M

achinery and technology suppliers for the highly technical and nonwoven textile as well

as traditional sectors, and sewn products equipment and services suppliers will colocate in Atlanta

when Textile and Sewn Products Industry Week (TASPIW) opens its doors at the Georgia World Congress

Center (GWCC) Tuesday, May 18, through Thursday, May 20, 2010. TASPIW will comprise three

well-established trade shows: the East Coast edition of Techtextil North America (TTNA) and its

concurrent TTNA Symposium; the quadrennial ATME-I® Megatex — American Textile Machinery

Exhibition-International®; and the triennial SPESA Expo and its concurrent seminars and related

events.

Although visitors need register to attend only one show, that registration will gain them

access to all three, which will be held in GWCC’s Hall B. Under the TASPIW umbrella, all three

shows will be participating in the U.S. Commercial Service’s 2010 International Buyer Program,

which promotes 35 selected U.S. trade shows and their exhibitors internationally and brings

delegations of foreign buyers to the shows in search of business opportunities.

Visitors to Techtextil North America 2008 examine military apparel on display at an

Visitors to Techtextil North America 2008 examine military apparel on display at an

exhibitor’s booth.

Techtextil North America

Show organizer Messe Frankfurt Exhibition GmbH, through its Atlanta-based U.S. subsidiary,

Messe Frankfurt Inc., this year will be putting on its seventh TTNA. For TASPIW, the East Coast

North American edition of the world-renowned Techtextil brand of trade shows will be moving from

its usual location in the Cobb Galleria Centre in suburban Atlanta to colocate with ATME-I Megatex

and SPESA Expo at GWCC downtown.

TTNA is dedicated to the technical-textile/nonwovens sector of the textile industry, and is

the only trade show in the Americas that covers the full vertical spectrum of that sector —

including research and development, raw materials, production processes, conversion, further

treatment and recycling. The North American show, inaugurated in 2000, originally was a biennial

event located in Atlanta in even-numbered years, in alternation with the flagship Techtextil

exhibition held in Frankfurt in odd-numbered years. The brand has since expanded, and the show now

has several editions held in major textile regions around the world. TTNA itself was expanded last

year as well to include a West Coast edition in Las Vegas in odd-numbered years that alternates

with the East Coast show in Atlanta.

To help attendees find providers of the products, services and technologies pertinent to

their needs and interests, TTNA exhibitors will be classified according to 12 application areas:

- Agrotech, including agriculture and forestry, horticulture and landscape, animal husbandry,

fences and more;

- Buildtech, including membrane, lightweight and solid construction, civil engineering and

industrial construction, temporary construction, interior construction, earth, water and traffic

route construction, agricultural construction, and more;

- Clothtech, including specialized high-tech materials for apparel and footwear;

- Geotech, including civil engineering, earth and road construction, dam engineering, dump

construction, ground isolation, drainage systems, and more;

- Hometech, including furniture, upholstery and room design, carpets, floor coverings, and

more;

- Indutech, including filtration, cleaning, mechanical engineering, chemical industry, electrical

industry, seals, sound absorption products and more;

- Medtech, including medical applications and biomaterials, hygiene, rescue organization

equipment, and more;

- Mobiltech, including automotive, shipbuilding, aircraft, aerospace, rail and transportation

textiles, motorcycle and bicycle construction, and more;

- Oekotech, including environmental protection, recycling and disposal applications, and

more;

- Packtech, including packaging, protective cover systems, sacks, big bags, storage systems and

more;

- Protech, including personal and object protection; and

- Sporttech, including sports, leisure, activewear, outdoor, equipment and outfits, and sport

shoe applications, and more.

Products and services offered include: fibers and yarns; wovens, scrims, braids and knitted

fabrics; nonwovens; coated textiles and canvas products; composites; Bondtec including adhesive,

bonding, laminating, finishing and other processes and materials; research, development, planning

and consultation; technology, machinery and accessories; publishers; and associations.

TTNA Symposium

The TTNA Symposium, under the direction of William C. Smith, Industrial Textile Associates,

has earned high ratings as a forum for presenting the latest developments in the technical

textiles/nonwovens sector. The schedule includes 13 sessions and more than 65 presentations by

leading industry experts covering cutting-edge technologies and applications, industry developments

and trends, and issues that impact the technical textiles sector.

