PARIS — April 24, 2025 — JEC Forum Italy organized in partnership with ASSOCOMPOSITI is dedicated to gather the composite materials community from Italy. This event is a unique opportunity to foster stronger connections with the local companies, research & development centers and applications sectors industries. This second edition will be held at the Villa Erba, Cernobbio, Lake Como, on June 11 & 12, 2025, with an optional company visits organized after the event, on June 13, 2025.

PARIS — April 24, 2025 — JEC Forum Italy organized in partnership with ASSOCOMPOSITI is dedicated to gather the composite materials community from Italy. This event is a unique opportunity to foster stronger connections with the local companies, research & development centers and applications sectors industries. This second edition will be held at the Villa Erba, Cernobbio, Lake Como, on June 11 & 12, 2025, with an optional company visits organized after the event, on June 13, 2025.

Its complete program combines business meetings, conferences, round tables, and interactive workshops with the participation of internationally renowned experts and guests.

BUSINESS MEETINGS

At the core of this event is the Business Meetings program, which offers participants pre-arranged business appointments, ensuring targeted and effective interactions among key industry players.

These meetings provide a unique opportunity to establish strategic partnerships, discover the latest innovations, and develop new business opportunities.

Wednesday June 11: 10:00-12:30 / 14:00-18:00

Wednesday June 11: 18:30-21:00 Evening Networking Event

Thursday June 12: 09:30-12:00 / 13 :30-16:30

More info: https://www.jec-italy.events/business-meetings/

CONFERENCE

Wednesday June 11 – 10:00-10:15

Opening speeches

TECHNOLOGIES FOR COMPOSITE MATERIALS – Wednesday June 11 – 10:15-11:15

This session will feature presentations from companies at the forefront of production technologies. Attendees will have the chance to explore key topics related to product and process innovation. These insights aim to inspire participants in their search for new solutions to enhance their products and expand into new markets.

Moderator: Prof. Alfonso Maffezzoli, University of Salento

10:15-10:45 Keynote Speaker: Innovation in Additive Manufacturing for automotive

Speaker: TBA, Bercella

10:45-11:15 Combining Circularity and Affordability: Hybrid Fiber Technologies for High Performance Thermoplastic Composites – Speaker: Paolo Ermanni, Prof. em. ETH Zurich, Antefil Composite Tech

INNOVATION IN THE TRANSPORT SECTOR – Thursday June 12 – 9:30-10:30

This session will showcase the latest advancements in high-performance composite manufacturing technologies for the transportation industry. Participants will gain insights into cutting-edge solutions developed worldwide, highlighting key examples of technological excellence and superior product quality.

Moderator: Prof. Roberto Frassine, Assocompositi

09:30-10:00 Composite side fairings for high-speed trains

Speaker: Giuseppe Cavaliere, Production Manager, Production Group

10:00-10:30 Keynote Speaker: Performance and Sustainability in energy-absorbing structures – Speaker: Vincenzo Castorani, R&D Project Manager, HP Composites

SUSTAINABILITY AND CIRCULARITY OF COMPOSITE MATERIALS – Thursday June 12 – 15:30-16:50

This session will offer participants the opportunity to explore the knowledge and strategies of EuCIA – the European Composites Industry Association – on the development and implementation of sustainable, circular end-of-life solutions for composite materials. The session will also feature industrial case studies and emerging research trends focused on integrating sustainability into materials and production processes.

Moderator: Prof. Alfonso Maffezzoli, University of Salento

15:30-15:50 Keynote Speaker: Activities to promote the circularity of composites at the European level – Speaker: Prof. Roberto Frassine, President Assocompositi

15:50-16:10 Treatment and recovery of end-of-life composite materials; state of the art and future developments – Speaker: Luca Gentilini, R&D, Cobat Compositi

16:10-16:30 Polynt Group Sustainability Strategy: A New Approach Towards Composite Materials featured by Reduced CO2 Emission – Speaker: Lorenzo Grazia, Composites – UPR/GC EU Technical Service Manager UPR/GC – Polynt Group

16:30-16:50 Circularity of composite materials in the Motor Valley: FIB3R is born, the first industrial-scale carbon fiber recycling plant in Italy

