H

istorically, the nonwovens industry was organized differently from the textile industry

and grew to present a broad array of highly functionalized, yet disposable, single-use engineered

products that are driven by high-speed, large volume and low cost. The market segments most

impacted by nonwovens have been those requiring desired performance at reasonable costs —

disposable products are used in a myriad of applications ranging from hygiene, medical, filtration,

wipes and consumer products to geo-nonwovens — and, consequently, they are separate from the more

traditional textiles that have been focused primarily on apparel. Interestingly, there has been

little or no overlap with technical textiles products because of the fact that nonwovens are driven

by large volumes. The nonwoven roll goods industry produces close to 6 million tons of fabrics per

year, with an annual growth rate of 8 percent.

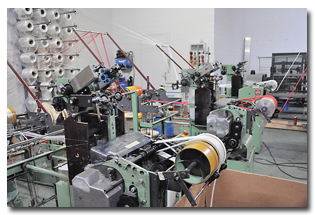

Today’s segments of the industry include raw material suppliers; roll goods producers;

converters/fabricators of the end-use products; the machinery industry supporting the previous

three categories; auxiliary material suppliers; and winding, slitting and packaging equipment

makers; among other segments. Even this segmentation does not offer as clear a picture as one might

imagine, because the picture is further clouded by varying degrees of vertical and horizontal

integration in the industry. Globally, the picture is further complicated by the local market and

economic nuances.

Historically, nonwovens started as single-use, large-volume, disposable products, but the future

expansions beyond the historical market segments will be quite different: We are now coming

full-circle and focusing on smaller-volume, high-value products; and this only means that technical

textiles and nonwovens will emerge as functional structures driven by performance. This is the

battleground for durable products made from nonwovens.

The term “durable” is in, but its meaning is not always clear in this context; nonwovens can

be long-lasting or have a short life cycle. Most nonwovens currently are engineered to be

single-use products, and function adequately in the applications for which they’re designed.

Automotive nonwovens, geosynthetic nonwovens and the like are intended to last for a long time, and

are often called durable, but it is preferable to refer to these as long-life nonwovens.

Figure 1: This full-sized tent, delivered recently to Tyndall Air Force Base, Fla., is made

using a coated nonwoven substrate in which the islands-in-the-sea fibers have been

fibrillated.

There is also the multi-use nonwovens classification. For example, many commercial wipes

used in Europe today can be used to wipe a surface and be washed/rinsed/cleaned and reused multiple

times. From the perspective of functional clothing, the materials need to withstand multiple

launderings without loss of functionality or appearance. One must make a distinction here:

Long-life nonwovens are not necessarily launderable, although they can function for a very long

time. Durable, launderable nonwovens are a different class altogether. There are not too many such

products on the market — yet. But, watch out for functional nonwovens products in technical

clothing applications — these are going to emerge a lot sooner than many imagine. But, what will be

the technology of choice? That depends on the assets in place, applications, functions required and

other parameters.

Durable Nonwoven Fabric Formation

Historically, there have been two major efforts in forming durable nonwoven fabrics.

Charlotte-based Polymer Group Inc. (PGI) introduced the line of Miratec® fabrics not so long ago.

These were carded staple-fiber-based products that were hydroentangled using PGI’s unique Apex™

technology that would create textures and structures equivalent to those of any textiles. Most were

formed with blends of fibers, and their performance could be equal to or better than that of their

woven counterparts. Most of these fabrics had additional binders to ensure that the fabrics would

not unentangle during laundering. Consequently, these fabrics did not have the hand, feel or drape

required; and, as a result, their uses remained limited. Interestingly, some groups are still

pursuing staple-fiber-based products. For example, the U.S. Army Natick Soldier Systems Center,

Natick, Mass., has worked with a number of groups to develop staple-fiber-based nonwovens for

soldiers’ uniforms. These structures ultimately find their niche.

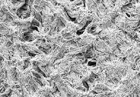

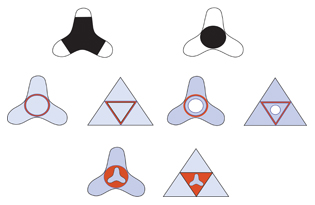

Figure 2: Segmented pie is one example of a splittable bicomponent fiber.

