N

ear-term textile and apparel trends in large part could depend on how American consumers

respond to the millions of tax rebate checks that have been sent out to beef up spending. While

most business analysts agree this one-shot fillip will encourage some uptick in clothing and other

consumer goods sales, there’s still a lot of disagreement as to whether it will have much of a

lasting effect on economic growth. Some, for example, think much of the windfall will be used to

reduce debt and build up depleted savings accounts. There are equally important question marks as

to how the Federal Reserve’s recent interest rate cuts will play out. So far, the impact has been

relatively small. But many feel that, given the traditional lag between monetary easing and

economic pickup, some positive effects should become evident by summer or early fall. The question,

of course, is just how much impact. In any case, putting precise numbers on all these recent

Washington moves isn’t going to be an easy task. Nevertheless, the economic gurus who are willing

to hazard a guess feel that when the dust finally settles, 2008 consumer spending should still be

up by about 1 to 2 percent. While a lot better than some of the recent gloomy forecasts, it still

represents a modest decline from the 3-plus-percent gains of recent years. And this will almost

certainly have some impact on textiles and apparel sales in the months and quarters immediately

ahead.

Encouraging Price News

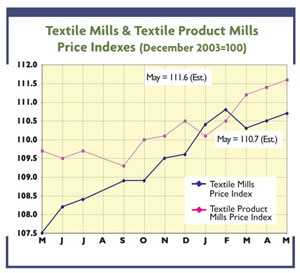

On a somewhat rosier note, our domestic industry’s competitiveness seems to be improving. One

sign: The price differentials between US-made and imported goods is beginning to narrow a bit.

China, our biggest competitor, for example, has begun to post some significant textile and apparel

price increases as that nation’s production and transportation costs begin to take off. Further

evidence of a narrowing US-overseas price gap can be gleaned from latest official government price

reports. Looking at domestic quotes first, Uncle Sam’s producer textile price index for basic

textiles is up less than 3 percent vis-à-vis a year ago. That’s considerably under the

near-6-percent jump noted for comparable imported items. And the picture is pretty much the same in

the apparel sector. Thus, while US domestic clothing tags have remained pretty much unchanged over

the past 12 months, imports of these products over the same period have gone up around 2 percent.

More significant: All indications suggest this drift toward a narrowing US-foreign price gap will

continue through the remainder of the year and into 2009. And it’s all beginning to have some

impact on our imports. One especially encouraging sign: First-quarter 2008 incoming shipments of

textiles and apparel on a square-meters-equivalent basis — from China as well as other overseas

sources — have actually slipped from comparable year-earlier levels. Bottom line: With incoming

totals down a surprising 4.6 percent over this three-month period, our huge market share losses of

the past few years may finally be ending.

Productivity Is Another Plus

Improving mill efficiency is also helping to buoy the industry outlook. Latest figures, for

example, suggest that output per worker in the basic mill sector (fibers, fabrics and so forth) has

advanced at a near-4.5-percent annual rate over the nine-year period ending in 2006. And for the

more highly fabricated textile product area (rugs, home furnishings, industrial products, and so

forth) the efficiency increase, while smaller, is still put in the respectable 2.25-percent range.

The fact that hourly pay rates have been rising at roughly the same pace also suggests that mill

unit labor costs have held relatively stable. That’s not an insignificant development in this

labor-intensive industry. It’s all in marked contrast to the rapidly rising labor costs now being

experienced by many of our overseas textile and apparel competitors. Moreover, these upbeat

domestic labor cost trends are likely to persist as our mills continue to invest in new, more

efficient facilities. One result of this better handle on costs: American mills are becoming

increasingly confident of both surviving and prospering. True, this year’s demand — hurt by the

business slowdown — will take another hit, with perhaps another 4 to 5 percent being shaved off

overall textile activity. But after that, things should begin to look up. Upshot: Our projections

beyond 2008 aren’t all that gloomy — with production and shipment totals expected to fall at only a

relatively small 1- to 2-percent annual rate by late next year or early 2010. Not bad for an

industry that had been virtually written off as recently as one year ago.

June 10, 2008