Ga., has announced that David C. Meek has joined the company as executive vice president and chief

financial officer.

The company also announced that John P. Cafaro was promoted to vice president,

International.

January 2000

The company also announced that John P. Cafaro was promoted to vice president,

International.

January 2000

O

ne issue that never surfaced in all of the “battles in Seattle” over the World Trade

Organization (WTO) was China’s upcoming entry into the WTO.

China is one of the few major textile and apparel producers that are not members of the

WTO.

China plays a unique role — it is the world’s largest textile producer, with some 24 billion

square yards of output in 1998.

In 1998, China shipped $7.9 billion of textiles and apparel to the United States, while our

textile and apparel exports to China were only $72 million. On top of that, add the annual $5

billion of illegal textile and apparel transshipments from China that enter this country each year.

China also closes its market to nearly all other textile and apparel producing countries and

has a positive trade balance in these products of some $32 billion.

Principles And Rules

China’s entry into the WTO presents

major problems in conforming to WTO principles and rules. The WTO’s fundamental objective is to

embrace world trade by lowering tariffs and non-tariff barriers. Clearly, China must do that in

order to join the WTO. However, because China is not a market economy, nor is it likely to be one

in the foreseeable future, it may lower its barriers, but little or no trade might occur. Why is

this?

Such an outcome is possible because China could continue to operate as a centrally directed

non-market economy with state-owned companies and state-directed importers. No barriers, but still

no trade — unless China had a shortage of some particular item. Airplanes, yes; textiles,

no.

WTO Membership

WTO membership has the potential to

open China’s market and could also require China to conduct its trade regime under new rules and

disciplines. If this were to happen, a truly open Chinese market would benefit the United States in

several ways.

First, the U.S. textile industry could sell to the Chinese market — especially home

furnishings and industrial fabrics. Second, an open Chinese market means that other countries,

especially developing countries, would ship to China and take some pressure off our own market as

one of the most open for imports. That is why the American Textile Manufacturers Institute’s (ATMI)

Board of Directors made real, effective access into the Chinese market a major precondition for

China’s joining the WTO. Another ATMI objective is to get China to eliminate its dumping and

subsidized exports.

ATMI is also seeking a 10-year phaseout of U.S. textile and apparel quotas that is identical

to the phaseout period other WTO members faced beginning in 1995.

All of these issues were addressed in the negotiations between the United States and China

concerning China’s WTO membership, negotiations that concluded in mid-November with results quite

different from ATMI’s objectives.

What Happened?

First, China rejected the concept of

a 10-year quota phaseout. The United States agreed to a five-year phaseout with the possibility of

quotas for another four years, provided China could be shown to be disrupting our market or

threatening to do so.

Second, because the agreement treats China as a non-market economy, the United States will

be unable to use U.S. trade laws to attack any of China’s illegal export subsidies.

Based on a difficult-to-follow logic, the United States has concluded that non-market

economies subsidize everything; therefore, U.S. laws are useless because it is impossible to single

out the effect of any particular export subsidy that might be the subject of a complaint.

Third, China did agree to reduce its tariffs significantly by 2005 and to eliminate its

non-tariff barriers as well. However, it remains to be seen whether this will lead to real market

access into the centrally directed economy of China.

Moreover, by the time China completes its tariff cuts, it will have obtained quota-free

access to the U.S. market. The United States will have traded off potential access to China’s

market for real, unrestricted access to our own market by China.

Finally, nothing in the U.S. agreement with China deals with the critical labor and

environmental issues raised in Seattle that the WTO has clearly not addressed.

Economic Impact

To learn the economic impact of

China’s entry into the WTO on the U.S. textile industry, ATMI commissioned a study by Nathan

Associates, a well-known economic consulting firm in Arlington, Va.

The study found that once China gains quota-free access to the U.S. market, its share of

apparel imports will grow rapidly from its current 9 percent to more than 30 percent. This means

that China not only will take away production from other countries that supply the United States,

but also will displace U.S. production of textiles and apparel.

The study concluded that more than 150,000 U.S. textile, apparel and supplier jobs will be

lost — and these losses will occur on top of the damage caused by the phaseout of quotas with the

other 43 WTO members now subject to restraints.

ATMI is making its case to Congress. While the agreement itself does not have to be approved

by Congress, in order for the agreement to be implemented, Congress must grant China unconditional

“normal trade relations” status. This means that the United States must treat China exactly the

same as it does our traditional trading partners.

ATMI’s message to Congress is to oppose granting normal trade relationship status to China

because the agreement is terribly flawed and will put at risk many thousands of U.S. jobs and

significant production.

Congress needs to ask one fundamental question:

Has China earned its way into WTO membership by truly reforming its trade regime or has it

bullied its way in with no real commitment to play by the rules?

Adjusting To The Challenge

Whether or not China enters the WTO

at this time, ATMI’s member ship will have to deal with the fact that all textile and apparel

quotas disappear as of 2005. We are facing this challenge and finding ways to adjust.

First, we will have five years to more fully develop our markets of our NAFTA partners and

the Caribbean region, provided the Senate CBI bill can be enacted quickly.

The combination of a high-tech, capital-intensive textile industry in the United States,

linked with a labor-intensive apparel industry south of the border in Mexico and the Caribbean, can

effectively compete

with imports from Asia.

Secondly, we need to take a look at Europe. The European textile industry has survived a

flood of imports, and it can serve as a model of us in some areas.

The textile industry represented by the 15 countries of the European Union (EU) can be

compared to the United States in Table 1.

The European Textile Industry

Finally, even though the European

textile industry has higher wages and a greater social burden than we do in the United States,

their textile industry is larger than ours and they enjoy a positive balance of textile trade. How

have they accomplished this?

The European textile industry concentrates on specialty and higher value added products.

They source many commodity fabrics from abroad.

The industry works hard to develop its export markets.

Europeans have teamed up with their own south-of-the-border countries for apparel production

using their own fabrics, similar to the “809” program in the Senate CBI bill.

They reinforce a preference with their own consumers for European brands and European

products.

We can learn a great deal from our European cousins. We need to work together to meet the

Asian threat and to continue our growth and prosperity into the new century.

