T

he charge of reviewing developments in spinning equipment shown at a machinery show from

which several of the major players were absent could be viewed as a daunting task. The opposite has

proven to be true, however, because greater emphasis could be placed on the limited offerings of

those manufacturers that elected to exhibit.

There were developments from several machinery makers, but perhaps the most noticeable

feature was the general change in color of the offerings of major spinning machinery, from the

traditional blue/green to much lighter shades of gray/cream with highlights in bolder colors.

Greater use of improvements in drives and controls was promoted, and many manufacturers featured

touch screens to provide input of settings. It is also interesting to note that several machinery

makers promoted improvements aimed primarily at easier operation and maintenance, coupled with

improved product quality, rather than focusing on productivity. An additional feature was that

exhibitors showed only a small selection of their range of potential offerings, and these tended to

be the newer developments.

Trützschler’s TC 03 card features a raised cylinder, which increases the potential carding

area by 50 percent.

Carding

Since some of its major competitors were not present, Marzoli S.p.A., Italy, elected to

restrict its exhibit to the C601 card and indicated it would launch a new range of machinery in

2004. The new card, claimed to process potentially in excess of 120 kilograms of fiber per hour,

utilizes a 350-millimeter (mm), single licker-in rather than the multiple roller configuration used

by others. In order to maximize the potential carding and cleaning capacity, nine pre-carding and

six post-carding elements are used. The card also features a medium-term autoleveling system that

is based around the feed roll, and a short-term autoleveler that utilizes a 3/3 drafting system at

the delivery of the card and, according to Marzoli, enables the elimination of one (or more)

drawing passage(s). China Textile Machinery (Group) Co. Ltd. (CTMTC), part of China Textile

Machinery and Technology Import & Export Group, included a cotton card as part of Marzoli’s

exhibit.

Germany-based Trützschler GmbH & Co. KG’s new TC 03 card offers several developments and

innovations in short-staple carding technology. The major design difference between it and

traditional cards is that the cylinder has been raised a foot, and this in turn increases the area

potentially available for carding by 50 percent. The new card offers several advantages with regard

to quality, flexibility and optimization, according to Trützschler. Notable features include:

• easier maintenance and cleaning through better access to machine

components;

• assessment of fiber content in waste removed, achieved by detecting

white fiber in the suction duct;

• easy adjustment of manual or motorized “mote knives,” which can be used

in conjunction with the waste assessment to optimize fiber usage;

• automatic detection of flat settings and optional motorized adjustment;

and

• on-line nep assessment.

An additional off-line mobile assessment system exhibited was the Trützschler TC-LCT Length

Control unit, which can be moved next to the carding machine or draw frame to assess slivers for

fiber quality. Properties measured include fiber length and short fiber content, plus information

on hooked fibers. The information provides feedback on the machines’ processing performance, and

the data can be used to assist in decisions about optimum settings, among others.

N. Schlumberger – NSC Fibre to Yarn’s Era comb offers many new features.

Combing

In the arena of short-staple combing, there was little that could be regarded as novel.

Machines were exhibited by Lakshmi Machine Works (LMW), India, and Shanghai Pacific Mechatronic

(Group) Co. Ltd., Shanghai, but neither could be regarded as offering significant developments.

Sant’Andrea Novara S.p.A., Italy, exhibited its Millennium wool comber operating at 280 nips

per minute. This new comb is an evolution of the P100 comb, and affords the potential of higher

speeds coupled with improvements in setting times for the various units within the comb combined

with easier and quicker component change. Notable refinements include the possibility of

electronically adjusting the ratch while the machine is running and fully electronic bush

adjustment.

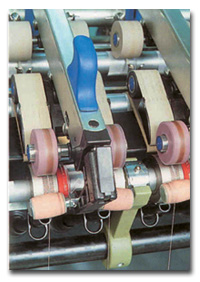

The Era combing machine from France-based N. Schlumberger – NSC Fibre to Yarn incorporates

many state-of the-art features including multiple motor drives, ease of use and maintenance, and

the ubiquitous touch screen controls. The use of four motors on the comb means the drives are much

simplified, enabling faster and more accurate adjustments. Additional features include

electro-pneumatic adjustment of nip distance, a new circular comb with pinning of more than 360

degrees, shorter drawing-off and detaching cylinder settings, an increase in sliver quality, and

increased production by about 25 percent (without increasing the speed), according to the company.

