I

n a past article, a labor/capital-employed productivity measure was modeled

(See ”

Will

Productivity Save US Textiles?” November 2001). This index was for products in Standard

Industrial Classification (SIC) Code 22, and compared the amount of fiber converted into consumer

products with the amount of production labor dollars necessary to effect that conversion. Initial

calculations produced ratios that suggested firms making SIC 22-category textiles spent 68.7 cents

to convert 1 pound of fiber to finished products in 1991, and, through technology spending or

development, reduced that by almost 25 percent in the following decade. Unfortunately, in the same

time period, production employment in SIC 22 industries fell precipitously, suggesting that either

productivity investments had been wasted, or offshore competitors were so determined to export

their way out of the Asian financial crisis (commonly known as the Asian Flu) that no amount of

improved productivity could stem the import tidal wave. Investment capital appeared to take flight

to parts unknown.

In an attempt to improve the analysis, time has been spent over the past several years

refining the case to better understand the implications of efficiency movements in the model,

starting with the adoption of a new data source. Textile World’s basic data resource remains the

Fiber Economics Bureau (FEB), although for the updated model, it now uses a different FEB data

subset, “The Textile Fiber End-Use Survey.” This provides more detail about the flow of SIC 22

products through apparel, home fashions and industrial end-use channels.

Combined with new Bureau of Labor Statistics (BLS) labor data driven by large quantities of

historical SIC data and the new, more detailed North American Industrial Classification Series

(NAICS) data, the new FEB data set provided opportunities to filter out some of the

larger-poundage, lower-labor-cost end-uses and concentrate on traditional fabric constructions that

are most under the import gun – knitted and woven materials headed for apparel and/or similar home

fashions markets.

Definitions And Assumptions

Before reviewing details of the model, some underlying assumptions must be made:

• SIC 22 refers to fibers used in woven, knitted, braided and nonwoven

textile mill products, including finishing activities but not including the cut-and-sew operations

usually associated with apparel or made-up home fashions products.

• All man-made and natural fibers are included except textile glass and

vegetable fibers – such as sisal, bast and others – and cigarette filtration materials.

• Industrial and Other Consumer Products, accounted for in SIC subsets

2290 through 2299, include narrow fabrics; medical, surgical and sanitary products; transportation

fabrics; all types of tires; hose and belting for home, transportation and industrial uses; felts,

not including felted carpets or felted apparel items; filtration fabrics; sewing thread; rope,

cordage and line; bags and bagging; coated and protective fabrics; paper and tape reinforcing

materials; fiberfill, stuffing and flock; plus an assortment of smaller categories such as book

bindings, luggage, shoe fabrics, tobacco and agricultural cloth, wipes, wall coverings, laundry

supplies, mops, carrier fibers, bale wrap, cable binding and civil engineering fabrics.

This category also includes significant poundage of “Unallocated Nonwovens.” This is a

bucket category arrived at by knowing the total pounds reported for nonwovens minus those assigned

to identifiable end-uses such as diapers, medical surgical materials, paper and tape reinforcing,

coated and protective fabrics, and others. Examples of unallocated nonwovens include apparel

linings, furniture scrim, home and commercial building materials and protective packaging

materials.

Efficiency Versus Effectiveness

These terms are not synonymous. The former is measurable against certain output through

models, and effectiveness, or efficacy, is measured in the external investment marketplace. The

market allocates capital to industries and companies offering returns exceeding the return on

capital available in the external market.

In a January 2001 article in the Wall Street Journal, author Richard Foster quoted Jack

Welch, former General Electric CEO: “[Corporate life] is driven by the contradictions of survival;

it cannot succeed without excellent operations, but it will fail if it focuses primarily on

operations. The corporation is afflicted with the survivor’s curse, operational efficiency at

virtually any cost, including exclusion from market-driven efficiencies of capital allocation.

Control processes, designed to ensure the continuity of operational efficiencies, deaden … the

need for change.” In Welch’s world, change is Schumpeter-like; it means creative destruction of

products to make and offer products and services that maximize the return on invested capital, thus

satisfying the capital allocation demands of the marketplace.