January 2000

U.S. Economy Closes Out The 20th Century With Robust Growth;

Inflation Well Under Control

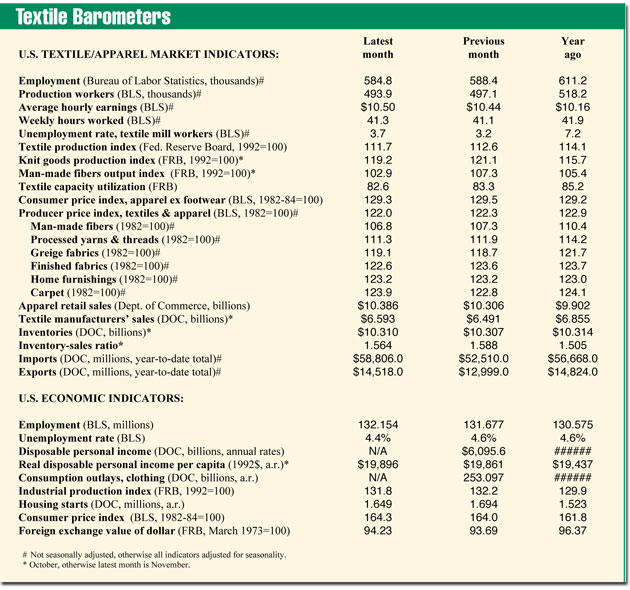

The latest economic reports show that growth of the U.S. economy in its final stretch for the

20th century was robust, with booming retail sales, falling unemployment and still low inflation.

The jobless rate held steady at 4.1 percent in November, close to the lowest rate in more

than three decades. The economy added jobs at a fast clip, while workers put in more hours per week

in November despite some weakness in manufacturing. Nonfarm payrolls grew by 234,000 jobs in

November, on top of a 263,000 gain in October. The November gain was in line with the average of

the last 12 months. Construction employment rose by 55,000 jobs. Manufacturing job losses of only

2,000 nearly vanished in November after dropping by 36,000 a month during the first half of 1999.

Despite tight labor markets, inflation is still well under control. The Producer Price Index

for finished goods rose 0.2 percent in November as energy prices jumped 1.4 percent. The core

index, however, which excludes food and energy prices was unchanged in November.

The Consumer Price Index inched up 0.1 percent in November as energy prices remained flat in

November.

The core inflation rose 0.2 percent for the second month in a row. From a year ago, overall

consumer prices have moved up 2.6 percent, due to a 10.6-percent surge in energy prices, but the

core inflation rate rose only 2.1 percent, which is better than 2.4 percent in 1998.

Industrial Output Grows; Housing Starts Still Strong Factor In U.S. Economy

Industrial output grew 0.3 percent in November after rising 0.8 percent in October. Warm weather

cut into electricity and natural gas demand forcing utilities’ output down. Factory output rose 0.5

percent.

The operating rate held steady at 81 percent of capacity in November, which is well below the

levels that typically result in an upward pressure on inflation.

Construction on new homes weakened in November reflecting the effects of higher mortgage

rates. Builders started work on 1.60 million units, off 2.3 percent from 1.637 million in October.

Single-family units came down 3.6 percent, while multi-family units rose 3.7 percent. By

region, housing activity was mixed.

Starts shot up 14.8 percent in the West to 417,000 units and rose 2.1 percent to 147,000

units in the Northeast.

Conversely, starts fell 6.8 percent in the Midwest to 356,000 units and took a 9.9-percent

dive in the South to 417,000 units.

Business sales advanced 0.5 percent in October and business inventories rose 0.2 percent in

October. The inventory-to-sales ratio, however, was left virtually unchanged at 1.33.

Textile Shipments Rise, Consumers Get The Holiday Buying

Spirit

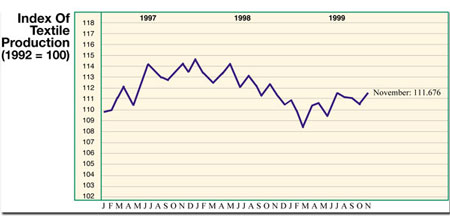

Results for textiles and apparel were disappointing. Textile output eased 1.1 percent following

a strong gain of 2.8 percent in October. The operating rate for textiles fell to 85.8 percent from

86.7 percent in October, according to revised data back to 1992. The industry’s output in 1999 was

0.6-percent higher than previously reported by the Federal Reserve.

Shipments by textile manufacturers were strong rising 1.8 percent in October after slipping

0.2 percent the previous month. With inventories down 0.4 percent in October, the

inventory-to-sales ratio dipped to 1.52 from 1.56 in September.

Industry payrolls slid 0.2 percent in November, after falling 0.5 percent the previous month.

The jobless rate for textile mill workers, not adjusted for seasonal variation, jumped to 5.8

percent from 3.2 percent in October.

Consumers were in a full holiday buying mood in November. Retail sales surged 0.9 percent.

Apparel and accessory stores did well with sales gains of 0.8 percent in November. Producer prices

of textiles and apparel were unchanged in November. Prices rose 0.1 percent for gray fabrics and

were flat for processed yarns and threads. Prices fell 0.2 percent for finished fabrics, and 0.1

percent for synthetic fibers and for carpets.

January 2000

According to the company, the plant, which is slated to be completed by 2003, will provide

innovative and cost-effective emulsions to South America’s expanding adhesives markets.

“This strategic investment demonstrates our commitment to provide the best product

technology to customers in South America,” said Frederick W. Fisher, chemical group vice president

and general manager, Latin America.

“Because of our intention to price imported products more competitively, the regional

adhesives industry will be able to immediately start using state-of-the-art emulsions technology

that, until now, has only been broadly cost competitive in the United States, Europe and Asia.”

The plant is the second major chemical investment by Air Products in the region. The company

previously acquired Quimica Da Bahia, Brazil, which serves the Latin American amines markets.

Two products from the AIRFLEX product line, the AIRFLEX 300 and the AIRFLEX 400, will be

manufactured at the new facility.

Air Products also has plants in Germany, Mexico and Korea along with six plants in the

United States.

January 2000

Eccoscour WA-305 is a biodegradable, non-ionic scour based on natural ester and alcohol that

removes trimer, oils, grease and waxes from fabrics without the use of petroleum or chlorinated

solvents.

This scour is stable in normal storage, but will not tolerate freeze and thaw cycles.

January 2000

T

T

he mention of Scottish textiles summons up images of traditional tartans and thick

hunting tweeds, superb quality, sturdy and a bit stodgy. Although the rustic tweeds and colorful

checks are still there, the Scottish textile industry is creating a new identity. Modern facilities

with new spinning, weaving and knitting equipment, products designed for today and new marketing

strategies have brought about a demand for Scottish fabrics from designers around the world who are

looking for unique fabrics, quality and performance.

Some of the companies that first began producing cloth in the 17th and 18th centuries still

exist. Today they have combined a legacy of tradition with innovation. They have identified their

customers and niche markets.

From the Lowlands in the south, to the Highlands and islands of the outer Hebrides, textile

production is scattered throughout the country. In the Borders, a region south of Edinburgh, the

major export is textiles, accounting for 45 percent, or about $18 million annually. This represents

more than a third of the total national share. Over 70 percent of all exports are to European Union

countries, with Asia and the Americas coming in at around 10 percent each.

Historically, domestic Scottish wool was the main component of Scottish yarns and fabrics.

Realizing the limitations of heavy woolens for year-round wear, the industry has diversified.

