Introduction

This is the third installment of a four-part series of papers stemming from a research

project conducted by B.J. Hamilton to analyze the competitiveness of the U.S. textile industry.

Earlier parts of this series have reported trends in fiber and yarn costs followed by the costs of

yarn production in the United States when compared to global competitors. This and the subsequent

part will investigate whether the demonstrated cost advantage of U.S.-produced yarn can be carried

through to afford economic advantages in fabric production.

The main sources of secondary data utilized in this paper were surveys conducted by the

International Textile Manufacturers Federation (ITMF), Switzerland, and include the ITMF

International Production Cost Comparison reports (1991-2010) and the ITMF International Textile

Machinery Shipment Statistics reports (1990-2010).

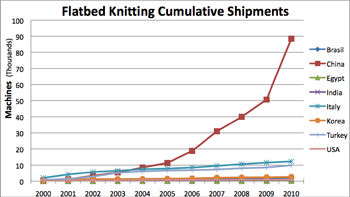

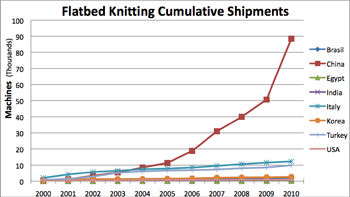

Knitting Machinery Cumulative Shipment Data

The ITMF International Textile Machinery Shipment Statistics reports do not include total

knitting capacity for each country. As an indicator of recent investment in knitting capacity,

Figures 1 and 2 were created from available data to show the cumulative shipments from 2000 to 2010

for flatbed knitting machines and for large circular knitting machines.

Figure 1 shows that China accumulated more than 88,000 flatbed knitting machines during that

time period. No other country accumulated more than 13,000 such machines during the same period.

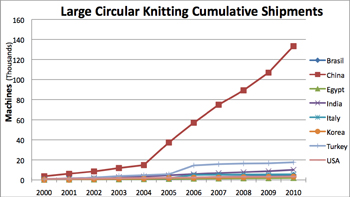

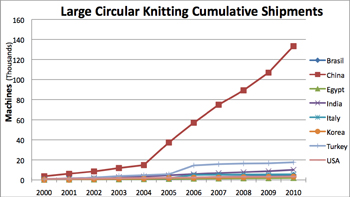

Figure 2 shows an even more extreme accumulation of large circular knitting machines by

China, with more than 130,000 cumulative shipments between 2000 and 2010. No other country exceeded

20,000 over that time frame.

Figure 1: Cumulative Shipments Of Flatbed Knitting Machines

Data Source: ITMF International Textile Machinery Shipment Statistics (1991-2010)

Click

here to view Figure 1 in a new window

Figure 2: Cumulative Shipments Of Large Circular Knitting Machines

Data Source: ITMF International Textile Machinery Shipment Statistics

(1991-2010)

Click

here to view Figure 2 in a new window

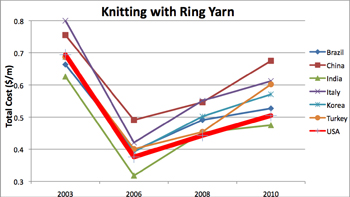

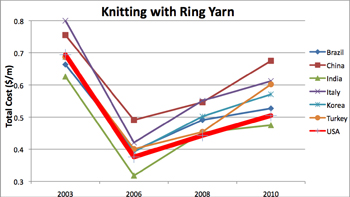

Knitting Cost Trends

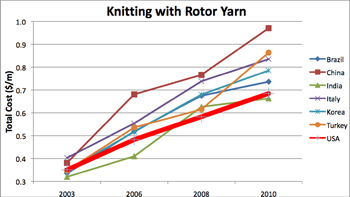

Figures 3 and 4 show the trends of knitting cost, including input cost (yarn) in each of the

included countries from 2003 to 2010. The U.S. is shown in a bold red line to emphasize its place

among competition.

Figure 3 shows the U.S. cost lowering from third-lowest to second-lowest over this time

frame and cost in China rising from second-highest to highest. In Figure 3, note that for the cost

of knitting with ring yarn, the steep decline for all countries between 2003 and 2006 is caused by

an adjustment in how the costs were calculated by ITMF. Specifically, a different base knit fabric

was used for the calculations.

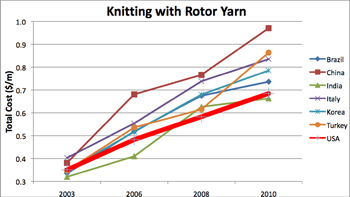

Figure 4 clearly shows that over recent years, when using rotor yarns as the raw material,

the cost of producing knitted fabrics in the U.S. has become more competitive. This is mainly due

to the lower rate of increase in cost over time as compared to other countries.

