R

ecent declines in cotton tags are relieving some of the cost pressure on hard-pressed

mills. Spot quotes have been hovering in the low 40s range — some 35 percent under

earlier-in-the-year peaks, and about 20 percent under the 50 cents-per-pound and higher prices that

prevailed last summer.

Some upward correction can’t be ruled out, but it’s likely to be small, with cotton remaining

relatively soft through the rest of the year. Behind the slippage: revised forecasts calling for

higher production — with gains now projected for both US and global output. US production is now

pegged at near 18 million bales — 2.2 percent above earlier estimates and 11 percent above last

year’s level.

A not-too-uncomfortable cost picture also seems to be shaping up in the man-made fiber

sector. True, some constructions like polyester and rayon are up — but only enough to offset

weakness in other areas. Upshot: Man-made price averages are pretty much where they were last year

at this time.

No Real Labor Headaches Either

Worker pay costs also remain pretty much under control. At latest report, average hourly

earnings in both the basic mill and textile mill product sectors were running less than 1 percent

above a year earlier. Equally important: Given estimated productivity gains over the same period,

unit labor costs have probably held steady or perhaps even declined a bit. Bottom line: Material

and labor costs haven’t been posing too much of a problem — and aren’t likely to do so in the

quarters immediately ahead.

The fact that all these costs haven’t risen — when added to the recent bottoming-out in

demand and prices — helps explain how textiles (at least on an overall basis) have remained in the

black.

The latest Census Bureau profit numbers are on the anemic side — only about $110 million on

an after-tax basis was reported in the first quarter 2004. That’s nowhere near the relatively

robust levels prevailing just a few years ago. Nevertheless, these figures do represent a positive

sign — helping to offset the import and other problems that have been plaguing the industry in

recent years.

A Near-Term Look Ahead

The remainder of 2004 doesn’t seem to be shaping up all that badly. There are a few negative

factors that could affect textile and apparel demand — namely high energy costs plus the

diminishing stimulus coming from past tax cuts and home refinancings. On the latter score, such

refinancings are expected to drop 70 percent from the second to the fourth quarters.

While these developments will slow down economic growth, they won’t stop it completely

because there’s still an impressive array of plus factors operating. These include extremely high

consumer confidence; improving personal income (rising at a 6-percent rate in the second quarter as

income and job rates continue to inch up); and current relatively low interest rates, which,

despite recent increases, remain well under levels of a few years back.

It’s a scenario that suggests 3-percent-or-so gross domestic product annual rates of gain for

both the third and fourth quarters — nothing spectacular, but probably enough to keep textile and

apparel buying at fairly firm levels.

Specific Projections

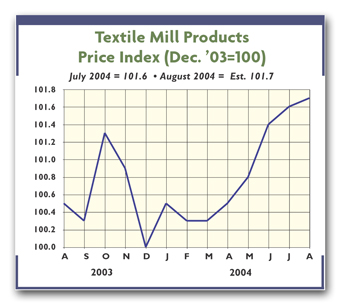

Mills are likely to fare considerably better than they did last year. Given current trends,

overall 2004 textile mill output isn’t likely to fall more than 2 to 3 percent under the 2003

level. Hardly nirvana, but a heck of a lot better than the big 7-percent decline reported last

year.

Moreover, compare

Textile World

’s second-half 2004 projections to actual second-half 2003 results, and the decline in mill

output pretty much disappears. Beyond year end, however, the picture becomes a little more fuzzy.

For one, the ending of import quotas in January is bound to have some impact. But where and to what

extent remain big questions.

Finally, there are general business conditions that traditionally become more iffy the

farther one goes into the future. Upshot: At this stage of the game, early 2005 textile mill

forecasts could be prone to considerable error. Nevertheless, a continuation of the current

flattening in demand and relatively unchanged prices is predicted — a not-all-that-downbeat

forecast given the industry’s recent declines and all the uncertainties looming ahead.

September 2004