Fabrics are lighter and softer. Yarns may contain a variety of wools grown in the far reaches of

the globe, or are spun with other fibers. Quality and service are constant.

Historic Spinning

Laidlaw

Laidlaw

& Fairgrieve has been producing yarn for 135 years on a site where the first Borders spinning

plant was built in 1793. They were the first commercial spinners of Shetland yarns. Today they

offer a contemporary range of product. Along with traditional Shetland there is extra-fine lambs

wool, merino, machine washable wool, printed wool and blends with cotton, linen, mohair and camel

hair.

Recently Laidlaw & Fairgrieve announced restructuring. They have formed a new alliance with

Ferney Spinning on the Island of Mauritius, and will form another with a European spinner.

“This will make us more competitive in world markets,” said Colin Plumbe, managing director.

Laidlaw & Fairgrieve anticipates an annual capacity of 3 million kilos. They export yarns

to 36 countries, maintain offices in Tokyo, Hong Kong and New York and sell to 175 accounts in the

United States.

Customer service and research and development are of prime concern at Laidlaw &

Fairgrieve. Color is a key factor. There are 700 shades on their current color card. Stock service

provides delivery of sample yarns anywhere in the world, with no minimum requirements. Color and

yarn requests are tracked, 50 percent are updated each year.

Shetland is the base for stock service colors because it is, according to Plumbe, the least

expensive natural fiber. Realizing the importance of softness, there are finer micron Shetland

yarns, lambs wool, ultra-light merino, and blends with Lycra® readily available. Novelty yarns such

as marls, melanges, Donegals, slubs or blends can be ordered with a small minimum. The same is true

for custom yarns developed to a customers specifications. Product development work shows customers

what they can do with specific yarns through knitting and finishing. New fabrics and patterns are

created and each is washed, felted, brushed and pressed.

“We encourage our customers to think of us as their partners,” Plumbe said. “In addition to

color development and product development, we offer design support and technical support. We will

assist a customer through the entire manufacturing process.”

Quality is another factor. At Laidlaw & Fairgrieve there are stringent checks at every

stage to ensure the right color, strength, evenness and consistency of the yarn. Laidlaw &

Fairgrieve buys washed wool and top. Tests are made through each production stage of combing,

dying, blending and spinning.

“We are careful where we buy wool, and visit every grower,” Plumbe said. “We test every bale

of wool that comes in for fiber length and contaminants. Ideally wool should contain 16 percent by

weight of water. Lower than 12 percent and it’s too brittle; over 18 percent there is risk of rot

and mildew.”

Gardiner Wool Spinning

Located by the Tweed River in the

Borders, Gardiner Yarns (Yarn Sales Corp.) started as a weaver and finisher in 1867. They got into

spinning in 1975. Today their mill in Selkirk produces only wool spun yarns. Sales are divided

equally between weaving and knitting, with single-ply yarns of 12 to 4 metric count going to

weaving, and the same yarn two-ply going to knitting.

Exports account for 65 percent of sales, with most of that going to the European Community.

Asia is their second largest market, the United States comes in third.

Also specializing in stock service, Gardiner will deliver any of 72 colors in Shetland,

lambs wool or merino to customers around the globe in generally under three weeks. The minimum is

one kilo, which is enough yarn to make three sweaters.

Current best sellers are a 100-percent wool yarn called Highland Tweed, which is thick and

chunky, and Melrose, a three-ply yarn of wool/silk.

Diversity At Calzeat

Jacquard weaver Calzeat & Co.

(sold in New York through Textile Import Corp.) produces a variety of fabrics for womenswear,

menswear and the home. In addition to the Calzeat line, they produce and sell textiles under four

other names, all purchased since their inception 25 years ago.

The Calzeat line specializes in jacquards and dobbies. Patterns are subtle, misted,

heathered and sophisticated. There are ultra-soft double-faced fabrics, textured tweeds, ripple

effects, pressed velvet finishes and chenilles. Fabrics are woven of 100-percent wool or blends

with mohair, silk or linen.

“Linen is becoming a year-round fiber,” said Robin Galbraith, managing director. “We are

blending it with wool for lighter weight fabrics.”

The Claridge line produces fancy wovens for high fashion. The look is very Chanel. For fall

there are all-over textured looks in combinations of wool with silk, mohair or angora, sometimes

highlighted with fancy yarns. Weights range from 300 grams to 450 grams The number one export

market for this line is Japan.

Calzeat’s Peter MacArthur label is noted for traditional and off-beat semi-plains and

tartans woven with fine merino or lambs wool and frequently blended with cashmere, mohair or

angora. Finishes are brushed, sueded, milled and clean. The newest fabrics are ultra-light

including feather-weight gauze.

Dickson Fabrics, another Calzeat label, is a sporty line specializing in traditional checks,

classic weaves, rustic Shetlands and worsted flannels. It sells to bridge level casual and

sportswear firms.

Calzeat’s Thistle Mills accounts for about 15 percent of their total sales. It produces

fabrics for the home, primarily upholstery, household accessories, rugs and throw blankets. There

are fire retardant damasks and rich plaids.

Royal Tartans At Lochcarron

Spinner,

Spinner,

weaver and knitter, Lochcarron (sold in the United States through Rutytex) has been in business for

more than 50 years, but the family connection with weaving goes back five generations. In 1932, the

current sales director’s great-great grandfather was commissioned to weave a special tweed for King

George V.

Currently on display in their Galashiels sales office is the Diana Tartan, created for the

late Princess of Wales. Mel Gibson wore a tartan kilt supplied by Lochcarron in the film

Braveheart. Another new tartan is called McLlennium.

Since its modest beginnings with crofters weaving on handlooms in Loch Carron, a small

village in north west Scotland, the company has changed dramatically. The Loch Carron factory is

still in operation but the main site is in Galashiels.

According to David Ogilvie, managing director, business is equally divided between

traditional kilt and uniform fabrics and a fashion line. Customers for the traditional line include

the Royal Canadian Mounted Police and tartans for 12 different schools in Japan. The fashion line

caters to the high end of the market.

“A very few of the top designers do not use Lochcarron for the quality and design service we

offer,” Ogilvie said.

“We are best known for our tartans that are available in all weights from a light

“springweight” through to upholstery strength fabric. We have over 1,200 patterns in stock for

overnight sampling. Our other fabrics include traditional tweeds, some with added interest of

mohair overchecks, stripes for blazers and upholstery, and cashmere velour overcoating.” Ogilvie

continued.

A recent investment of £1 million ($1.75 million) in the most up-to-date rapid

high-technology looms enables Lochcarron to cope with demanding high volumes. Old equipment is

still used to weave kilts to assure the perfect edge.

Although Lochcarron uses only natural fibers, they are beginning to work with Lycra. Another

new development is worsted denim tartan.

