CCI Encourages AsianApparel Makers To Use U.S. CottonCotton Council International (CCI),

Washington, recently brought 14 Asian apparel manufacturers to the United States to encourage them

to use U.S.-made cotton textiles in apparel produced in their plants in the Caribbean Basin. The

companies located in Korea, Hong Kong, Taiwan, Guatemala and El Salvador visited textile mills,

cotton harvesting and ginning facilities, and Cotton Incorporateds Cary, N.C.-based research

facility.The tour was organized as part of the 2002 Sourcing Caribbean Basin Initiative (CBI)

Program, which is funded by the U.S. Department of Agricultures Section 108 Program, Cotton

Incorporated and participating U.S. textile mills. Participating mills include Ameritex,

AMTEC/Tuscarora, Buhler Quality Yarns, Four Leaf Textiles, Frontier Spinning Mills,

HarrietandHenderson Yarns, National Textiles, Parkdale Mills, Ramtex, Spectrum Dyed Yarns, TNS

Mills and Swift Spinning Mills.The tour went very well, said Vaughn Jordan, CCIs international

program director and director, CBIandMexico. We definitely changed some minds. Asian manufacturers

own a majority of the apparel mills in the Caribbean Basin and have been using Asian materials in

their production. I think now well be seeing more U.S.-made cotton content in the apparel they

produce there.

November 2002

CCI Encourages Asian Apparel Makers To Use U S Cotton

Philadelphia39 S Textile Engineering Receives Accreditation

Philadelphia’s TextileEngineering Receives AccreditationPhiladelphia University, Philadelphia, has

received accreditation for its bachelor of science degree in textile engineering from the

Engineering Accreditation Commission of the Accreditation Board for Engineering and Technology

(ABET).Textile engineering is both personally and professionally rewarding a field of engineering

where one can practice a wide range of activities that benefit society, said David Brookstein,

Sc.D., dean of the universitys School of Textiles and Materials Technology.

November 2002

SheLyn EWarna Establish Strategic Relationship

Through collaboration and pooling of development and sales and marketing resources, Greensboro,

N.C.-based SheLyn Inc. and Malaysia-based eWarna are to develop and offer color control software

solutions.In addition, talks to form a more formal link between the two companies are underway.The

two companies hope to use eWarnas Internet-based color management platform to bring SheLyns shade

sequencing and recipe prediction software to mills and retailers.By combining our strengths and

resources, we can provide our customers with the best color control solutions, said Roland

Connelly, president, SheLyn.

November 2002

Cargill Dow And Fountain Set Announce Collaboration

Fountain Set Advances Development of PLA in Apparel Minneapolis November 4, 2002 Fountain Set and

Cargill Dow have teamed up to introduce more sustainable alternatives into the apparel market. The

companies are working together to offer a line of performance fabrics from PLA fibers renewable

resource-based fibers derived from crops like corn. The companies have signed a letter of intent to

launch the fabrics into the activewear market by first quarter 2003. PLA is a melt-spinnable resin

developed by Cargill Dow. It is created through a process where simple plant sugars can be used to

create a performance fiber product. The products offer a unique blend of performance properties and

a “natural” message. “Fountain Set is dedicated to furthering the development of sustainable

products,” said Mr. C. F. Ha, chairman and managing director for Fountain Set. “With PLA fibers we

will be able to offer the industry a line of fabrics that are more sustainable and offer the

performance expected in apparel.” “Our objectives are to continue expanding our products, without

losing sight of our belief in sustainability,” said Tim Eynon, general manager – fibers for Cargill

Dow. “Our relationship with Fountain Set meets those objectives and allows us to offer the industry

natural-based performance fabrics for apparel.” “Based on our founding principles of diligence,

frugality, sincerity, and integrity we at Fountain Set continue to develop new markets and products

in order to achieve long-term growth. PLA is an ideal addition to our product line,” said Mr. Ha.

Having built a reputation for their dedication to the environment, Fountain Sets systems allow for

more sustainable processing including azo-free dyes and extensive wastewater treatment facilities.

