-I Exhibitors 3M Abrasive Systems Division, St. Paul, Minn., will exhibit drive and pull roll

coverings made from engineered polymers and available in smooth, textured and bristle surfaces;

unique methods that do not use glues or chemicals to attach coverings to drive and pull rolls; and

abrasive solutions featuring 3M bristle technology for maintenance repair operations. Primary

contact in booth: Jim Kessinger. Booth No. B-1411.AC Corp., Greensboro, N.C., will exhibit the

Z92000, a complete HVAC system to keep precise environmental control of temperature, humidity and

cleanliness at a low cost. Primary contact in booth: Ron Howerton. Booth No. A-228. Air Relief

Inc., Mayfield, Ky., specializes in remanufactured parts and services for Ingersoll-Rand Centac Air

Compressors. Primary contact in booth: Kerry Williams. Booth No. B-1421.Albatross USA Inc., Long

Island City, N.Y., will be displaying its full line of Mistral® Spot Cleaning Chemicals and

equipment. Albatross will demonstrate Mistral XS Textile Cleaning solvent that has been

reformulated without 1,1,1 trichloroethane. Primary contact in booth: Jay Margulies. Booth No.

A-113.American Cutting Edge, West Carrollton, Ohio, will display blades and knives for all types of

cutting applications. Primary contact in booth: John Ramantanin. Booth No. B-1222.American Filteco

Machinery Corp., Marietta, Ga., will exhibit BCF extrusion equipment and winders for the carpet and

textile industries. Primary contact in booth: Larry Hummer. Booth No. B-1316.American Linc Corp.,

Gastonia, N.C., will show the CV-35 frieze yarn/coiled yarn conversion system for processing spun

yarn, BCF, nylon, polyester and polypropylene. Other equipment to be displayed includes the EFT-900

even feed tensioner and the MVS-600 mechanical yarn sensor, which is a low-maintenance replacement

for traditional photo eyes. Primary contact in booth: Ryan Hoover. Booth No. B-1302.American

Moistening Co., Pineville, N.C., will exhibit humidification systems including space, air-assist,

high-pressure and custom-designed humidifiers. Primary contacts in booth: Hal Wilson and Dave

Kelsey. Booth No. D-2219.Amsler-Tex AG, Switzerland (Symtech Inc., Spartanburg, S.C.), will display

yarn-effect devices for ring-spinning and open-end frames as well as core-yarn devices for

ring-spinning frames. The company also offers software and hardware for all types of fancy yarn

creation and visualization. Primary contact in booth: Peter Egli. Booth No. D-2100.Argus Fire

Control, Charlotte, N.C., will have among its exhibits automatic fire-protection systems,

metal-detection systems, and building fire alarm and security systems, as well as card access

systems and the Odyssey Intelligent Fire Control system. Primary contact in booth: Mike Viniconis.

Booth No. D-2619.Ashworth Card Clothing Inc., Greenville, S.C., will be exhibiting metallic wire

for cotton and nonwoven carding. The company also supplies card parts and offers card roll repair

and card clothing installation. Primary contact in booth: Carlton Reeves. Booth No. C-1700,

C-1701.ATI (Americas Textile Industries), Atlanta, will offer copies of the magazine (including

Fiber World and Knitting/Apparel), which features extensive reports and information on ATME-I 2000.

Primary contacts in booth: James M. Borneman, Editor In Chief; James C. Phillips Jr., Executive

Editor; Eric Vonwiller, Senior Technical Editor; Marcella Nacmias, Associate Publisher and Vice

President, International Operations; and Denise Buchalter, Advertising Business Manager. Booth No.

C-1625.Atkins Machinery, Spartanburg, S.C., will exhibit used textile machinery and Schlafhorst

open-end parts. Primary contact in booth: Greg Atkins. Booth No. D-2531, D-2540.Autefa GmbH,

Germany (Fi-Tech Inc., Richmond, Va.), will offer solutions for complete package automation

including doffing, transportation, storage and packing. Also featured will be automatic

staple-fiber bale presses and bale storage solutions. Primary contact in booth: Udo Teich. Booth

No. D-2617.Awa Spindle Co. Ltd., Japan (Izumi International Inc., Greenville, S.C.), will show

twisting spindles, covering spindles and interlacing nozzles. Primary contact in booth: Ken Overly.

Booth No. D-2604.Bahmer Machine Works, Germany (W. Fritz Mezger Inc., Spartanburg, S.C.), will show

a spiral can coiler that is adaptable to any type of carding machine. Primary contact in booth:

Fritz Mezger. Booth No. B-1426.Bamco Belting, Greenville, S.C., will present nylon and leather

belting for conveyors and various other types of applications. Primary contact in booth: Don James.

Booth No. A-202.Barco Automation, Charlotte, N.C., will present equipment for the detection and

elimination of contaminants in the spinning plant. This includes the Cotton Sorter for the blow

room, Sliver Watch for drawframes, and ABS foreign fiber detection on open-end spinning machines.

The company will also highlight its Barcoprofile optical yarn-measurement systems, which can be

used on air-texturing machines, air-entangling machines and sewing-thread machines. The Opti-Spin

detection system for ring-spinning machines, Opti-Twist speed-control system for twisting machines,

KIT sliver information system for cards and drawframes and Sycotex system for spinning plants are

other equipment that Barco will emphasize. Primary contact in booth: Joe Essick. Booth No.

C-1926.Barmag AG, Germany. Booth No. C-1740.Louis P. Batson Co., Greenville, S.C., will show

textile accessories and supplies. Primary contact in booth: Marie Cox. Booth No. B-1335.Bay

Controls Inc., Maumee, Ohio, offers advanced compressed-air system management solutions. Bay will

introduce the new BayWatch performance enhancement service that includes 24-hour-a-day efficiency

monitoring and web-based reporting for flexible access to key information. Primary contact in

booth: Gary Thaxton. Booth No. A-414.Befama, S.A., Poland (Wise Industries, Kings Mountain, N.C.),

will exhibit an edge-trim opener for nonwovens. Other products offered by the company include

carding machinery, opening and blending machinery, textiles recycling equipment and ring-spinning

frames. Primary contact in booth: Piotr Fialkowski. Booth No. A-322, A-324.Belmont Textile

Machinery, Mount Holly, N.C., will show an air-entanglement machine, take-up winders, accumulators

and yarn coilers. Primary contact in booth: Jeffrey T. Rhyne. Booth No. C-1936.Belt Shop Inc.,

Belmont, N.C., will showcase flat power-transmission and conveyor belting as well as spinning and

twister tapes, ID bands, crosslapper belts, and screen and mesh belting. Primary contact in booth:

Jim Mull. Booth No. D-2225.BettariniandSerafini, SRL, Italy (Stellamcor Inc., Larchmont, N.Y.),

will emphasize various machinery and technology for yarn production. Some of the machines on

display include carding machines, opening machines, fiber openers, metering machines, card feeding

systems and weighing control systems. Primary contact in booth: Giovanni Bettarini. Booth No.

D-2925-A.Binsfield Engineering Inc., Maple City, Mich., will display rotary temperature

transmitters used to accurately monitor temperatures on heated godet roll sheets. New products to

be featured are the RT300 Rotary Temperature Transmitter System, the RT220 Rotary Temperature

Transmitter and the DS220 Digital Stator. Primary contacts in booth: Michael Binsfield and Mike

Kawiecki. Booth No. B-1230.Adolf Bockemuehl GmbHandCo. KG, Germany (Symtech Inc., Spartanburg,

S.C.), will exhibit special accessories for spinning machines, including condenser tapes, aprons

and bobbins, rubbing and combing aprons, cots, texturing aprons and high drafting aprons. Primary

contact in booth: Bobby Patrick. Booth No. D-2101-A.Bombi Meccanica, Italy (Stellamcor Inc.,

Larchmont, N.Y.), will exhibit spray, low-melt fiber, powder and foam bonding technologies; hot and

cold calenders; computerized foam generators and foam applicators; various ovens and dryers; and

air-cleaning towers. Primary contact in booth: Tancredi Bombi.Booth No. D-2927.Bowman-Dunn Mfg. Co.

Inc., Charlotte, N.C., will display aprons, belting, flexible card clothing and wire cylinders for

yarn formation processes. Primary contact in booth: Russ Bowman. Booth No. B-1522.Brer Ltd.,

Switzerland (Graf Metallic of America Inc., Spartanburg, S.C.), will introduce its new Titan finish

spinning rings and the latest developments in traveler design and finish for high-speed, quality

ring spinning. Brer will also show Rapid, equipment for semi-automatic insertion of travelers.