Robert Noble

Robert Noble has been weaving fabrics

in Scotland since 1666. Their archives include tartans woven for Scottish regiments dating back to

the 1880s. The boardroom, built in 1884, has been newly decorated using fabrics similar to designs

they created for the English Houses of Parliament.

In 1980 Robert Noble branched into upholstery fabrics. Based on the success of this venture,

they purchased Replin Fabrics, specialists in contract weaving. Today one third of their sales are

to apparel industries, the remainder goes to upholstery for home, office and industry.

Replin is a major supplier of fabrics for transportation. Airlines, ships, busses and trains

are furnished with wool/Nomex blends. Seats on the Orient Express are upholstered in Replin’s

electronic jacquard designs. American Airlines, TWA, United and Delta use these fabrics, which pass

the most stringent flammability tests, for crew seats and wall coverings.

“With our modern equipment we offer speed, variety and tough fabrics,” said Roland Brett,

managing director. Recent new machinery has been installed at a cost of about about $8 million.

“One reason for wool upholstery for pilots seats is that it breathes better than other

fibers,” Brett continued. “And there is only seven percent duty on wool upholstery fabrics into the

United States, versus 30 percent for apparel fabrics.”

The majority of Robert Noble’s fabrics are CAD designed and woven on jacquard looms.

“Hand-drawn designs take about eight weeks to complete,” said Brett. “We can do the same work in

eight hours with our CAD equipment.”

Robert Noble weaves woolen and worsted fabrics for menswear and womenswear. Hickey Freeman

and Jones New York are among their customers.

Most of their fabrics contain natural fibers. For summer designer Gill Cable mentioned that

silk/linen blends sold exceptionally well. Wool twisted around silk and linen and woven into plaids

and herringbones is being shown for fall.

Hunters Of Brora

In the Highlands of Scotland the

hour-and-a-half drive north east from Inverness to Brora winds along narrow coastal roads. The

scenery reflects the dichotomy of Scottish textiles. Heather-filled moors, misted hillsides and

grazing sheep provide a romantic backdrop to North Sea oil rigs.

The newly built vertical mill Hunters of Brora occupies is on 17 acres adjacent to the beach

and beside hills and moors. Officially opened in April 1999 by HRH The Prince of Wales, the factory

is fully equipped with state-of-the-art spinning, weaving and finishing equipment.

Established in 1901, Hunters set out to manufacture, from raw material to the finished

article, using wool from the Highlands and Islands of Scotland, in particular from Shetland.

“We are currently exporting at around 60 percent, mainly to the United States, Hong Kong,

France, Italy, Germany, Japan and Korea at the mid- to high-end of the market for both menswear and

womenswear,” said Brian Hinnigan, sales director. “The Hunters’ color signature, which has been the

hallmark of production since the company was established, is well known throughout the world,

alongside high quality and service.”

Robert Beattie, managing director, said: “The new facility allows us to manufacture a

greater variety of products, particularly finer and softer yarns and fabrics in real Shetland from

the Shetland Isles, Australian lambs wool and New Zealand merino. Hunters now has the capability to

blend wools with many other natural fibers such as silk, mohair, alpaca, angora, cotton and linen.”

Some of Hunters’ yarns contain as many as 18 colors. 180 colors are in stock. Knitting yarns

are offered in rich melanges, marls and nubs suitable for 2.5 gauge to 8 gauge knitting machines.

One new yarn is a merino/opossum blend called Kapua, which in Maori means dreamy clouds.

According to Hinnigan, opossum is finer than cashmere and just as expensive. It has a lot of

natural elasticity. Currently Reed and Taylor is running trials on worsted fabrics.

The Hunters’ collection for fall is softer and lighter, with fabric weight ranging from 300

grams to 650 grams There are rustic weaves in lambs wool, Donegals, wool/mohair boucles,

100-percent merinos in misted herringbone patterns, wool/cashmere blends and lightweight tweeds

woven with high-twist yarns.

For spring and summer, Hunters’ Senior Designer Anne Robertson said: “We are getting away

from the woolen mill label. We are developing a total new look using linen, silk and cotton.

The new facility allows room for expansion. New jacquard looms will soon be in place.

Light And Soft

Since

Since

the 18th century, crofters on the islands of the Outer Hebrides have been hand weaving Harris

Tweeds, using wool from local sheep. This cloth first gained popularity in the 1840s when Lady

Dunmore, wife of the Laird of the islands, introduced it to the British aristocracy. Hunting,

shooting and fishing in the Highlands had become popular pastimes for the privileged, and created a

demand for a special cloth that could cope with the rigors of cold weather and rugged

terrain.

Authentic Harris Tweed must be made from 100-percent pure virgin wool, dyed, spun and finished

in the Outer Hebrides and hand woven by the islanders at their own homes. The Harris Tweed

Authority certifies all finished fabric with its stamp of authenticity, the Orb Mark.

The KM Harris Tweed Group produces 95 percent of all Harris Tweed. It is a marketing company

established in 1996 to promote Harris Tweed, and is composed of three companies: Kenneth Macleod

Ltd., Kenneth Mackenzie Ltd. and The Harris Tweed Trading Company Ltd. In the United States,

Textile Import Corp. is the agent for The Harris Tweed Trading Co.; St. Andrews handles Kenneth

Macleod.

Although each company has the same ownership, each retains its individuality, with separate

mills, production, design and sales teams. Another producer of note is Donald Macleod, who formed

his company in 1982.

In the mid 1980s, 3 million meters of Harris Tweed was exported from Scotland to the United

States, and 1 million meters was sent to Canada. By 1991 that number was down to 130 meters to the

United States, a loss of 96 percent. Last year 100 meters was shipped to Canada.

According to Derick Murray, managing director, The KM Harris Tweed Group, the strength of the

British pound, high U.S. duty on wool and the Asian crisis all contributed to the decrease in

sales. The fabric itself was another factor.

In the 1920s Lord Leverhulme owned the islands. He brought in Hattersley looms which weave a

75 cm single-width cloth. Carpet quality wools from local Black Face and Cheviot sheep turned out

tough rustic fabrics weighing in at 500 grams/sq. meter.

Realizing that they were not addressing the demands of fashion designers and consumers, who

have little interest in fabrics that are impervious to wind, rain or thistles, Harris Tweed

producers have changed the width, weight and touch of the cloth. The old Hattersley looms are being

replaced by Griffith looms, which produce double width cloth of 150 cm. Today there are 130

Griffith looms and 150 Hattersley looms in use.

Harris Tweed is still 100-percent pure raw new wool. Finer and lighter grades from outside of

Scotland are being combined with local wool. After the wool is scoured, carded, dyed, blended and

spun, warp yarns are put onto beams and delivered, along with bags of filling yarns, to crofters.