Figure 3: Knitting With Ring Yarn Costs By Year

Data Source: ITMF International Production Cost Comparison (2003-2010)

Click

here to view Figure 3 in a new window

Figure 4: Knitting With Rotor Yarn Costs By Year

Data Source: ITMF International Production Cost Comparison (2003-2010)

Click

here to view Figure 4 in a new window

Components Of Knitting Cost

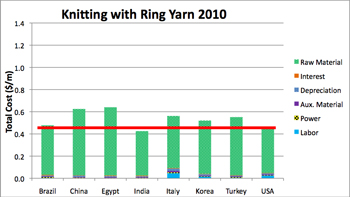

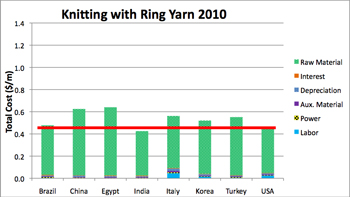

It can immediately be recognized that, according to the surveys of the ITMF, raw material

costs are more significant for knitting than for spinning or weaving. The individual cost

components available for each country for knitting in the 2010 ITMF International Production Cost

Comparison report are raw material, interest, depreciation, auxiliary material, power and labor.

Please note that the “raw material” for weaving and knitting processes refers to the costs of

purchasing yarn. It has been previously shown that yarn manufacturing costs are very competitive in

the U.S., and this benefit of locally produced inexpensive, high-quality yarn should impact

knitting costs. For the sake of brevity in this paper, only the results for knitting with ring yarn

are shown below, but knitting with rotor yarn had similar results.

Figure 5 shows the total cost of knitting for each country in 2010, broken into cost

components. A bold red line was placed on the top of the U.S. bar in order to gauge its cost

relative to the other countries.

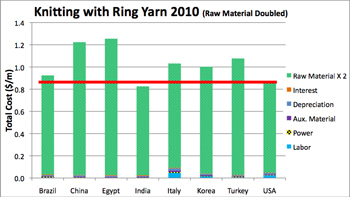

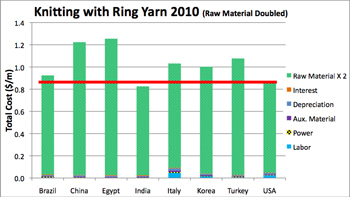

Figure 6 shows what the total knitting cost for each country would become if the raw

material cost were doubled. As shown in Part 1 of this series, this scenario could easily happen as

the result of an elevation in fiber costs, such as experienced with the cotton price increase in

2010-11. This figure shows the clear advantage gained by the U.S. versus the majority of its

competitors in the face of a large increase in yarn cost. Another factor for which a uniform global

increase might be advantageous to the U.S. is power cost. However, as indicated in Part 2, it may

be unrealistic to expect a uniform increase, and there is growing evidence that the rises in power

costs may be more influenced by regulatory issues, which vary significantly from country to

country. This is a subject of ongoing research.

Figure 5: Cost Components For Knitting With Ring Yarn

Data Source: ITMF International Production Cost Comparison (2010)

Click

here to view Figure 5 in a new window

Figure 6: Cost Components For Knitting With Ring Yarn (Raw Material Doubled)

Data Source: ITMF International Production Cost Comparison (2010)

Click

here to view Figure 6 in a new window

Conclusions

This paper shows that the U.S., while losing worldwide share in knitted fabric production,

has been slowly gaining in global cost competitiveness in knitting. Additionally, the cost

structure of U.S. knitting provides the opportunity for the U.S. to benefit from global increases

in fiber prices. The reasons for the advantage being much more applicable to knitting is that there

are very few operations in the conversion of yarns into knitted goods, which require a significant

labor input compared with weaving, which requires warp preparation.

References

Hamilton, B.J. (2012). “Short- and Long-Term Opportunities for US Textile Manufacturing.” Ph.D.

Dissertation, North Carolina State University.

ITMF. (1990-2010). International textile machinery shipment statistics.

ITMF. (1991, 1995, 1997, 1999, 2001, 2003, 2006, 2008, 2010). International production cost

comparison: Spinning, texturing, weaving, knitting.

Editor’s note: Brian John Hamilton, Ph.D., is product developer – Domestic Lifestyle at New

Balance Athletic Shoe Inc., Boston. William Oxenham, Ph.D., is Associate Dean, and Kristin Thoney,

Ph.D., is Associate Professor at North Carolina State University’s College of Textiles, Raleigh,

N.C.

June 25, 2013