Primary contact in booth: James Mauney. Booth No. B-1301.Briggs-Schaffner Co., Winston Salem, N.C.,

will highlight its new and used beam maintenance programs for tricot, section and loom beam

repairs. Primary contact in booth: Steve Hagood. Booth No. C-1818.Bunting Magnetics Co., Newton,

Kan., will exhibit permanent and electro magnets. Primary contact in booth: Dale J. Thortsen. Booth

No. D-3029.Christoph Burckhardt AG, Switzerland (Fi-Tech Inc., Richmond, Va.), will feature its

patented fibrillating system using replaceable pin bars. In addition, Burckhardt will highlight its

extensive capabilities for hot and cold perforation. Primary contact in booth: Christoph Ulmer.

Booth No. D-2506.Burckhardt America Inc., Greensboro, N.C., will show rotor spinning components

including rotors, navels, twist traps, combing rolls and wear coatings. Primary contact in booth:

Robert Mackey. Booth No. B-1436.BVO Corp., Monroe, N.C., will exhibit roll-shop equipment including

cots, aprons, rollers and spare parts for the spinning and yarn industry. Primary contact in booth:

Don Bump. Booth No. D-3016.CandD Robotics, Beaumont, Texas, manufactures material-handling gantry

robotic systems that palletize and depalletize. CandD will showcase its specialty multi-line

palletizers, order picking, and packaging-material handling equipment. Other equipment in the

companys product line includes conveyors, pallet dispensers, rail cars and a zip-coded bundle

palletizer. Primary contact in booth: J. C. Caraway. Booth No. A-312.C. B. Mfg.andSales Co., West

Carrollton, Ohio, is a manufacturer of custom and standard blades for the textile industry and also

provides blade coatings for longer life. Booth No. B-1222.Caraustar, Fort Mill, S.C., will display

yarn carriers for filament and spun yarns, various tubes for texturing drawtwist, and paper tubes

used in the packaging and windup of nonwoven fabrics. Primary contact in booth: Richard Massey.

Booth No. D-2119.Cardan Design Corp., Maplewood, Nev., will have among its exhibits tungsten

carbide tow-cutter blades. Various other types of blades will also be on display. Primary contact

in booth: Charles Sears. Booth No. A-125.Carico Systems, Fort Wayne, Ind., will exhibit wire

container models 15102, 15403, 15406 and 15739 as well as roll cart models RC-4, RC-5, RC-9 and

RC-11. Primary contact in booth: Lori Graves. Booth No. B-1507.Carolina Brush Mfg. Co., Gastonia,

N.C., will show custom design and special application brushes for use in the textile industry.

Primary contact in booth: Fred Spach. Booth No. D-2629.Meccanica Carresi, SRL, Italy, will show a

video highlighting its machinery for the opening, cleaning, oiling, storing, blending and feeding

of textile fibers destined for woolen spinning, worsted spinning, nonwoven production lines and

rag-tearing lines. Primary contact in booth: Alessandro Badiali. Booth No. D-3023.A. B. Carter

Inc., Gastonia, N.C., will introduce a mag-feed traveler installation tool for improving spinning

productivity; the Resch in-line steaming machine to steam bobbins for the purpose of relaxing yarn

twist and controlling residual moisture; and the neps and trash indicator tester (NATI), which is

designed to monitor sliver quality at the carding, combing and drawing machines. Other laboratory

testing equipment will be on display. Primary contact in booth: Fred Rankin. Booth No. B-1326.Cary

Mfg. Corp., Charlotte, N.C., will exhibit blowers and vacuum pumps, vacuum accessories and the Cary

Super Vac portable and stationary vacuum systems. Primary contact in booth: Gil Millsaps. Booth No.

D-2505.Cason, SPA, Italy (Fi-Tech Inc., Richmond, Va.), will exhibit an extensive line of manual,

semi-automatic and fully automatic bobbin/pirn stripping units. The company will also promote new

fine-denier polypropylene turnkey spinning plants. Primary contact in booth: Giovanni Cama. Booth

No. D-2508.Ceramco Inc., Charlotte, N.C., is a source of roll manufacturing and reconditioning

technology and will have on display ceramic and metal coatings that offer wear resistance and

engineered surface properties. Booth No. A-206.CeramTec North America, Laurens, S.C., will

introduce conductive alumina pins and eyelets that can dissipate static and have good wear

resistance. The company also offers technical ceramics including eyelets, applicators, air-jets,

stationary guides and traverse guides. Primary contact in booth: James Satterfield. Booth No:

B-1505.Cezoma BV, The Netherlands, will show various tube, cone and bobbin winders as well as

accessories. Primary contact in booth: A. W. F. Ceelen. Booth No. B-1218.Chase

MachineandEngineering, West Warwick, R.I., will display a cut-to-length machine and a two-box

festooner. Booth No. B-1219.Chemineer-Kenics, North Andover, Mass., will highlight its mixing

technology, which has been developed to offer in-line processing with a minimal drop in pressure.

The Kenics mixing element can blend and disperse fluids in-line, eliminating the need for batch

processes. Primary contact in booth: Steve Willis. Booth No. D-2728.Clarkson Industrial

Contractors, Spartanburg, S.C., will offer information on installation, erection or relocation

services for equipment and machinery. Primary contact in booth: Rick Smith. Booth No.

D-2524.Clemson University, Clemson, S.C., will be promoting textile and fiber education at Clemson

with information on majors and services available to industry. Primary contact in booth: Bob Bowen.

Booth No. B-1133.Cognetex, SPA, Italy (ZTM, Ashville, N.C.), will exhibit stretch-breaking

machines, drawframes, roving frames for worsted yarn and ring-spinning frames for worsted spinning.

Primary contact in booth: Paolo Campagnoli. Booth No. C-1932.Component Resources, Spartanburg, S.C,

will highlight open-end spinning parts. Primary contact in booth: Greg Atkins. Booth No.

D-2430.Conitex Sonoco, Gastonia, N.C., will feature high-performance paper cones and tubes for the

spun-yarn market. Primary contact in booth: Leary Cloer. Booth No. C-1836.Corghi, SPA, Italy (Louis

P. Batson Co., Greenville, S.C.), will show cone-to-cone winders, hank-to-cone winders and

dewinders. Primary contact in booth: Marie Cox. Booth No. B-1432.Custom Industries Inc.,

Greensboro, N.C., will exhibit automatic yarn-packing systems, laser marking for yarn packages and

cones, replacement parts for Schlafhorst and Murata winding and spinning machines, and Electrotex

sensing and monitoring devices. Primary contact in booth: Mike OConnor. Booth No. C-1922.Cutrite,

(Louis P. Batson Co., Greenville, S.C.), will display scissors and shears. Primary contact in

booth: Marie Cox. Booth No. B-1335.Dalmec Italia, SPA, (Symtech Inc., Spartanburg, S.C.), will be

exhibiting Speedyfil, its miniature Manipulator, which is equipped with specific pneumatic grippers

for handling textile bobbins. Also on display will be the Partner Industrial Manipulator, which can

handle carton boxes with the use of special vacuum grippers, enabling operators to move any product

effortlessly. Primary contact in booth: Daniel Martin. Booth No. D-2115.C. R. Daniels, Ellicott

City, Md., will show material handling solutions including shipping containers, tilt trucks and

conveyor belting. Primary contact in booth: George Frazier.Booth No. D-2413, D-2415, D-2417.Datapaq

Inc., Wilmington, Mass., will showcase the Oven Tracker System for monitoring the temperature

profile in a tenter oven. The system combines the latest data-logger technology with thermal

protection and analytical software to ensure the process is kept within specified tolerances.

Datapaqs 9000 data logger has the fastest sampling rate in the industry, the company claims.

Primary contact in booth: Connie Wood. Booth No. B-1409.Datatex TIS Inc., Greenville, S.C., will

demonstrate its software for textile manufacturing applications. The systems are fully integrated

and offer everything needed to operate a plant. Datatex will also introduce Java-based

applications. Primary contact in booth: Jim Watters. Booth No. B-1526.Davis-Standard Corp.,

Pawcatuck, Conn. (Lawson-Hemphill Sales, Spartanburg, S.C.), will show various extruders and

controls, feed screws, film lines and lab lines for staple and synthetic fiber. Primary contact in

booth: Mark A. Reese. Booth No. B-1236-A.Day International Inc., Greenville, S.C., will feature

various cots and aprons for spinning and texturizing yarn. Primary contact in booth: Marsha Marsh.

Booth No. C-1820, C-1832.DellOrcoandVillani, SAS, Italy (Stellamcor Inc., Larchmont, N.Y.), will

have information on opening and blending equipment, pneumatic transport systems and presses.