Crofters are freelance weavers who live on the islands, some in remote areas where Gaelic is

still the mother tongue and the heritage of weavings has been handed down through generations. They

are paid by the piece. A single piece is 85 meters long, a double piece is 65 to 70 meters. Once a

fabric is woven, it goes back to the mill to be scoured, milled, cropped, pressed and inspected.

Fresh water from local lochs is used, giving the fabrics extra softness.

Ultra-light weights as low as 260 grams/sq. meter, soft handles, excellent drape and

innovative styling have brought about renewed interest in Harris Tweed. It is turning up in major

collections around the world.

Luxury And Quality

Over

Over

the past 15 years, cashmere specialist Johnstons of Elgin has experienced dramatic expansion. Their

business has quadrupled. If predictions for the future are somewhat guarded it is because the price

of cashmere has increased 60 percent, and duties to the United States are 30 percent.

Since its inception in 1797, the company has been owned and run by just two families, the

Johnstons and the Harrisons. In 1851 they pioneered in the weaving of vicuna and cashmere in

Scotland. Today luxury fibers remain the foundation of Johnstons of Elgin’s products and success.

In the middle of the l9th century Johnstons of Elgin originated a range of designs which

have become known as Estate Tweeds. To some extent Estate Tweeds might be said to be distant

cousins of Clan Tartans. Both tweeds and tartans identify groups of people. A tartan identifies

members of the same family, no matter where they live. Estate Tweeds identify people who live and

work in the same area, whether they are related or not.

Today the major portion of Johnstons’ woven fabric business is in 100-percent cashmere

jacket-weight fabrics for both menswear and womenswear. Priced at between £40 to £65 per meter ($68

to $110.50), they are selling 75,000 meters of cloth annually. Eighty percent goes to export, with

Italy their biggest market. In the United States, Windsor Textile Corp. is their agent.

In the 1960s Johnstons expanded into knitwear. In addition to fabric, they produce a line of

accessories. For the past decade they have invested around one million pounds annually in new

machinery. In addition to cashmere and vicuna, alpaca, guanaco camelhair, mohair, angora,

chinchilla and mink are other luxury fibers Johnstons weaves or knits into a variety of fabrics.

Lambs wool, merino and blends with silk are also available.

“The average cashmere goat yields about four and a half ounces of underfleece a year, which

must be combed or plucked by hand every spring,” explained John Gillespie, divisional design

director. “It takes the hair from one goat to make a scarf, two to make a woman’s sweater.”

When the fleece arrives in Elgin it is matted, greasy and full of coarse hairs. It is

dehaired to separate the fine cashmere from the coarse guard hair. There is a 40- to 50-percent

fiber loss in the dehairing process.

Cashmere grows in four colors: white, grey, camel and brown. White is the most expensive.

Some cashmere is processed in its natural state, some is dyed. White is used for dyeing light

colors; brown for navy and darks.

Jacket- and coat-weight fabrics range in weight from 240 to 600 grams/m. There are sheers of

l80 grams/m and double-faced coatings of up to 600 grams/m.

Ballantyne

The name Ballantyne is synonymous

with cashmere products of the highest quality. “In fact our cashmeres get softer with age,” said

Ann Ryley, sales director, Ballantyne Cashmere Company Ltd. She attributes this in part to the fact

that Ballantyne cashmere is washed in the soft pure waters of the River Leithen, the same magic

ingredient of Scotch whiskey.

Founded in the 1920s, Ballantyne today is part of Dawson International PLC, a company that

has been dealing in cashmere since 1870. Raw cashmere is purchased and processed by Dawson. The

fiber is dyed and spun by Todd & Duncan, another company in the Dawson group. Dyed yarn is

shipped to Ballantyne, where it is styled and made into apparel.

On its journey through the factory each garment goes through approximately 40 production

processes before it reaches the exacting standards demanded by Ballantyne. A lot of the work is

done by hand. It is checked thoroughly every step of the way.

Designs are submitted with suggested colorways, and prototype garments are made. Colors are

selected from dyed yarns. Ballantyne holds 160 colors in stock at any one time. Each garment

consists of a minimum of nine separate pieces, each of which must be knitted from the same dye lot

to ensure uniformity of color and hand.

Ballantyne has the largest hand intarsia operation in the world. Patterns can range from

simple geometrics to intricate florals, abstracts, portraits and animals. A simple intarsia design

can take three hours to knit. A more complex pattern can take up to 25 hours. The most intricate

intarsia ever produced took two weeks to make. Anything up to 25 colors can be incorporated into an

intarsia design.

Eighty percent of Ballantyne’s production is exported to over 50 countries. Japan and Italy

are their two major markets, followed by the United States and France. Showrooms are in Italy,

Japan and the United States, as well as a network of agents worldwide, with shops in London, Paris,

New York, Chicago and Tokyo.

January 2000

The RJE, based on the RJ 72 E 2-way machine, allows for electronic needle-selection, double

jersey jacquard with the ability to change to any 3-way technique on the cylinder electronically.

The need to change cams mechanically has been eliminated. According to the company, the RJE

increases the range of fabric posibilites while reducing the downtime.

January 2000

Premiere Vision Offers Peek At Fabric Futures

Tradition and technology reign supreme at European textile show. A majority of the

876 textile exhibitors who show at Premiere Vision are medium-sized companies, yet their combined

annual total turnover is 16.4 billion euros. Exports make up 54.5 percent (8.9 billion euros), with

nearly 76 percent of that coming from neighboring European countries. Close to 12 percent is

derived from the Americas and more than nine percent from Asia.A recent survey of exhibitors shows

a decline in sales for the first half of 1999 of about 4.5 percent. With the Millennium Round of

negotiations, which took place in Seattle a few weeks after Premiere Vision, a debate was staged at

the show where textile leaders and European members of parliament discussed issues of

globalization, fair trade, de-localization and investment in the European textile industry. A

Textile OpinionOn the textile side, Jean de Jaegher, president of Euratex and the Italian group

Marzotto, said: We have specific advantages in terms of creativity, quality, flexibility,

employment and a market for specialties. If only the politicians would give us the means to survive

and develop these advantages.Other textile panelists were Eduardo Miroglio, chairman of Miroglio;

Wilhelm Otten, chairman of Josef Otten; James Sugden, managing director of Johnstons of Elgin;

Eduardo Malone, chairman of the Chargeurs group; and Nico Leendertz, managing director of

Girmes.Concerns cited by this group include balanced reciprocity. How can we survive if Third World

countries have permission to dump cheap fabrics in our home markets asked Otten. Sweatshop labor,

poor quality and politicians lack of response to events such as the Banana War were other issues

cited.In defending their position, members of the European Parliament said that it is difficult to

take measures that will be upheld by the majority of member states when there are many different

special interests. Although nothing was resolved, the debate did focus attention on problems facing

