D

on’t bet the ranch on it, but the biggest decline in US textile/apparel history may be

slowing down. Indeed, if all goes well – and no new international crisis throws a monkey wrench

into things – the new year could mark a turning point for hard-pressed textile and textile product

mills.

To be sure, further modest shrinkage seems unavoidable. But, as the year wears on, the

overall picture should begin to brighten – with perhaps even some fractional gains in a few select

areas by late 2004 or early the following year.

That’s not to say textile executives can let their guard down. Clearly, global competition

continues to intensify – with the ending of quotas in 2005 spelling lots of trouble if the wave of

incoming Chinese shipments doesn’t slow down.

Compounding the problem is the lack of any coordinated government strategy to effectively

fight this import surge. Also disturbing: Both earnings and prices remain far too low for comfort.

But these continuing problems have to be weighed against a growing number of offsetting

upbeat factors. These would have to include ongoing mill reorganizations and consolidations, as

well as the improved production and marketing steps currently being taken by an increasingly

savvy industry.

Clearly, the shuttering of older inefficient mills, continuing plant and equipment spending,

solid productivity gains, and a more globally oriented approach should begin to pay off. All should

help make for a leaner, meaner industry – one more likely to survive in today’s hotly competitive

marketplace.

Costs, meantime, should remain in manageable bounds. True, raw cotton may cost a bit more.

But most man-made fibers are likely to remain steady, or at worst inch up fractionally. And on the

wage front, modest pay hikes will, for the most part, be offset by the aforementioned productivity

gains.

Aiding and abetting sales will be the ongoing introduction of innovative new and improved

products that look better, wear better, feel better, provide more protective features and are more

stylish.

Finally, there’s today’s improving business climate. True, a repeat of the big gross

domestic product gains of recent quarters is unlikely. Nevertheless, most analysts now predict

solid 3- to 4-percent annual rates of gain this year. These kinds of advances almost surely will

translate into increased consumer demand for both textile and apparel products.

In short, there’s precious little to indicate the demise of domestic activity. Combined

textile mill and mill product shipments still managed to reach about the $73.5 billion mark this

past year. True, that’s far under the near-$90 billion peak hit back in 1997. But, by and large, if

the industry plays its cards right, the next few years aren’t likely to turn out all that badly.

This is certainly the case for the year just getting underway – with

Textile World

editors expecting the key segments of the industry to shape up something along these lines:

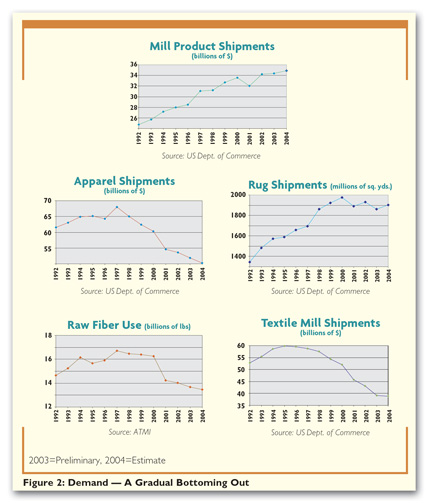

2003 Demand: Basic textile mill shipments (yarns, spinning, texturing, throwing,

twisting and all types of fabrics and finishings), which declined a hefty 35 percent since the late

1990s (to only $39 billion at last report) are likely to fall only fractionally in 2004. Credit the

likely bottoming out to somewhat larger apparel purchases (the first increase in purchases in seven

years), as an improving economy loosens consumer purse strings.

Meantime, mill product shipments (carpets, rugs, curtains, other home furnishings, canvas,

tire cord and fiber, and textile bags) – which have managed to remain in the plus column (though

just barely) over the past few years – should rack up another small gain. Best bet here: close to a

$35 billion shipment year – a bit more than 1 percent above estimated 2003 levels.

Add both major segments of the industry together, and total shipments should pretty much

equal the combined 2003 reading – a welcome change from the declines of recent years.