Basic questions facing textiles focus on what the industry will look like tomorrow. The

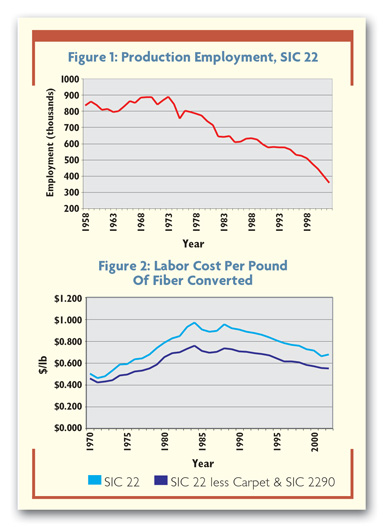

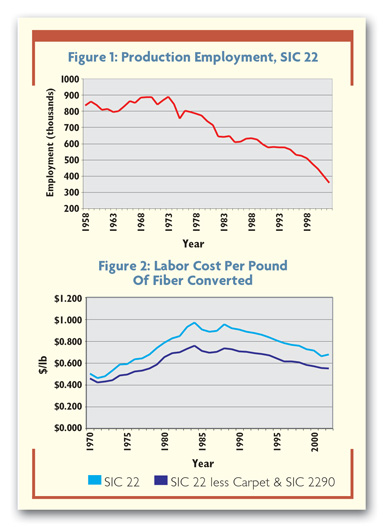

human cost of recent industry history is shown in Figure 1, Production Employment in SIC 22. The

story is well known – layoffs, bankruptcies, consolidations and closings. What is not shown,

however, is the impact of technology as these human costs run up. In 1970, SIC 22 manufacturers

employed 885,000 production workers who converted 9.45 billion pounds of fiber into finished

products. By the end of 2002, production employment had dropped by 60 percent. But at the same

time, direct labor costs for SIC products had risen (in current dollars) from $2.45 per hour to

$11.72 per hour, a 5-percent compounded annual rate of increase. Total direct labor had skyrocketed

from $4.3 billion to a recession- and import-reduced level (from the 1997 high of $11.5 billion) of

$8.6 billion in 2002. This produces the anomaly seen in Figure 2, Labor Cost Per Pound Of Fiber

Converted, which suggests 30 years of investment appears to be somewhat for naught; and production

labor costs per pound of product converted to SIC 22 products rose from $0.457 per pound in 1970 to

$0.546 in 2002, a compounded annual rate of increase of 0.55 percent. Productivity, as measured by

the difference between wages and labor costs, seems to have increased by almost 4.5 percent

compounded annually.

Parenthetically, the wages, not adjusted for inflation, of the SIC 22 production worker grew

5 percent compounded annually from 1970 through 2002. On a constant dollar basis, with 1995=100,

SIC wages rose by 4.56 percent compounded annually.

Figure 2 leads to the question: With the announced investments in new equipment, why are

labor costs continuing to rise ahead of attempts at control? This led to an examination of the

product mix in SIC 22. More specifically, has a dramatic change in product mix impacted labor

costs? So far, it is possible to categorize eight product areas that have enjoyed unusual growth in

the 1970-to-2002 period: carpets; coated and protective fabrics; tires; nonwovens – both

medical/surgical types and a myriad of undefined smaller end-uses; cordage and twine; fiberfill;

and other consumer-type and industrial end-uses. Were these the culprits in this labor/cost rise?

Examination of these products reveals that the technologies for manufacturing tufted

carpets; braided or twisted ropes; dry-, melt- and other-laid nonwovens – and the replacement of

radial-type tires over traditional bias ply tire support materials – differ from those set forth

for traditional SIC 22 materials. Examination revealed that production and labor-cost data were

available for the identified materials, which, with the exception of carpet, fell into the SIC 2290

to 2299 subgroups. Not surprisingly, and without exception, labor costs for carpet and the SIC

subgroups were lower than those for SIC 22. This means eliminating SIC 2290 to 2299 items from the

SIC 22 total reveals the true higher labor costs of traditional woven and knitted materials.

Patents

The industry’s apparent commitment to apparel and import-sensitive home fashions, combined

with its desire to improve productivity revealed another path. Was the industry investing in new

technologies simply to increase productivity, or were there some fundamental changes underway that

would reshape the way America does business in textiles?

The private ownership nature of the textile industry makes it difficult to determine the

investment of true research and development. Historically, researchers have used a surrogate for

the movement of and return on capital through technology. The stand-in employed here is widely used

– the number of patents issued to an industry. Granted, technology can provide advancements in both

basic and applied research – the former more likely to meet the demands of Schumpeter’s creative

destruction by developing a new business, and the latter more focused on improved efficiencies.