The other effort was initiated by Freudenberg Nonwovens, Germany, and utilizes bicomponent

spunbond technology coupled with hydroentangling. Spunbonding bicomponent extrusion technology

involves the spinning of continuous filaments composed of two polymers deposited onto a forming

belt followed by mechanical, thermal or chemical bonding. The fine-fiber spunbond process often is

capable of producing only fibers larger than 10 to 15 microns. The key will be to form a structure

composed of smaller fibers than usual, and that only means that exotic fiber types will be needed

for these applications. One of the key patents in this area was granted to Dr. Robert Groten and

others at Freudenberg for detailing the process for splitting segmented pie fibers in a continuous

process. The fabric thus formed is now known as Evolon® and is the first commercial spunbond

reusable, durable microdenier fabric, and arguably the best-known microdenier nonwoven in use

today. These structures are far superior to those made from staple fibers in terms of durability,

strength and drape.

The term “splittable” refers to bicomponent fibers that have one common interface and in

which the two components are exposed to air on the surface of the fibers. Classic examples include:

segmented pie

(see Figure 2); segmented ribbon; and side-by-side. Mechanical splitting requires the

fiber components to have little affinity to one another; therefore, the selection of polymers and

polymer ratios plays a key role in the ability and quality of the splitting.

Figures 3 and 4: In hydroentangling of bicomponent fibers, water jets split the bicomponent

segments (top), resulting in two different, wedge-shaped fibers (bottom).

Hydroentangling uses high-pressure water-jet curtains to mechanically move, wrap and

entangle fibers. During the process, the water jets split the bicomponent segments, resulting in

two different, wedge-shaped fibers

(See Figures 3 and 4).

The fiber size after splitting is dependent on the diameter of the original fiber, the

number of segments and the spinning parameters. There are a few limitations to the segmented

pie structure. The segmented pie structure is limited by the wedge-shaped fibers formed during the

splitting. These fibers can pack tightly when consolidated. This behavior creates the challenge of

balancing consolidation and mechanical properties. When consolidation is low, pilling and tensile

are low and tear is high. When consolidation is high, pilling and tensile are high and tear is

low.

Spunbond microfibers are also formed by the removal of one of the components in a

bicomponent structure using caustic and other solvents. The most common cross section used is the

islands-in-the-sea (I/S), in which the sea is removed, leaving the islands behind. As the number of

islands increases, the size of the resulting fibers decreases. Because this method requires removal

of a component, there are often environmental concerns along with additional costs due to the

removal process and waste of the sea polymer. Additionally, the challenge with these structures is

that the islands tend to stay as bundles.

Microfiber nonwovens are used in suede and leather products, durable wipes, and automotive

components such as headliners, but they have made little headway in durable, launderable, technical

clothing applications. This is partly due to the fact that microdenier fabrics thus far have lacked

adequate drape and stretch, and are difficult to dye — they cannot be dyed to deep shades.

Emerging Durable Nonwoven Fabrics

There have been numerous attempts to overcome the shortcomings of the existing microdenier

and staple-fiber durable nonwovens. These efforts have resulted in a number of new developments

that will likely appear as products in the near future. Following is a glimpse into the future and

what some new technologies may offer in a durable nonwoven structure.

Structures With Super Moisture Transport

Coolmax®, 4DG™, and other structures utilize the fiber shape as a means to create

capillarity for rapid moisture transport. Wichita, Kan.-based Invista’s Coolmax is essentially a

flat fiber with a superior surface finish to allow the transport of moisture. Because of its shape,

it also packs differently compared to round fibers, creating more capillarity

(See Figure 5).

Figure 5: The shape of Coolmax® fiber affects the way it packs in a yarn, creating more

capillarity compared with a round fiber, and enhancing the yarn’s moisture-transport function.

Schematic courtesy of Invista

4DG, developed by Fiber Innovation Technologies Inc., Johnson City, Tenn., is formed by

controlling the shape of the spinnerets, and, consequently, fibers are larger than normal —

typically 6 deniers per filament or larger — and these are not ideal for technical clothing

applications.

A new structure that is emerging is known as the Winged Fiber™, developed by Allasso

Industries Inc., Raleigh, N.C. Originally created for use in a spunbond nonwoven, the fiber can

easily be utilized in critical applications in which Coolmax and other similar structures are used.

Here, the filaments are formed as a bicomponent fiber in which the winged component is wrapped by a

sacrificial sheath. The shape is controlled through the spinpack design and not the spinneret.

