T

extile industry leaders and government trade officials are honing a new set of tools to

deal with the declining textile industry, and taking actions they hope will lead to eventual

recovery and growth opportunities.

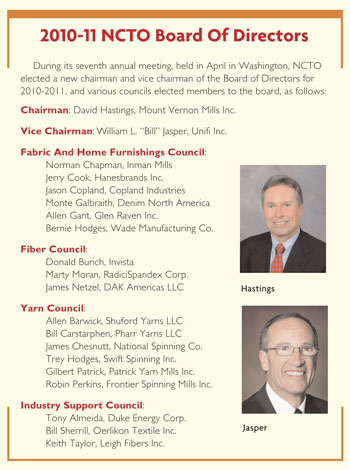

As some 100 industry and government officials met recently in Washington for the seventh

annual meeting of the National Council of Textile Organizations (NCTO), a subtitle for the

meeting’s theme – “Knowledge, Innovation, Speed and Integrity: Leveraging the U.S. Advantage” –

might well have been “Thinking Outside the Box.” Assistant U.S. Trade Representative for Textiles

Gail Strickler used that term in talking about government assistance for export financing. NCTO

President Cass Johnson did the same as he described NCTO’s lobbying activities. And Janet Labuda of

U.S. Customs and Border Protection (CBP) seemed to be saying the same thing as she described a new

program to crack down on Chinese import fraud.

Rep. Bobby Bright, D-Ala. (right), emphasizes the need for job creation and calls for tax

incentives to encourage manufacturers to hire new workers, as outgoing NCTO chairman Wally

Darneille looks on.

In his state-of-the-association report, NCTO Chairman Wally Darneille said 2009 had been a

“tough year for textiles,” pointing out that the nation faced the worst economic downturn since the

Great Depression. At the same time, Chinese imports surged after the removal of import safeguards;

subsidized imports from India, Pakistan, Bangladesh and Vietnam “gobbled up an even bigger share of

our market”; and textile exports to North America Free Trade Agreement (NAFTA) and Central

America-Dominican Republic Free Trade Agreement (CAFTA-DR) nations fell off by 20 percent.

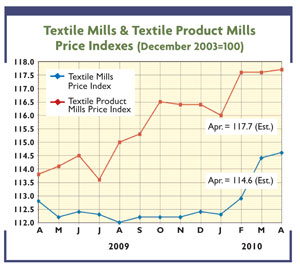

“Hopefully, the worst is behind us,” he said, noting that NCTO members are reporting increased

orders and prices are inching up a little, although input costs also are going up.

Darneille urged NCTO members to “focus daily on the competitive advantages we can create

within our supply chain,” saying: “Our knowledge, innovation, speed and integrity give us a total

value proposition that is clearly superior. We know what our customers want better than suppliers

in other parts of the world. We constantly innovate our products and our processes and stay ahead

of the curve. We can react to changes more quickly, and shorter supply chains mean lower

inventories for our customers, and they know they can depend on our integrity to deliver them the

proper quality on a timely basis. Our challenge is getting our customers to quantify that.”

In a report covering trade issues, Johnson cited as a major problem the steady decline in

trade with Western Hemisphere nations with which the United States has preferential trade

agreements that require use of U.S. and/or regional yarn and fabrics in duty-free apparel imports.

NCTO issued a report showing a drop in trade in a range of products including trousers, underwear,

T-shirts, socks, knit shirts and brassieres. The data show that qualifying regional apparel imports

between 2008 and 2009 were down 14 percent within the CAFTA-DR region, 16 percent within the NAFTA

region, 43 percent within the Andean region and 16 percent under the Caribbean Basin Initiative.

Johnson said China is the “major contributor to the decline.”

He added that there is a dangerous trend line and “we are trying to prevent worse things

happening.” He cited the need for meaningful actions against China and other nations that illegally

subsidize their exports. He also said NCTO is working with government agencies on innovative means

to obtain export financing. Another high-priority area is working with CBP and Congress to develop

better means to combat illegal imports.

Legislation

NCTO’s staff outlined a number of legislative issues and placed considerable emphasis on the

need for immediate passage of the duty suspension bill, which grants duty-free treatment to imports

that do not compete with U.S.-made products. There are a number of textiles on the list of duty

exemptions that expired at the end of last year, and some products have been added. Johnson

said failure to act on the bill “is coming at the worst possible time.” NCTO supports legislation

calling for tougher Customs enforcement, measures in the House and Senate that would make it easier

to take anti-dumping and countervailing duties against countries that manipulate their currencies,

extension and expansion of the Buy America requirements for government procurement, and extension

of the Andean Free Trade Agreement.

Listed as threats are bills under consideration that would grant assistance to Haiti;

preference reform legislation that would grant duty preferences to Cambodia and Bangladesh; and the

cap-and-trade environmental control legislation. With respect to Haiti, NCTO says it has taken a

leadership role in supporting measures the would help bolster the Haitian apparel industry, but it

feels some measures under consideration by Congress would permit inputs from Asian nations that

would result in U.S. textile job losses. NCTO is opposed to granting new trade preferences to

Cambodia and Bangladesh, as they already are major suppliers to the U.S. market without special

treatment.

Thinking Outside The Box

A number of speakers at the meeting discussed new and innovative approaches to addressing

problems. Labuda described a new Customs program designed to crack down on Chinese import fraud

stemming from undervaluing exports. She said her agency has uncovered countless cases of imports

entering the United States at declared values that are only a fraction of their actual value. She

said her agency is investigating how the declaration system is being abused, and that, where

possible, it will levy fines and exclude entry of offending products. Johnson said Labuda has

“discovered a large hole in the system [and she is] pressing the government to fill it.” Labuda

also said her agency is monitoring the performance of trade preference programs to ensure that they

are being properly enforced, and the agency is stepping up its training of textile and apparel

specialists.

Strickler discussed new inter-agency efforts to help facilitate exports of textiles and

apparel. She noted export financing is a major problem, as many of the countries that present

market opportunities do not have the resources and effective systems to come up with the credit

needed to finance trade. She said the office is working with the Export-Import Bank, the Commerce

Department and other agencies, and that it is in contact with factors and others in the industry

who can contribute to developing new ways to address export financing.

NCTO reported on the creation of TexNet, a new grassroots network that draws on the

resources of outside organizations that have similar interests in the area of international trade.

This effectively doubles the number of employees involved in issues on the textile industry agenda.

Sen. Lindsey Graham, R-S.C., addresses problems with Chinese trade and says his

anti-currency manipulation bill would pass the Senate by a wide margin.

Congress And Textiles

Members of Congress speaking at the meeting emphasized the importance of trade to the U.S.

economy but said it must be not just free trade, but also fair trade. Sen. Lindsey Graham, R.-S.C.,

addressed problems with China trade and said, “We must bring balance to an imbalanced system.” One

way to do that would be to enact his bill, which for the first time would permit anti-dumping cases

to be brought based on currency manipulation. In view of widespread concern about China trade, he

believes his bill would pass the Senate by 75 to 80 votes. Rep. Bobby Bright, D-Ala., a member of

the Blue Dog Coalition of conservative Democrats, called for bipartisan legislation to bring down

the record level of unemployment, and said one step would be to improve credit access for small and

medium-size manufacturers to help them export. He also supports tax breaks for companies hiring new

employees. Saying there are many ways to promote fair trade, Rep. Linda Sanchez, D-Calif., called

for renewed efforts to open export markets but at the same time attack illegal subsidies of imports

and require fair labor standards in exporting countries. “We want to promote trade, and if we do it

right, we can boost our economy,” she said.

May/June 2010