Blending boxes, reclaiming machinery, hopper feeders, bale openers, fine openers, apron feeds,

condensers, automatic control systems and horizontal presses are included in the machinery and

technology that DellOrco has to offer. Primary contact in booth: Sergio DellOrco. Booth No.

D-2925-B.Dent Inc., Huntersville, N.C., will exhibit optical yarn-break detectors and software

systems for data monitoring and processing. Primary contact in booth: Andrew Dent. Booth No.

D-2410.Diamond Wire Spring Co., Taylors, S.C., will show various compression, extension and torsion

springs, as well as wire forms. Primary contacts in booth: Gene Coyle and Frank Fazio. Booth No.

A-403.DietzeandSchell GmbH, Germany (American DietzeandSchell Corp., Piedmont, S.C.), will have an

information booth displaying pictures and catalogs of winding and texturing machinery. Primary

contact in booth: Christian Iyer. Booth No. D-3033.Dilo System Group, Germany (Dilo Inc.,

Charlotte, N.C.), will have among its exhibits a special airlay Turbo-Card system fed by a

Trutzschler FBK feeding unit followed by the Hyperpunch ultra high-speed needler. This line aims

for high-speed needling of lightweight hygienic or medical material as well as special filtration

products. Other Dilo technology to be shown includes a Di-Lour double-structuring unit for the

production of velour for auto interiors; and the high-speed patterning machine, Di-Loop DYSXB, for

floor coverings; along with Dilo Di-Sign software. Booth No. C-1829.DMandE Corp., Shelby N.C., will

exhibit tow cutters, crimpers, cutter reels, winder cams, tension stands and a cutting-load

indicator for diagnostic measurement. Primary contact in booth: Phil Love. Booth No.

D-2829.DO-Ceram Engineered Ceramics, Co. Ltd., Germany, will present its line of ceramic thread

guides made from alumina, titania and zirconia, and will also introduce Cerazur, its brand-new blue

ceramic with an extremely high impact resistance and hardness. Primary contact in booth: Thomas

Krause. Booth No. B-1506.Dover Flexo Electronics Inc., Rochester, N.H., will exhibit WebHandler, a

low-cost automatic tension controller; the TrueTension series of tension indicators; tension-roll

transducers, roll-shell transducers and narrow-web transducers to measure tension on textile

machinery; and heavy-duty dual-disc pneumatic tension brakes to control tension on any rewind.

Primary contact in booth: Mark Breen. Booth No. D-2227.Dukane Corp., Ultrasonics Division, St.

Charles, Ill., is a leader in ultrasonic equipment for the bonding, slitting, laminating and

cutting of synthetic wovens and nonwovens. The company will show an Ultrasonic sewing machine,

slitter, hand-held mini slitter and press system. Primary contact in booth: Joe Re. Booth No.

D-2427.Eldon Specialties Inc., Graham, N.C., will show ceramic yarn and thread guides, tension

devices, creel caps, rollers, air-assist suction guns and various other parts for textile

machinery. Primary contact in booth: Don Foster. Booth No. D-2618.Electric Systems Inc.,

Chattanooga, Tenn., will demonstrate drive controls manufactured by ABB, Reliance, Siemens, Allen

Bradley and MagneTek, integrated into a singular drive enclosure powering a center winding

application. Primary contact in booth: Mike Mauney. Booth No. D-2908.Electro-Jet, S.A., Spain (PSP

Marketing Inc., Charlotte, N.C.), will show cleaners, bobbin strippers and material handling

systems. Primary contact in booth: Mireia Rovira. Booth No. C-1734.Electromatic Equipment Co. Inc.,

Cedarhurst, N.Y., will highlight tension-measuring instruments and systems, which include hand-held

mechanical and digital tension meters, in-line tension sensors and indicators, tachometers,

yarn-speed indicators and durometers. New equipment offered by the company includes the Check-Line

models ZEF and ZED for the accurate measurement of running-line tensions on a wide variety of

yarns, fibers and fine wires. Primary contact in booth: Andrew Kaner. Booth No. B-1221.Elitex

Machinery SRO, Czech Republic (Epic Enterprises Inc., Southern Pines, N.C.), will showcase a

two-for-one twisting machine. Primary contact in booth: Peter Magie. Booth No. B-1207.The Elliott

Co., Jeannette, Pa. (Ron Whites Air Compressor Sales, Anderson, S.C.), will show centrifugal air

compressors. Primary contact in booth: C. David Gibson.Booth No. B-1511.Eltex U.S. Inc., Greer,

S.C., will exhibit yarn-break detectors for winding, spinning, weaving, warping, heat-set and

air-entanglement machines, as well as various tension monitors. Primary contact in booth: Jonathan

Bell. Booth No. B-1435.Enka Tecnica, Germany (Fi-Tech Inc., Richmond, Va.), will highlight its

ability to manufacture spinnerets for all fiber processes and will exhibit a line of fiber-quality

devices and components. Primary contact in booth: Iris Ross. Booth No. D-2603.Epic Enterprises

Inc., Southern Pines, N.C., will have among its exhibits parts for Volkmann, Verdol and Elitex

two-for-one twisters and cablers, as well as parts for Superba and Suessen heat-setting machines.

Primary contact in booth: Herman Harris. Booth No. B-1206.Edmund Erdmann GmbHandCo. KG, (Edmund

Erdmann Enterprises, Charlotte, N.C.), will feature a draw winder. Primary contact in booth: Daniel

Troutman. Booth No. C-1817.EREMA GmbH, Austria (EREMA North America Inc., Topsfield, Mass.), will

have an information booth displaying materials on plastic recycling systems, PET recycling systems,

automatic backflushing screen changers, size-reducing machinery and WAREMA wash lines. Primary

contact in booth: Karl Maas. Booth No. D-2221.eSASA.com, Atlanta, will promote the new global,

multi-lingual, full-service Internet marketplace for textile machinery. Primary contact in booth:

Don Cotney. Booth No. C-1830.Excel Inc., Lincolnton, N.C., will display material handling

solutions, which include spring-bottom trucks, doff trucks, roller-deck trucks, tray trucks, pin

and cone trucks, and shelving. Primary contact in booth: Charles Eurey. Booth No. D-2302.Exim Ltd.,

Greenville, S.C., will present cone and tube adapters, anti-vibration machinery mounting pads and

ceramic thread guides. Booth No. C-1629.Exxon Lubricants, Burnsville, N.C., will highlight textile

lubricants and lubrication engineering solutions. Primary contact in booth: Ed Siles. Booth No.

B-1516.FandT Products, Greenville, S.C., will feature rubber cots and aprons, spinnerettes, weaving

parts, separator rolls, hot knives and acrylic tow stretch-breaking equipment. Primary contact in

booth: Michael Alexander. Booth No. D-2521.F.O.R. Ing. Graziano, SPA, Italy, (McKittrickandAssoc.

Inc., Charlotte, N.C.), specializes in the construction of cards as well as machines for fiber

opening, blending and feeding. This includes cards for nonwovens, woolen cards, worsted cards and

cards for semi-worsted yarns. The company will introduce a patented Y.M.2+1 woolen card that is

equipped with the most modern drives available. Primary contact in booth: R. Bacchio. Booth No.

D-3013.Fadis, SPA, Italy (J-Tex Corp., Troutman, N.C.), will exhibit Syncrotex electronic doubling

winders and electronic soft winders. Primary contact in booth: Harry H. de Jong. Booth No.

D-3019.Far44; SPA, Italy (Carolmac Corp., Greenville, S.C.), will have a large information booth

with samples of fiber and drawings of machinery. The company has been a pioneer in designing and

manufacturing compact staple fiber machinery and is now entering the market with machines for

producing spunbonded nonwovens and meltblown fiber webs suitable for PP, PE, PET, PA and their

copolymers. New machines to be highlighted will include Superstaple III and Superstaple IV for

carded webs in staple fibers, Superspun spinning system for spunbonds in continuous filaments, and

the Supermeltblown spinning system for spunlaid webs in meltblown material. Primary contact in

booth: Marco FarBooth No. C-1600.Fehrer AG, Nonwovens Machinery Division, Austria (Batson

YarnandFabrics Machinery Group Inc., Greenville, S.C.), will have samples and information regarding

Fehrer machinery and technology, which includes the latest in nonwoven and needle-punching

developments. Primary contact in booth: Peter Schoeffer. Booth No. C-1741.Fehrer AG, Spinning

Machinery Division (DREF), Austria (Symtech Inc., Spartanburg, S.C.), will introduce the DREF 2000

6/E12 friction spinning machine. Primary contact in booth: Norbert Ziebermayr. Booth No.