Consequently, fibers as little as 1 denier or less are possible. With this technology, the fibers

are formed into the final product, and a finishing step removes the sacrificial sheath releasing

the winged fibers. Therefore, the fibers do not interdigitate but, rather, stay apart, providing

for higher permeability and capillarity. The fibers can reach a specific surface area of 20 square

meters per gram (m2/g), compared with 0.2 m2/g for a round fiber of the same size and between 0.3

and 0.4 m2/g for Coolmax.

Figure 6 (top): The Winged Fiber™, whose cross section is shown here, measures 15 by 10

microns. This particular fiber is made from polyester.

The nonwovens version of this structure is durable and drapable, and will be an interesting

component in activewear. Whether in a knitted, woven or nonwoven fabric, the high surface area will

translate to much faster drying of the fabric. Therefore, for next-to-skin applications requiring

moisture management, this structure can offer unrivaled performance.

Structures made with fibers such as the Winged Fiber also can be used to form durable wipes,

filters, suede and leather products.

Figure 7 (bottom): Shown here is a cross section of a nonwoven fabric made with the Winged

Fiber.

High-strength Micro And Nanofiber Structures

Nonwovens are not necessarily known for their strength because of our daily contact with

disposable products. Many high-performance nonwovens are used to stabilize structures such as

roads, embankments, and other similar structures. These, however, are often heavy and not

necessarily drapable.

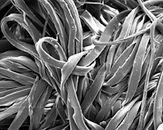

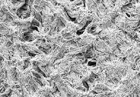

It was recently discovered that through mechanical action including shear and

hydroentangling, I/S fibers can be fibrillated

(See Figure 8). If the sea component is fractured and fibrillated, the sea remains in the

structure, making the process more economical and environmentally friendly, as the fractured sea

elements wrap the fibers and can act as a binder when and if melted.

Figure 8: When islands-in-the-sea fibers are fibrillated through mechanical action such as

shear or hydroentangling, the fractured and fibrillated sea elements wrap the fibers and can act as

a binder when and if melted.

This fibrillation allows the formation of structures composed of sub-micron fibers that are

superior in terms of tear and tensile and abrasion properties, and offer properties that are not

easily achievable. As a coated substrate, the structures can be formed into shelters, tents,

awnings and other structures.

(See Figure 1).

Durable Structures With Super Drape And Hand

Splittable fibers often end up with what could be called the “velcro effect.” The surfaces

tend to be sticky and easily cling to other surfaces. Some fine silk woven fabrics often

produce the same result partly because the fibers are available on the surface and partly because

they are too fine.

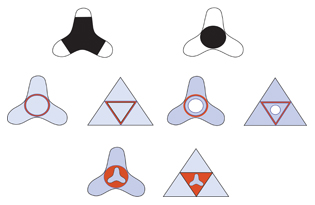

A modification in the typical tipped trilobal bicomponent fiber can lead to a flexible

drapable, durable fabric. Here, the tipped trilobal cross section is modified in one of two ways:

The structure accommodates a core within the trilobal configuration; or the tips become the

majority component, allowing for easy splitting (See Figure 9). With the addition of a core, once

split, there will be three fibers — the tips — and one sheath core. The sheath is normally a

different polymer and melts at lower temperatures, allowing it to be used as a binder fiber to

further strengthen the structure.

Figure 9 (top): Tipped trilobal fibers are easily split by hydroentangling. Examples

include (left to right): a tipped trilobal in which both core and tips are exposed on the surface;

and a modified tipped trilobal in which the core is wrapped by the tips. Figure 10 (bottom): The

core-modified structure offers interesting possibilities, as shown here.

The core-modified structure offers interesting possibilities in that the polymer B

component, shown as the minority component, can be polymers that are not easily spinnable

(See Figure 10). For example, highly loaded polymers with additives such as titanium

dioxide cannot be spun easily into a fiber. Here, the B component can accommodate such polymers.

Recently, the combination of elastomers with other polymers such as nylon and polyester has led to

the introduction of durable nonwovens with stretch and recovery. The surface of these structures is

interesting in that the fibers appear to be self-crimping, which consequently results in much

better hand

(See Figure 11).

Figure 11: The modified tipped trilobal fiber shown in this scanning electron micrograph is

an 80-percent polyester/ 20-percent nylon bicomponent fiber.

