 1973, the first permanent fabric structure was completed at LaVerne College, LaVerne,

Calif. The structure was built using woven glass fabric coated with PTFE resin. The world’s largest

fabric structure, the Haj Terminal, was built in the early 1970s in Jeddah, Saudi Arabia. This

structure covers 105 acres and was built to service Muslims making their pilgrimages to Mecca(See ”

From

Radomes To Mega Structures,” October 2002). More than 500 million square feet of woven

fiberglass fabric coated with PTFE resin were used for the structure. This building is a tribute to

the outdoor weathering resistance of fluorocarbon polymers.

Fluorocarbon Films For Lamination

DuPont makes Tedlar® films, which are based on polyvinyl fluoride (PVF) in oriented and cast

forms. DuPont supplies its PVF only in film form. PVF resin also can be used for coating fabrics

and other structures, but it must be applied in a solvent system.

The air-supported Paddock Chevrolet Golf Dome in Tonawanda, N.Y., is an example of how

Tedlar film is used in a fabric structure. The fabric is Shelter-Rite® vinyl-coated polyester

fabric manufactured by Seaman Corp., Wooster, Ohio, with a durable Tedlar PVF soil-resistant outer

surface. The structure is 270 feet wide, 350 feet long and 80 feet high, and does not have any

supporting pillars. When the golf driving range and the miniature golf course are not in use, the

space is used for indoor soccer, baseball or softball.

Atofina’s Products

Atofina, France, produces the polyvinylidene fluoride (PVDF) film KYNAR®. PVDF resins

have a wide processing window and can be used in a range of processes including solvent casting,

blown film extrusion, cast film extrusion and biorientation.

Monofilament Fluorocarbons

PVDF has the capability of being melt-spun into fibers. PVDF monofilaments are produced for

sewing thread, filtration and fishing lines. A major producer of PVDF monofilament products is

Shakespeare Co., Columbia, S.C. Shakespeare also manufactures monofilament yarns from most

melt-spinnable polymers including nylon, polyolefins, polyetheretherketone (PEEK™), Ryton™ and

other specialty polymers.

The properties of PVDF monofilament yarns that make them useful in textile applications are:

• outstanding resistance to weathering and UV light;

• outstanding chemical resistance;

• high continuous use temperature (up to 150°C);

• inherent flame resistance;

• low coefficient of friction;

• lowest moisture regain; and

• excellent soil resistance.

Shakespeare supplies its ISOray™ UV-resistant PVDF sewing thread in a range of diameters

from 0.006 inches to 0.012 inches (295-1,180 denier) for applications such as awnings, tents,

sails, flags and banners, tarpaulins, boat covers and filtration fabrics. These yarns can last for

up to 10 years in outdoor applications, according to the company.

Shakespeare produces a range of standard and custom PVDF monofilament yarns for fishing

lines. The refractive index of PVDF monofilaments makes them highly transparent and invisible to

fish.

Diverse, Specialized Products

Since the discovery of PTFE, the uses of fluorocarbons have proliferated in the forms of

fibers, films, coatings, surfactants and finishing agents. Although most fluorocarbons are

relatively high in cost per pound, they are very cost-effective when used in high-performance

applications. Without fluorocarbons, our present high-technology society, which uses fluorocarbons

in products from vascular grafts to aircraft and vehicle bearings, could not function.

September 2004