D-2108.Fiber and Textile Services Inc., Lewisville, N.C., will exhibit spare parts for take-up

winders, ceramic eyelets, traverse guides, ceramic and polyurethane friction discs for false-twist

texturing, and breaker plates. Primary contact in booth: Jim Arrington. Booth No. D-2308.Filatech

GmbH, Germany (FranklandThomas Inc., Greenville, S.C.), will highlight cleaning systems for polymer

filters, spin packs and melt pumps. Primary contact in booth: Thomas Mueller. Booth No.

D-2523.Fillattice, SPA/OMM, Italy (Fillattice Inc., Charlotte, N.C.), will present covering

machines for double and single yarns; and for fine, medium and coarse yarns. Also on display will

be spandex fiber, synthetic and natural fibers for narrow elastic fabric, high-speed hollow

spindles and electronic bobbin winders. Primary contact in booth: Davide Monti. Booth No.

C-1628.Fi-Tech Inc., Richmond Va., will be on hand to discuss spinpack design, polymer filtration

solutions and its spare parts program. Primary contact in booth: Jeffrey G. Bassett. Booth No.

D-2609.Fleissner GmbH, Germany (Fleissner Inc., Charlotte, N.C.), has developed five new

technologies in the field of spunlace hydroentanglement. At the show, Fleissner will be exhibiting

an Aquajet hydroentangling unit with a 5.0-meter working width. Other offerings include a jumbo

crimper, a godet unit and a sunflower reel plaiter for conjugate fiber. Primary contact in booth:

Don B. Gillespie. Booth No. D-2600.Formall Inc., Knoxville, Tenn., will exhibit reuseable,

returnable plastic yarn packages for both shipping and in-house handling. Primary contacts in

booth: Bryan Yarnell and Bob Stovall. Booth No. B-1519.Fortechnology Inc., Norwood, Mass., will

demonstrate the Fort760 Moisture Analyzer with a network-ready Windows N/T Operating System. The

company says the system instantly and nondestructively determines the moisture regain percentage

and commercial weight allowance of yarn packages. Primary contact in booth: Rose Murphy. Booth No.

D-2314.Fortress Technology, Canada, will feature metal detectors for the textile industry, and web

and blown fiber applications. Primary contact in booth: Steve Mason. Booth No. A-213.Foster Needle

Co. Inc., Manitowoc, Wis., will show a complete range of felting and structuring needles and

needle-removal tools. Primary contact in booth: John Foster. Booth No. C-1931. FranklandThomas

Inc., Greenville, S.C., will exhibit rubber cots and aprons, spinerettes, acrylic tow

stretch-breaking equipment, separator rolls, hot knives and weaving parts. Primary contact in

booth: A.W. Thomas III.Booth No. D-2422.Freudenberg, Germany.Booth No. D-2717.H. Talleres Gal#44;

S.A., Spain (PSP Marketing Inc., Charlotte, N.C.), will feature ring doubling and twisting machines

as well as precision winders. Booth No. D-2218, D-2226, D-2319,D-2327.Gaudino, SPA, Italy (Dawson

Textile Machinery, Greensboro, N.C.), is a supplier of automated ring-spinning frames for the

carpet, worsted, semi-worsted and short-staple synthetic markets. Information will be available on

specialty frames that can be custom-made to fit the needs of the spinner. Primary contact in booth:

Claude Dawson. Booth No. D-2124.Giesse, SRL, Italy (OTEX Inc., Lyman, S.C.), specializes in

machinery for the production of chenille yarns. The company will highlight the new SL 2000 machine,

which was developed with flexibility, quality and productivity in mind. The SL 2000 features

computerized controls and a redesigned diagnostic system. Primary contact in booth: A. Maier. Booth

No. C-1800.Gip Exports, India, will show precision spare parts for draw texturizers, cone-winding

machines for the man-made fiber industry and spare parts for weaving machines. Primary contact in

booth: U.V. Shah. Booth No. D-3031.Giudici, DavideandFigli, SNC, Italy, (PetreeandStoudt Assoc.

Inc., High Point, N.C.), will introduce the RG.6 BE electronic air-covering machine for the

air-entangling of elastomers with synthetic fibers. The machine has central electronic controls,

high-speed take-up, easy threading, and electronic yarn sensors among its many features. The

company will also showcase the RGT A model electronic air-texturing machine for nylon, polyester

and polypropylene. Primary contacts in booth: Domenico and Paolo Giudici. Booth No. C-1716.Gneuss

Inc., Matthews, N.C., will present RSFgenius, the new top product of its rotary filtration systems.

The RSFgenius can be used for the ultra-fine filtration of high-viscosity and low-viscosity plastic

melts. The filter has a fully automatic mode of operation with constant pressure consumption across

the filter. Primary contacts in booth: Monika Gneuss and Daniel Gneuss. Booth No. C-1640.Goulston

Technologies Inc., Monroe, N.C., produces specialty lubricants for manufacturing and processing

synthetic fibers including fiberfill finishes, spandex finishes and spin finishes for fibers made

from PTT- and PLA-based polymers. Primary contact in booth: Gordon Magee.Booth No.

C-1939.GrafandCie., Switzerland (Graf Metallic of America Inc., Spartanburg, S.C.), will feature

the latest technology in metallic wire for clothing high-speed cards and opening and cleaning

rolls. Primary contact in booth: James Mauney. Booth No. B-1300.Gualchierani Textile Automation,

SAS, Italy (Dawson Textile Machinery, Greensboro, N.C.), will have information on the GSA bale

press that was introduced at ITMA as well as information on spinning automation and filament

production. Primary contact in booth: Claude Dawson. Booth No. D-2130.Habasit Belting, Chamblee,

Ga., will demonstrate a wide range of high-performance Armid® tangential drive belts featuring the

first open-end spinning belt with a performance guarantee. Habasit will also introduce the AS-250H,

a new abrasion-resistant tangential belt. Primary contact in booth: Gary Paradise. Booth No.

B-1232.Hacoba Spultechnik GmbH, Germany (Symtech, Inc., Spartanburg, S.C), will display the Thread

King and Thread Master series of automatic and semi-automatic winders for sewing threads.

Electronic gears, slit drum systems and newly added traverse systems guarantee highest package

quality and gentle yarn treatment. Other equipment on display includes the NSA-U underbobbin winder

and the FSA braider bobbin winder.Booth No. D-2300. HDB Houget Duesberg Bosson 1823, S.A., Belgium

(Symtech Inc., Spartanburg, S.C.), will have an information booth emphasizing its manufacturing

program, which includes opening, blending, carding, spinning, gilling, crosslapping and

web-drafting machinery for woolen, semi-worsted and nonwovens manufacturing. Primary contact in

booth: Bobby Patrick. Booth No. D-2101-B.Heany Industries Inc., Scottsville, N.Y., will show

Heanium industrial solid ceramic eyelets, guides, tension assemblies, pigtails and bushings, as

well as ceramic pulleys designed for wire, cable and fiber optics. Various coatings for wear

resistance will also be on display. Booth No. D-2318.Heberlein Fiber Technology Inc., Switzerland

(Heberlein North America Inc., Greenville, S.C.), will exhibit key components and system solutions

for effective processing and finishing of yarns, which includes PolyJet, SlideJet and ACV-Jet

air-interlacing jets and the Pulsar-Fancy-Yarn-System. Primary contact in booth: A. Weber.Booth No.

D-2802, D-2903.H. Hergeth GmbH, Germany, will introduce a plucker for long and staple waste, as

well as a high-production plucker and condenser and a blending system. Primary contact in booth:

Hubert Hergeth. Booth No. C-1640. Heritage Cutlery, Bolivar, N.Y., will display more than 80

models of textile-cutting scissors and shears that are configured to cut a wide array of synthetic

and natural materials. Primary contact in booth: Chris Olix.Booth No. D-2231.August Herzog, Germany

(August Herzog U.S.A., West End, N.C.), will show braiding machinery, winding machinery, unwinding

and rewinding machinery and a computer-aided design program. Primary contact in booth: John Owen.

Booth No. B-1515.Hills Inc., West Melbourne, Fla., will show bicomponent fibers and related

products. The company will highlight 100-islands-in-the-sea nanometer fibers and a 1-micron

meltblown fabric made using a 100-holes-per-inch die. Primary contact in booth: John Hagewood.Booth

No. C-1933.Himson Ind. Ceramic Ltd., India, will feature ceramic thread guides, brakes for yarn,

and wire guides and assemblies. Primary contact in booth: P.G. Rave. Booth No. A-204.Hi-Tec Plating

Inc., Statesville, N.C., will highlight tdC-1® thin dense chrome plating. Also on display will be

conventional, flash, matte and industrial hard chrome platings. Primary contact in booth: Buddy

Bray.Booth No. B-1135.Hi-Tech Products Inc., Greenville, S.C., will show ceramic yarn guides and

tension assemblies. Primary contact in booth: Rick Lankford.Booth No. D-2916.James

HoldsworthandBros. Ltd. England (Redman Card Clothing, Andover, Mass.), will exhibit flexible and

metallic card wire in addition to mounting, grinding and cleaning equipment for all card wire.

