The new year is starting off on a relatively encouraging note. For one, there’s the just-ended

holiday buying season, when overall consumer purchases ran an impressive 6 percent ahead of the

previous year’s level. That’s actually above projections made just a few months earlier. Moreover,

zero in on the apparel sector, and November/December sales were up by an equally impressive

percentage. Also on an upbeat note, consumer confidence continues to improve, suggesting that this

willingness to spend is spilling over into the current quarter.

This is further backed up by the Institute for Supply Management’s (ISM’s) latest monthly

business survey. This grassroots organization of the nation’s top purchasing executives is

generally first to reflect prevailing business sentiment. And what this prestigious group is

finding for early 2012 textile and apparel activity can only be described as positive. More to the

point: The group finds that demand in both those sectors is continuing to grow. That’s been the

case not only for the past two months, but also for most of the past year. Also suggesting better

days ahead are

Textile World

talks with industry executives, almost all of whom now describe incoming business as anywhere

from satisfactory to quite good. All this, in turn, is bound to impact bottom-line performance.

Indeed, there’s now the virtually unanimous feeling that profits will show some solid gains over

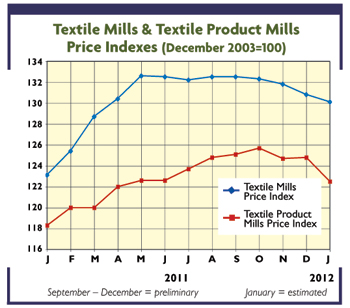

the next six months. It’s all in marked contrast to early 2011, when the huge run-up in cotton

costs made for some sharp declines in both industry earnings and margins.

And Gains Should Persist

Moreover, optimism seems to be spilling over into the last six months of the year. At least

that’s what the purchasing leaders referred to in the above-mentioned ISM study seem to be

indicating in their responses to another recent survey — this one on the entire 2012 outlook.

Looking first at the general economy, they see activity over the last two quarters of the year

actually topping that of the first six months. The group’s unique “diffusion” index, which weighs

the combined impact of expected gains, declines, and no-change responses, provides the details.

Using 50 as the neutral level on a 100-point scale, the second half diffusion index reading of 65.5

looks even better than the not-too-bad first half’s 62.5. Even more important, this latter ISM

survey is equally bullish when it comes to downstream apparel activity, for which the industry’s

revenues for all of 2012 are expected to sport their third straight year of advance.

Also on an upbeat note, increases are also anticipated for both apparel prices and apparel

exports. These projections, if nothing else, would seem to confirm

TW

’s own beginning-of-year forecast, which calls for a modest 1- to 2-percent overall apparel

advance for the new year (See “Textiles 2012: The Prognosis Is Good,” www.TextileWorld.com,

January/February 2012). In fact, these projections may be somewhat on the conservative side. True,

TW

is not yet ready to upgrade those numbers, but, instead, now has increased confidence in

those numbers and feels that the upper part of the projected range is now most likely to prevail.

Another Potential Plus

Falling unit labor costs could be still another factor that may help bolster

TW

’s competitive positions — not only over the coming months, but also over the next few years.

And again, this is true not only for overall U.S. manufacturing but also for the domestic textile

and apparel sectors.

Looking first at all U.S. manufacturing: New government numbers show an impressive 13-percent

decline in pay per unit of output over the past decade — in large part due to strong productivity

gains, which have consistently outpaced relatively small increases in hourly pay rates. Moreover,

factor in the added American advantages of somewhat cheaper energy — due mainly to the shale oil

boom — and a generally weaker dollar, and it’s easy to see why American-made goods are becoming a

bit more attractive in today’s one-world marketplace.

Focus in on U.S. domestic textile and apparel industries, and the picture is pretty much the

same. At least that’s what’s suggested when employment numbers, wage rates and productivity gains

of these two sectors are analyzed in closer detail. Do the appropriate calculations, and unit labor

costs in these two industries have probably been dropping by at least 1 percent annually over the

past few years. That’s not all that different from the all-U.S. manufacturing average. Moreover,

this has been occurring at a time when the unit labor costs of this nation’s key overseas supplier,

China, have jumped substantially. If nothing else, it partly helps explain why the previously huge

textile/apparel price advantages of Far Eastern sourcing are slowly beginning to shrink.

February 2012