Kicking off the symposium as part of the General Session Tuesday morning, keynote speaker Kim

Glas, deputy assistant secretary of commerce for textiles and apparel, will speak about relevant

trade issues and the Department of Commerce’s Sustainable Manufacturing Initiative. The opening

session also will include a global industry overview, a look at U.S. manufacturing and discussions

related to the technical textiles sector.

Subsequent sessions will cover subjects related to natural fibers and sustainable materials,

technical textiles research, military developments, new product development, nonwovens,

smart/intelligent fabrics, high-performance narrow fabrics, fiber and yarn developments, protective

textiles, technology and medical textiles/biotechnology. The ever-popular session on technical

textiles research, led by Dr. Martin Jacobs, executive director of the National Textile Center,

will present some of the latest research being conducted at universities associated with the center

as well as poster sessions showing recent student work.

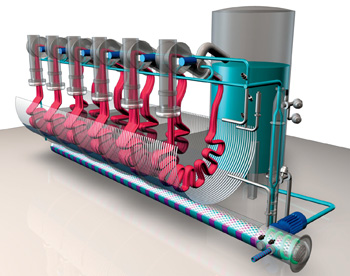

Machinery for printing labels on T-shirts will be among the range of machinery to be shown

Machinery for printing labels on T-shirts will be among the range of machinery to be shown

at ATME-I® Megatex.

ATME-I® Megatex

Owned and organized by the Falls Church, Va.-based American Textile Machinery Association

(ATMA) and United Kingdom-based Mack Brooks Exhibitions, ATME-I Megatex 2010 will draw

textile manufacturers and professionals from around the world to see the latest textile

manufacturing machinery, equipment, accessories, supplies and services for the yarn and fiber,

weaving, knitting, dyeing, printing, finishing, and nonwoven industries, among other industries.

ATME-I was first held in 1915 in Greenville as the Southern Textile Exposition. In 1969, ATMA

became involved with the expo, and the show’s name was changed to American Textile Machinery

Exhibition-International. It continued to be held in Greenville until 2006, when it moved to

Atlanta. The show last took place in October 2006, and was colocated under the Megatex umbrella

with IFAI Expo 2006 and the American Association of Textile Chemists and Colorists’ (AATCC’s) 2006

International Conference and Exhibition. That overall event saw a combined total attendance of more

than 13,000 visitors and suppliers from more than 80 countries. According to 2006 show registration

records, nearly 25 percent of attendees were owners, CEOs or other management personnel; 13 percent

were responsible for technical, operations, planning or purchasing; and 13 percent were involved in

manufacturing/production and research and development.

Exhibit categories at this year’s ATME-I Megatex will include:

- machinery for spinning preparation, man-made fiber production, spinning, winding, texturing,

twisting, auxiliary machinery and accessories;

- testing and measuring equipment

- pneumatic equipment and air-conditioning plants;

- transport, handling and packing equipment;

- equipment for liquid, air and solids recycling;

- software for design, data monitoring and processing (CAD/CAM/ CIM) and integrated

production;

- automatic controls and data collection systems including process controls;

- technical information sources, education and associations and professional services;

- machinery, apparatus, accessories, supplies and services required for the general maintenance

of plants and equipment;

- allied industrial activities;

- weaving preparatory and weaving machinery, tufting machinery, auxiliary machinery and

accessories;

- knitting and hosiery machinery, auxiliary machinery and accessories;

- washing, bleaching, dyeing, printing, drying, finishing and making-up machinery, auxiliary

machinery and accessories;

- other machinery and accessories;

- cut and sew machinery and accessories for the making-up industry;

- textile testing and measuring equipment, laboratory equipment, electrical equipment, air

compressors and air dryers, lubricants and lubricating equipment;

- mill and process supplies for weaving, knitting and finishing plants;

- dyestuffs and chemical products for the textile industry;

- associated goods and services for the textile industry; and

- agents and distributors.

ATME-I Megatex will conduct a series of educational, networking and business seminars in

tandem with the show as well. The ATME-I Megatex Golf Day, organized by ATMA, will be held prior to

the show. As part of TASPIW, ATME-I Megatex also will host an exhibitor networking party for all

visitors and exhibitors. Show organizers will release event details as the show nears.

