Outgoing NCTO Chairman Charles Heilig outlined the U.S. textile industry’s major challenges and achievements last year during his “State of the U.S. Textile Industry” address during NCTO’s 21st annual meeting in Washington.

By Charles Heilig

As we all know, the last few years have been challenging, both within our businesses and here in Washington. I would like to provide an overview of some of the major issues our industry faced as well as the progress we made, and achievements accomplished last year.

The National Council of Textile Organizations (NCTO) represents the full spectrum of the U.S. textile industry — a production chain that employs 471,000 workers nationwide and produces $64 billion in output annually. Our industry is a key contributor to our national defense and supplies over 8,000 products a year to the military. It is also a leading high-tech innovator supplying cutting-edge solutions and end products in diverse fields such as heart valves and stents to aircraft components and advanced body armor.

Our industry’s resilience and innovation is unparalleled and strong, despite economic and trade headwinds that have impacted our sector and our customers.

The breadth of challenges we face every day is astonishing — economic downturns, predatory trade practices, such as the use of forced labor in supply chains, ill-conceived trade policies, inadequate customs enforcement of trade fraud, post-pandemic inventory

related issues, freight and logistics challenges, and race-to-the-bottom business models that — all combined — are suppressing growth and investment, leading to a persistent and severe downturn in business.

There is no doubt we have experienced a very challenging three-year-cycle and our domestic production has been harmed as a result.

There is no doubt we have experienced a very challenging three-year-cycle and our domestic production has been harmed as a result.

With all that in mind, I am reminded of a comment Kennesaw State University’s top economist Roger Tutterow said at a past NCTO meeting.

I’m paraphrasing here but he noted: “A market disruption like this takes years to rebalance,” and that is what we are all experiencing.

Recognizing that we are in a pro-longed market disruption, the challenge we now face is to effectively respond not only with improvements to our business models, but also in the policy arena to ensure we will rebound and continue to expand as an industry.

To confront these challenges, NCTO and industry leaders launched an aggressive lobbying campaign over the past year to raise awareness about the myriad trade policies impacting the industry and the importance of our sector to the economy.

I can’t stress how important and invaluable NCTO is to each of our members individually and to the industry as a whole. It is our collective voice where we make a meaningful difference for companies and employees.

And our voices are being heard at the highest levels of the administration and on Capitol Hill.

Cabinet secretaries and members of Congress elevated the textile industry’s importance to the economy and national defense base at congressional hearings, conferences, in the press and in countless letters — all due to our diligent and effective work through executive fly-ins, high-level meetings, policy analysis, letters and press engagement throughout the year.

Cabinet secretaries and members of Congress elevated the textile industry’s importance to the economy and national defense base at congressional hearings, conferences, in the press and in countless letters — all due to our diligent and effective work through executive fly-ins, high-level meetings, policy analysis, letters and press engagement throughout the year.

Before highlighting NCTO’s policy wins in 2024, I want to quickly share a “by the numbers” recap of the key data points that highlight our industry’s resilience and staying power.

By The Numbers

Despite the economic downturn and unfair trade practices impacting the industry in 2024, our metrics remained stable or registered only slight declines, with the exception of employment in the cotton and wool sectors. This again underscores the industry’s ability to adapt during challenging times and remain viable even while registering painful losses.

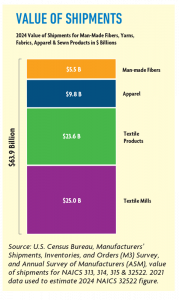

- In 2024, the value of U.S. man-made fiber, textile and apparel shipments totaled an estimated $63.9 billion compared with $64.8 billion in 2023.1

Here are additional key industry facts:

- U.S. exports of fibers, textiles and apparel were $28 billion in 2024 compared with $29.7 billion in 2023.2

- The United States remains the second largest individual country exporter of textile products in the world.

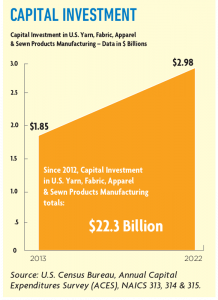

- The U.S. textile and apparel industry invested $3 billion in new plants and equipment in 2022, which is the last year data was available for this figure.3

The bottom line is many key fundamentals for the U.S. textile industry remained sound, while some weakened due to the economic and trade headwinds I mentioned a few moments ago.

Policy Issues

Now I would like to highlight a few accomplishments the NCTO staff achieved during the year.

NCTO actively promoted policies to expand the U.S. textile industry at home and in key overseas markets, such as the Western Hemisphere — which accounts for 70 percent of U.S. yarn and fabric exports and supports more than 2.6 million workers throughout this hemisphere — including efforts to preserve yarn-forward rules on origin and broaden export opportunities.

Customs Enforcement

In the area of customs enforcement, NCTO and industry leaders met with Department of Homeland Security (DHS) Secretary Alejandro Mayoras in early January 2024 to highlight industry challenges and make recommendations for an aggressive enforcement plan. We stressed the prioritization of robust enforcement of free trade agreement rules of origin, the need to close the de minimis loophole, and fully enforce the Uyghur Forced Labor Prevention Act (UFLPA).

Following our direct engagement and input, Secretary Mayorkas unveiled a textile enforcement plan in early April, which marked a critical step to combat import fraud and circumvention of free trade agreement rules and trade laws. Secretary Mayorkas also participated in a fireside chat with NCTO’s president and CEO Kim Glas at our Annual Meeting last year.