Primary contact in booth: John Murray.Booth No. D-2312.John D. Hollingsworth on Wheels Inc.,

Greenville, S.C., will introduce Mastersteel, new metallic card clothing. The company also offers

standard and enhanced-point metallic card clothing for nonwovens, yarn spinning and worsted yarn

applications as well as various carding accessories. Primary contact in booth: Carl Martin. Booth

No. C-1618.HSGM GmbH, Germany (HSGM Inc., Duncan, S.C.), will demonstrate hand-operated and

tabletop heatcutting and sealing equipment, soldering guns and styrofoam-cutting equipment.

Visitors are invited to bring samples of fabric and other materials to the booth for test

cutting.Booth No. D-2626.Hydradyne Hydraulics, Charlotte, N.C., will showcase pneumatic components

and systems. Primary contact in booth: Gary Grussing. Booth No. A-314.ICBT Inc., see Rieter ICBT

Greensboro Inc.Booth No. C-1812.Igus® Inc., Rumford, R.I., will be displaying its Iglide®

self-lubricating polymer plain bearings, DryLin® linear bearings and linear guide systems, and

Igubal® polymer rod end bearings and spherical bearings. Igus will also introduce a new cable

carrier for advanced noise reduction and a new compact, self-lubricating linear guide system.

Primary contact in booth: Cate Keefe. Booth No. A-120.Industrial Air Inc., Greensboro, N.C., will

present a system that allows coordinated, interactive control of air-conditioning, refrigeration,

air-filtration, waste-handling and other process equipment. Features include centralized monitoring

with customized color graphic displays; selectable trending; alarm reporting; on-line operating,

maintenance and parts data; and off-site diagnostics of all systems via modem connection, including

control program modifications. Booth No. C-1732.International Baler Corp., Jacksonville, Fla., will

show a double box as well as raise

ATME-I Exhibitors

NAFTA Six Years Of Fibers

NAFTA UpdateBy John E. LukeNAFTA: Six Years Of Fibers

NAFTA shows mixed results for U.S. manufacturers, but opportunity for cross-border,

intra-industry trade. Economists have a habit of reviewing results and predicting the

future in five-year increments. These professionals notwithstanding, it is now past time, six years

and 40 percent through complete implementation, to review the performance of the U.S. fiber

industry in world trade with a specific focus on accomplishments with Mexico and Canada under

NAFTA.NAFTA has been good for the U.S. fiber industry. This is not to say that the industry shipped

all it could make or that fiber prices reflected adequate investment returns. It also is not to say

that the industry was not hammered by cheap fiber and manufactured product imports from all areas

of the world. It is to say, however, that facing the inexorable advance of world/free trade as

evidenced by NAFTA and WTO passage, U.S. fiber producers found new markets in the fabric-producing

industries of our immediate North American neighbors and have turned the tri-country poundage trade

balance from a negative to a positive figure. Accurate cross-border prices are not available, but,

based upon the current border-crossing product mix, the dollar balance of trade is still somewhat

negative, although significantly improved from pre-NAFTA levels.World Fiber TradeIt is important to

note that the negative trade balance in fibers results more from increased imports than from

decreased exports. Since NAFTA, new international capacity particularly in polyester and acrylic

has lusted after the worlds largest market, and U.S. fiber imports surged from a 1995-1996 average

of 1.1 billion pounds to over 1.3 billion by 1999. Simultaneously, U.S. fiber imports from NAFTA

countries remained virtually constant at approximately 480 million pounds. This means that NAFTA

countries share of U.S. fiber imports dropped from approximately 45 percent of total to under 38

percent in the most recent year.

In exports, a contrary story has developed. Between 1995 and 1997, U.S. fiber industry

exports held steady at slightly over 1.1 billion pounds. Since that time, with world polyester

prices tanking and foreign producers offering the output of new polyester and acrylic capacity at

almost any price, domestic manufacturers pulled back; 1998 and 1999 exports dropped to under 900

million pounds. It must be noted in these figures, however, that U.S. fiber manufacturers responded

to NAFTA in the spirit in which it was created. In 1995, at 326 million pounds, U.S. fiber exports

to NAFTA countries represented 31 percent of total fiber exports. By 1999, fiber exports of 501

million pounds an increase of 11 percent per year represented almost 62 percent of total fiber

exports. NAFTA provides the economic essentials to allow and encourage U.S. producers to compete

close to home. This has brought us to a positive poundage trade balance with our NAFTA

partners.Table 1 details total U.S. fiber trade since the onset of NAFTA. Regular readers of this

space will recognize the abrupt change from an industry contributing a positive balance of trade to

one mired in seemingly eternal negative balances. In a word, the pattern is ugly and speaks loudly

to changes in fiber manufacturing and distribution brought on by the political and economic

turmoil, particularly in Southeast Asia, of the 1990s.In mid-decade, American fiber producers were

struggling to maintain the positive balance of payments historically provided by the industry. The

effort was for naught, however, as economic and political forces, particularly in Asia, unleashed a

frenzy of exporting to generate hard currencies and balance overstretched economies. In fibers, as

has been noted in this space several times in the past, the forces of King Polyester descended on

the U.S. market, resulting in a 160-million-pound positive balance of filament trade in 1995

turning to a 38-million-pound negative by 1999. Similarly, polyester staple swung 100 million

pounds negative to finish 1999 at almost 400 million pounds net imports. Some backing and filling

occurred in other fiber categories, most of which, save acrylic, amounted to little more than

normal variances in trade reporting. Acrylic manufacturers, traditionally an industry sector that

exported a substantial proportion of its fiber production, suffered from recent building of

capacity in Asia, and from customer lack of hard currencies with which to pay for traditional

imports. The first negative balance in memory of acrylic trade occurred in 1999. Considering the

amount of production capacity added in acrylic and polyester in Asia in the 1990s, it is highly

unlikely that the U.S. total manufactured fiber trade balance will ever again be positive.NAFTA

Fiber TradeA recent report from the El Paso Branch of the Federal Reserve Bank of Dallas (El Paso

Business Frontier, Issue 2, 2000, hereinafter called the El Paso Report) reviewing NAFTA trade

patterns provides an interesting perspective on the current shape of cross-border trade engendered

by the treaty. According to the report, at NAFTAs inception, an amusement in the United States

centered on identifying which industries or sectors would be winners and losers in the treaty. A

winner was identified as a sector in which exports would rise as a result of the treaty; a losing

sector would see increased imports. Generally speaking, the U.S. fiber/fabric/apparel complex

designated itself as losers, a title that unfairly groups several winners into the losers category.

As cross-Rio Grande trade has unfolded, it appears that apparel manufacturing accurately falls in

the loser category. Fabric manufacturing rides a middle ground, less impacted by NAFTA than by

expanded Southeast Asian garment production that reduces the overall need for U.S.-produced

fabrics. The El Paso Report notes that in 1999, the states of North Carolina (No. 6), South

Carolina (No. 17) and Alabama (No. 22) were among the top 25 states exporting to Mexico. North

Carolina and Alabama made the list for having apparel and other textile products as their top

export, and South Carolina made it for rubber and plastics products. Together, these three states

in 1999 represented more than 3.5 percent of all exports to Mexico. In the same year, textile yarn

and fabrics and articles of apparel and clothing represented more than six percent of total U.S.

exports to Mexico.The description hints at the shape of Mexican-U.S. bilateral trade. The El Paso

Report, rather than looking for winners and losers, views trade as two positives. Imports create

opportunities for consumers to broaden purchasing patterns, often at reduced prices; exports

provide opportunities for industry to expand markets and potentially operate factories at efficient

levels. In effect, U.S.-Mexican trade is raw materials and work-in-process in and finished goods

out. Trade is moving both ways, and, in the textile complex, it is intra-industry trade with

manufacturers on each side of the border that is adding value in specialty areas. This matches the

El Paso Report description of the U.S.-Mexican macro-trade as 80 percent intra-industry. Mexican

wages are a fact, and trade has changed under NAFTA to reflect their attractiveness. It now becomes

the responsibility of raw material suppliers to optimize opportunities for business south of the

border by combining the capital advantage of U.S. manufacturing with the labor attractiveness of

Mexico.In marked contrast to the world experience and moving toward the intra-industry description,

fiber trade among the three NAFTA partners has moved from a distinct negative position in

mid-decade, soon after NAFTA implementation, to a positive balance by the end of 1999. From a

negative 165-million-pound balance in 1995, the fiber industry has fought back to a positive

10-million-pound balance in 1999. Impressively, as U.S. man-made fibers reversed negative trade

trends and fought to a positive balance, they waged a losing battle with other geographic areas.