This dichotomy tends to muddy conclusions about research and development expenditures, but it is

logical to conclude that an industry willing to invest in research, basic or applied, has better

odds of finding a business-changing product or process. If you don’t invest in either, you don’t

have many chances of uncovering your next business.

A sampling was conducted of the more than 300,000 patents issued under the banner of

textiles since 1852, looking at those issued under Current US Classifications (CCL): 139, Textiles,

Weaving; 28, Textiles, Manufacturing; and 66, Textiles, Knitting. These three categories cover

approximately 56,000 patents, or 18.5 percent of all patents issued to textiles. The sampling

focused on discovering areas of new business development – as a cursory examination suggested that

these covered more fundamental processing questions, while the remaining patents tended to approach

aesthetics and more efficient ways to do the same business. Of the remaining 250,000 patents,

82,400 are in CCL 427, Textiles, Coatings; 67,700 in 424, Textiles, Biocide Treating; 64,400 in

252, Textiles, Finishes; 19,300 in 57, Spinning/Twisting/Winding; and 14,400 in 19, Textiles, Fiber

Preparation. Closer examination is planned to further segment these patent categories.

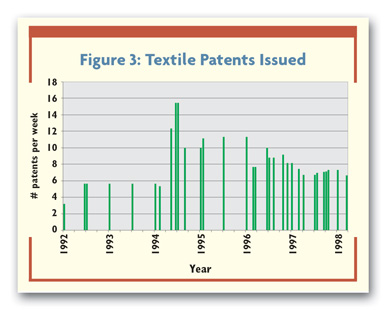

Figure 3, Textile Patents Issued, provides an interesting peek at development. In the three

selected CCLs, the number of patents issued each week from 1852 through 2004 was charted. Up to the

early 1930s, approximately five patents were issued each week in these textile CCLs. A surge in the

early ’30s currently defies explanation, but it may represent either finalizing the dyestuff work

started during World War I or increased attention to the new world of man-made fibers and the

technologies needed to adapt fabric-forming equipment to these new materials. The World War II

years brought increased technological developments, some of which resulted in industry- and

marketplace-changing events such as nonwovens, tufting, durable press and improved machinery

materials. The ability of man-made fibers to be designed for specific end-uses opened new doors

virtually daily.

Man-made fibers provided both good and bad news. The fibers’ adaptability forced new fibers

into almost every fabric construction ever created. In the 1960s and 1970s, fiber company

development officers prowled the hallways of every mill, intent on substituting their new fiber for

whatever the mill currently was running, irrespective of changes in the utility afforded by the new

material. Fabric development became the purview of the fiber producer, transferring that creative

investment to an up-the-food-chain participant. Fiber companies usurped the traditional

mill/converter/manufacturer distribution channel, sometimes armed with wads of advertising

allowances in return for a logo display. The mill assumed a lesser position in the channel;

research became efficiency-focused as every mill tried to use the same new fibers to make the same

fabrics as its competitor. Through the 1970s and 1980s, the sample seems to indicate that, with the

notable exception of nonwovens, mill development centered on efficiency, and fiber company

development focused on new fibers, finishes and end-uses. Product line creative destruction was all

but ignored by traditional SIC 22 manufacturers.

Enter imports. By the late 1980s and into the 1990s, fiber company profit margins were

sorely tested by a combination of too much domestic capacity and textile world-dominating ambitions

from Asia. Development and patent issuances dropped to less than one per day. Product strategy

evolved to “efficiency will keep us whole.” Efficacy – that is, are we invested in the right

business? – fell by the wayside.

Back To The Future

Return to Figure 2, Labor Costs Per Pound Of Fiber Converted. Despite receiving multiple

patents in the past 15 years and despite forcing labor conversion costs to 65 cents per pound, well

below the mid-90-cents-per-pound level to which they had risen in the middle and late 1980s, the

traditional textile industry still is being hammered by cheap imports and losing employees and

companies to technology, consolidations, closures and bankruptcies. There seems to be no respite

from the deluge. Today’s exporter is China; tomorrow it will be another developing economy. Where

is the industry to turn?

