M

an-made fibers are becoming more important than ever. Their share of world fiber

consumption today is more than 60 percent. The challenge and the opportunity for the man-made fiber

industry will be in the area of environmentally friendly products. This development is a matter

more of a new attitude than of technology. And the fiber industry is on the right track, especially

the European man-made fiber industry.

Every year, the man-made fiber industry summit, the Dornbirn Man-Made Fibers Congress, takes

place in Austria. The 47th congress, held in September 2008, closed with a record attendance of

more than 720 visitors from 40 countries. Main topics included new fiber developments, sportswear,

safety, technical textiles and nonwovens. However, the overarching subject was sustainability, with

the focus on cradle-to-grave products.

Not only is the global climate changing, but also the attitude of the man-made fiber

industry. It was remarkable to see that the industry worries about climate change, too, as was

reflected in many papers presented at the congress. However, the whole situation has become very

emotional, because climate change directly and personally affects each and every one of us.

The 47th Dornbirn Man-Made Fibers Congress offered lectures covering a range of topics

The 47th Dornbirn Man-Made Fibers Congress offered lectures covering a range of topics

including fiber developments and sustainability, among other topics, to more than 720 congress

attendees from 40 countries.

Rising Raw

Material Costs And Energy Prices

It’s obvious that raw material and energy prices and the consciousness related to climate

change are linked with one another. In a world of finite resources, an increasing number of people,

mainly in Asian countries, are striving to attain the same consumption level of the West, and the

gap between production and demand is increasing.

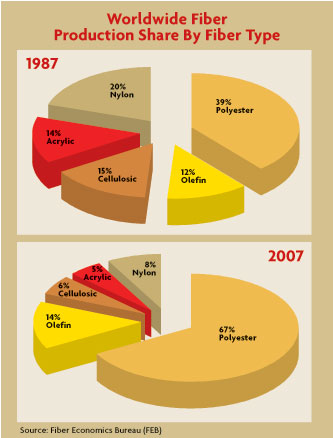

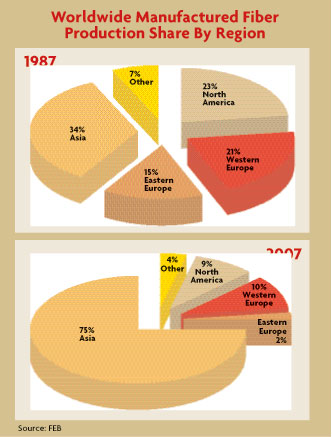

Over the last few years, the man-made fiber industry has enjoyed considerable global growth.

Today, the production ratio of natural to man-made fibers is about 35 percent to 65 percent, with

the share of man-made fibers growing.

The current need for raw materials on the part of the high-growth economies of China and

India is in contrast to a raw material supply industry that has been stagnating for decades. In the

past few months, just like in almost every other industry sector, problems have occurred

dramatically as energy prices and raw material costs have exploded. According to experts, the era

of relatively inexpensive natural resources is over. This situation will remain for many years, due

to the fact that the production of raw materials is a very capital-intensive and time-consuming

process. For example, the expansion in capacity of petroleum-based raw materials is nothing that

can be solved in a short time. For sure, speculative trading in raw materials has intensified this

effect. However, without this firm trend toward increasing demand, there would not be any

speculators.

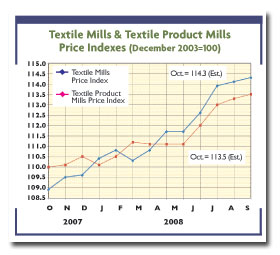

The price of energy has become more volatile than ever in the last 12 months. In spite of

day-to-day fluctuations between $100 and $140 per barrel and back down to below $60, it is more

important to know that oil prices rose to these levels from the customary $10 to $20 a barrel.

The Carbon Footprint

Everybody is aware that energy costs have become a major item on the balance sheets of

companies, whatever sector of activity they may be involved in. This awareness has in recent months

become part and parcel of a new form of consumer awareness with respect to greenhouse gas

emissions, global warming, and the so-called carbon footprint. A number of retailers have now begun

to be more transparent as a result of consumer pressure, and are indicating, for example, whether

or not a food product offered for sale has been air-freighted into the country of consumption.