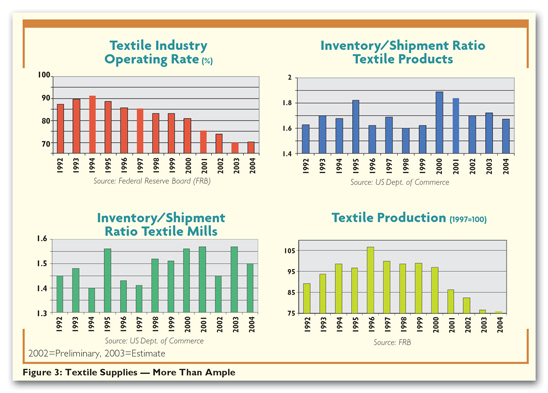

Supply: No sweat here, judging from the combination of still-increasing imports

and more-than-ample US capacity. On the latter score, the textile mill operating rate is currently

pegged at around the 70-percent mark – with perhaps a fractional rise possible over the new year.

Even so, that’s a far cry from the near-90-percent reading reported in the early and mid-1990s.

Relatively high inventories also point to adequate or even excess supplies. Textile mills,

at last report, had a close-to-1.5-months’ supply of goods on hand. While down a bit from early

2003 peaks, that’s still considerably above the 1.4-month low hit during 1997 (the last good

textile year).

Nor are any major fiber problems anticipated. To be sure, cotton and wool supplies are down

a bit – but not to where they’re likely to precipitate any major dislocations. As for man-mades,

heavy capacity overhands – both here and overseas – continue to weigh down the market.

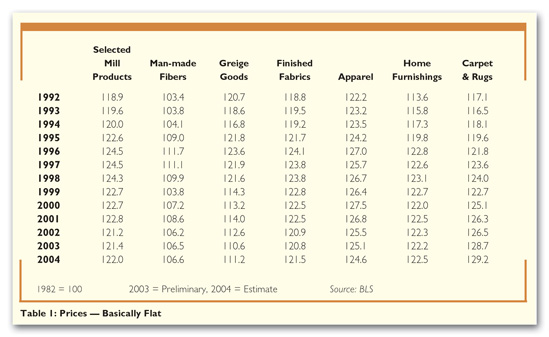

Prices: Any increase this year will be scattered and quite modest, with the

overall advance remaining well under the general inflation rate.

TW

‘s all-inclusive mill index, for example, isn’t likely to advance by more than 0.5 percent or

so over the year. That would still leave this bellwether average some 2 percent under 1997-98

peaks.

Factors behind all this price restraint would have to include a combination of foreign

competition, excess capacity and downstream apparel/retail pressures.

But there could be a few exceptions to the overall softeners. Cotton, for one, could see

some added firming as global supplies tighten. Rugs and carpet should also edge higher – aided by

another good construction and renovation year. And this would be on top of this past year’s

2-percent average advance. Strength is also seen for some of the newer specialty fibers and

fabrics, where product differentiation dampens the general competitive effect.

Costs: Fiber expenses look to remain under control – aside from the just-noted

creep-up in cotton. Labor rates, meantime, aren’t likely to advance by more than the 3

percent-or-so increase of the past year. But with a similar 3-percent increase anticipated for

productivity, overall mill unit labor costs should again remain relatively flat.

Global Insight, a leading economic forecasting firm, also backs up the feeling that costs

will remain under control. The company’s analysts, for example, expect overall labor outlays for

textile mill products to decline in each of the next few years. The firm is equally upbeat about

material and service costs, which are also forecast to edge down a bit.

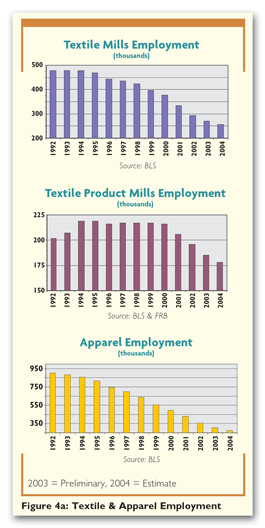

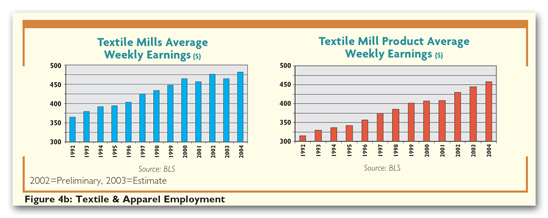

Employment: The expected increase in productivity (output per worker) combined

with a fractional 2004 production decline would also seem to pretty much assure some further labor

shrinkage.