Table 2 outlines the balance of trade in fibers among the NAFTA partners. As the U.S. position in

world fiber trade deteriorated to a 510-million-pound negative balance in 1999, the NAFTA position

continued the positive trend first exhibited in 1995. By adding the data in Tables 1 and 2, one can

calculate the size of trade with non-NAFTA world areas can be calculated. In 1995, it was positive

116.7 million; 1996, positive 108.9 million; 1997, negative 202.9 million; 1998, negative 397.2

million; and 1999, negative 520.9 million. It certainly appears the U.S. fiber industry should be

thankful for the apparent positive benefits of NAFTA trade. NAFTA trade has a distinct geographic

slant, with the United States historically running positive trade balances with Canada and

negative, but decreasingly so, balances with Mexico (See Table 3). Canada apparently has focused

its fiber manufacturing in non-apparel markets, particularly in nylon. In total fiber trade between

the United States and Canada, except for a small negative trade balance in cellulosic filament,

only nylon filament runs a negative trade account, one approaching 100 million pounds annually.

This position reflects a regional approach by producers to fiber production, with much nylon

industrial filament production transferred to Canada since 1990. In polyester, the 800-pound

gorilla of trade, the United States maintains with Canada a small positive trade balance in

filament, while dancing around a zero balance in staple. At the southern end of NAFTA geography,

the trade picture with Mexico is significantly different from that with Canada. Consistent with the

difference in apparel industry wages between the United States and Mexico, Mexican trade in fibers

focuses on apparel-type items, and, not surprisingly, the major emphasis is on polyester. Mexican

polyester filament trade has run a consistent deficit approximating 22 million pounds in the past

five years. Once falling below 100 million pounds, staple has settled into a negative balance of

approximately 75 million pounds. This negative balance may grow as DuPont participates with its

Mexican Alpek alliance in building new capacity and faces issues of productivity in old U.S.

facilities vis-a-vis new operations in Mexico.

ConclusionAccording to the El Paso Report, since NAFTA opened the U.S. market to Mexicos

textiles and apparel goods, overall textiles and apparel exports to the United States have

increased 419 percent. In fact, Mexico surpassed China as the top supplier for the United States

for these products. That is the gauntlet. Mexican wage rates will rise, but so will those in the

United States. The U.S. fiber and fabric industries are as efficient and productive as any in the

world. Creativity, marketing and design abound in the United States. If industry marries the

competencies admits that the United States is a capital-sensitive, large-quantity manufacturer of

fibers and fabrics, and supports Mexicos management of its labor competencies then the natural

forces of cross-border intra-industry trade can be ridden to new records.

Editor’s Note: John E. Luke is owner of Five Twenty Six Associates Inc., Bryn Mawr, Pa., a

consulting firm specializing in strategic marketing and operations facing textile fiber and fabric

manufacturers. He is also a professor of textile marketing at Philadelphia University.

September 2000

Open-End Vs Ring-Spun Pricing

Yarn Market ResearchBy Erin Dodd and William Oxenham, Ph.D Open-End Vs. Ring-Spun Pricing

A new progam underway at N.C. State’s College of Textiles uses ATI pricing data to analyze and

forecast production and pricing of open-end and ring-spun yarns. There have been several

comments recently in the textile press regarding the differential pricing of ring-spun and open-end

(rotor) yarn. Further concern has been expressed about the difference in yarn pricing associated

with yarn count, and how this difference is influenced by the yarn type (ring-spun or

open-end). Identifying Pricing TrendsA project currently underway at N.C. State Universitys

College of Textiles, Raleigh, N.C., is investigating possible approaches to predicting future

trends in yarn production in the United States. Various sources of data are being utilized,

including data associated with yarn pricing, some of which has been obtained from back issues of

ATI. Based solely on data from ATI, it is possible to clearly identify certain trends that are

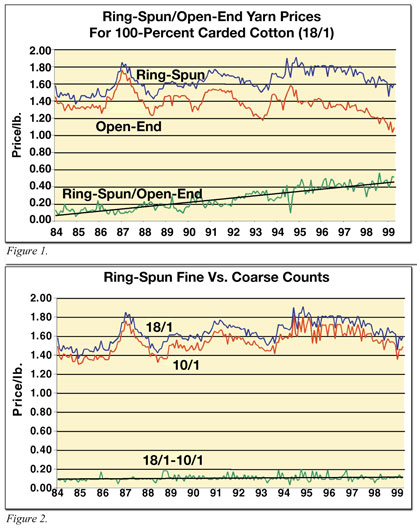

apparent in the figures that follow.Figure 1 shows a comparison of the prices for ring-spun and

open-end yarns of the same count (18Ne) from 1984 to the present. The difference in yarn prices is

also included (ring-spun yarn price/open-end yarn price), and it is clearly shown that the price

difference has increased almost linearly over time.Indeed, while the price difference in October

1984 was 13 cents, the difference in January 2000 was 51 cents. This trend is also shown for other

yarn counts for which prices were available.The reason for the increasing difference in prices is

that while ring-spun prices showed a general increase (up to 1997), open-end prices either remained

static or fell more rapidly than their ring-spun counterparts.Figure 2 compares the prices of 18Ne

and 10Ne ring-spun yarns (again from 1984 to the present), with the difference in yarn price due to

count also included. While there is considerable variation in price over time, it appears the

difference in price between the finer and coarser yarn is increasing slightly.

Figure 3 shows a similar exercise (comparing prices for 18Ne and 10Ne) for open-end

yarns. While the effects are small, the data indicates that for open-end yarns, the difference in

price between finer and coarser yarns is diminishing over the time period studied.While the

analysis is based on historic data, making it risky to extrapolate to make future predictions, the

findings are summarized as follows: The price difference between ring-spun and open-end is

increasing. The price difference between finer and coarser counts is increasing for ring-spun

yarns.The price difference between fiber and coarser count open-end yarns is decreasing.

Editor’s Note: William Oxenham Ph.D, is professor, associate department head and graduate

administrator in the Department of Textile and Apparel Technology and Management in the College of

Texiles at N.C. State University.Erin Dodd is a graduate student at N.C. State’s College of

Textiles. She is completing her Master’s degree and preparing to enter the Ph.D program in Textile

and Apparel Technology and Management.

September 2000

TrendWatch Introduces Report On Textile Apparel Market

TrendWatch, Harrisville, R.I., has developed a new report for aiding technology firms in strategic

analysis of the textile and apparel industry.Published annually, the report will help executives

shed light on this industry and identify market segments, competitors, investment trends and market

opportunities.While design professionals may use similar tools, each market has a unique structure,

workflow, economic factors and expectations about how those resources are best used, said Dr. Joe

Webb, TrendWatch partner.Information is detailed by marketing and type of business, size of

business, geographic region and major investment categories.Discussion and analysis of the

challenges facing these businesses, their investment plans and technology threats will be included.

This report will collect the basic data that has been unavailable, as well as add insight to the

changing industry dynamics, said Alison Hardy, owner of FabriCAD and collaborator with TrendWatch

for this report.Bringing this kind of research to the textile and apparel markets will also result

in a Demographic Atlas and Market Segmentation Guide, which will provide managers with the

necessary statistical background and market sizing information to make strategic and tactical

decisions. The number of design businesses by zip code or major metropolitan area as well as

estimates of annual shipments will be included.

August 2000

Ring-Spun Yarn Sales Fantastic

A

brief comment from a respondent involved in raw cotton markets will be encouraging to

spinners: “The cotton crop looks beautiful this year, even with the drought. A large crop is

anticipated and the quality is good. Prices, however, don’t look good.” In other words – bad

news for farmers, good news for spinners. As with just about everything in this business, it’s not

over ’til it’s over. So we’ll see how it looks a couple of months from now.

The markets for ring-spun yarns are causing exuberance, to say the least, among spinners. One

spinner said, “Ring-spun markets are fantastic in all counts and all market segments.” Another

whole-heartedly agreed saying, “Ring-spun markets are excellent – really tight!” Now, the

question is, how long will it be until everyone moves to these markets and saturates them as we

have done in the open-end (OE) markets?

Spinners of ring-spun yarns are confident that the market is strong enough to see an

improvement in pricing. A spinner commented, “We will start moving prices up – the market can

take it. We are running full, but are still far behind. We have no inventory, and we are booked

solid through the third quarter. I wish we could have run through the fourth.”

