Outgoing NCTO Chairman David Poston outlined key industry facts and economic data in his “State of the U.S. Textile Industry” address during NCTO’s 19th annual meeting.

By David Poston

Let me begin by saying what an honor and privilege it has been serving as chairman of the Washington-based National Council of Textile Organizations (NCTO).

The business climate in 2022 was defined by a multitude of global and domestic challenges impacting our industry’s overall performance.

The U.S. textile and apparel industry faced challenging macroeconomic conditions throughout the year.

As we all witnessed, the headwinds from global supply chain disruptions, inflation at home, rising material costs and rising interest rates were strong. Fluctuating consumer demand started out strong in the first half but flattened by the second half of the year as inflationary pressures flipped the script from an economy fueled by excess demand and inadequate supply to one of too much supply and not enough demand.

Despite these challenges, there also were many positive trends that helped offset some of those pressures, including softening inflation towards the latter half of the year, coupled with a surge in onshoring and nearshoring that led to historic investments, commitments and expansion in the U.S. and the Western Hemisphere.

Overall, our industry remained resilient with strong performances in some key areas in 2022. We remain cautiously optimistic that we will see growth this year, though inflationary pressures and rising costs are expected to persist.

NCTO has been highly engaged in working with the Biden administration and our allies in Congress to achieve key policy priorities, and we succeeded on many fronts in 2022.

I would like to sincerely thank our staff, led by NCTO President and CEO Kim Glas, as well as our industry leadership for successfully navigating through challenging economic times and polarization in Congress, while partnering with the administration and key congressional offices to secure a number of critical achievements last year.

NCTO’s effective advocacy efforts resulted in a long list of accomplishments in 2022, including enhancing government procurement of U.S. textile-based products, intensifying pressure to crack down on unprecedented abuse of our de minimis waiver system, safeguarding the integrity of our free trade agreements, and maintaining a strong position on China trade enforcement, including tariffs on finished textile and apparel.

Last month, many of you participated in a number of Zoom calls with House and Senate leadership on maintaining the integrity of the yarn forward rule of origin in the Dominican Republic Central America Free Trade Agreement (CAFTA-DR) and advancing a proactive agenda to drive investment and expand regional co-production in the CAFTA-DR region.

Your participation in these discussions matter and are critical to pushing our issues collectively.

I would like to sincerely thank the entire NCTO staff for this enormous effort and to all the NCTO members who participated in these critical discussions.

Before laying out NCTO’s policy wins in 2022, I want to quickly recap how the industry fared last year.

By The Numbers

By The Numbers

We continued to expand our capital investments, exports and value of shipments in 2022.

Many metrics for our industry were strong last year, as business continued to increase exports and investments.

In 2022, the value of U.S. man-made fiber, textile and apparel shipments totaled an estimated $65.8 billion, compared with $64.04 billion in shipments in 2021.1

Here are two additional key industry facts:

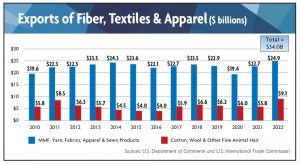

- U.S. exports were also up compared to 2021. Exports of fibers, textiles and apparel were $34 billion in 2022 compared with $28.4 billion in 2021.2

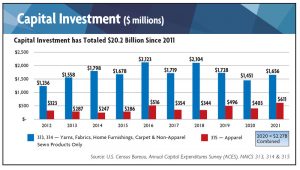

- Capital expenditures have remained strong. Investment in yarn, fabric, apparel and sewn product manufacturing in 2021 —the latest figure that is available —hit $2.27 billion in 2021 compared with $1.85 billion in 2020.

Onshoring and nearshoring trends strengthened Made in USA production as you can see from these metrics, and policies in Washington aimed at expanding Berry and Buy American rules are contributing to overall growth in American-made products for the military, PPE and federal agencies.

Once again, the Western Hemisphere supply chain remained a key driver behind the industry’s growth and remains a vital economic engine for the textile and apparel sectors.

We have $39.8 billion in annual two-way trade with the Western Hemisphere, representing an 18.4-percent increase over the past five years, which supports 2 million direct jobs in the entire supply chain.

Trade flows remained positive and on a growth track, despite the headwinds from three years of sourcing disruptions due to the pandemic.

U.S. textile and apparel exports to the Western Hemisphere rose 14.9 percent to reach $18 billion in 2022, compared with five years ago in 2017. Similarly apparel and textile imports to the United States from the Western Hemisphere continue to rise. These imports from the entire region to the United States grew by 21.4 percent to hit $21.8 billion over the same time period.