But any decline will be a lot more modest than the 7-percent drop in combined textile and

mill product jobs noted over the past year. Best bet here: a modest 4- to 5-percent slippage.

But add this to the much larger drops of recent years, and one can appreciate how much the

industry has been hurt. More specifically, basic mill employment in 2004, excluding mill products,

will be hard-put to reach 257,000 – little more than half the 478,000 total of a decade earlier.

The picture is even more disturbing in the apparel sphere, as imports take an

ever-increasing share of the market. True, the new year’s 9- to 10-percent expected decline here is

well under that of the last few years. But compare the 275,000 estimated 2004 apparel employee

level with the decade-earlier 883,000 level, and you end up with an eye-opening 69-percent decline.

Capacity: Industrial potential, meantime, hasn’t really dropped by all that much.

This can be inferred from the fact that this past year’s 5-percentage-point drop in the textile

utilization rate would never have occurred if capacity reduction had kept pace with reduced

industry production.

To be sure, spinning capacity has dropped – with declines over the past 12 months noted for

ring spindles, open-end rotors and air-jet positions. But given recent sharp declines in output,

there seems to be more than enough spinning capacity to go around.

Reports of fairly substantial purchases of new equipment also would seem to support the

feeling that overall capacity remains ample or even more than ample. So would rising productivity –

for, other things being equal, mill efficiency depends in large extent on the increasing number of

new and faster machines coming on-line.

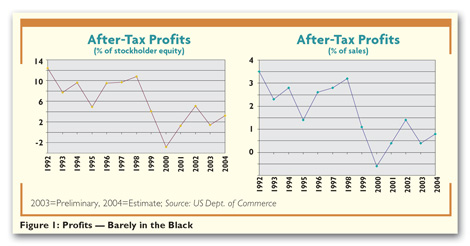

Profits: Despite today’s rough times, the industry has managed to remain in the

black – at least as far as overall averages are concerned. True, this past year’s estimated

less-than-$200 million after-tax earnings total is pretty anemic, especially when compared to the

$2 billion levels of 1997 and 1998. But it does suggest US mills have the ability to ride out the

current storm – thanks to improved management strategies, overseas sourcing and still-increasing

productivity and innovation.

Looking ahead, it would be unrealistic to expect any significant improvement – at least not

over the next 12 months. On the other hand, the bottoming out in demand envisioned for 2004

(combined with continued efforts to keep costs under control) should allow for some fractional

advances in some sectors – enough to bring the after-tax overall profit level to more than $300

million.

The same pattern also is expected for margins (profits per dollar of sales and profits as a

percent of stockholders’ equity). They’ll remain very low, but begin to inch up – probably sometime

after mid-year.

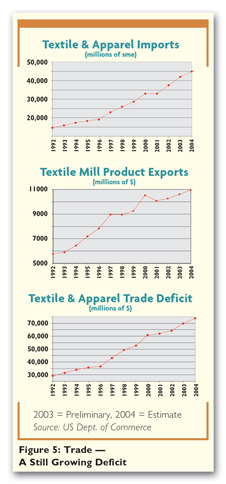

Foreign Trade: Further import increases are unavoidable, though the 2004 gain

(expected to be something in the order of 6 to 8 percent on a square meters equivalent [sme] basis)

could fall a bit shy of this past year’s 11-percent-plus spurt.

Exports also should inch ahead – not so much because there’s all that much progress on

toppling overseas barriers, but rather because the global economy will be increasing faster than in

2003. And that, other things being equal, should raise foreign demand for US textile products.

But these export gains won’t be enough to reduce the dollar gap in the US textile and

apparel trade deficit. Indeed, it looks like another 5- to 6-percent increase in the red-ink

balance – enough to push the total trade deficit to nearly $74 billion. That would be more than

double the figure prevailing as recently as 1996.