Sant’Andrea Novara’s RF5 vertical rubbing frame features double rubbing aprons.

Drawing

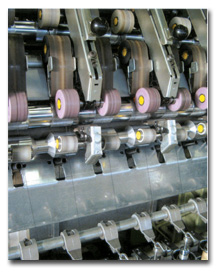

Trützschler made a big impact with its new TD 03 draw frame. This machine offers several

innovations aimed at enabling processing to be more easily optimized, and potentially improving

product quality. The machine permits easy changes in ratch settings, and utilizes multiple motors

to drive creel and back rollers, front rollers and take-off rollers, can turntable, and middle

drafting roller.

It is the last of these that offers the possibility of readily changing the draft in the

back and front zones of the drafting system. In particular, the break draft is known to play a

significant role in yarn imperfections, and this can readily be altered on the new draw frame,

either manually using a push button, or by automatic adjustment so that the optimum value is used

for each lot. The Autodraft system performs a preliminary run lasting about one minute, during

which time a range of predrafts is utilized and the drafting force is assessed. From data generated

during this run, the optimum draft is selected and automatically set.

Schlumberger’s display included its GC 30 high-speed chain gill and GV 20 vertical gill. The

GC 30 utilizes multiple motor drives, and its maximum mechanical speed is 600 meters per minute

(m/min). There are some similarities to the TD 03 draw frame with respect to ease of ratch

adjustment, and rather than moving the front rollers to change the ratch, the back rollers and

faller assembly are moved. In common with the other machines exhibited by Schlumberger, the various

components are easily accessed for routine maintenance. The GV 20 vertical gill can be supplied as

either a four-head (bicoiler) or two-head output. The former runs at 400 m/min, while the latter is

capable of 500 m/min.

Electro-Jet’s ADR cotton roving frame offers a doffing time of 90 seconds.

Roving

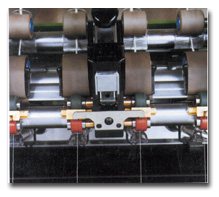

Cotton roving frames were shown by CTMTC and Electro-Jet S.A., Spain. The latter

manufacturer claims to have a very quick doffing time of about 90 seconds on its ADR frame, which

doesn’t require manual input during restart. This significantly enhances the productivity of the

roving frame, according to Electro-Jet.

Sant’Andrea Novara demonstrated its RF5 vertical rubbing frame which, when supplied with the

optional high-precision electronic winding device, offers a maximum mechanical speed of 300 m/min.

According to the company, this machine utilizes a double rubbing system, which doubles the amount

of rubbing at a particular running speed, enabling the rubbing section to potentially run at a

lower oscillation rate to maintain an acceptable compaction of the roving. An additional benefit of

this setup is that the second rubbing zone can reinforce the dead centers that occur at the

reversal of the rubbing aprons, which are present when only one apron set is used.

Schlumberger maintains only one set of rubbing aprons is necessary to achieve satisfactory

roving quality. The company demonstrated its FMV 42 vertical rubbing frame with integrated

automatic package doffing. A notable feature of this machine is that the drafting system can easily

be changed to accommodate different fiber types. Three possible alternatives – double apron,

roller/apron and short/long apron – are available.

The following review of the final stage of yarn production is constructed according to

technology and includes systems for both long-staple and short-staple fiber.

The Com4® wool system from Cognetex uses angled balloon rollers in the compacting

zone.

Ring Spinning

In recent years, the major development in ring spinning has been the introduction and

promotion of compact spinning. This technology promises yarns with a more consolidated structure,

which in turn can offer the following:

• less hairy yarns, which yield products with lower pilling propensity.