European textiles in a global environment. Divisions and ConsolidationsAt a separate press

conference, Marzotto announced it has divided its textile fabrics division into three separate

lines: Fabric by Marzotto, a collection of wool for menswear; Ws Marzotto for womenswear; and

Fusion Line for contemporary/sportswear.The Fusion line will produce innovative wool/polyester

blends, primarily coming from Marzottos Nova Mosilana plant in Czechoslovakia. According to the

company, production of 3 million linear meters is anticipated.In a reverse move, Como silk weaver

Ratti announced consolidation of three divisions: Donna Ratti, Ratti 7 and DEste-Brochier into one

unit Ratti Fashion. According to Donatella Ratti, printed fabrics began an upturn with the Summer

2000 collection.For Fall 2000, Ratti Fashion is printing on a variety of fabrics including

cashmere, taffeta, satin, velour, felted wool, jersey, crepe and chiffon. There are ethnic motifs

coupled with traditional designs, sophisticated flowers, macro and micro geometrics combined,

animal skin designs and paisley.Novelties at Ratti are sandwich cloth sheers with three fabrics

combined for a shimmering effect. Laser cuts turn up on leather-look fabrics and polyurethane

coated cotton/viscose blends. There also are double-faced silks which are softly brushed on one

side and satin surfaced on the other. New Ways With WoolTraditionally at the Fall/Winter show,

the wool sector has the largest number of exhibitors. There was a lot of innovation here, along

with concern about price and high tariffs.At Woolmark, easy care is increasingly prominent. A

fabric produced by Lanificio Cabal is going into machine washable suits for Emporio Armani.

Sportwool and Wool plus Lycra® are two other areas gaining market share.Other new developments at

Woolmark are wool denim in an intimate blend of 60-percent wool/40-percent cotton, steel/wool in

fabrics that mold, crush and wrinkle, and air-wool. The air-wool fabrics are woven with a yarn of

wool/PVA (polyvinyl alcohol). The PVA washes out in finishing, resulting in a ultra light fabric of

100-percent wool. The fabric on display was woven by the Italian mill Tiberghien.Wool/Lycra with a

polyurethane coating and bonded fleece fabrics of wool/polyester are other new developments at

Woolmark. These are being produced by Limonta (Strachman Associates). American designer Ron

Chereskin sampled several for his new outerwear line, which he describes as sportswear driven with

a softer approach.Limonta has also added a wool line. Most of the fabrics are lightweight blends of

wool/nylon with a breathable coated surface. Some are brushed and ultra soft, others have a rubber

touch. British MP Visits Show FloorIn the British wool sector, The Harris Tweed Group got an

extra boost with a visit by Brian Wilson, MP, Minister of State at the Scotland Office. A major

concern American buyers expressed to Wilson is the exceptionally high duty on wool fabrics,

especially when fabrics such as Harris tweeds can not be produced in the United States.Wilson noted

that Harris Tweed has a tradition that exists no where else in the world. The cloth is still hand

woven but today great efforts have been made to ensure that fabrics produced in the Hebrides can

meet the needs of contemporary designers, while maintaining the essential characteristics of Harris

Tweed.On the last day of the show, Derick Murray of the KM Harris Tweed Group (St. Andrews)

reported interest among American buyers in plains and large checks with a lot of color. Now that

Harris Tweed is available in 150 cms widths, it has a softer hand and is lighter in weight.Hunters

of Brora (St. Andrews) also reported checks selling well. Heather shades with touches of flat

boucle yarns in vibrant pink and scarlet, and rustic chunky herringbone weaves were shown. Menswear

designers were sampling ultra-light New Zealand merino wools, while womenswear customers opted for

dark, richly colored checks in lambs wool. Lightweight fabrics of 320 gms and heavyweights up to

540 gms were sampling well.At Robert Noble, Gill Cable said: Were busier than usual. I think its

because we have color. The Italians dont.At the top of the line there was interest in red shades.

Subtle checks in wool/cashmere blends, small neat patterns in lambs wool and small nubby boucles

were pointed out. American menswear designers sampled checks in wool/silk/linen blends. Double

cloths reversing from pattern to plain sampled well for outerwear and unlined jackets.At Calzeat

(Chantal) there was a move to muted colors and checks in the McArthur worsted line. Soft misted

wool spun checks at Dickson and raised patterns with touches of mohair at Claridge were popular.

Pressed velvet finishes and ripple effect mohairs in the Calzeat jacquard line were of special

interest.Weathered shades of green, olive and slate with old gold and pink were of note at

Lochcarron (RuLytex). An indigo-dyed denim tartan of 100-percent cotton, mohair tartans, blazer

stripes and anything with surface interest were featured. Cashmere With A Rustic LookJohn

Gillespie of Johnstons of Elgin (Windsor Textiles) reported excellent reactions to the fall line,

especially from Italian customers, who now account for 50 percent of their business. One of their

best selling fabrics is a Donegal tweed with a deceivingly rustic look and ultra-soft hand. New

cords and cavalry twills were selling, and there was less interest in traditional fabrics and

patterns.French weaver de Cathalo, part of the Chargeurs group, reported precious fiber blends

selling well. A shaggy, hairy-surfaced coating of baby alpaca/mohair/wool was one fabric of note.

Another contained beaver fur.The animals are farm raised and shaved, said Thomas Brochier, North

American market manager. Color reversing, double-faced fabrics, subtle raised surfaces and boucles

were other fabrics Brochier showed.Wool coats are coming back, Brochier added. Most of what he

presented contained Lycra and are scotchguarded. Generally the coating fabrics are lightweight and

have texture. There are velours, hairy fabrics and loops in blends of wool/cashmere/angora or

wool/kid mohair/nylon.Axel Delacroix of de Vaudricourt (Chantal) also mentioned wool coating

fabric. He showed tonal boucles and jacquards woven in Cashwool, a merino yarn from Zegna Baruffa.