Strangely, it is suggested that the same technologies that the industry ignored can supply

the wherewithal for resurgence. This does not mean that, miraculously, all will be well, but it

does suggest that technology is the long-term answer. Short-term, there likely will be additional

mill closings and consolidations as more fabric users answer the siren call of cheap manufacturing

labor in the developing world.

Long-term, businesses must change. Long-term, textiles will mean technical textiles plus

home fashions, including carpet. In some cases, the form utility of the product – carpet, for

example – precludes serious import competition. In others, the need for information and adherence

to specifications inhibits imports. Apparel manufacturing is moving offshore rapidly, so

manufacturers must find those areas with some type of “technological wall” between them and the

dedicated offshore producer. The same nations that provide cheap apparel labor increasingly are

building fiber and fabric plants aimed at keeping all the value added in garment manufacturing at

home. While the jury still is out on increasing imports of home fashion materials, the

technological ability of the American textile workforce pleads for investment to survive by

creating new markets using technical textiles.

US textile manufacturers have done a yeoman’s job of filling fabric needs. However, there is

no gaping hole in distribution just waiting for the next mill to arrive. FEB data for the last

several years reveals that poundage consumed in apparel has decreased from 1995 highs under the

weight of imports and the lingering effects of the 1990 recession; poundage destined for non-carpet

home fashions has stagnated in the same time period; while fibers in carpet continued to grow

through 2002. As fibers destined for industrial (more technical) areas continue to grow, it must be

pointed out that a substantial portion of this growth is reflected in increased fiber consumption

in nonwovens and fiberfill products. There is no easy entry to technical fabrics. It will take a

total revision of thinking and a totally new way to go to market with innovative, creative

offerings.

Traditional marketing strategies focus on a four-unit matrix:

• Offer the same product to existing markets. This strategy involves price

cutting to gain advantage – bad for competitors but good for overall distribution as lower prices

attract new purchasers.

• Offer existing products to new markets. This requires the offerer to

provide distributional creativity – for example, Ford’s morphing the Model 150 pickup truck into

the Explorer and opening the sport utility vehicle market.

• Offer new products to existing markets. The offerer provides

product/service creativity – for example, General Motors’ use of basic Blazer technology to create

the Escalade. Cadillac reread its traditional buyer profile and discovered an undercurrent of

excitement among Baby Boomers that prior management had ignored.

• Offer new products to new markets. This is most difficult because the

offerer is not a readily recognizable voice in either venue. Polypropylene manufacturers integrated

downstream into nonwovens and developed new markets for new products. In many ways, polypropylene

nonwovens creatively destroyed traditional SIC 22 markets.

A Few Ideas

The future of textiles lies in rethinking its role. Historically consigned to the role of

component manufacturer, textiles must adopt the mantle of product/market leader. The system

designer/producer requires an aura of control sadly lacking in many firms whose standard approach

is reactive. Spend capital in leading developments; don’t wait for new fabrics and ideas to drop

magically from the sky on the shoulders of the next style pixie.

Maybe nanomaterials are an answer. Can nylon – long thought to be stronger than steel – be

used in rod-like constructions to achieve the same strength and stress deflections in concrete or

other matrices? Why can’t nylon be on the floor as carpet and reinforce the floor like rebar? Are

there additional uses for carbon fibers? What would happen if every golfer could carry one

additional club or more spars were made from fibers? Glass has built a large business in the marine

trades. Fiberglass hulls are preferred because sailors want to enjoy the boat, not work on it. Do

opportunities exist for increased use of fiberglass in automobiles? Maybe the industry has to build

glass repair shops and thereby provide a complete system supporting increased use of glass

sandwiches. Do additives or applications exist that can turn a basic, run-of-the-mill yarn into a

conductive material, a resistive material, or who knows what type of material?

A Caveat

Current United States trade policy is, to be kind, somewhat of a hash. Many believe that the

North American Free Trade Agreement (NAFTA) model works, and expanding beyond the original borders

is important. That said, however, the first real attempt to expand the concept – the Central

American Free Trade Agreement (CAFTA) – through trade preference levels contains holes large enough

to allow millions of yards of non-CAFTA and non-NAFTA fabrics to achieve preference status, hardly

an encouraging sign for trade equality.

The playing field probably will never be level, but at least one can hope it will be

predictable. Risk is the enemy of creativity and innovation. Political risk currently inhibits US

mill investments that could advance world textile technology.

May 2004

Catbridge

Catbridge