Additionally, Forbes Global Magazine has recognized them as one of the best 200 small companies in

the world in 2002. Fountain Set (Holdings) Limited, a publicly listed company in Hong Kong and

founded in 1969 is one of the leading manufacturers and suppliers of knitted fabrics in the world

with an annual turnover in 2001 of over US$570 million and an annual fabric production capacity of

220 million pounds. The company operates with a high level of vertical integration in

manufacturing, encompassing yarn spinning, fabric knitting, sewing thread, yarn and fabric dyeing,

fabric printing and garment making. Founded in 1997, Cargill Dow LLC is based in Minnetonka, Minn.

It is the first company to offer its customers a family of polymers derived entirely from annually

renewable resources with the cost and performance necessary to compete with packaging materials and

traditional fibers. The company has achieved this breakthrough by applying its unique technology to

the processing of natural plant sugars to create a proprietary polylactide polymer (PLA).

Editor39 S Note

Editor’s NoteEditors Note: In Weaving On The Cutting Edge (October 2002), TW misstated a reference

to engineered nonwovens, rather than to engineered wovens as submitted by Fritz Legler, president,

Sulzer Textile Inc., Spartanburg. Sulzer Textil has made a major commitment to the woven technical

textile sector.

November 2002

Unifi To Use Tuntex Facility As Asian Sourcing Base

Unifi Inc., Greensboro, N.C., has formed a relationship with Thailand-based Tuntex (Thailand)

Public Co. Ltd., whereby Unifi will use the Tuntex facility as a base for sourcing Unifi yarns in

Asia. In return, Unifi will help Tuntex to expand the variety of polyester filament yarns it

currently manufactures and also to refine its textured yarn processes.The two companies will

maintain separate sales and distribution organizations, but they will cooperate to develop business

opportunities and to increase global market sales.The agreements with Tuntex will establish an

effective foothold into the market from which we can distribute high quality textured polyester

yarns, particularly to supply the needs of western companies that have already shifted production

to the region, said Mike Delaney, senior vice president, Unifi.

November 2002

Cinte Techtextil China Posts Large Exhibitor Visitor Gains

Cinte Techtextil China PostsLarge Exhibitor, Visitor GainsCinte Techtextil China 2002 has reported

a significant increase in the number of exhibitors and visitors over the 2000 exhibition.Exhibitors

numbered 214, a 75-percent gain over 2000, and included national pavilions from Austria, Belgium,

France and Germany. Visitors came from 42 countries and regions, and totaled 5,215, up 95 percent

over the previous show. More than 80 percent of the visitors came from China.

November 2002

FIT Receives Lectra Gift Of U4ia Workstations

New York City-based Fashion Institute of Technologys (FIT) School of Continuing and Professional

Studies has received 11 U4ia workstations valued at $800,000 from Lectra Systems Inc., Atlanta.The

workstations, Lectras second major gift to the colleges Center for Professional Studies, have

enabled the school to offer two new courses this fall, Introduction to U4ia and Intermediate U4ia.A

knowledge of U4ia software is required for design-related positions, said Joan Volpe, managing

coordinator for the center. Having the generous support of friends like Lectra makes it easier for

us to fulfill our commitment to be a resource for leading-edge training in this area.

November 2002

US Industry Protests Indonesian Textile Embargo

The US textile industry is strongly protesting a decision by Indonesia to ban all imports of

textiles. The action, taken in response to a flood of imports from China, applies not only to China

but to all textile imports from the US and other countries. Van May, chairman of the American

Textile Manufacturers Institute (ATMI), has written U.S. Trade Representative Robert C. Zoellick

and Commerce Secretary Donald Evans protesting the embargo and urging the US government to

intervene. Charging that the action is illegal under rules of the World Trade Organization (WTO),

May said the US government should quickly launch a complaint before a dispute settlement panel at

the WTO. In the meantime, May urged the US government to prohibit all textile imports from

Indonesia–which amounted to $350 million last year–until the ban is lifted.Indonesia is not a

particularly important market for US textiles as exports, consisting mainly of cotton and man-made

fiber broadwoven fabrics and specialty and industrial fabrics, have hovered around $17 to $19

million a year. However, under the ban that trade could fall to zero.