There is a lot of novelty and innovation here. There are double-faced window pane checks in

wool/copper blends, boiled wools, wool/Lycra puckers, shaggy loops in patterns and wool/nylon

checks which are burned out to form a pattern.Rough and rustic stripes, zig-zag patterns and

waffles woven with thick and thin yarns have the look of Peruvian ponchos at Alba la Source

(ColemanandMason).Donegals and boucles with a spongy hand are woven with Shetland or lambs wool

yarns, some have angora or silk to give a soft or dry hand to the fabric. Rich shades of khaki and

red were featured.At Isoule (Barn Hill), washable shirtings in wool/cotton are napped for extra

softness. Stretch wools come in a variety of weights and coordinating patterns. The Isotex division

has puckered and embossed surfaces, lightweight bulky double cloths, heathers and tweeds.The

Spanish firm Dimtex (Rashi) has a wide range of classics and novelties for menswear. Worsted wool

suitings of 290/310 grams are classic favorites. There is ultra-light flannel of wool/cashmere in

plain and mini pattern designs. A line described as going from the country to the city includes

wool/Lycra bi-stretch, corded crepes and metallic stripes. There are washable wool blend jacket and

trouser weight fabrics here as well.Casual, rustic and sporty wools and blends at Dobert (Chantal)

include spongy terry and boucle, velours, meltons and washed boiled wools. There are double cloths,

some with foam bonding or fiber fill. Pastels and light beiges were popular colors.At Milior

(Gordon Textiles), an Italian firm in the wool sector, there is a lot of new technological

development. Lycra turns up in a variety of weights and textures. There are double cloths which

reverse from a hard to soft or felted to wrinkled surface. One new treatment, called Newskin, is an

ultra-light polyurethane adhesive with a rubber touch. It is semi-transparent and applied to

fabrics. Another is a thermostatic yarn developed by DuPont which helps maintain body

temperature.Milior has used a lot of mohair in light, open airy weaves. It is frequently blended

with viscose and nylon for subtle shine. There are also breathable bonded fabrics that resemble

suede and anti-stress fabrics that contain copper. Function And StyleIn the sportswear sector,

Schoeller continues to be a leader in technological advances. For Fall/Winter 2000/01 they

demonstrated climate control ComforTemp® products, introduced a year ago and developed for

astronauts in outer space. These fabrics are making the transition from sport to leisure, blending

functionality with style. They are breathable, moisture regulating and can be washed or dry

cleaned.Stretch has been reinvented at Schoeller. There is four-way stretch denim,

nylon/acrylic/Lycra stretch double-weave fleece and transparent stretch fabrics in a variety of

looks. Metallics continue, with new fabrics and blends. Some have a lot of sheen, all can be

crumpled, smoothed and molded. Metal is blended with wool, linen or synthetic fibers.

Christine Jenny of Schoeller models a jacket made with the company’s new fabric that contains

metal. At Griffine (Gordon Textiles), fake leathers and suedes are lightweight, breathable and

going into skirts and trousers. Polyurethane-coated nubuck types are available in weights of 160

gms. They are soft, supple and easy care. There are coated organic non-woven fabrics with a paper

touch, lightweight textured effects, soft noisy taffetas and a double-faced fabric called R2D2. It

reverses color and sheen.

Griffine showed many different styles of fabrics including fake leather and suedes and coated

organic nonwovens with a paper touch. At AGB (Fitsimmons Fabrics) there are noisy,

Teflon®-coated paper-touch cottons, soft, slick shirt and dress weights in blends of

nylon/cotton/Modal®/wool, Tencel®/polyester/Lycra ribbed fabrics, and double-faced fabrics

reversing from slick to brushed surfaces.Portuguese weaver Riopel (Lyn Alessi) is showing a lot of

double cloths in polyester/viscose blends. Some also contain Lycra and stretch in all directions.

These reverse color and weave. The hand is soft and wool-like. There are Teflon finishes and almost

all are easy care. Textile AromatherapyNew developments at Welbeck are selling for activewear,

liesurewear and intimate apparel. The scent of lavender, rose, citrus or vanilla is encapsulated

into micropolyester/Lycra jersey. The aroma is released only by friction against the skin and lasts

through 40 washings. In development stages is a fabric that will contain moisturizer.Another

micropolyester/Lycra development at Welbeck is low temperature dyed fabrics that mold, pleat and

retain their shape for the life of the fabric. There are moisture-wicking Tactel/cotton/Lycra

fabrics for athleticwear and double-faced gossamer sheer nylon/polyester/Lycra fabrics that shimmer

with subtle luster.Marioboselli (HorneandWeiss) has developed three distinct lines. At the high end

are yarn-dyed wool knits and wool blended with precious fibers. There is a lot of cashmere, angora

and silk in this range. Second are piece-dyed wools and blends with polyester or nylon.The Active

line contains fabrics with a sporty look. There are sandwich cloths with a glittery metallic fiber

in the middle, heat reflecting stretch fabrics coated with polyurethane or aluminum and laser

cut-outs on a variety of weights. New In KnitsGruppo Dondi now offers four knit collections.

The newest is called TechnoandLogico. Fabrics combine natural with man-made fibers aluminum,

polypropylene and polyester that are blended with wool or cotton. Rubber-coated surfaces, puffed or

wadded looks and paper-touch fabrics offer resistance to moisture, wind and cold. There are

waterproof fleeces and heathered tweeds in this line.Other Dondi lines feature extra-fine wools

blended with angora, alpaca, cashmere, mohair or silk. There are bulky, soft boucles, alpaca

heathers, silk/cashmere reversibles, hairy jacquards, fabrics with metallic glitter and airy open

stitched fabrics.New at Mabu Jersey (Nuvotex) are ultra-lightweight sandwich cloths with

wool/angora stripes between layers of sheer nylon. There is a lot of Lycra and metallic glitter in

this line. Fabrics for evening are opulent. Nylon/Lycra in textured cobweb patterns, undulating

pleats on sheers and shiny cellophane hairs on open-stitch knits are some of the looks.French

knitter Billon Freres (Gera Gallico) showed engineered jacquards with open patterns, wool-blend

jacquards in crochet-like patterns with fringe and a spongy hand, and light, airy lacy looks in

blends of mohair/nylon/acrylic. There are pleated nylon sheers in this line. The same fabrics, with

the addition of spandex, are crinkled and textured. Printed Fabrics Pick UpInterest in printed

fabrics has picked up. Ed Harding of Barn Hill, agent for Liberty, said this line is selling

exceptionally well. Base fabrics here are cotton lawn and voile, wool challis and viscose crepe.

Clean, finely engraved mini flowers, Art Deco graphics and paisleys are among the most popular

designs.Paisleys are also popular at Miroglio. Here they turn up in large panel and boarder

placements. Animal prints on polyester satin are another acclaimed motif. Zebras are the animal of

choice.Long-stem roses and mixed florals turn up on a variety of fabrics at Miroglio including

brushed acrylic knits. Iridescent flocking printed on chiffon, double cloths with spots of glitter,

and diffused effects with a transparent fabric layered over a print are other new techniques.Print

base cloths at Josef Otten (Filtex) include lightweight stretch jersey, micro Modal interlock,

viscose jersey, plush velvet and nylon/spandex sheers. Art Tone prints are updated. The patterns

are graphic, minimal and modern.Other designs at Otten are nature abstracts, animal prints,

splatters and splotches. Many of the same motifs are duplicated in jacquards.There are a lot of new

fabrics at Otten. Metal is used in sheer fabrics which can be crushed and molded. Double-faced

fabrics change texture and surface. The knit line goes from thick, rustic heathers and fleeces to

soft sweater knits. Wool is blended with a small percentage of nylon, spandex or lurex. There are

boucles with mohair, and sandwich cloths in polyester/nylon with lurex in the middle.The Segalini

