Sometimes it is not easy to understand global markets. On the one side, people from Main Street are complaining about never-ending rising costs in everyday life. On the other side, the relevant markets are complaining that prices are too low. At the moment, this particularly is the case for crude oil and therefore the stuff to fuel heaters around the globe. Hmm.

It is understandable that oil producing countries — dependable on this precious raw material — are complaining about the current low prices, while people from Main Street are more happy than ever about purchasing cheap fuel. Experts, fortunetellers and (probably) wise men are asking the question: Why all this? And what about another raw material, cotton? It its latest report, the International Cotton Advisory Committee (ICAC) wrote that low cotton prices could be a long-term problem? Why?

Production Surplus

The Rupp Report has informed its readers more recently about volatile cotton prices. Since last spring when they were above 90 cents per pound (cents/lb), international cotton prices have fallen to under 70 cents/lb in December. To counter low prices, cotton consumption is forecast to increase by 925,000 tons to 24.4 million tons in 2014-15, after falling 1 percent to 23.5 million tons in 2013-14. “Lower international and domestic prices are expected to bolster consumption in China by 6 percent to just under eight million tons,” said a recent press release from the ICAI. “The contraction in China’s demand for cotton yarn imports is expected to cause India’s cotton consumption growth to slow to 4 percent reaching 5.3 million tons. This is down from 5 percent in 2013/14 and 14 percent in 2012/13 when demand for Indian yarn exports was much stronger.

“Despite expected growth in cotton consumption this season, a world production surplus of 1.7 million tons is still anticipated,” continued the ICAC press release. “This will bring 2014/15 world ending stocks to 21.3 million tons, up 9 percent from 2013/14 and up 147 percent from 2009/10 when stocks reached a 15-year low. The average world stock-to-use ratio in the 25 years before China began its reserve policy in 2011 was 47 percent. However, the volume of ending stocks would represent 87 percent of the projected consumption in 2014/15, and is weighing heavily on prices this season. Even assuming reasonably lower production and higher consumption in the next few years, it will take several seasons for the significant volume of stocks to reach a more sustainable level, and low cotton prices are likely to persist while the market adjusts.”

Yes, But …

The ICAC report continues: “However, world production is estimated down 1 percent to 26.1 million tons due to reductions in China and the Southern Hemisphere. As a result of the contraction in area caused by changes in its cotton policy and falling domestic cotton prices, China’s cotton production is projected down 7 percent to 6.4 million tons. In response to low world prices, Brazil’s production is forecast to fall by 10 percent to 1.5 million tons. Meanwhile, low prices and a significant drought are expected to reduce Australia’s production by 47 percent to 470,000 tons. India’s production is expected to remain stable at 6.8 million tons due to less favorable monsoon weather this season despite an expansion in the cotton area by 5 percent to 12.3 million hectares. However, its production will surpass China’s by over 300,000 tons, making it the largest cotton producer in 2014/15. Production in the United States is looking to rebound 23 percent to 3.5 million tons, partially offsetting declines in the other major producing countries.

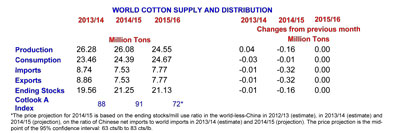

How is the global situation? Have a look at the table:

United Kingdom-based Plexus Cotton Ltd., one of The Rupp Report’s preferable sources for cotton news, said in its Market Report dated January 8, 2015: “NY futures continued to trade sideways last week, with the March contract edging up 29 points to close at 60.56 cents. So far, around 7.6 million bales have been freed from the loan, which means that including beginning stocks of 2.5 million bales there are now 10.1 million bales outside the government loan system. U.S. export sales ended the year on a firm note, as 158,800 running bales of Upland and Pima cotton were sold during the week of December 26 to January 1. China was once again the major force in the market with 78,500 running bales, followed by Vietnam with 34,700 bales. Total commitments for the current marketing year now amount to 7.9 million statistical bales, whereof 2.6 million bales have so far been exported.”

It’s The Market. What Else?

Probably the best explanation for all these ups and downs is quite simple: It’s the market, in most cases, that dictates the price. Today, when OPEC is weak and some countries are able to drill or use fracking to obtain oil for much less money than other countries, then they want to have the advantage of more competitive prices.

The January 8 Plexus Market Report states: … the magnitude of this drop in energy prices — which includes other energy sources such as natural gas and coal — is mindboggling! When crude oil was trading at US$100/barrel, the global annual production value amounted to around US$3.4 trillion dollars, which means that at US$50/barrel, producers are losing about US$1.7 trillion dollars in revenue per annum, while users are saving that same amount. About half of global oil production crosses borders and therefore the trade value would drop by around US$850 billion dollars a year if the price of crude were to remain near current levels. Countries like the U.S. and China are both big producers as well as importers, which means that certain sectors of the economy will take a hit.”

And if the Chinese are sitting on some 10 million plus metric tons of cotton, and stop buying, the result is clear as well. Plexus estimates that by the end of the season, stocks held outside of China will rise by 20 percent, to nearly 9 million tons, the second largest volume (after 2004-05) in the last 30 years. Much of this increase will be held by producing countries, and likely will cause world exports to fall 15 percent to 7.5 million tons.

However, having US$1.7 trillion dollars in the pocket of the global consumers is not a bad thing. Let’s hope that this money will be spent this year, maybe at the ITMA Europe in Milano; or at the very least, in buying more cotton products!

January 13, 2015