Several factors have contributed to the continued excellence of markets for ring-spun yarns,

according to spinners. As one said, “Denim is back. Docker twill is back.” As you know, both of

these markets use tremendous quantities of yarn.

Opportunities Abound

“Open-end yarns, however, give us many opportunities in outerwear, underwear and T-shirt

markets,” commented one such spinner. Despite the lackluster market conditions, most OE spinners

are running full and booking ahead. One spinner informed the Yarn Market that he was booked solid

for the rest of the year and was beginning to book first quarter 2001. He said, “Of course, we are

quoting higher prices for next year, but we will never see inflated prices again. All we want to do

is make a reasonable profit – something we haven’t done in several years.” He also said that

once they got through the current contracts, prices will probably improve.

Many spinners feel the OE markets will always be tough because no one is getting out of it.

Therefore, the oversupply of OE yarns will continue. “It’s funny,” said one spinner, “the spinners

who complain most loudly about pricing in the OE markets are the same ones who are selling low.” In

spite of it all, volume remains good for these markets.

Inventories are strictly controlled, according to virtually all spinners. As if to justify

more than their standard of two-week inventory, one spinner said, “Of course, when you run so many

products, you have to maintain a stock of your basic items.”

South Of The Border

The Yarn Market received some interesting comments from spinners concerning the Carribean and

Mexico. One spinner observed, “While spinners will probably benefit, those textiles which are

labor-intensive will move offshore.” Yet another spinner commented, “I think the CBI will be good

for us as long as it lasts, but a couple of large producers could eat up the quotas. Also, a

company must get positioned beforehand and be able to identify the players. The logistics could be

a problem, such as credit and freight. Those who capture the market will profit the most.” This

same spinner (discussing NAFTA) said, ” Those manufacturers already involved in Mexico are

beginning to question their position, feeling they must supply the local market rather than ship

the goods back to the USA.” Shipping costs are apparently part of the problem.

Weavers are having real problems with synthetic fabrics. As one weaver said, “It’s a struggle

every day.” In cotton and poly/cotton goods, volume is good, but margins are terrible. Doesn’t that

sound familiar to you spinners?

The Good Old Days

A spinner reminisced, “Way back yonder, we had peaks and valleys in our earnings report. Today,

it is all valleys. We need to climb a peak and start making a profit for a change. Seriously, I

think the future for spinners looks good, at least for the near future.” He was reminded that back

in the old days, we came out of the mills covered in so much lint that we never had a problem with

dry hair days. Who wants to go back to the good old days?

August 2000

Textile Institute Creates Strategy Marketing Group

The Textile Institute, England, has strengthened its network of industry-focused Special Interest

Groups with the creation of a new body to promote strategy and marketing for textiles, apparel and

related industries.Chaired by David Rigby, a strategy and marketing consultant to the global

textile industry, the new group aims to provide services to members associated with the commercial

issues they face in day-to-day business strategy.Increasingly, companies in textiles and related

industries have to think more clearly about business strategies and market focus, said Rigby.

Having efficient operations is not enough if the strategic focus is wrong. Rapid changes in the

global market, and its supply chain, mean that overall business direction and marketing strategies

need to be constantly under review.The group will be based on the Internet so that advice, support

and information can be quickly shared worldwide.

August 2000

Quality Fabric Of The Month: Tactel® Fuses Fashion And Performance

The 2000 International Hosiery Exposition (IHE), held in Charlotte, N.C., was the venue for the introduction of new products made using Tactel®, DuPont’s family of innovative specialty, fine denier per filament nylon yarns. With Tactel, fashion and performance are fused in a variety of seamless applications including swimwear, activewear, lingerie and support garments, as well as the complete spectrum of legwear. Tactel and Lycra® are used in combination to offer softness, luster, texture and visual interest as well as comfort, fit and freedom of movement.

Seamless Concepts

Tactel and Lycra are leading players in the growing market for seamless fashions. “The current uses of seamless have only touched the surface of what is possible with this innovative technology, as more women look for innovative ready-to-wear fashions,” said Kathy Smith, intimate apparel marketing manager for DuPont Lycra. “It is our partnership with key industry leaders that has made this growth possible.”

In the category of seamless apparel, Tactel has developed a multifunctional concept collection which presents possibilities for a variety of garments from intimate apparel to bodywear to ready-to-wear. New silhouettes, patterns and textures are available using jacquards, tone-on-tone, color blocking, striated effects and combinations of sheer/opaque and bright/matte.

“We are seeing a growing awareness of fashion, style and embellishment in the seamless category,” said Ida Corraggio, intimate apparel marketing manager for DuPont Tactel. “The fluid designs of seamless garments help to redefine the silhouette, while trends such as romantic florals and control tops and bottoms softened with ornamentation offer the perfect combination of functionality and allure.”

New Fashions In Legwear

Some of Tactel’s new legwear products combine fashionable new textures and bold colors with softness, breathability and durability. Among these new products is Hue’s new fashion sock, Sport Shell, made of Tactel Aquator™, a double-sided fabric that keeps feet dry and comfortable by wicking moisture away from the skin.

Also new on the legwear scene is Nine West’s So Strong line of 20-denier sheer hosiery made of Tactel Duo™.

“We are thrilled to be a part of the solution in creating products that consumers are looking for,” said Sharon Cook, DuPont’s retail marketing manager for Legwear. “Our Tactel family of yarns can help our customer’s brands stand apart with our offerings of different lusters, shimmers and color vibrancy. We allow the consumer more fashionable options, helping turn hosiery into a contemporary accessory.”

Tactel Soft Black

Tactel Soft Black, the newest offering in DuPont’s line of Tactel products, is solution-dyed to give the black a softer appearance than is achieved in package-dyed yarns. When blended with other yarns, it can be overdyed to obtain a uniform, deep color. The integrity of the companion yarn is maintained, while Soft Black enhances the styling capabilities of the blend. Particularly well-suited for jacquards and other patterned effects in seamless apparel, Soft Black is available

with a variety of yarn effects including air-jet-textured marls, false-twist combinations, covered and fancy yarns, organzines, metallic looks and soft-as-cotton natural looks.

For more information on DuPont’s new Tactel products, contact Eleanor Walsh, DuPont, (212)

255-1081.

August 2000

Growth Fiber Polypropylene

Arguably, the growth fiber of the 1990s is polypropylene. Total production of polypropylene

filament, staple and film was 1.8 billion pounds in 1990 and rose at a compounded rate of 5.5

percent to the 2.9-billion-pound level in 1999, easily besting the 2.7-percent rate posted by its

nearest competitor, polyester fibers

(See Table 1).Filament fiber shipment growth through the 1990s averaged a compounded 5

percent per year while staple averaged 7.2 percent per year. To be sure, the U.S. fiber industry

ships more polyester than olefin, nearly 3.6 billion pounds for polyester filament and staple in

1999, but olefin wins the battle for growth rate hands down and is catching up fast in the total

shipment category.Faced with this growth despite a stagnant domestic market deluged by imports, it

becomes important to pose several related questions. First, is polypropylene technologically and

marketing-wise ready to move up into the class of 3-billion-pound fiber Second, are fiber suppliers

prepared to invest in fiber development to sustain/increase the current rate of growth And third,

are fiber producers prepared to adopt sufficiently creative marketing strategies to balance the

pressures expected from the combination of existing domestic competitors and importers In this

article, we first will review statistics to set the stage, and then reveal marketing and product

strategies planned or in execution by several major players in polypropylene distribution. These

activities are not all that is going on, but we suggest that they are admirable examples of

creative marketing and product strategic thinking found among polypropylene producers and

processors. Setting The StageA closer look at Table 1 suggests that growth in shipments of

total polypropylene fibers has slowed, a pattern consistent with maturing product lines. The data,

particularly in filament, hints that shipments to carpet end uses, representing almost two-thirds

of all filament shipments, gained a substantial boost in 1994 as spending on housing responded to

Federal Reserve-activated lower interest rates and recovered from the early-decade recession. This

was followed naturally by a slowing as current interest rate upticks exacted a toll on housing.