This transparency offers the consumer a choice. Other retailers are prepared to quote the

number of air miles flown per kilogram of product, in a kind of inside-out loyalty scheme. There

will inevitably come a time when this approach will also apply to apparel and other lighter-weight

products – which, as distance and weight are linked to increased air-freight costs, will begin to

shift back part of the production advantage toward the Western industrialized countries and their

peripheries. The same thing, too, will apply, mutatis mutandis, to maritime transport. In Europe,

for example, there is a growing opportunity for more efficient and just-in-time man-made-fiber

apparel and technical textiles production in and around the Mediterranean region as compared to the

Far East, with the added advantage that European yarns and fabrics are used as raw materials for

the final making-up processes. This opportunity also exists in the Western Hemisphere.

The unforeseen rise of the euro and the decline of the US dollar, which could not have been

predicted to the extent that they have occurred, cannot be laid at the door of European companies.

Soaring energy costs, the introduction of REACH – the Registration, Evaluation, Authorization and

Restriction of Chemical substances – and other burdens have been imposed upon European producers

and have not made their lives easier. Sustainability is one of the key issues in the production of

fibers and fabrics. The most important parameters for the future are:

• fiber production;

• yarn and fabric production;

• dyeing, printing and finishing;

• conversion to end product;

• transportation

• product use and maintenance; and

• recycling, incineration or disposal.

Today, economic success, social acceptance and political stability are intimately linked to

the sustainable economic management of a company. However, governments also have a high level of

responsibility to create an overall framework enabling companies to pursue this approach. The

debate about climate change has led all big companies to reconsider their policies. Some years ago,

nobody could explain the term “carbon footprint.” Now, this expression has almost become

mainstream. Companies that refuse to deal with the issue of sustainable development are clearly at

a competitive disadvantage.

Europe cannot pass responsibility for sustainable economic development to others, experts

said in Dornbirn. Whoever violates the rules that the international community has imposed as a

basis for ensuring the preservation of a world worth living in should potentially be subject to

sanctions. For this reason, the Western industrialized countries should deal with the issue of

import duties on products that are not optimally produced when it comes to their carbon footprint.

This issue especially affects the fiber industry, which is particularly vulnerable. Europe

faces massive expenditures for environmental protection. But for companies outside of Europe, these

costs comprise a fraction of what is spent in Europe. This is a perverse distortion of the

situation: Factories that produce fibers but fail to sustainably and efficiently use natural

resources are rewarded with high margins, whereas plants that act in a more responsible manner are

being punished.

Trends

On the one hand, fiber producers are in the midst of a long-term, substantial growth in

demand for their products. On the other hand, everybody is forced to prudently and sustainably use

natural resources.

If one is to produce more but use fewer natural resources, one should make use of more

renewable raw materials. One example is cellulosic fibers. Wood from trees is the basic raw

material required for 90 percent of regenerated cellulosic production, and trees have a very low

impact on the environment and the fertility of the soil. Moreover, one is far from tapping the full

global potential for wood production. According to Austria-based Lenzing AG, the leading producer

of viscose fibers, only about 10 percent of the annual worldwide wood harvest, currently totaling

about 1.7 billion metric tons, is processed into pulp. Of this amount, only about 3 percent is

chemical pulp, which is used in the fiber industry and for other applications. In addition, 90

percent of the renewable land biomass is lignocellulose, which underlines the growth potential.

Product Life Cycle

Product life cycle is becoming more important than ever, and the understanding of the life

cycle of products with respect to greenhouse gas emissions has significantly improved. Assessing

the carbon footprint will become standard practice for all products in the same way that tenacity

is used to describe fiber strength. The fundamental understanding of the climatic impact of the

products is the prerequisite for optimizing production. Those companies that implement innovative

measures at an early stage will logically have a competitive edge.

In the upcoming decades, there will continue to be sufficient raw materials for the

polyester industry, but at higher prices. Polyester is the most important polymer for fiber and

will remain so in the future, especially if the recycling rate for polyester increases. It will

also be necessary to discover completely new raw materials for the man-made fiber industry.