A Closer Look At Imports/Exports

A good deal of the import surge can, of course, be traced to China, whose shipments to the

United States have nearly doubled year-earlier totals. The Chinese increase over the past 12 months

represents more than two-thirds of the total US import advance over the period.

More importantly, these gains have established China as the number-one supplier to the

United States – replacing Mexico, whose incoming shipments have actually declined.

Also worth noting: The World Bank estimates that once all quotas are lifted in 2005, China’s

piece of the United States’ $60 billion in apparel and textile imports could rise from the current

$6.5 billion level to nearly $40 billion by 2010.

To be sure, the United States has already taken some corrective action by imposing a

7.5-percent cap on annual growth of knit fabrics, bras and dressing gowns. But it’s only a small

step because this will restrict the growth rate on only 4.7 percent of China’s textile and apparel

exports to the United States.

In any event, the China problem isn’t going to disappear. Blame much of this on the fact

that this Far Eastern producer’s currency (the yuan) is greatly undervalued – some feel by as much

as 30 to 40 percent. This, in turn, is keeping US imports from that nation unrealistically cheap.

True, there’s growing pressure to revalue the yuan. But little in the way of major change is

likely – partly because this could create an international financial crisis and partly because

China needs these exports to offset trade deficits in other manufactured products.

Another reason why China may avoid a currency revaluation: The country is increasingly

appeasing US critics by agreeing to buy more US non-textile products. Witness the recent agreement

to purchase millions of dollars worth of American-made autos and components.

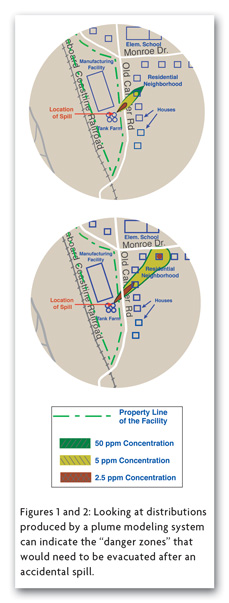

Meantime, some aid to the beleaguered US textile and apparel industries could come from more

effective monitoring of illegal transshipments. New techniques have been developed for tracing such

clandestine imports. New approaches, for example, are being taken to eventually come up with a

marking system to determine country of origin.

Steps to improve exports – such as ongoing negotiations to lower other nations’ trade

barriers – can’t be ignored either. Other factors pointing to a more positive export picture would

have to include a slightly weaker dollar, which makes our offerings somewhat cheaper; and a

strengthening world economy, which will hopefully sweeten demand for our textile and apparel

products.

One answer to many of our trade problems has been suggested by Wilbur L. Ross, the new

leader of Burlington Industries Inc. As he puts it: “We believe the real solution to the China

problem is to revise the January 2005 quota date to a more gradual phase-in over a number of years.

That would give the industry a chance to consolidate and restructure itself to cope with the

inevitable globalization.”

A Mixed Fiber Picture

A few further comments on basic fiber costs also are in order. The current supply/demand

situation, for example, suggests some new inching up in cotton quotes. On the other hand, no such

problems are seen for man-mades, where overcapacity and the absence of any major upward pressure on

petrochemicals (man-mades’ key feedstock) point to a relatively stable price pattern.

Zeroing in on cotton, upward pressure already is quite apparent, with current tags running

some 30 percent ahead of a year ago. The basic cause: a global market shortfall making for the

fourth inventory drawdown in five years.

The latest US Department of Agriculture (USDA) estimate, for example, puts global stocks at

32.2 million bales. That’s almost 5 million under last year, and not even within shooting distance

of the 48-million bale peak hit back in 1998-99.

Less-than-hoped-for US production has been a factor in this year’s drawdown. But probably

the key reason is a big Chinese production/consumption imbalance.

Battered by bad weather in some provinces, the Chinese have lost a hefty chunk of their

cotton crop. Result: Estimates of that nation’s 2003 crop have dropped by 3.5 million bales.

