S

taying on top of the manufacturing game often requires being the first to introduce a new

idea or product, making forays into new markets, and/or expanding in order to serve customers in

new locations. Following such a model, Dothan, Ala.-based Twitchell Corp. started out offering an

innovative product, expanded its product line to serve new markets and also expanded overseas to

serve customers that moved operations offshore. As it has grown, it has succeeded by identifying

high-growth market niches; developing innovative solutions in terms of performance, design and

environmental responsibility; and having a high degree of flexibility to provide well-designed,

durable products for a multitude of applications.

Today — with manufacturing bases in the United States and Asia and a global workforce of more

than 400 employees, and exporting 30 percent of its product to 35 countries worldwide — it boasts

$55 million in annual revenues. Its customers include global manufacturers of roller shades, pool

and patio furniture, awnings and screens, contract interior products, geotextiles, safety products,

automotive interiors and disposable operating room supplies; as well as the US military.

“Twitchell has a decades-long history of being a successful innovator in the field of outdoor

fabrics, textiles and yarns; and we’ve taken that and developed now into a real kind of product

development house,” said Jon Nash, CEO. “That’s where a lot of our future lies.”

Founded in 1922 by Earl Wagner Twitchell in Unionville, Conn., the company originally

manufactured woven paper products — the first in a string of industry firsts. The original product

line, Kanekraft™, today plays only a small part in its repertory.

Twitchell’s Earthtex fully recyclable thermoplastic olefin yarn is used in Long Island

City, N.Y.-based MechoShade Systems Inc.’s EcoVeil solar shade cloth.

Twitchell Corp. moved to Dothan in 1954 and eventually made a transition to manufacturing its

current dominant product lines, beginning in 1968 with Textilene™ polyvinyl chloride (PVC)-coated

yarn products — another first for the industry.

“Twitchell has a history of reinventing itself as new markets develop,” said Jeff Register,

vice president, sales and marketing. “We began producing PVC-coated products during the 1960s and

became a major player in the outdoor furniture market, producing yarn and fabric for sling seating

and pool and patio furniture. In general, this was our major focus in the ‘90s and the early ‘00s.

“Textilene is our umbrella trade name for PVC-coated yarns,” Register said. “The yarns are

predominantly polyester, but the company is experimenting also with exotic core yarns such as

Vectran®, Spectra® and Kevlar®.”

The company also manufactures PVC extrusion-coated nylon, olefin and fiberglass yarns and

fabrics; hot-melt-coated fabrics using olefin-based resins; and thermoplastic olefin (TPO) yarns

and fabrics.

Expansion Into China

Creates Opportunities Back Home

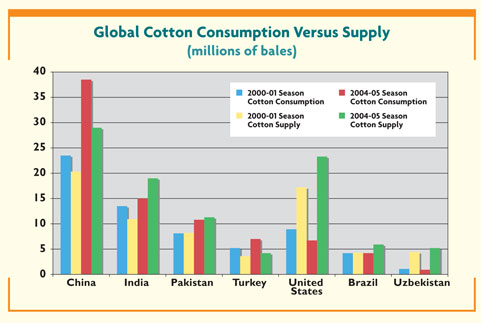

As Twitchell’s customer base of pool and patio furniture manufacturers began to move to Asia to

take advantage of cost benefits, the company also moved to Asia to serve these customers. In 2001,

it set up a wholly owned subsidiary in Kaiping, China, to manufacture extruded wicker yarn and flat

strap that is handwoven onto chair frames.

As part of what Nash described as a three-pronged strategy, Twitchell also has set up joint

ventures and contracts with several leading manufacturers in Taiwan and China to produce fabrics

that are sold predominantly to outdoor furniture accounts. These relationships are beginning to

supplement the company’s specialty fabric sales. Twitchell continues to do all design work for

these fabrics in Dothan.

Today, 25 to 30 percent of Twitchell’s gross sales revenues come from products it makes in

Asia, Register said. “But, our move to Asia created capacity opportunities in Dothan, and we began

to reinvent ourselves again. Whereas in the ‘90s outdoor furniture was our major market, now it’s

contract interiors and specialty markets,” he explained, adding that these two markets now account

for more than 65 percent of sales.

In order to meet new product demands in these markets, the company has invested in new

equipment including wide-width weaving, beaming and extrusion machinery. It purchased 11 looms in

2005, and this year will install five more.

Nash noted the importance of innovation and product development to the continuation of

Twitchell’s domestic production.

“We’ve got to develop new, cutting-edge technologies that are appropriate for manufacture in

the United States. We watch the product life cycle very carefully as it goes from innovation and

our invention, to growth, to stability and ultimately to decline,” he said. “Some of the product

life cycles may be a couple of years long, and some may be several decades long, but we watch each

product as it goes through that life cycle and try to produce it in the appropriate place depending

on where it is in that life cycle.”

Earthtex

With the company’s growth in the contract market also came the development of Earthtex™ fully

recyclable, volatile-organic-compound-free TPO yarn and fabric, which has earned Charlottesville,

Va.-based McDonough Braungart Design Chemistry LLC’s Cradle to Cradle™ Silver-level certification

for eco-effective design and manufacture. The yarn is coated with the same olefin material as the

core, thereby allowing closed-loop recycling of the end-product at the end of its useful life into

new, virgin-quality product.

The first end-product made with Earthtex to reach the marketplace is Long Island City,

N.Y.-based MechoShade Systems Inc.’s EcoVeil™ solar shade cloth, introduced at NeoCon 2004. An

Earthtex wall covering has been developed in collaboration with Atlanta-based Interface Inc.’s

Interface Fabrics division and New York City-based Designtex. Register said that product will

receive a full launch at NeoCon 2006.

