HO CHI MINH CITY, Vietnam — January 26 2026 — The Vietnam International Trade Fair for Apparel, Textiles and Textile Technologies (VIATT) is set to host its first Trend Forum, offering a forward-looking, industry-wide perspective for Spring / Summer 2027. With the show scheduled from 26 – 28 February 2026 at the Saigon Exhibition and Convention Center (SECC), VIATT’s trend curators – NellyRodi™ Agency and MUSEATIVE – will provide comprehensive insights across the interconnected realms of Apparel Fabrics & Fashion, Home & Contract Textiles, and Technical Textiles & Technologies.

HO CHI MINH CITY, Vietnam — January 26 2026 — The Vietnam International Trade Fair for Apparel, Textiles and Textile Technologies (VIATT) is set to host its first Trend Forum, offering a forward-looking, industry-wide perspective for Spring / Summer 2027. With the show scheduled from 26 – 28 February 2026 at the Saigon Exhibition and Convention Center (SECC), VIATT’s trend curators – NellyRodi™ Agency and MUSEATIVE – will provide comprehensive insights across the interconnected realms of Apparel Fabrics & Fashion, Home & Contract Textiles, and Technical Textiles & Technologies.

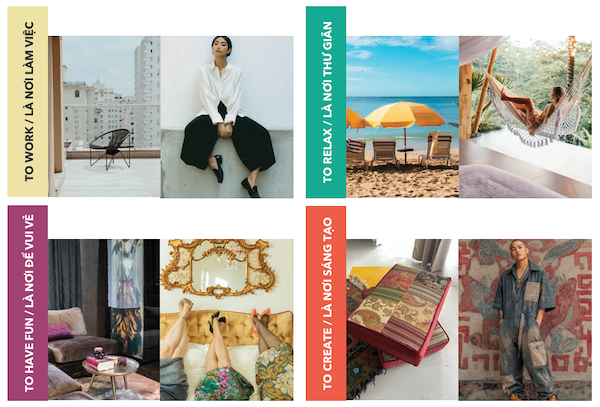

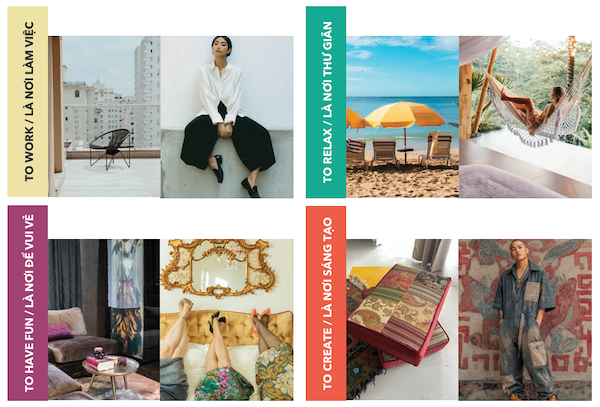

The display of these integrated LIFESTYLE TRENDS, under the umbrella theme ARTISANSHIP, is a first for the textile industry, exploring an alternative to the traditional sector-specific trend focus. The sub-themes set to be showcased include TO WORK, TO RELAX, TO HAVE FUN, and TO CREATE, all key aspects that shape how people dress, create comfort in the home, and interact with technology.

The display of these integrated LIFESTYLE TRENDS, under the umbrella theme ARTISANSHIP, is a first for the textile industry, exploring an alternative to the traditional sector-specific trend focus. The sub-themes set to be showcased include TO WORK, TO RELAX, TO HAVE FUN, and TO CREATE, all key aspects that shape how people dress, create comfort in the home, and interact with technology.

“The launch of VIATT’s inaugural Trend Forum marks an important new step for this fair,” stated Ms Wilmet Shea, General Manager of Messe Frankfurt (HK) Ltd. “Leveraging Messe Frankfurt’s nearly three decades of leadership in coordinating apparel and home textiles trend forecasting – a track record of consistently setting industry benchmarks – we are now extending this unparalleled expertise to enlighten the entire textile value chain. Utilising the expertise of our top-level trend curators, this holistic approach is designed to deliver unparalleled insights, foster robust innovation, and empower businesses to anticipate and shape consumer preferences with greater precision and relevance.”

Acting as a unified set of principles that flows seamlessly across sectors, the LIFESTYLE TRENDS shape fashion choices, home interior design, and interactions with technical products and interfaces.

Mr Kai Chow, Lead Curator, VIATT Trend Forum and Creative Director of MUSEATIVE, explained the unique approach: “Rather than treating fashion, home, and technology as separate worlds, the Trend Forum presents lifestyle trends as a shared design language – one that shapes what we wear, how we live, and how we engage with the products around us. Instead of presenting trends in isolation, it demonstrates how a single mindset can influence products, spaces, and technologies simultaneously. Because these themes are rooted in human behaviour, they naturally scale across sectors – creating one coherent language that connects what we wear, how we live, and the materials and technologies that support everyday life.”

