By Robert S. Reichard, Economics Editor

More good news on the profit and margins front. To be sure, significant demand gains still are a bit hard to come by. And import totals remain at or even slightly above year-ago levels. But despite these less than ebullient trends, textile mill bottom lines are still moving higher — a continuation of the increases that started nearly two years ago. Newly released government numbers provide the details. During the latest available three-month period (Q2 2014), mill after-tax profits jumped to near $750 million. That’s about a 50-percent improvement over the year-earlier reading. Profits per dollar of sales show equally upbeat gains, with domestic mills at last report making about 7 cents on every dollar of sales. Again, that’s well above the 5-cent figure reported only a year ago. Another widely monitored margin yardstick — profits per dollar of stockholders equity — is similarly encouraging, with the latest 17-cent-plus estimate again running well above the near 12 cent figure of 12 months earlier. What makes this last number especially impressive is the fact that the domestic mill return on equity is now actually above the some 15 cent estimated return for all U.S. manufacturing activity. Indeed, this could be the key reason why mill executives are continuing to invest more than a billion dollars per year for modernization and expansion. True, profit estimates for downstream apparel manufacturers are not quite as bullish. Nevertheless, the numbers in this sector, as in the case of textile mills, are still running above levels prevailing just a few years back when many domestic firms were hard put to just break even.

Behind The Improvement

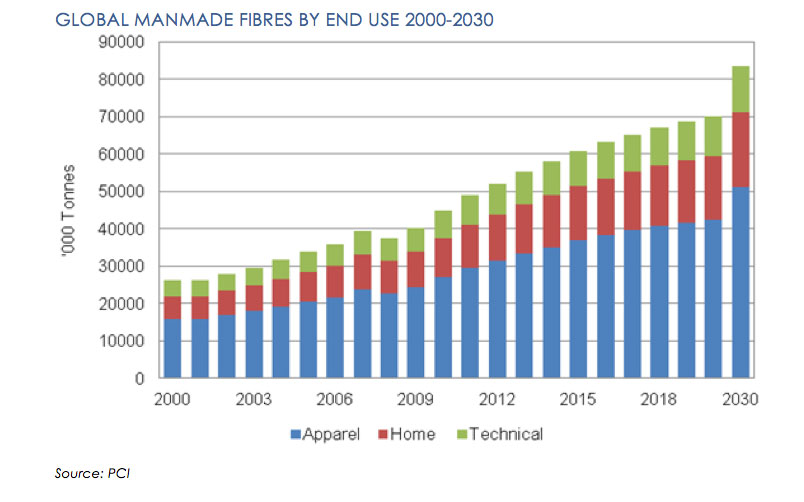

A series of factors — most notably continuing cost containment — are behind this increasingly rosy profit and margin picture. For one, cotton fiber costs, as noted in a recent column, have been dropping significantly — leaving them at last count, better than 10 percent under levels prevailing just one year ago. And man-made fiber averages have barely moved over the same period. Add in the combination of steady-to-slightly-lower labor costs — thanks to the combination of relatively small pay hikes and continuing productivity gains — and it’s easy to see why the overall cost share of the average mill and apparel shipment dollar has actually been declining. Industry prices, meantime, also appear to be another industry profit contributor. They’ve held up well and in some cases, have actually inched up. For mill shipments, this can be best appreciated by looking at the accompanying chart. It’s pretty much the same when it comes to apparel quotes. Finally, two other pluses for bottom line performance also deserve mention. First, there’s today’s intensifying producer emphasis on more profitable niche products and less on highly competitive commodity lines. And last, but not least, there’s the role played by increasingly savvy supply-chain-management strategies. More and more companies are becoming increasingly active in this area. Indeed, one recent study finds that some 90 percent of today’s firms have supply chain management teams aimed at lowering operating costs, improving quality, and speeding up responses to customer demand changes.

More Gains Ahead

With all these positive factors expected to continue, the profit outlook for the next few years looks to remain equally encouraging. Indeed, IHS, one of the nation’s prestigious economic forecasting firms, is anticipating further increases well into the future. Its estimates, based on projections of dollar shipments less material and labor costs, suggest the following: Mills making basic textile products like fibers and fabrics should post better than a 20-percent earnings increase for 2014, with smaller 2.5-percent annual advances projected for 2015 through 2017. As for mills making more highly fabricated products like carpets and home furnishings, projections call for 3- to 5-percent gains for both 2014 and the following few years. And for apparel manufacturers, IHS forecasts suggest a rather impressive 35 percent profit jump this year, followed by around 5- to 15-percent increases over the 2015-17 period. Going out another three years to 2020, IHS sees small average annual gains of 2 to 3 percent for both basic and fabricated mill products, with apparel makers ending up with slightly higher 5-percent increases. If nothing else, these numbers would pretty much seem to confirm recent TW forecasts pointing to continued industry strengthening — not only over the current year, but also well into the foreseeable future.

October 2014