Colocating alongside ATME-I Megatex will be the AATCC International Conference, which will

feature three educational tracks, a poster session, student paper competition, student textile

bowl, welcoming reception and awards luncheon. The educational tracks will feature presentations

applicable to all aspects of the textile industry; and will include Concept 2 Consumer®, Chemical

Applications, and Materials.

Demonstrations of machinery and technology for the sewn products industry will be offered

Demonstrations of machinery and technology for the sewn products industry will be offered

by many SPESA Expo exhibitors.

SPESA Expo

SPESA Expo 2010 and its concurrent symposium, owned and produced by the Sewn Products

Equipment Suppliers of the Americas (SPESA), Raleigh, N.C., covers the entire concept-to-delivery

sewn products lifecycle. The expo will offer a complete range of equipment technology and services

for all sectors of the global sewn products industry including apparel, footwear and accessories;

home furnishings and upholstery; luggage and leather goods; technical and industrial textiles;

safety and protective gear; and automotive and transportation interiors. Visitors will have the

opportunity to observe live demonstrations and new product introductions from exhibitors

specializing in cutting, spreading, sewing, pressing, finishing, design and production software

solutions, sewing threads, needles, purchasing, logistics, and more.

As of

Textile World

‘s press time, SPESA reported booth sales had already surpassed the total exhibit space

occupied in the previous SPESA Expo, held in Miami Beach, Fla., in May 2007. The organization also

reports that attendee registration is very strong, surpassing the numbers seen at the same point

prior to SPESA Expo 2007.

As a result of strong exhibitor and attendee response, SPESA has added several new exhibit

categories to this year’s expo, including fabrics and materials, trims and components, product

development services, production and supply chain services, and information technology.

The expo also will feature a variety of new attractions, including the first-ever “Made in

USA Supply Chain,” pavilion, presented by Columbia, S.C.-based SEAMS, the National Association for

the Sewn Products Industry. The pavilion is expected to cover more than 2,000 square feet and will

feature products made by SEAMS member companies, as well as individual exhibits by U.S.-based

companies that provide manufacturing and other services for the soft goods supply chain.

“Supply Chain of the Americas” will highlight opportunities and resources available to sewn

products manufacturers, brand marketers and vertical retailers in the Western Hemisphere. Designed

to complement the expo, this exhibit will expand the event’s coverage to the entire

concept-to-delivery sewn products lifestyle – adding a new direction for the show, which in the

past primarily has showcased machinery and technology.

Other new attractions include the IT Showcase, which will display innovative enterprise- and

industry-specific software solutions; the Cool Zone 2.0 exhibit, featuring exciting new

technologies that are changing the sewn products industry; and numerous country and regional

pavilions from Latin America, Asia and Europe.

SPESA will hold several pre-show events on Monday, May 17, beginning with a workshop from

9:00 a.m to 4:00 p.m. titled “Exploring Lean Business Practices” and an executive conference from

1:00 to 5:00 p.m. titled “Building the Supply Chain of the Future – Case Studies From Today.” Both

will feature speakers from Cary, N.C.-based [TC]

2, a provider of technology development and supply chain improvement solutions for the

apparel, sewn products and related soft goods industries.

On Monday evening, SPESA will host an Industry V.I.P. Opening Gala to benefit the American

Apparel & Footwear Association (AAFA) Education Foundation, which supports and recognizes

students and institutions that contribute toward the advancement of the apparel industry. The

event, to be held at the Georgia Aquarium in downtown Atlanta from 7:30 to 9:30 p.m., will offer an

evening of networking and entertainment.

The SPESA Expo Forum will offer 30 workshops and seminars during the course of the expo.

Activities will kick off with a headliner breakfast Tuesday morning that will include a program

titled “Global Sourcing Perspectives — Things to Consider,” led by Laura Rowen, director of

manufacturing, Brooks Brothers; and Dr. Mike Fralix, president and CEO, [TC]

2. Other presentations will cover a wide range of topics of interest to sewn products

industry leaders.

For more information about Techtextil North America and TTNA Symposium, visit

www.techtextilna.com. For more information about ATME-I®

Megatex, visit

www.atmei-megatex.com. For more information about SPESA

Expo, visit

www.spesaexpo.com. Online registration for the exhibits is

free. In addition, registration for activities associated with each exhibition is available at the

respective websites.

March/April 2010