During the year, NCTO remained actively engaged with DHS and U.S. Customs and Border Protection (CBP) leadership as the plan was put into action, providing tips to investigators; highlighting increased penalties and onsite verifications, which increased from 38 in FY22 to 136 in FY24; and amplifying the expansion of the UFLPA violator’s entities list, which grew from 33 to 144 companies.

In addition, NCTO members attended the opening of a new isotopic testing facility at the port of Savannah in September which will help the agency in its UFLPA enforcement. The agency has purchased new equipment and is in the process of ramping up this important testing capability to detect banned cotton grown in the Xinjiang province.

De Minimis

De Minimis

In perhaps one of the most targeted and coordinated efforts undertaken by NCTO, industry leaders executed a sweeping and effective lobbying campaign on Capitol Hill and with the administration to press for de minimis reform to permanently close the trade loophole for all countries.

I cannot stress enough how important this engagement is to the industry. It involved fly-ins, letters, and meetings with members of Congress and key staff on relevant congressional committees — both on the Hill and in districts. It required detailed policy analysis, phone calls and countless emails to educate and raise awareness about the adverse impact this ill-conceived provision in U.S. trade law has had on our industry and manufacturing as a whole.

In addition, NCTO spearheaded the formation of the Coalition to Close the De Minimis Loophole, a broad alliance including families of victims of fentanyl fatalities and non-profit organizations, domestic law enforcement associations, manufacturers and business associations.

Coalition members participated in roundtables and press conferences with reform champions like Congressman Earl Blumenauer and Congresswoman Rosa DeLauro.

They lobbied lawmakers on the Hill and sent letters to key policymakers —all in a coordinated and unified effort to close this dangerous loophole.

NCTO and the coalition are constantly pressing President Trump and his administration to reinstate his pro-posed ban on de minimis imports from China and to take additional action to close the harmful de minimis loophole for all countries permanently.

NCTO is also urgently working to pass a new Miscellaneous Tariff bill with immediate and full retroactivity.

And the organization continues to press for the expansion of the Berry Amendment, after securing key pro-visions in the Fiscal Year 2025 National Defense Authorization Act (NDAA) which Congress passed late last year. The NDAA supports the Berry Amendment, which requires the Department of Defense to purchase 100 percent U.S. made textiles and clothing. The legislation includes two new key provisions important to the domestic textile industry.

Another key priority is advocating for full enforcement of the Make PPE in America Act, which recently led to the award of two government contracts to NCTO member companies.

Additionally, NCTO continues to amplify support for the Section 301 case against China’s intellectual property abuses and pressing for a dramatic increase in tariffs on finished textile and apparel imports from China.

And NCTO is working diligently to protect qualifying trade within our free trade agreements (FTAs).

While we don’t have time to delve into all these important issues, I do want to emphasize that NCTO remains highly engaged on every policy matter that affects the U.S. textile industry with the intent of shaping policies that directly benefit U.S. textile investment, production and employment.

Please also note that industry leadership and involvement is of paramount importance. From contributions to NCTO’s Textile PAC to arranging congressional visits, the industry makes a difference every day in raising awareness about our important contribution to local and state economies and the U.S. economy overall.

Conclusion

Our industry is experiencing historic challenges that have tested our resolve, and we will continue to see headwinds in the year ahead.

But I know the true resilient nature of our industry and I’ve seen how it has sustained a foothold as a major contributor to the U.S. economy through historic downturns. We will again weather the storm and rebound from this current business cycle, possibly even later this year. There are many reasons I am optimistic about the industry’s future. I know that NCTO and industry leaders will be at the forefront of advocacy on our behalf and continue to engage with members of Congress and the administration to enact policies that bolster and expand the industry, ranging from targeted tariffs to tax reform and expanded government procurement of American-made products. And I know our organization and industry will continue to work in conjunction with our Western Hemisphere trading partners to thwart challenges to our free trade agreement rules, focus on our export markets and sustain and expand our coproduction chain.

In addition, we will continue pressing for stepped-up enforcement and penalties against rampant illegal trade practices and fraud.

In 2025, we look forward to continuing our engagement with Congress and the new administration to secure additional policy achievements and ensure a vibrant future for this industry.

References:

1 U.S. Census Bureau, Manufacturers’ Shipments, Inventories, and Orders (M3) Survey, and Annual Survey of Manufacturers (ASM), value of shipments for NAICS 313, 314, 315 & 32522. 2021 data used to estimate 2023 NAICS 32522 figure.

2 U.S. Department of Commerce data for Export Group

0: Textiles and Apparel.

3 U.S. Census Bureau, Annual Capital Expenditures Survey (ACES), NAICS 313, 314 & 315.

Editor’s Notes: Information contained in the speech was current as of NCTO’s annual meeting. Charles Heilig is president of Gastonia, N.C.-based Parkdale Mills. He served as the 2024 NCTO chairman. At the 2025 annual NCTO meeting in Washington, Chuck Hall, global president and CEO of Spartanburg, S.C.-based Barnet, succeeded Heilig as NCTO chairman; and Amy Bircher-Bruyn, president and CEO of Brooklyn, Ohio-based MMI Textiles, was elected vice chairman.

The North American Industry Classification System (NAICS) is the standard used by Federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy. NAICS Subsector 313 covers Textile Mills, sub-sector 314 covers Textile Product Mills and subsector 315 covers Apparel.

2025 Quarterly Issue II