Additionally, lower hairiness is claimed to yield benefits in preparation and fabric formation –

including the possible elimination of sizing, singeing and waxing, which also can result in

improved print quality;

• stronger yarns, yielding fewer breaks during spinning and subsequent

processes;

• the possibility of utilizing lower twist (and hence, higher production

speeds) to achieve normal yarn strength; and

• softer yarns and fabrics.

Unfortunately, the benefits may be mutually exclusive: If softer yarns are required, then

lower twist and associated higher production would be required as well – but the hairiness benefits

may not be realized.

There were several new entries into this area with very different approaches to achieving a

more compact structure.

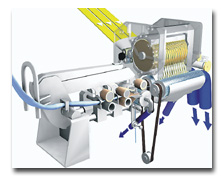

Cognetex S.p.A., Italy, exhibited its Com4® wool system, which is a long-staple adaptation

of the Rieter Com4 system. The major changes made accommodate much longer fibers, achieved by

utilizing angled balloon rollers as the front rollers in the compacting zone. The usual benefits

for compact yarn are claimed for this system; however, the major potential advantages are

associated with the impact of these benefits in subsequent processing. One particular claim is that

it may be possible to replace a normal folded warp yarn with a single Com4 wool yarn. An additional

cover mounted over the sieve roller, termed the “air conveyor,” may be used for certain fiber

types. This is recommended for use when processing cashmere, but it is claimed to be unnecessary

for wool. An additional feature of the exhibition machine was the incorporation of a Fani end-break

detection system plus roving stop motion.

Officine Gaudino S.p.A., Italy, also showed a long-staple spinning machine – the Model FP 03

– with mechanical compacting system (MCS). This is an unusual system because it does not require

the additional suction system that is needed in other compact spinning machines. The MCS system

consists of an additional smooth bottom front roller and an angled top roller. These rollers run at

a slightly slower speed than the front drafting rollers, and this “negative” draft, coupled with

the offset top roll, creates false twist, which compacts the drafted strand as it issues from the

compacting zone. This system can be incorporated into new machines or retrofitted to existing

machines, and can easily be added or taken off the spinning frame. Compared to that of its

competitors, the cost of the compact spinning option on this system is about 20 percent higher than

the standard machine, whereas an increase of 200 percent to 250 percent was given for other

manufacturers’ offerings.

A totally different approach to reducing the hairiness of ring-spun yarn was promoted by the

Woolmark Co., Australia. The Solospun system, which is retrofitted to existing machinery, was shown

at a previous ITMA. It uses a small additional multi-grooved plastic roller to deliberately spread

and separate the strand issuing from the drafting rollers into a series of smaller strands, each of

which is consolidated by twist running into the yarn formation zone. While this system is presently

restricted to long-staple fibers, there are initiatives to determine its applicability to

short-staple processing.

The only short-staple ring frame with compact spinning was the LR6AX exhibited by LMW. The

RoCoS compact spinning system, developed by Hans Stahlecker of Rotorcraft Maschinenfabrik,

Switzerland, is incorporated into LMW’s LR6AX short-staple ring-spinning frame. This magnetic

compacting system replaces the normal top front roller with a pair of smaller rollers between which

is a condenser. The condenser is held against the bottom front drafting roller by means of a

magnet. This is a seemingly simple approach to reducing the width of the strand of drafted fibers,

but it carries a cost penalty of two to two-and-one-half times the price of a standard machine. The

use of very small rollers could be a potential problem with regard to both fiber lapping and

serviceability.

It is interesting to note that, while under a totally different classification of spinning

technology, Fehrer AG, Austria, exhibited a DREF® 3000 friction spinning machine in which the

drafting system creating the core component utilized a compacting roller, which was of course the

forerunner of the Com4 system. This approach yields a stronger core and thus a higher tenacity in

the resultant yarn, according to Fehrer.

Officine Gaudino S.p.A. offers long-staple spinning systems.

Self-Twist Spinning

Self-twist spinning has been around since the 1970s with Repco, Selfil and a return to

SelTwist spinning. While the system never gained wide acceptance, it developed a niche market in

Europe for the production of high-bulk acrylic yarns. There were several in-house modifications

applied over the years. These were associated with trying to accommodate sliver feed rather than

roving, and facilitating easier relaxation of the yarns after spinning. These evolutionary concepts

all have been combined into one unit marketed by England-based Macart Spinning Systems as the S300.