“Earthtex is a premium product and is priced competitively, but slightly higher than PVC

products. It is a very focused product for very specific applications. Companies like BP Oil and

Google have been among the first to grab it up,” Register said. Both companies installed EcoVeil

solar shade cloth at their corporate headquarters.

Register expects Earthtex will play an ever-larger role in Twitchell’s product strategy as

the company increases its involvement in the contract interiors market, where designers and

architects increasingly are specifying environmentally sustainable products. He also sees growth

opportunities in residential and consumer product segments.

“Our strategy is to partner with key players in key markets where Earthtex has significant

advantages,” Register said. In addition to the current solar shade and wall covering applications,

Twitchell is targeting floor covering, seating, panel fabric and automotive interior applications.

Specialty Markets

In the specialty arena, Twitchell manufactures upscale pool and patio products such as durable

wicker strap and yarns that look like natural fiber or leather. Other specialty areas include

outdoor screens, erosion-control products and super-strength hurricane screens.

“The rash of hurricanes, the change in intensity and the number of hurricane events has

really opened up a new marketplace, particularly on the Gulf Coast. We are developing several

products specifically for that new opportunity,” Register said. “The first is SuperScreen™, a

PVC-coated polyester screen that is approximately three times stronger than traditional fiberglass

screen. It has much better UV [ultraviolet] resistance and does not degrade in terms of strength

over time like fiberglass does. In some instances, trees have actually blown over on top of lanai

[pool enclosures], and the SuperScreen and lanai supported the tree. From both a strength and a

durability standpoint, it is vastly superior to the market norm. We provide a 10-year limited

warranty, while most fiberglass manufacturers provide at most one to two years if they provide

anything at all.”

The CAT 5 Hurricane Netting System, offered by Frank L. Bennardo PE Inc., Boca Raton, Fla.,

protected this manufactured home on Hutchinson Island, Fla., when Hurricane Jeanne hit in 2004 with

winds exceeding 130 miles perhour. Only the exterior patio room sustained damage.

Twitchell products also are being sourced for beach restoration and levy reinforcement

projects along the Eastern Seaboard and the Gulf Coast. One product resembling a giant air mattress

filled with water and sand underlies the beach surface and prevents further erosion. Another

product, made with a bicolored Textilene mesh that blends with the sand color, forms a groin that

runs perpendicular to the shoreline into the water, preventing sand erosion parallel to the

shoreline.

Twitchell is collaborating with engineering firms to develop hurricane screens that have been

tested to withstand the impact of Category 5 winds and have passed Dade County, Fla., certification

for wind and projectile protection. It sees these screens as a viable soft alternative to aluminum

shutters.

Australia is a major market for Textilene for what Twitchell calls Awning with a View,

offered as Shadeview by Australia-based Imex Creative Products and as Vistaweave by Radins Agt Pty

Ltd., also based in Australia.

ldquo;Awnings there are different than what we think of here in the United States,” Register

explained, noting Australia’s drier climate, high UV intensity and skin cancer rates, and low angle

of the sun. “Awnings there are much lower to the ground and actually will cover up a large portion

of the window. A solid product would create a cave-like effect inside.

“Our Textilene product allows light to come through, and you can see out through it,” he

continued. “As long as it’s installed at an angle, 98 percent of the rain sheds off. But it also

allows a person inside to see out and allows some degree of light to come into the building,

creating a much more airy, open feel, while at the same time providing good shade. Most of these

products provide 90- to 98-percent UV protection.”

Register said Twitchell has modified the Awning with a View concept for a US Air Force

application.

“We worked with another company to create a solid PVC laminate on top of our awning material.

That laminate is extremely tough and durable and is used by the Air Force for fighter-jet

canopies,” he said. “Bases in the Florida Panhandle, New Orleans and Phoenix all use our product

exclusively. In a high wind, if a metal roof tears off, that could become a very hazardous

projectile. When a fabric tears off, its just a fabric and it rarely tears off. During Katrina last

year, the New Orleans base sustained 145-mile-per-hour winds. Less than 20 percent of the canopies

were damaged, and that damage was primarily due to flying debris.”

Advanced Coastal Technologies LLC, Dothan, Ala., uses Textilene fabric in its ProTecTube

beach restoration products. The outer-layer fabric is offered in colors to match the beach sand

within the project area.

Flexibility Serves Niche Markets

“Our niche orientation is not a feature of Coated Products alone, however,” Register added. “

We have our own olefin extrusion line, and we can produce a 50-pound or a 5,000-pound order of

olefin, which predominantly is consumed in-house. Most of our olefin products are sold into outdoor

furniture, and we have recently started working with consumer products including cut yardages for a

multitude of end-uses.”

Market Challenges

Nash spoke about the challenges

facing Twitchell, especially in the retail marketplace.

“One of the biggest challenges we face is the fact that the domestic retail market is driven

by such a ruthless sourcing model — which is not necessarily a bad thing, but it very definitely

drives you to different sorts of formulations in order to achieve the cost requirement for the

customer. So you’ve got to be very careful about exactly what you’re selling at any given time.”

While acknowledging the need to “stay on top of your game” when dealing with mass retailers,

Nash said, “We also work on how we can give a competitive advantage to the rest of the retail

marketplace — the market that is at the other end of the spectrum.” Speaking specifically about

outdoor furniture, Twitchell’s main retail market, he noted the “incredibly diverse market” in

which the mass retailer may sell a very inexpensive chair, while a smaller, specialty shop may

offer a much higher-priced chair.

“And the nice thing about that market is that it is so diverse and expanding,” Nash

concluded.

March/April 2006