BURLINGTON, N.C. — June 14, 2024 — Trivantage, a one-stop shop for fabrics, hardware, and accessories, announced today newly expanded product offerings specially for designers and workroom customers that includes not only high-quality fabrics but also thread, hand tools, notions, and other supplies needed to save time and get the job done right.

BURLINGTON, N.C. — June 14, 2024 — Trivantage, a one-stop shop for fabrics, hardware, and accessories, announced today newly expanded product offerings specially for designers and workroom customers that includes not only high-quality fabrics but also thread, hand tools, notions, and other supplies needed to save time and get the job done right.

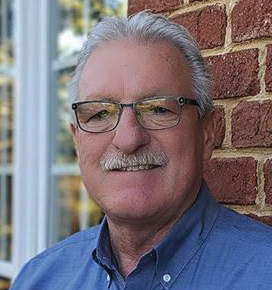

“At Trivantage, we aim to have everything our customers’ need to keep their shops going strong and their clients happy,” said Lindsay Shakarjian, marketing director for Trivantage. “They can also count on us for responsive service from a dedicated care team, hassle-free ordering, and fast shipping for a best-in-class experience that is second to none.

“At Trivantage, we aim to have everything our customers’ need to keep their shops going strong and their clients happy,” said Lindsay Shakarjian, marketing director for Trivantage. “They can also count on us for responsive service from a dedicated care team, hassle-free ordering, and fast shipping for a best-in-class experience that is second to none.

“We’ve always been known for our fabric selection, but now we have so much more, allowing customers to get everything they need, all in one place,” she added.

Trivantage is a turnkey solution for customers who want to spend less time ordering supplies and more time on their craft. Shopping for the essentials just got easier with Trivantage’s expanded selection now including:

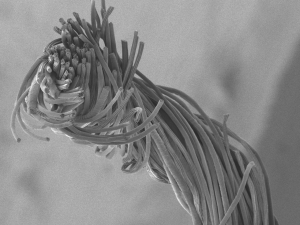

- Sewing machine accessories;

- Hand tools;

- Cutting tools;

- Threads;

- Invisible zippers;

- Clasps, needles, and pins;

- Tapes; and

- High-quality fabrics.

Customers of the largest supplier for awning, marine, upholstery, and related industries also have access to online resources where they can browse fabric by color, pattern, or collection while stocking their shops with the essentials they need. They can shop the Sunbrella x David Rockwell Currents Collection, new collaborative concepts inspired by nature; find the perfect curated upholstery thread and bobbins with the performance features they need; and shop the latest Sunbrella patterns and colors that are on trend and in demand.

Additionally, Trivantage is offering designers and workroom customers 50 percent off the first year of premium membership of Trivantage Plus, the industry’s first customer membership program.

“Trivantage Plus marries our core customer benefits with membership advantages designed for customers to level up their businesses,” Shakarjian said. “Designers and workroom customers can now enjoy half off their first year’s membership and unlock exclusive benefits, including product discounts they can’t get anywhere else.”

The annual Trivantage Plus membership program offers several key benefits to help customers gain a competitive edge plus peace of mind:

- Flat-rate, same-day shipping on parcel package orders;

- Complimentary memo samples;

- Special offers on machines, software, and more from industry partners like Consew;

- Year-round discounts on select Trivantage products and brands; and

- Virtual seminars.

“We are dedicated to providing exceptional service through responsive support, deep inventory, efficient shipping, and access to resources tailored to customer needs,” Shakarjian said.

“Trivantage is also committed to helping customers save time and money with one-stop shopping,” she added. “We make it quick and easy for customers to get what they need when they need it, so they can focus on what matters: their business.”

Posted: June 15, 2024

Source: Trivantage