In this system, slivers up to 12 grams per meter are fed through a pre-draft unit, which is placed

before the normal drafting unit, incorporated in the ST spinner. The main body of the ST spinner

looks identical to a Repco system – with one double apron drafting system for all strands and

reciprocating twisting rollers – but it has no built-in winding unit. The yarns instead are fed to

a continuous relaxation unit before being wound onto a take-up package. In an illustrated

installation, 15 S300 units were linked to one 60-spindle automatic winder.

Belgium-based Gilbos NV’s Air Twist system operates on the same self-twist principle, but in

this case, the process is applied to combining filament yarns to resemble a multifold twisted yarn.

The alternating twist is applied by means of detorque jets manufactured especially for Gilbos by

Heberlein Fiber Technology Inc., Switzerland, and the no-twist region is reinforced by an

intermingling process. The timing of the various functions and other processing parameters is

computer-controlled. The system has found use in the area of carpet yarns, and other areas of

application are being pursued.

The RoCoS magnetic compact spinning system is incorporated into LMW’s LR6AX short-staple

ring-spinning frame.

Rotor Spinning

The new Savio S.p.A. FlexiRotorS3000/Duo-Spinner is the first venture of this Italian

company into high-speed spinning utilizing the twin-disc bearing system that has been adopted by

other major players in this area. The politics behind the machine are almost as interesting as the

technology, as the new frame is based around a Suessen SC-S spinbox (as is Rieter’s), and the

machine is described as “essentially an updated R40.” Savio claims the following major improvements

for this machine:

• straighter threadline;

• two independent sides – the machine at the exhibition was shown spinning

Ne 30 using a 28-mm rotor at 150,000 revolutions per minute (rpm) on one side and Ne 6 using a

40-mm rotor at 85,000 rpm on the other side;

• up to 312 positions;

• flexible use of up to four doffing and piecing trolleys;

• electronic threadguide drive and electronic package building that enable

flexibility of package size and production of denser packages up to 6 kilograms;

• option to change from cylindrical to conical packages using an adapter;

and

• wireless communication and control using a handheld computer.

Fehrer exhibited its DREF® 3000 friction spinning machine at ITMA 2003.

Fasciated Yarn

Perhaps the displays arousing the greatest attention in the spinning area were both

associated with fasciated yarns. While the offerings are very different in their maturity and

product ranges, the underlying principles of yarn formation are the same.

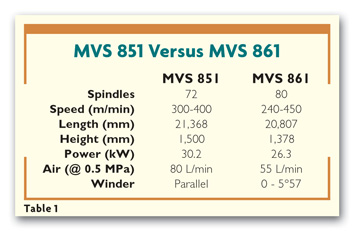

The Murata Vortex Spinner (MVS) 861 from Murata Machinery Ltd., Japan, represents a

significant refinement of its previous machine with regard to footprint and energy consumption

(See Table 1).

Junichi Murata (left), chairman, and Daisuke Murata, president and CEO, Murata Machinery

Ltd., pose in front of the MVS 861.

The immediately observable differences between the new machine and its forerunners are that

it seems to be more compact, and the lower profile is more user-friendly. Another feature that

stands out is the so-called “Tension Ruler,” which functions like a yarn accumulator between the

take-up roller and winding unit. This unit not only enables higher speeds and the potential of 5

degree 57 cones, but it also does so with reduced energy when compared to earlier machines.

Additional features include the MSC-F improved yarn clearer with foreign fiber detection, new

waxing unit with alarm system, and automatic waste fiber extracting system. The machine offers the

potential to spin core yarns including spandex, and effect yarns can be created by utilizing

appropriate feed yarns. The current restriction on the system is the range of yarn counts that can

be spun successfully. A significant market potential would be available if it were possible to

process coarser yarns; however, there were reports of major sales of this machine at the

exhibition.

The second machine using this technology, which aroused considerable interest at ITMA, was

the Uniplex™ system developed by Wilmington, Del.-based DuPont and manufactured by Schärer

Schweiter Mettler (SSM) AG, Switzerland. It was shown at the exhibition as a three-position unit.