November 2002

The Balance Shifts

The Balance Shifts

Increased capacity in Asia threatens world fiber production stability. Information

recently received from the Fiber Economics Bureau (FEB) clearly points out the increasing

concentration of fiber-producing facilities in Asia. A comparison of actual production and

projected capacity intentions for eastern Asia can uncover some interesting clues about the

direction of fiber and textile businesses, particularly for apparel, in the region.The evolution of

imported textile materials from Asia is reaching a conclusion. Government and industry cooperation

has created a regional powerhouse industry, whose production ranges from man-made fibers to

complement the ready availability of regional cotton, to fabrics of all descriptions, all focused

on support of traditional labor-intensive garment manufacture throughout the entire region. The

past 10 years have seen a dramatic change in fiber plant siting, as traditional Japanese and

Taiwanese plants play a less active role and are supplanted by dramatic increases in production in

several mainland Asian areas. Fiber GeographyIn this report, Asia is defined as follows:

Central Asia China and Hong Kong; Northeast Asia South Korea, Taiwan and Japan; Southeast Asia

Indonesia, Malaysia, the Philippines, Thailand, Myanmar, Singapore and Vietnam; and West Asia

India, Pakistan, Bangladesh and Sri Lanka.

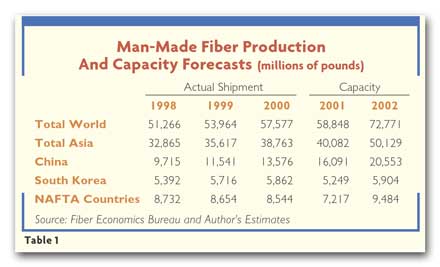

Table 1 details the changing geography of world man-made fiber production. Man-made

cellulosics are not included, not because their consumption is unimportant, but rather because

their market position is static and not a meaningful part of current Asian fiber capacity

ambitions.It quickly is apparent that major shifts in fiber production and capacity are underway.

Asias share of total world fiber productive capacity, in pounds, has risen to almost 69 percent,

and actual production has matched this rise. In 1998, Asian production represented 64.1 percent of

total world production. By 2001, Asian production had risen 15 percent, 7.5 billion pounds, to 68.1

percent of the world total. More interesting, however, is the production rise in China, almost

doubling from 9.7 billion pounds to 16.1 billion. Chinas share of Asian production rose from 29.6

percent in 1998 to 40.1 percent in 2001 representing the entire Asian market share increase.

Putting this in a broader perspective, Chinese production rose from 18.9 percent of the worlds

supply in 1998 to 27.3 percent in 2001. As might be expected, the primary losers were South

Korea and Japan. Korea finally has slowed building fiber-producing capacity and, in so doing, has

lost share to the expansion binge in China. Koreas share shrank from 16.4 percent of Asian

production (10.5 percent of world) in 1998 to 13.5 percent (8.9 percent of world) in 2001.

Similarly, Japan, a former world fiber power, now produces a modest 1.3 billion pounds of fiber in

an industry with capacity to produce almost 1.9 billion. Japans fiber operating rate languishes in

the high 60s to low 70s range, a formula for disaster. Total Asian apparent operating rates are not

much better, settling in the high 70s, traditionally a marginally profitable experience.

As seen in Table 1, the North American Free Trade Agreement (NAFTA) nations have fared

about as well as Korea in the world fiber sweepstakes. North American fiber shipments represented

17 percent of world shipments in 1998, dropping to 12.3 percent in 2001. Unfortunately, while

shipping approximately 7.5 billion pounds annually, the North American fiber industry is saddled

with almost 9.5 billion pounds of capacity. This translates to an average operating rate of just

under 80 percent possibly, but not assuredly, profitable.The interesting statistic underlying these

geographic descriptions is an analysis of product emphasis, particularly that of filament and

staple polyester. Of 1998 world production of 51,266 million pounds, 36,461 million (52.9 percent)

were filament and staple polyester. Asia shipped 27,095 million pounds, almost 75 percent of world

polyester shipments. By 2001, Asian shipments of polyester totaled 33,764 million pounds, 57.4

percent of total world fiber shipments and almost 80 percent of world polyester shipments.The

picture is clear. Chinese planning focuses on concentrating manufacturing in apparel for the U.S.