In this vibrant tapestry for S/S 2027, ARTISANSHIP is set to elevate style into a rarefied realm of artistry, with NeIlyRodi™ Agency bringing the four distinct themes to life:

TO WORK

This theme slows the rhythm of the city and transforms metropolitan living into an oasis of calm. In fashion, garments take the shape of fluid tailoring, softly draped dresses, and minimal separates. Interiors echo this sentiment, with cushions, throws, and drapery that create restorative sanctuaries within dense cityscapes.

It is expressed through a colour palette of soft, natural hues, accented by slate blue and black. Fabrics are notably soft, tactile, and sustainable. Design direction emphasises minimalist botanicals, tonal motifs, and organic lines. Applications span tailored separates, light outerwear, and city-chic loungewear in fashion; cushions and drapery for the home; and aesthetically innovative, wellness-tracking technical textiles.

TO RELAX

Celebrating the season’s carefree spirit, this theme encapsulates the romance of leisure, expressed through light, airy, and deliberately imperfect fabrics. This mood is liberated by a jubilant blend of airy pastels and sun-soaked brights, including mint, aqua, and teal for freshness, a soft touch of blush and pink, and optimistic pops of vivid yellow and orange.

Fabrics include linen, cotton voile, chambray, and organic blends. Design direction highlights hand-drawn botanicals, romantic florals, nautical strips, and country checks. Applications include airy curtains and casual throws for the home; relaxed fashion pieces; and tech innovations focusing on functional performance, wellness tracking, and circular materials.

TO HAVE FUN

This theme presents an unapologetically dramatic counterpoint, unfolding a world of grandeur, decoration, and glamour. Terracotta, sage, and lavender establish a grounded base, while golden ochre, crimson, cobalt, and royal purple electrify the narrative with jewel-like vibrancy, balanced by the mysterious depth of deep teal and midnight blue.

Luxurious fabrics and textures include ornate brocade, jacquard, beading and jewel. Design direction features baroque florals, ornate geometrics, and embellished surfaces. Applications span statement bedding and dramatic drapery for interiors; evening gowns and statement accessories in fashion; and textural, 3D-printed, and light-emitting textiles in tech.

TO CREATE

Being the most personal and expressive of the S/S 2027 narratives, this theme champions individuality and cultural storytelling. It blends earthy-warm colours with bold vibrancy, where terracotta reds, golden yellows, and forest greens echo artisanal roots, while teal and indigo provide modern contrast.

Fabrics and textures are notably natural and textural, encompassing hemp, bamboo blends, patchwork, and circular/recycled textiles. Design direction draws from cultural motifs, alongside painterly abstracts and hand-painted details. Applications range from fashion-forward layered streetwear and boho ensembles; to bold rugs and artistic throws for the home; to AI and digital design integration, protective textiles, and real-time data integration in tech.

For an initial exploration of ARTISANSHIP, the complete Trend Guide is available.

Overall, trends will be an important aspect of the fair’s fringe programme. Mr Kai Chow will present the VIATT Lifestyle Trends Spring/Summer 2027 Seminar, along with two Trend Forum Introduction Tours taking place on 26 and 27 February in Hall B. The first tour will occur right after the seminar on Day 1 – ideal for fairgoers seeking more in-depth analysis.

In addition, the Thai Industrial Hemp Trade Association (TiHTA) will return to the fair to host a seminar focused on design and trends. The association aims to captivate global buyers with fashion designs that leverage organic raw materials and promote sustainable fashion made from hemp fibres.

Meanwhile, Style Republik, Vietnam’s fashion media dedicated to championing and empowering the country’s fashion talents, will also lead a panel discussion on upcoming local fashion trends.

The Vietnam International Trade Fair for Apparel, Textiles and Textile Technologies (VIATT) is organised by Messe Frankfurt (HK) Ltd and the Vietnam Trade Promotion Agency (VIETRADE). For more details on this fair, please visit www.viatt.com.vn or contact viatt@hongkong.messefrankfurt.com

VIATT 2026 will be held February 26 – 28, 2026.

Posted: January 26, 2026

Source: Messe Frankfurt (HK) Ltd

![]() Saint Paul, MN— January 30, 2026 — Nalco Water, an Ecolab company, has entered a strategic three-year collaboration with international technology group ANDRITZ to support innovation and accelerate product development at the PrimeLineTIAC Tissue Innovation and Application Center (TIAC) in Graz, Austria.

Saint Paul, MN— January 30, 2026 — Nalco Water, an Ecolab company, has entered a strategic three-year collaboration with international technology group ANDRITZ to support innovation and accelerate product development at the PrimeLineTIAC Tissue Innovation and Application Center (TIAC) in Graz, Austria. Innovation is driving the future of the tissue and towel industry, meeting rising consumer expectations for softness, strength and sustainability while enabling manufacturers to optimize production.

Innovation is driving the future of the tissue and towel industry, meeting rising consumer expectations for softness, strength and sustainability while enabling manufacturers to optimize production.