This system is radically different from other staple-spinning systems because the feedstock is

filament yarn, which is drawn and stretch broken, and the resultant yarn structure is held together

by wrapper fibers produced by an air jet. The modularly constructed machine, which is available

with up to 48 positions (16 x 3 position modules), is capable of processing a wide range of

filament types and blends, according to the companies, and production speed is currently limited by

jet design to about 350 m/min; however, the other components will run up to 700 m/min.

Significant work has been carried out in optimizing the processing parameters to yield the

desired fiber length distribution without creating a discontinuity in the fiber flow. Data seem to

indicate that the fiber length produced is about 10 inches, and there is information comparing

Uniplex, ring and rotor yarn and fabric properties; however, each of these technologies utilizes a

different fiber length. At the present time, the machine must be regarded as a development unit for

rapid prototyping and/or niche markets, but this may change as larger machines and more independent

information about product properties become available.

The FlexiRotor S3000/Duo-Spinner from Savio uses a twin-disc bearing system.

Other Components

Several vendors exhibited sensing and detection units for mounting on spinning and winding

machines. Foreign fiber detection continues to arouse a lot of interest, and while there are

approaches applied earlier in processing (blowroom, draw frame), there also are several units for

the spinner/winder. Both Loepfe Brothers Ltd., Switzerland, and Barco, Belgium, had units

available. Barco claimed its units are able to sense the total length of a foreign fiber and not

just the portion on the yarn surface. This is achieved by utilizing multiple sensors, which were

shown mounted on an exit tube of a rotor-spinning machine.

The Loepfe YarnMaster Spectra+ digital system provides yarn clearing and quality control in

the winding department.

Yarn-setting systems also were shown. While units such as Germany-based Resch Maschinenbau

GmbH’s Sewimatic utilize steam to set the twist, the Fehrer Yarn Puncher® uses mechanical forces to

lock the structure together. This is suitable for consolidating coarse multi-ply yarns, combining

different yarns, attaching yarns to substrates and preventing peel backing in core-spun yarns.

New models of winding machines were shown along with developments in wet splicing for

two-fold yarns. There also were a large number of exhibitors showing machinery for creating fancy

yarns. The technologies range from ring frames, modifications to rotor frames and hollow spindle

systems to variations on very small tubular knitting machines. Machines for making twisted chenille

also were numerous.

Several companies exhibited twisting machines. A lot of interest was aroused by Italy-based

MTS Officine Meccaniche di Precisione S.p.A.’s system for “four for one” twisting. While there have

been previous disclosures of such systems, this seems to be the first commercially available system

in operation. The system obviously needs development and refinement, but it was intriguing to see

the concept brought to realization.

SSM and DuPont developed the Uniplex™ system, which uses filament yarn as

feedstock.

Spinning Evolution

There was very little that could be regarded as new in spinning technology at this year’s

ITMA, and some of the potential developments such as centrifugal spinning, present at the last

ITMA, seem to have floundered. It appeared there was a change in the manufacturing base for textile

machinery. For example, Turkish manufacturers offered several different machines.

In terms of evolution of the spinning industry, the following seems clear:

• There is a move to make machines more accessible and easier to operate,

while maintaining or improving product quality.

• The use of multiple motors controlled by integrated computer can lead to

a simplification of the process.

• While there is interest in compact spinning, its area of application may

be restricted, and the economics of the process are worrisome.

• The move by Savio into high-speed rotor spinning increases the

competition in this area in which the United States has, until recently, been a major customer.

• Vortex spinning continues to improve, and while the jet-spun yarn market

has been almost exclusively in the United States, recent sales of MVS machines indicate this will

change.

• There will be a market for machines creating products for niche areas.

Editor’s Note: William Oxenham, Ph.D., is associate dean for academic programs at North

Carolina State University’s department of textile & apparel technology & management,

Raleigh, N.C. Oxenham received a B.Sc. and a Ph.D. from the University of Leeds, England, and is

regarded as an international expert in the area of yarn manufacturing.

January 2004