market and is building capacity, particularly for polyester, at all levels of distribution in an

effort to dominate this market area. By supplying fibers, fabrics and garments, China retains the

value added by labor at each step of the production process. This virtually guarantees the country

will accumulate substantial quantities of hard currencies, such as dollars, to be spent in

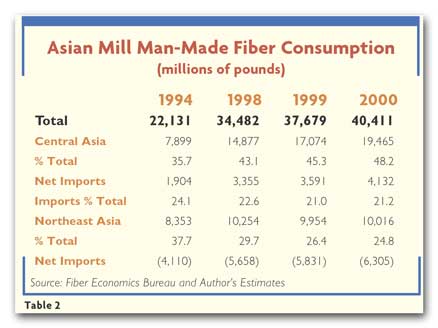

modernizing other areas of the Chinese economy. Mill ConsumptionIn addition to portraying the

Asian textile economy by analyzing fiber shipment, a valuable adjunct to this analysis is a look at

mill fiber consumption. Not surprisingly, mill consumption data paint a similar portrait of the

growing importance of fibers, fabrics and garments to Asian economies.Table 2 analyzes two areas of

the Asian textile economies: Central Asia and Northeast Asia. These areas show the two divergent

directions in which the Asian textile economy is headed apparent total dedication to a fully

vertical industry in developing states, balanced by decreasing emphasis in the developed states as

they metamorphose from labor/manufacturing to capital-sensitive/service/knowledge economies. The

time frame of the analysis stretches back to 1994 for a perspective on growth and change.

Traditional competitors, the Japanese, Koreans and Taiwanese of Northeast Asia, have

moved up the scale of economic industrialization, wherein labor plays a lesser role in economic

activity. Consider these three states. In 1994, mill consumption of man-made fibers totaled 8,353

million pounds, and fiber manufacturers net-exported an additional 4,110 million pounds. Northeast

Asia obviously was a substantial producer of fabrics and a large exporter of fibers. In six years,

mill consumption rose a modest 3+ percent, compounded annually, to 10,016 million pounds, on top of

which fiber producers exported another 6,305 million pounds. Investment obviously was put to

capital-sensitive fiber plants for worldwide product distribution, rather than national retention

for fabric and garment manufacture. Contrarily, in the same time frame, Central Asia, represented

by China and Hong Kong, more than doubled mill consumption from 7,899 million pounds in 1994 to

19,465 million pounds in 2000. Of 1994 consumption, more than 24 percent was produced from imported

fibers. By 2000, the absolute level of pounds imported for consumption had more than doubled, from

1,904 to 4,132 million pounds. Despite this growth, imports share of mill consumption fell from a

24.1-percent share in 1994 to a 21.2-percent share in 2000. Investment obviously focused on

downstream fabric and garment-making activities, employing more labor and exporting products to

accumulate or conserve strong currencies. Rate Of Change

If history repeats itself, one can expect continued disinvestment in the textile and apparel

economies of Northeast Asia and continued increased investment in the relatively undeveloped

economies of Central Asia. This is a quite normal appearance of the traditional development curve

for economies. What is surprising is the rate of speed at which this maturation has occurred.

Similar development took the United States several centuries; it seems that the Chinese want to

accomplish the same jump in only several generations. Can they do itAs the target of Chinas

manufacturing explosion, can the United States sustain the current orgy of consumer spending

necessary to provide adequate markets Or, maybe more important is the issue raised in these pages

two months ago

(See Fibers Fast Track, TW, September 2002). Will the U.S. textile and apparel complex use

its technology, marketing and distribution expertise to expand the United States presence in

non-Asian international apparel and textile markets

November 2002