D

omestic mill activity is holding up well despite the flood of imports from China and

other countries. Based on results for the first three quarters, overall 2005 production and

shipment totals for US mills won’t be down all that much vis-à-vis year-earlier levels. Part, of

course, reflects continuing economic growth.

Even with Hurricane Katrina’s negative effects, the nation’s overall 2005 gross domestic

product advance is estimated at around 3 percent. This, accompanied by still-growing employment and

incomes, is helping keep consumer spending on apparel and other textile products strong enough to

keep the domestic textile industry afloat.

Analysts at economic forecasting firm Global Insight see only a 4.8-percent decline in basic

textile mill revenues for 2005. And when it comes to the textile product sector, the forecasting

group anticipates a fractional 0.6-percent gain.

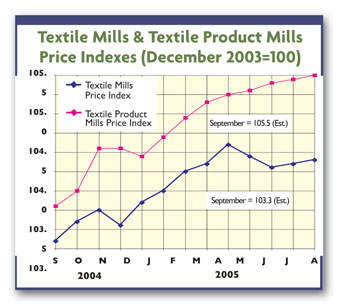

Prices, too, haven’t been faring badly and clearly haven’t experienced the catastrophic

tumble that many predicted following the junking of quotas this past January. Indeed, using Global

Insight’s latest projections, 2005 textile mill, mill product and apparel quotes are all seen

ending up within 1 percent or so of their 2004 averages.

Productivity Factor

Nor are current demand and price trends the only factors behind our continuing viable textile

industry. Much of the domestic mills’ ability to stay afloat in today’s highly competitive global

markets stems from continuing productivity gains – as firms continue to modernize and take

advantage of new technological breakthroughs. A recently released government report covering the

16-year period from 1987 to 2003 finds average output per textile worker rose 3.9 percent

annually – with fiber/yarn/thread and fabric mills racking up even more impressive 5.2-percent

and 4.4-percent increases, respectively. Efficiency gains in the domestic apparel sector over this

same period aren’t all that bad either – averaging out near 3.1 percent a year.

Combine this with very modest wage gains, and there actually are some fractional declines in

both textile mill and apparel unit labor costs over this same 16-year time span. Productivity and

unit labor cost performance in these two areas has been as good as or even a bit better than those

noted in many other domestic manufacturing sectors.

More Efficiency Gains Ahead

Productivity gains show every sign of continuing. This can best be seen by looking at employment

and output trends over the last 12 months. Domestic mill production over this period declined by

only about 2.3 percent. On the other hand, employment in the combined basic textile mill and mill

product sectors was off about 4.5 percent. Implication: Output per worker over the past year has

again risen – probably somewhere in the order of 2 percent. This trend is expected to continue

into 2006 as domestic mills continue to invest in new, increasingly efficient equipment and

processes. This willingness to spend on new world-class equipment also is confirmed by the fact

that overall textile mill capacity – despite the spate of recent mill closures – hasn’t

really declined all that much when compared to the levels prevailing just one year ago.

Lingering Trade Uncertainties

There’s still no final answer on how the US-China dispute over textile and apparel imports will

be resolved, but a compromise – limiting future Chinese shipments – is virtually certain.

On the other hand, putting specific import numbers on any such agreement isn’t easy. Odds would

seem to favor a final pact along the lines of the recent deal with the European Union – one

that limits future Beijing-to-EU shipment gains to specified category-by-category percentages. Any

such agreement would clearly rule out any repeat of our huge import gains of recent months. Another

plus: A US-China deal would also assure our continuing exports of cotton, other textile raw

materials and textile/apparel manufacturing equipment to Chinese manufacturers.

Finally, an agreement would return some stability and predictability to an industry that has

been in a constant state of turmoil for nearly a year now.

October 2005

“Thread

“Thread