Since 1997, the rate of growth in filament has slowed dramatically, dropping to 2.0 percent from

1998 to 1999.Staple, however, appears to be enjoying a renewed rise, energized by an almost

one-third rise in staple use in nonwovens. In the 1990s, staple has received two positive

market-share shots, all driven by improving fortunes in nonwovens, which represent approximately

three-fifths of all polypropylene staple sales. First came the significant bump from the 1991-1992

recession recovery, followed by a significant jump from 1998 to 1999 as major diaper producers

displaced some film layers with fibrous (staple or spunbonded) layers to diapers to make the

product seem more fabric-like and consumer-friendly (Authors Note: Part of mid-decade growth

represents the Fiber Economics Bureau fine tuning its database to include both captive fiber and

spunbonded/meltblown fiber capacities, which historically had been under-reported).Filament

polypropylene in carpet face fibers, the main driver of filament polypropylene market share, grew a

mere 1.5 percent from 1998 to 1999 and filament in carpet-backing fabrics, a barely better 2.2

percent (See Table 2). Other broadwovens incorporating filament, including items like geotextiles

and upholstery, increased an average of 6 percent per year, compounded for the 1996-1999 period, to

retain a 12-percent share of filament shipments. Rope, cordage and fishline grew more slowly than

the category average and watched market share deteriorate slightly. Other filament end uses grew at

the category average of approximately 4 percent and thereby held their own in market share.The

largest end use in the Other category is an amalgam of spunbonded and meltblown filament products

for such markets as carpet backing, interliners, medical disposables, etc. Also included are much

smaller miscellaneous markets for such products as backing/structural materials for sliver knit

products, miscellaneous apparel items like thermal underwear, sport-specific athletic garments for

biking, aerobics, scuba diving, running and the like. Together, all the miscellaneous end uses do

not consume nearly the amount gobbled up by spunbonded and meltblown, but these smaller uses appear

to provide opportunities for new specialized products that can lead to increased market share and

value-added potential.Staple shipments in 1996 grew 12+ percent over 1995 (See Table 1). It must be

noted, however, that 1995 lagged behind 1994 by 6+ percent as all major end-use areas carpet face,

broadwoven (largely upholstery) and nonwovens sagged from record levels. Secondly, 1996 staple

shipments recovered from the 1995 lethargy to scale the 500-million-pound mountain for the first

time, regaining all and more of the 1995 losses (See Tables 1 and 3).This growth has continued to

the present, driven in large part by double-digit gains in carpet-face fiber shipments, coupled

with a mind-boggling 34-percent increase in nonwovens consumption in the 1998-1999 period (See

Table 3). All of this increase is not yet understood, although a significant portion represents

changes in diaper construction.As filament polypropylene is beholden to carpet distribution, so

also must its staple cousin answer to a demanding master, nonwovens. To date in this market,

polypropylene successfully has bested polyester staple, which in its day bested rayon and cotton.

The question now becomes, what can polypropylene staple suppliers do to retain market interest in

the product Is the current product satisfactory or is newness mandatory for continued growth Are

there more diaper construction changes on the horizon to re-energize polypropylene fibers again

Going ForwardIt is quite apparent from the foregoing analyses that polypropylene fibers

enjoy dominant positions in several large markets. It also appears that these markets are

commodity-focused and often subject to the rawest of price and cost competition actions. These

pressures already have forced current polypropylene technology into efficient manufacturing

postures to fend off inter- and intra-fiber competition and market-share grabs from imports.So far

the campaign is successful in both filament and staple, but some industry observers suggest that

practical machine production/efficiency limits are at hand and a new efficacy paradigm is required

to continue growth patterns. The industry has been effective in providing low-cost materials. Now

it must build new product and marketing strategies and become effective at those endeavors.

Marketing ChangesPolypropylene fibers are natural receptors for additives that bring

permanent market-specific characteristics to the material. Additives currently in use provide

anti-microbial, flame-retardant, higher heat resistance and higher strength characteristics to the

market. While these product innovation strategies find homes in a wide variety of end use markets,

it is important to note that new, innovative marketing strategies are an integral part of this

movement. The phrases solutions marketing and customer-focused are approaching hackneyed status,

but their impact is proving real in fiber marketing.Slimmed-down marketing organizations, created

by urgent needs for cost control or elimination, patrol customer plants looking for opportunities

to add value to existing businesses. For example, a two-year marketing initiative aimed at

improving carpet backing led Synthetic Industries, Chickamauga, Ga., to develop the secondary

backing, Softbac and the primary backing Patternloc. Both come from customer inputs, but this time

the customer was the installer, not the homeowner, who would be the ulitmate purchaser.Both

carpet-backing ideas came from installers. They save labor and material, making the overall cost to

the consumer lower than previous materials, despite a slight increase in per-square-yard expense

for the carpet because of the new technology.Polypropylenes environmental resistance and light

weight have long made the fiber a material of choice for geotextiles. As geotextiles have matured

into a science, fabric producers have adapted to and adopted specifications substantially more

detailed than predecessor materials demanded. Fiber development has played a small role in meeting

these new requirements. More importantly, however, has been the ongoing dialog with users and

installers that created an atmosphere of trust and gave fabric producers sufficient comfort to

justify the purchase of new processing equipment to meet the upgraded standards.Another example of

market-driven development comes from Coville Inc., Winston-Salem, N.C., which is creating fabrics

for scuba diving. Traditionally, divers like to leave the water and not remove their wet suits.

With traditional materials, this practice often results in rashes from microbe growth under a wet

suit. Coville decided to try using antimicrobial polypropylene in a line of diving fabrics. By

talking to divers, the company discovered that, particularly in warmer climes, diving garments dry

in the heat of the sun from the outside in. The challenge was to reverse this natural sequence by

creating a product that would dry from the inside out, thereby minimizing possible microbe growth

and promoting skin health. The answer lay in combining antimicrobial filament polypropylene with

spandex. The fabric is napped on the inside to create a warmth layer and brings with it the wicking

capacity of polypropylene plus a natural resistance to microbes granted by additive technology.

Individually, all the described technologies existed; it took diver input to group them into a

solution. Coville sells a premium fabric and develops opportunities to translate basic technology

into traditional bathing suit distribution. Fiber suppliers sell premium, performing yarns.

Technology DevelopmentsThe two cited marketing developments could not have worked

without advances in technology. Marketing is but one of the routes to added-value, niche markets.

Marketing has learned to work with development in an applied nature rather than as basic research.

Polypropylene producers are becoming increasingly adept at translating customer problems into

marketing opportunities incorporating marketing and technology advances.Lightweight filament yarns

are a small part of polypropylene distribution. Historically, the most successful filament olefin

markets have demanded heavy-denier fibers in the 200- to 1,000-denier range.Apparel has been the

holy grail for polypropylene marketers; polymer, fiber and fabric producers have searched for

apparel and home furnishings markets large enough to justify development of fine-denier products.

Until activewear developed around spandex in the late 1980s and early 1990s, polypropylene really

had little exposure in apparel.Following activewear, and development of antimicrobial polypropylene

additives, a natural marriage of two man-made fibers began to enjoy increased volume in the

traditional high-sweat markets of running, cycling and aerobics. Permanent color, wicking capacity

and antimicrobial advantages were wedded in a series of market-specific performance fabrics that

enjoyed vigorous growth among the Boomer and Gen X generation exercise fanatics.In addition to

diving and bathing suit materials, apparel fabric producers are modifying fabrics for running,

cycling and aerobics for a generation attempting to age gracefully, but still demanding hard bodies

and the visible trappings of success. Fabric developments continue apace to expand the fibers role

in activewear markets.Slow progress is being made in lightweight knitted and woven constructions

for apparel and home furnishings. Dyeable polypropylene has been the wish of fiber producers. It

currently is available in heavy deniers for woven rugs through KromaLon® polymer technology

developed by Equistar Chemical, Houston, but it is a long way from commercialization in fine

deniers for apparel and home furnishings. Considering the pressures from polyester and from

imported garments, we suspect that commercialization will continue to remain more a dream than a

reality. Fine denier, therefore, should continue to depend on marketing innovation and additive

technologies for growth.As might be inferred from the last paragraph, developments at the heavy end

of the polypropylene denier spectrum are much more active than those in fine deniers. For example,

the Clean Air Act and the Clean Water Act mandate levels of air and water cleanliness.

Polypropylenes low melting point often has prevented it from acting as a filter in hot-exhaust

environments. Copolymer research currently is providing higher-temperature materials to provide a

new growth market for polypropylene. Copolymers providing high strength are targeted for selected

industrial end uses like belts and geotextiles where tensile strength above current levels is

needed. In these markets, polypropylene will go head-to-head with polyester by bringing a

sufficiently strong material of considerably lighter weight at an anticipated lower

price. ConclusionsOur market background, always as a competitor to polypropylene, injected a

certain bias into this assignment. We are pleased to note, however, that completion of the work

convinces us that the polypropylene industry is populated with inquisitive managers who are

constantly peering around the next corner, not satisfied with the status quo. To be sure, in our

judgment, polypropylene always will depend on commodity-like materials if only because of the

fragmented nature of the supply chain. We are pleased, however, to have had the opportunity to