(Gordon) line has changed. Prints are now an adjunct to novelty wovens. There are quilted

jacquards, hairy boucles, crushed and wrinkled surfaces, double cloths and laser-cut taffetas.Wool

is blended with mohair, alpaca, acrylic or nylon. Prints are indistinct on luminous polyester

organza or diffused printed on wool jersey and sandwiched between layers of sheer nylon. Silks

Fit For A QueenIn the silk sector, first time exhibitor Paul Dulac (Fitzeimmons Fabrics) continues

to design hand-painted embroidered silks. Some of these have turned up in fashions worn by Queen

Elizabeth II. Quilted fabrics with printed polyester fiber fill under a layer of silk have a

clouded misty look. There are cobweb effects, double cloths and prints and embroideries on

mohair/nylon blends.The Rainbow division of Ratti showed silk mousseline and wool gauze which are

glue printed together. The same technique is used to combine iridescent silk with wool jersey or

felt. Prints are dimensional on mohair, splotchy or with the look of animal prints on felted wool,

or bright with a gypsy influence on silk.Muted book binder prints and soft paisleys at Dutel

(Fitsimmons) are done on polyester chiffon and wool flannel. New jacquards are crushed or cut to

show eyelash fringe.Jacquards at Sedera (Nuvotex) are metallic, lustered, slubbed or crushed. There

are large paisley panels, animal prints and small flowers. Double-sided cloths, moire effects and

chenilles with velvet ribs are other new developments in this line.European textile trend

consultant Angelo Uslenghi, in New York City for the ETS show two weeks after Premiere Vision,

surveyed exhibitors and reported best sellers. Double-faced fabrics, hairy and wooly surfaces,

mohair and cashmere, lightweight bulky rustic textures, blurred prints and tweeds are all on his

list.

December 1999

B

irmingham, England, is not a location that trips regularly off the tongue of textile

people internationally. But now after 20 years of trying, the city has finally broken the monopoly

of Hanover, Germany; Milan, Italy; and Paris, to host the next ITMA show, October 21-30, 2003.

Skepticism exists, largely because of unfamiliarity. An enthusiastic and ambitious

partnership of the British Textile Machinery Association (BTMA), Birmingham’s National Exhibition

Centre (NEC) and the city of Birmingham are making early efforts to persuade potential exhibitors

and the world’s textile media of the suitability of the NEC as a venue and of the adequacy of the

surrounding infrastructure, especially in terms of hotel accommodation and transport.

The Lay Of The Land

It is hardly surprising that the first thought of the majority of business and pleasure visitors

to the United Kingdom is London. As an ITMA venue, if the exhibition facilities were available —

which they are not — this would equate to ITMA Paris and virtually to the same extent, Milan.

Hanover, however, is a provincial German city with a superb exhibition complex, but hotel

accommodations catering to ITMA visitors are often an hour or more away.

In this way, Birmingham can fairly be compared with Hanover. The 160,000 square meters of

stand space are among the most modern in the world, with $100 million spent on new halls last year.

The NEC is used to hosting major international events although it may not be used to handling quite

the same amount of engineering, machinery and other heavy equipment as Hanover is.

Birmingham is the United Kingdom’s second-largest city, with a population of more than 3

million. It is modern, dynamic and an acknowledged European center of arts, music and culture. And

few now doubt that the dedicated team at the NEC will put on anything other than an excellent show

in 2003.

Exceptional direct access by air and rail links will be in place by 2003, and Birmingham is

at the hub of the central U.K. motorway network. Doubts may therefore center on hotel

accommodations. In response, Bob Gilbert, chairman of Birmingham Marketing Partnership, has been

quick to point out that there are already some 65,800 bedspaces within one hour’s drive of the NEC

and among the new hotels being built are three more on the NEC site itself.

Eric France, director of the BTMA, has pinpointed another advantage — English is the business

language of most large textile markets. Among other factors this has elicited “tremendous response”

from the United States, as well as a “positive reaction” from countries including China, India,

Pakistan and Taiwan.

CEMATEX Approval

Of equal interest is the fact that Birmingham provides a watershed in the future of the global

textile machinery exhibition scene.

On one hand, it demonstrates a new flexibility on behalf of CEMATEX, the 8-nation sponsor of

the ITMA shows. CEMATEX Secretary General Carlo Meandelwitsh has said that in the future there is

nothing to stop any European city from bidding for future ITMA’s, providing that they have suitable

exhibition facilities and infrastructure.

CEMATEX is also intent on pursuing its goal of reducing the proliferation of textile

machinery exhibitions around the world to manageable proportions, without depreciating the market

and promotional needs of machinery makers. In the past, breakaway textile machinery exhibitions

have sometimes proved a lucrative source of revenue for entrepreneurial individuals and

organizations.

Since it has effective control over the international exhibition intentions of such a large

proportion of machinery makers, CEMATEX feels it is in an ideal position to control any further

free-for-all proliferation of shows.

The future of ITMA exhibitions therefore looks to devolve around the European-based shows as

the only truly global showplace. Other exhibitions will, by implication, therefore revert to a

largely regional or domestic role. In this respect, ITMA Asia in 2001 is not expected to totally

extend its visitor appeal to Southeast Asia, including China, Hong Kong and Japan. What it will

cover is the new technology comparison needs of such growing markets as India, Pakistan and

Malaysia.

CEMATEX strongly denies that it is intent on usurping the OTEMAS exhibition in Osaka, Japan,

which follows right after ITMA Asia in Singapore. It is acknowledged that there is a highly

significant Japanese market which remains of great interest to many textile equipment suppliers and

that this will be supported by domestic machinery builders.

Other Factors

The two ATME-I exhibitions in Greenville, S.C., due to come together as one after 2001, will

remain key attractions for the Americas. The big question is whether the same will happen in China

with CITME in Beijing, and Shanghaitex in Shanghai.

Visitors to the most recent Shanghaitex, held this past September, report the growing textile

influence of the region and the increasing importance of the show. But there are powerful political

influences which favor a continuation of a textile machinery exhibition in the capital city of the

Peoples Republic.

December 1999

W.L. GoreandAssociates Inc., Elkton, Md., has announced that The Grandoe Corp., Gloversville, N.Y.,

has been licensed to use GORE-TEX® inserts in the its performance handwear.The new product

collections will be introduced in the 2000-2001 season under the Grandoe® and Stick It® brands. We

are excited about working with Grandoe, said Mary Jo Russell, business leader of Gore. Our customer

is the most demanding user in the business and expects the best material, Stated Bill Quilgley,

vice president, sales and marketing, The Grandoe Corp. Our new glove line incorporating GORE-TEX

will be introduced in fall 2000 will set a new standard in warmth, comfort and performance for

gloves.

December 1999