The bottom line is the fundamentals for the U.S. textile industry are sound, though headwinds this year will weigh heavily on business decisions. Our industry’s resilience in the face of a once-in-a-generation pandemic with COVID-19 gives me confidence it will weather the perfect storm of inflation, supply chain disruptions and rising costs.

Policy Issues

Policy Issues

NCTO was highly engaged in policy debates in Washington last year, advocating on every aspect of critical trade and economic issues impacting our industry’s performance and growth.

I would like to highlight a few accomplishments NCTO staff achieved during the year.

CAFTA-DR

NCTO engaged directly with the administration and congress to underscore the importance of strong trade rules to the economic stability of Central America and the need for increased private sector investment in regional manufacturing. NCTO staff also worked to counter a well-funded effort by certain importers designed to undermine the yarn forward rule of origin in the CAFTA-DR agreement to allow third-party textile inputs from Asia to displace U.S. and Central American-made textile inputs.

Further, NCTO continues to work with various elements of the federal government, including the Vice President’s office, USTR, the State Department, and the National Security Council to identify and implement solutions that will increase regional co-production and expand export opportunities for U.S. textiles.

Thanks to these efforts, Administration’s Call to Action for new investment, and the strength of CAFTA-DR, nearly $2 billion of new textile and apparel investments were made in the United States and Central America region.

Buy American Reform

NCTO partnered with congressional allies in 2022 to press designated federal departments for quick adoption of the Make PPE in America — legislation that applies Berry Amendment rules to nearly all personal protective equipment purchased by the federal government and ensures minimum two-year federal PPE contracts. This is something NCTO is continuing to lead an all-out push for agencies to adopt these critical standards.

Additionally, NCTO worked with our allies at the Warrior Protection and Readiness Coalition (WPRC) and several other industry associations and labor unions to help secure passage of the Homeland Procurement Reform (HOPR) Act, as part of the FY 2023 National Defense Authorization Act (NDAA). The HOPR Act encourages increased domestic sourcing and aims to support U.S. small businesses by improving the ability of the Department of Homeland Security (DHS) to purchase high-quality, American-made uniforms and PPE for frontline personnel. NCTO will be working in concert with partner organizations to help ensure this new law is enacted swiftly.

There are numerous other issues requiring NCTO’s focus and resources, such as amplifying support for the Section 301 case against China’s intellectual property abuses, promoting tariffs on finished products, the need to pass a new Miscellaneous Tariff bill with immediate and full retroactivity, and continued engagement with the Hill on enacting a provision that would effectively close the de minimis loophole for Chinese imports.

Due to time constraints, I cannot go into all of these important issues. But please know that without exception, NCTO is highly engaged on every policy matter that affects the U.S. textile industry with the intent of shaping policy determinations in a manner that directly benefits U.S. textile investment, production and workforce.

Industry leadership and involvement is of paramount importance. From contributions to NCTO’s Textile PAC to arranging congressional visits to facilities, the industry can make a difference and help raise the level of awareness about its importance to the overall U.S. economy and workforce, and to the local and state economies it supports.

Conclusion

The business environment for the year ahead looks challenging but based on the growth we are seeing in capital expenditures, output, exports and investments in the Western Hemisphere partners, I remain cautiously optimistic.

We will closely monitor emerging issues this year and continue to engage with Congress and the administration on a whole host of policy issues impacting our industry. Working in conjunction with our Western Hemisphere trading partners, we believe we can capitalize on the onshoring and nearshoring trends that we are seeing and strengthen our co-production chain, investment and employment.

That concludes my formal remarks.

On a personal note, I have been honored to serve as chairman of a highly effective organization and dedicated staff, which tirelessly advocates on policies impacting the day-to-day operations of our organizations and this economically vital industry.

I truly am optimistic about the innovative strength of the industry and its resilience to economic challenges. With the support of this effective trade and lobbying organization in Washington, we can overcome unforeseen challenges and continue to cement our position as an integral sector to the U.S. economy and the Western Hemisphere.

References:

1 Bureau of Economic Analysis

2 U.S. Department of Commerce data for Export Group 0: Textiles and Apparel.

Editor’s Notes: David Poston is president of Palmetto Synthetics, Kingstree, S.C. He served as NCTO chairman for FY 2022. At the recent NCTO meeting in Washington, Norman Chapman, president of Inman Mills, succeeded Poston as NCTO chairman for FY 2023.

The North American Industry Classification System (NAICS) is the standard used by Federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy. NAICS Subsector 313 covers Textile Mills, sub-sector 314 covers Textile Product Mills and subsector 315 covers Apparel.

May/June 2023