Result: only a 23-million bale production estimate – nowhere near the estimated 30-million

bale Chinese consumption requirements. Not surprisingly, the USDA has raised its forecast of

Chinese cotton imports in 2004 to 7 million bales. This, in turn, suggests our cotton exports could

climb 11 percent.

Given all this, it’s clear why cotton prices have tended to firm. On the other hand, there’s

little indication of any big inflationary spiral. Thus, while further price gains are likely, they

should be modest. Reasons: This past fall’s runup may have been overdone; and stocks, while low,

are nowhere near the critical stage. Also, current quotes will be high enough to eventually spark

some global production gains.

Meantime, prices of other natural fibers have remained quite firm. That’s not only true of

wool, but also silk, where output problems have been reported in both Japan and China.

One exception: cashmere, where ramped-up Chinese production has weakened prices

considerably. But quality could be a problem in some of the lower-cost grades.

On the other hand, the prognosis for buyers of man-made fibers is upbeat – with few upward

cost pressures anticipated. For one thing, there’s more than adequate capacity available both here

and abroad.

In any case, despite some announced closedowns over the past year, estimates of US 2004

potential is put in the 11.6 to 11.7 billion-pound range. That’s actually fractionally above this

past year. And there’s a lot more coming on-stream in developing countries.

New Products Proliferate

But no matter what happens to prices, American fiber producers (along with mills and apparel

makers) are readying a spate of new niche offerings – all designed to whet consumer appetites.

It’s a strategy that makes a lot of sense. In addition to seeking a good fit, buyers are

increasingly interested in such functional apparel benefits as warmth, breathability, stain

resistance, water repellency, waterproofness, and perspiration and odor control.

Aiding and abetting all the above trends are new breakthroughs in such areas as ultra-fine

microdeniers; antibacterials that inhibit bacterial growth in fabrics; flame-retardant items with

increased performance; and even electronic textiles that permit the use of smart fabrics that can

sense, respond and adjust to stimuli such as pressure, temperature and electrical charge.

These latter new products, now dubbed electrotextiles, are giving birth to a host of

military applications.

But the real dollar potential for all these technological innovations lies in the consumer

field. One example here: new wash-and-wear suits targeted to men who wear suits regularly, travel

extensively, and lack the access to or do not have the time for dry cleaning.

There also seems to be a big potential for pants that are virtually impervious to stains. A

product of nanotechnology, the fabric provides a microscopic layer of “whiskers” – too small to be

seen or affect the feel of the fabric – that causes fluids to bead up and roll off garments before

they penetrate the cloth.

In another sphere, there’s a new NASA-developed aerogel – a silica insulation only three

times heavier than air that is now being used in lightweight winter jackets that protect in

temperatures as low as -50°F. The material has more than 10 times the insulating properties of

conventional jacket fills. Another insulation innovation: new lightweight jackets and other

outerwear that come with adjustable insulation.

Equally impressive are vests that monitor physiological changes. There are already 8-ounce

cotton/Lycra® vests that can constantly monitor a patient through sensors woven into the fabric.

Sensors connect to a small data-storage unit the size of a personal digital assistant (PDA) and

enable tracking of the heart rate, breathing and even posture.

Then there are advances in stretchwear – eliminating the fabric’s clingy, sleazy feeling.

New men’s suits are appearing that are made with fabrics whose content of elastic fibers with great

recovery properties is as high as 19 percent. And some stretch shirtings could now be passed off as

pure cotton.

Cloth keyboards for portable electronic devices also have big potential. They’re already

available on most handheld devices – the big plus is the elimination of cramped PDA keyboards. The

fabric is made of conductive cloth, and the keys are little more than raised bumps on the fabric.

And for a real space-age product, there are garments made with woven optical fibers that

display video clips on cloth. Download a 10-second video clip from the Internet and play it back on

a repeating loop on your T-shirt.