Speaker: Daniele Biondi, Carbon Fiber Plant Manager, Hera Ambiente

WORKSHOPS

Wednesday June 11

15:00-15:30 Composites for steel substitution in mass production: advantages and approaches – Speaker: Claudio Mingazzini, ENEA

Thursday June 12

14:00-14:30 Circular Recyclable Graphene added Crosspreg® reactive prepregs to Super-Lightweight bodies production. Outputs from GIANCE, EC funded Project within Graphene Flagship – Speaker: Gianluigi Creonti, Crossfire Srl

JEC STARTUPS’ INNOVATION SESSION – Process and Manufacturing

JEC Startups’ Innovation Session will feature five startups in the composites industry, each focused on advancing new manufacturing processes. During this session, these startups will take the stage to showcase their innovative technologies, solutions, and methods that are set to revolutionize the way composites are produced and used.

From optimizing design processes to introducing cutting-edge manufacturing techniques and advancing sustainable recycling methods, these startups are at the forefront of transforming composite materials.

The five finalists revealed:

Acus – Acus offers sustainable solutions for custom composite manufacturing. Specializing in the development and production of reusable molds with a propertary technology, Acus leads the charge towards a greener, more cost-effective future without quality compromises.

Fibereuse Tech – Fibereuse Tech is a startup born in 2023 to address the hurdles in GFRP recycling. Thanks to the expertise of the team in GFRP treatment, from size reduction to reprocessing, and its patented technology, it is able to implement real and robust circular value-chains, following a cross-sectorial demand-driven approach.

Fibionic – Fibionic’s nature-inspired FFP (Fibionic Fiber Placement) is the world’s fastest fiber placement process. It uses fibers only where needed, produces zero waste, and enables strong, ightweight, and cost-efficient composites—sustainable and scalable for mass production, setting a new industry standard.

Futur-AI – The Futur-AI system provides an innovative solution for the traceability, lifecycle management, and sustainability of composite or advanced material components. Designed for the Aerospace market, it ensures compliance with industry certifications, leveraging predictive AI and Blockchain Technology.

RESCOMP – Software & Tools for the Reliability of Composite Parts RESCOMP Engineering is a spin-off of the University of Padova, leveraging cutting-edge research and innovative methodologies for improving the efficiency and reliability of composite parts. Rescomp offers software tools for the design against fatigue of components as well as smart sensor-less structural health monitoring solutions for the real-time assessment of the structural integrity.

COMPOSITES TOUR

Friday June 13 – 8:00-15:30

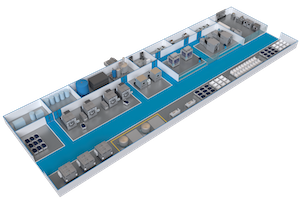

FKgroup offers state-of-the-art technological solutions for the industrial cutting of composite materials and technical fabrics. https://fkgroup.com/cutting-composite-materials/

Thanks to their resistance, modelling and lightness, composite materials are now present in many sectors. With that presence comes a need for versatile and flexible cutting machines able to meet the market demand.

From aviation to defence, construction to apparel, we have unique and high-tech patented solutions.

Company Visit

Introduction to FKgroup:

– Founded in 1961, FKgroup provides integrated production cycle solutions for the apparel, technical fabrics, and composites industries.

– FKgroup is the main sponsor of JEC Forum Italy 2025.

Tour Highlights:

– Cutting Systems: Tecnofreccia and Ultracut

– CAD Solutions for composites

– Spreading Systems for technical textilesTo visit our website: http://www.jec-italy.events

Posted: April 24, 2025

Source: JEC Group

COLOMBO, Sri Lanka — April 25, 2025 — The Joint Apparel Association Forum (JAAF) welcomes the Government of Sri Lanka’s proactive engagement with the Office of the United States Trade Representative (USTR) in Washington D.C., and extends its appreciation to His Excellency President Anura Kumara Dissanayake and the delegation for prioritizing discussions that advance equitable and mutually beneficial trade relations between Sri Lanka and the United States.

COLOMBO, Sri Lanka — April 25, 2025 — The Joint Apparel Association Forum (JAAF) welcomes the Government of Sri Lanka’s proactive engagement with the Office of the United States Trade Representative (USTR) in Washington D.C., and extends its appreciation to His Excellency President Anura Kumara Dissanayake and the delegation for prioritizing discussions that advance equitable and mutually beneficial trade relations between Sri Lanka and the United States.