Like any industrial process, textile printing requires raw materials, consumes energy and produces

waste. Nonetheless, there is considerable scope for reducing the impact of the process and helping

ensure it is carried out in a more responsible and sustainable way.

At Stork Prints BV, the Netherlands, activities to reduce the impact of the printing process

fall generally into five distinct categories: more sustainable consumables such as screens; greater

process efficiency; longer equipment lifespan; adherence to strict legislation; and fundamental

research and development (R&D) into sustainability-related issues. Following is a look at each

of these categories.

Cleaner Consumables

Any advances Stork Prints makes in the production and use of its screens can have a

significant impact because of the screens’ widespread use. There are three main areas in which

these screens differentiate themselves.

First of all, the lacquer used to coat the screens is chrome-free, so there’s no

contamination possible from this potentially hazardous material. Secondly, the holes in the

company’s NovaScreen®, which is made out of nickel because of its hardness, are also of a special

shape and size, so there’s less mechanical force required to push the printing paste through onto

the substrate. A major advantage of this unique feature is that considerably less nickel is

deposited on the textile being printed because there is less wear and tear. The screens also last

longer as a result.

In addition, the company has installed sophisticated wastewater treatment systems in its

screen production facilities throughout the world. In this way, regardless of whether the screens

are manufactured in countries such as the Netherlands, China, India, Brazil or the United States,

the water required during the process is carefully collected, purified and then used again.

More Efficient Printing Processes

Stork Prints has taken a number of measures in the design of both its conventional and its

digital printing machines to ensure reduced usage of energy, water and paste or ink.

-

Energy: An average printing line has a nominal power rating of approximately 75

kilowatts, most of which is required for the drying process. A relatively high temperature has to

be maintained inside the drying chamber, and the various vapors emitted as the textile dries have

to be extracted. The company’s drying systems use a radial extraction technique that removes

moisture while leaving more warmth in the chamber. This technique uses approximately 25-percent

less energy than conventional systems, and also means customers can produce more quickly because

the process is faster.

-

Water: The company uses recycled water to rinse the pumps and the printing

blankets in its systems. In this way, water use is reduced by 65 percent – typically, to only 1.5

cubic meters per hour (m3/hr) at 50-percent efficiency, compared to the 4 or 5 m3/hr consumed using

certain other machines.

-

Paste: At the end of a printing run, there are still approximately 6 liters of

printing paste in the system, predominantly in the tubes that run between the paste reservoirs and

the screens. With most non-Stork Prints systems, this paste is simply rinsed out and flushed down

the drain. But Stork Prints makes sure that around 80 percent of the printing paste is fed back

into the reservoir.

Urea-free Printing

Reactive printing techniques are often used during the production of fashion textiles to

obtain more vivid colors. These techniques necessitate the use of urea for pre-treating the fabric

and in the printing paste. Urea produces carbon dioxide (CO2) during the steaming process, and also

has to be washed out of the fabric.

With Stork Prints’ Eco Foam Unit, there is no need for urea. Instead, special foam is used

to impregnate the fabric. This process maintains – and in some cases even improves – the fabric

color characteristics, produces less CO2 and requires a minimum amount of water. Because the fabric

doesn’t get so wet, the drying time and amount of energy required are reduced by approximately

half. Even the time required for steaming is 30- to 40-percent shorter, which also results in

energy savings.

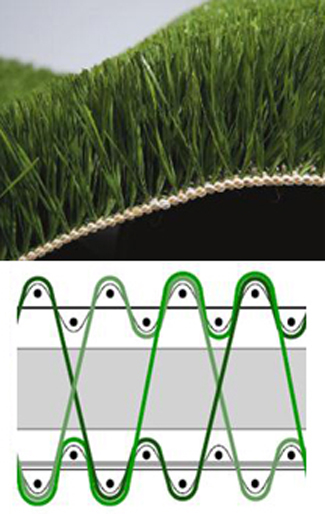

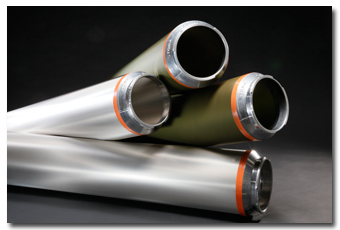

NovaScreen®: Stork Prints’ NovaScreen® rotary screens are made from nickel and combine a high

mesh count with minimum spacing between holes that are wider than holes on conventional screens,

resulting in lower paste usage and higher printing speeds as well as lower squeegee pressure, which

minimizes wear and provides sharper print results.

Using Water Instead Of Chemicals

To give another example, very aggressive acids typically are used to remove the lacquer from

screens after use, particularly in the Far East. This practice isn’t good for the environment, nor

is it good for workers exposed to these chemicals. Stork Prints’ processes, in comparison, use

high-pressure water.

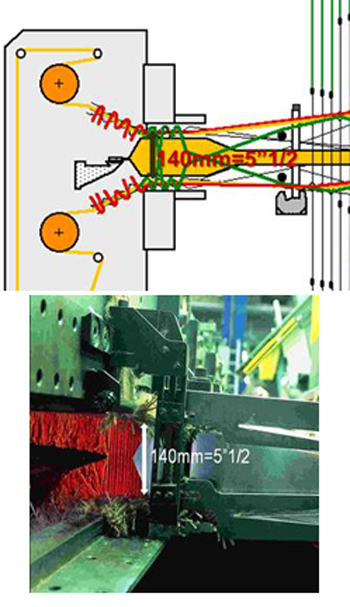

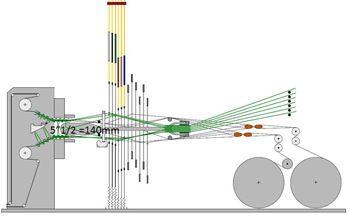

Substantial Savings Through Digital Engraving

There are also several sustainability-related advantages of direct laser (digital)

engraving. The turnaround time for screens is much shorter – typically only 15 minutes for the

company’s bestLEN, which means less energy is required. It also saves water; when using traditional

wet processes like digital wax or ink, screens have to be developed immediately after exposure,

which requires approximately 250 liters of water per screen. This is no longer necessary with Stork

Prints’ direct laser engraving.

Longer Equipment Lifespan

One of the most crucial contributions you can make as a capital equipment manufacturer is to

ensure that your products remain productive for as long as possible. Stork Prints provides

maintenance and spare parts for its printing machines for at least 20 years, and there are numerous

examples from around the world of its RD4 and RD3HD machines that are more than 35 years old and

still going strong – and still receive the company’s ongoing support and service.

Conforming To Strict Legislation

With Europe renowned for its strict environmental legislation, the company is subjected to

stringent and regular checks. In the Netherlands, for example, its screen production processes are

regularly audited by various organizations such as the fire brigade, the regional environmental

bureau, and health and safety. Worldwide, Stork Prints always makes a point of conforming to the

local regulations or its own internal standards, whichever are higher.

Ongoing Research To Further Reduce The Impact

The company also carries out fundamental R&D in a number of areas. For instance, even

though the levels of nickel and chrome in its screens are well below the permitted concentration

levels, alternatives are nonetheless under investigation so as to eliminate these potentially

hazardous substances altogether. The company is also working on screen-stripping concepts that

don’t require any chemicals. And, in addition to seeking constant improvement in its own

activities, Stork Prints also encourages its customers to adopt more socially responsible

manufacturing practices.

Joost Smits is managing director, Textile, and Geert Klaassen is consumables manager at Stork

Prints BV, the Netherlands.

April 17, 2012