It should also be pointed out that all these new developments embrace a broad range of

fabrics – with cotton, as well as man-mades continuing to come up with a growing number of

improvements. Wool isn’t being ignored either, as modern technology increasingly allows machine

washing of this natural fiber. Wools now also come in grades that are fine enough to eliminate the

fiber’s innate itchiness.

Even fabrics such as denim are getting their fair share of attention. Attractive new entries

here include knitted, striated and stretch denims – and even denim that looks like corduroy. Users

of these fabrics also can look forward to more distressed looks, tweed or chevron looks, and

surface manipulations.

Strategy For Survival

And there’s a lot more on the drawing boards – all being readied for introduction over the

next few years. One key factor behind all this activity is the need to de-emphasize today’s

extremely competitive commodity fibers and fabrics – and instead concentrate on more profitable,

custom-designed performance types.

In the words of one key textile executive, “the establishment of these niche markets,

coupled with new global strategies, will spell the difference between success and failure in the

years ahead.”

Burlington Industries’ Ross adds a second factor: the need to put the industry in stronger

hands. As he puts it, the survival of the US textile industry depends on the development of

technologies that will set it apart from foreign competition.

This theme of consolidation is also emphasized by John L. Bakane, CEO of Cone Mills, which

may also become part of Ross’ operations. He notes that, “by joining forces we will be much better

positioned to meet the enormous challenges of low-cost imports while remaining an important

employer in the textile industry.”

This same spokesman also sees capacity rationalization as a big help, adding that such

adjustments are “becoming increasingly feasible because you have so many big players in bankruptcy.

This is one time when you really get a chance to reinvent yourself.”

Still another part of the overall industry survival plan calls for improving supply chain

management. The problems and goals call for more emphasis in such areas as product tracking, global

linkages, better forecasting techniques, and third-party logistics.

In any event, the goal is quite simple – to deliver the right product at the right price at

the right time.

Quality control is still another area receiving a lot of attention these days. It’s become

especially important as global sourcing becomes more and more commonplace.

Helping quality control developments has been the introduction of a new generation of

electronic and automated instruments. Following up on this, a growing number of companies are

moving to on-line monitoring of spinning and finishing processes.

Uncle Sam is also beginning to provide textile firms with more help – witness the curbs

recently imposed on selected Chinese textile shipments.

Moreover, increasing pressure from the industry itself should force more government

involvement. Clearly, the setting up of a textile trade coalition has made it clear that textile

executives and even the unions are determined to make trade a big issue in the upcoming

presidential election.

Taking off on this, Fernando Silva, managing director of consulting firm Kurt Salmon

Associates, says the Bush administration will have to bend a bit in the move to save US textile and

apparel firms – adding that “politically, it’s not going to be possible to do nothing.”

All these strategies should pay off. To be sure, they’re not very likely to spark any big

boom. But they certainly seem impressive enough to stem the sharp declines of recent years –

especially now that the economy is in a stronger recovery phase.

That’s the opinion not only of

TW

editors, but also of analysts at Global Insight. Their latest projections call for a

bottoming-out in textile mill activity after mid-2004. True, early-in-the-year declines could be

enough to make for another negative textile mill production year. But dollar declines will be small

– only in the order of a few percentage points, far less than the precipitous 7.4-percent drop of

this past year.

Go beyond 2004, and Global Insight analysts are cautiously optimistic. While still not

seeing any textile gains, they expect only minimal erosion – not only for 2005 but for 2006 and

2007 as well.

Bottom line: Don’t write off the American textile mill industry or even its downstream

apparel counterpart. Both industries will survive.

True, companies won’t have cheap labor going for them. But clearly, these domestic firms

have big advantages in such vital areas as management expertise, product design and development,

quality, sales, marketing, distribution and customer service.

But it won’t come without more big changes. The American Textile Manufacturers Institute’s

former chairman, Willis C. “Billy” Moore, cautions the industry must come to grips with the

fact that free trade is here to stay – and in order to survive, it must learn to be globally

competitive in all phases of business.

And along with other top textile people, he stresses the big role that Uncle Sam will have

in all this – noting that industry survival will depend upon the ability of the government to level

the international playing field.

January 2004