These configurations result in a microfiber nonwoven with superior mechanical properties

over other cross sections with similar fiber diameters; however, it is limited in possible

polymer-to-polymer and polymer-to-additive ratios.

Conclusions

New durable nonwovens developments outlined above can emerge as the next generation of

technical textiles in many critical applications. These structures are strong and possess

significantly higher surface area than existing fabrics. Some of the developments may equally

impact wovens and knits as well in that the fibers developed for these nonwovens can readily be

spun into filaments and staples and can form the basis for the next generation of technical

clothing fabrics.

The emerging nonwovens, however, will not be your father’s nonwoven, and will be different

from nonwovens in use today. The future promises to be interesting and potentially very rewarding.

References:

- Fedorova, N. “Investigation of the Utility of Islands-in-the-Sea Bicomponent Fiber Technology

in the Spunbond Process.” (PhD diss., North Carolina State University, 2007).

- Okamoto, M. “Multi-core composite filaments and process for producing same.” 1977. US Patent

4,127,696, filed Sept. 6, 1977, and issued Nov. 28, 1978.

- Moriki, Y., and M. Ogasawara. “Spinneret for production of composite filaments.” 1982. US

Patent 4,445,833, filed Feb. 17, 1982, and issued May 1, 1984.

- Kiriyama, T., et al. “Novel assembly of composite fibers.” 1981. US Patent 4,414,276, filed

July 29, 1981, and issued Nov. 8, 1983.

- Fedorova, N; B. Pourdeyhimi. “High Strength Nylon Micro- and Nanofiber Based Nonwovens via

Spunbonding,” Journal of Applied Polymer Science 104, No. 5 (2007): 3434-3442.

- Freudenberg Nonwovens. Accessed Jan. 4, 2011. http://www.evolon.com/.

- Nagendra, A., S. Verenich; B. Pourdeyhimi. “Durable Nonwoven Fabrics via Fracturing Bicomponent

Islands-in-the-Sea Filaments.” Journal of Engineered Fibers and Fabrics 3, No. 3 (2008):

1-9.

- Groten, R.; G. Grissett. “Advances Made in Micro-Denier Durable Nonwovens.” Presented at

TechTextil North America 2006, Atlanta, March 29, 2006.

- Nakajima, T., Advanced fiber spinning technology, 108-109. Cambridge: Woodhead Publishing Ltd.,

1994.

- Durany A.; N. Anantharamaiah N; and B. Pourdeyhimi., “High surface area nonwovens via

fibrillating spunbonded nonwovens comprising Islands-in-the-Sea bicomponent filaments:

structure-process-property relationships.”Journal of Materials Science 44, No. 21 (2009):

5926-5934.

- Bond, E.B.; and T. A. Young.”Shaped fiber fabrics.” U.S. Patent Application Publication

2005/0176326A1, Aug. 11, 2005.

- Wang, C.: et al. “Method for producing ultrafine fiber and artificial leather.” U.S. Patent

Application Publication, 2004/0045145 A1, March 11, 2004.

- Pourdeyhimi, B.; N. Fedorova; and S. Sharp. “Lightweight high-tensile, high-tear strength

bicomponent nonwoven fabrics.” 2005. US Patent 7,438,777, filed April 1, 2005, and issued Oct. 21,

2008.

- Pourdeyhimi, B.; and S. Sharp. “High strength, durable fabrics produced by fibrillating

multilobal fibers.” 2007. US Patent 7,883,772, filed June 28, 2007, and issued Feb. 8, 2011.

- Pourdeyhimi, B.; and W. Chappas. “High surface area fiber and textiles made from the same.”

U.S. Patent Application Publication 2008/0108265 A1, May 8, 2008.

- Pourdeyhimi, B.; N. Fedorova; and S. Sharp. “High strength, durable micro & nano-fiber

fabrics produced by fibrillating bicomponent islands in the sea fibers.” U.S. Patent Application

Publication 2006/0292355 A1, Dec. 28, 2006.

Editor’s note: Dr. Behnam Pourdeyhimi is Associate Dean for Industry Research and

Extension, and William A. Klopman Distinguished Professor of Textile Materials at North Carolina

State University’s (NCSU’s) College of Textiles, Raleigh, N.C.; and Executive Director of The

Nonwovens Institute at NCSU.

May/June 2011