However, these raw materials will only be able to gain a significant market share on a

long-term basis because they are hard to process in technological terms, or they compete with other

applications. Think of casein. Its use as a raw material for fiber production is considered to be

technically feasible, but it will involve fiber producers in a competition with the food industry.

The fact is that cellulose is one of the most widely used natural polymers, which are the easiest

to process, particularly in an ecologically sensible manner, based on the technologies available

today. Perhaps, some years from now, the cellulose required for the fiber industry will not only be

derived from wood, but also from quickly growing plants – such as sugar cane, grass and straw –

thus opening up new perspectives.

The market share of fibers produced by using renewable raw materials with a correspondingly

attractive energy/greenhouse-gas balance will certainly increase in the years to come, and those

fibers that are manufactured in line with sustainability criteria will be more enthusiastically

welcomed by consumers. In this regard, new fiber qualities and increasingly specific applications

will be developed by mixing different raw materials.

Don’t Waste Your Waste

The industry must significantly increase the share of recycled raw materials, particularly

petroleum-based polymers, in the manufacturing process. Because of increasing raw material prices,

recycling has become quite attractive to the fiber industry. For economic reasons based on the rise

in energy costs, many industries have been driven to achieve impressive recycling quotas.

Europe is at the cutting edge of this development. The recycling rates in Europe are: for

paper, 55 percent; nonferrous metal, 50 to 70 percent; and glass, 62 percent, with

Switzerland recycling 99 percent.

In contrast, the recycling rates for US companies are considerably below the levels in

Europe. For example, the US glass industry recycles about half the quantities recycled in Europe.

However, some companies are already using polymers recycled from post-consumer waste, such as

polyethylene terephthalate bottles.

The European Challenge

Productivity is growing rapidly – close to 7 percent in 2007 as compared to an average of 3

percent in the final years of the 20th century. This bodes well for the future. In addition, there

is ever-growing recognition of the need for continuous innovation across the whole spectrum of

textile and apparel activity. There are technical textiles, but also apparel and interior textiles.

It is therefore no surprise that the European Technology Platform for the future of the textile and

apparel industry, established at the end of 2004, sees the following three main cornerstones:

• a move from commodities to specialties;

• new textile applications; and

• mass-customization.

These bases provide opportunities to get away from those areas in which, because of higher

costs, the Europeans are more vulnerable to outside competition. It will, for example, be

self-evident that as mass-customization grows, so will the consumer’s desire to have the product

delivered to him or to her as soon as possible. This will mean demand for fabrics made within

Europe and then made into final apparel articles there, too.

Consumer Awareness

Ultimately, consumer awareness will play a decisive role. An increasing number of companies

are already reacting to growing demand for eco-labels that provide information on how many grams of

carbon dioxide or equivalent greenhouse gas emissions arose in production, transport and storage of

a given product. An increasingly large group of consumers is prepared to pay more money to acquire

sustainably produced products.

In terms of the quantities used, the most important raw material in the man-made fiber

industry is and will naturally continue to be petroleum, which is a finite resource, as is

well-known. “Easy oil” is a relic of the past, and the gap between oil reserves and

demand/consumption continues to grow.

Consolidation

It is clear the textile industry is again going through a period of

consolidation. There are jobs to lose, but the European industry still employs 2.5 million people.

The automation of apparel manufacturing will stimulate a return of this activity to the European

Union (EU) and the countries in close proximity to it, and create sustainable demand for the yarns

and fabrics which that industry needs, and this demand in turn will be fueled by the growth of

mass-customization.

More generally, transport costs and environmental and ethical concerns – which until now

have tended to be costly handicaps – will foster a greater consumer awareness of the values of EU

production. Tomorrow, they will translate much more easily into consumer drivers.

Dynamic Growth Branch

From today’s perspective, one thing is clear: the man-made fiber industry will remain a

dynamic growth branch, with the exception of short-term cyclical fluctuations in demand. On the one

hand are the increasing demands for technical textiles and nonwovens. On the other hand is

population growth. Even if mankind more effectively manages to control population growth, there is

a consensus that the global population will continue to increase from the current level of 7

billion people to about 9 billion in the year 2050.

November/December 2008