TW Special Report

The automotive market is undergoing a period of great change. Global demand for light vehicles is increasing, but at slower rates than seen in previous years, and this is resulting in ever greater competition between carmakers. At the same time, the technological capabilities that can be offered are advancing rapidly. Areas such as autonomous driving, connectivity, interior comfort and the customization of vehicles in line with personal taste are becoming key ways that manufacturers can differentiate themselves and win market share. Indeed, automotive supplier Lear, recently unveiled a new biometric ‘smart’ seat, that tracks a driver’s health indicators.1

These trends are having a knock-on effect for suppliers. For original equipment manufacturers (OEMs), being able to satisfy diverse consumer preferences is now considered more of a success factor than getting a vehicle to production faster than the competition. Across the automotive supply chain — and especially for those involved in the production of car seats and interiors — a growing emphasis on interior styling and luxury components has created new challenges that are further compounded by increasing cost pressures.

Although news coverage about the automotive industry tends to focus on such innovations as ‘driverless’ cars and ‘intelligent’ vehicles, one of the most far-reaching changes occurring is this trend towards personalization: how automotive manufacturers are managing to make mass-produced items unique. Not only are manufacturers increasing the number of models they are offering but also the options available to a consumer per model. The Vauxhall Adam is a case in point: consumers can have more than 1 million different combinations when they order the car.2

To cope with these challenges, suppliers will need to re-evaluate and improve their production processes. Within this context, the integration of smart solutions and services, and the replacement of production tools that are incompatible with connected factory concepts, will be vital. The combination of Software as a Service (SaaS) with the cloud is already opening up new horizons for innovation. Factories remain at the heart of the value chain. But Industry 4.0 is revolutionizing mass production, allowing more and more large-scale, personalized — and profitable — manufacturing, with greater quality and no added costs or delays.

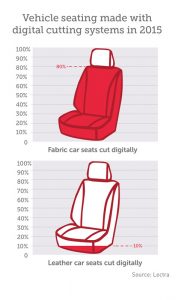

As customer expectations reach new levels, it is especially important that suppliers in the automotive cutting value chain ramp up their transformation, adopting the technologies and services shaping Industry 4.0. For years, OEMs and suppliers alike have used foam and frames to develop patterns for producing seat covers in material or leather. The automotive industry was among the first to use sophisticated 3D computer-aided design (CAD) programs for the design and development of vehicles. But it has taken time for this technology to be used extensively for seat covers. Although 80 percent of fabric seating and interiors are currently cut digitally, only 10 percent of leather seats are cut using this method.3 The majority of suppliers of automotive leather seating still rely heavily on manual cutting equipment, such as die and roller presses.

To gain the agility and flexibility to remain relevant and competitive in a market that is dictating more change, variants, and faster reaction times, close cooperation between OEMs and suppliers is necessary. For if even one aspect of the process fails to provide sufficient flexibility, speed to market and consistent quality, then the entire chain will be impacted.

In such a complicated and fast-moving market, only the most adaptable and innovative companies will succeed. The solutions that form part of the Industry 4.0 framework will help give suppliers the capacity to adapt and thrive in this new environment.

Introduction

The ability to configure the most flexible, efficient and standardized mega-platform has been a key evolutionary stage of mass car production. These global manufacturing systems have helped to generate enormous economies of scale, reduce development costs, improve times to market, and have allowed multiple cars to be built on one line.

However, as consumer demand in the automotive sector changes and the number of models and variants produced increases rapidly, these mega-platforms will have to become ever more sophisticated and flexible.

The digitalization and automation of end-to-end (E2E) manufacturing processes offers real and immediate benefits to automotive suppliers, allowing them to absorb variability in demand and meet new requirements faster. This white paper will review the chief trends that are impacting these companies, and the process and technology improvements that will enable them to succeed in the changing market.

Main Trends Impacting Automotive Suppliers

Automotive suppliers must create products that satisfy the end-user demand for novelty and personalization while extracting the most possible value from their materials. Flexibility will be key to their success — a factor with strong implications in terms of their entire seating and interior development processes. Below we look at the three main trends impacting automotive suppliers.

1. Evolving Consumer Tastes And Behavior

Despite ongoing price sensitivity, consumers have come to expect high-end features in their vehicles. Recent trends in business models, such as the ‘freemium’ model in telecommunications, have contributed to consumer expectations of getting more for less. Materials and features that in the past would have been rolled out in premium segment cars and eventually trickled down to the volume segments are now being installed as standard on mass-market models in the medium and economy car segments. However, customers don’t just want luxury for less. They also want a unique product that showcases their identity and fulfills their needs.

In 2015, 114 new vehicle models were launched, up from 73 in 2011. That number is expected to increase to 137 in 2019, representing an 87 percent increase over the past eight years.4

As a result, the industry is seeing traditional car segments, such as hatchbacks and sedans, fragmenting into an increasing number of niches. Manufacturers are also offering more ways to customize a vehicle in order to give the customer the impression of having a personalized product rather than a mass-produced one. With models like the Fiat 500 or BMW MINI, buyers can entirely customize their cars.

2. Interiors As Differentiators

2. Interiors As Differentiators

“The interior experience is how you’ll differentiate the car and satisfy consumers.”5 — Dave Muyres, Executive Director, Global Product Innovation for Johnson Controls International (JCI)

The increase in new vehicle models and re-designs also brings the growing importance of interiors into focus for suppliers, as shorter vehicle life cycles mean that these must be refreshed more frequently. Consumers place a high importance on interiors as well.

According to the 2016 edition of the JD Powers Initial Quality Survey, almost a fifth of new vehicle shoppers decided against a purchase due to the quality of the interior.6

This trend for personalized luxury is only likely to accelerate. With a forecast that at least 80 percent of the task of driving will be automated by the year 2025, drivers will have more time for doing something other than driving. As interiors become increasingly important as differentiators, we will see more manufacturers implementing changes such as swivel chairs, deep-form seating and high-tech textiles. Indeed, just adding ventilated seats can have a significant impact on customer satisfaction.6

3. An Expanding Choice Of Materials

Changes are also becoming evident in the materials used to build interiors. Sustainable textiles are already being incorporated into cars such as the BMW i3, which has seat covers made entirely of recycled fibers. Advances in available color choices, fabric combinations, texture, and resistance to UV rays have enabled the use of lightweight composites both inside and outside the vehicle.

The global automotive composite materials market will reach $11.6 billion by 2020, almost

double the market value in 2015.7

Smart textiles embedded with digital components will start to replace heavier components in the vehicle, such as weight sensors. Leather is also not immune to this phenomenon. Leather demand in vehicles is increasing, but so too is the variety of leathers; comfort, durability, color, and textures are all evolving, meaning that again more choices are available to the consumer.

This trend is only going to accelerate as automakers focus on an increasing number of limited and low volume models, resulting in an ever greater need for flexibility for suppliers.

Main Challenges Facing Automotive Suppliers

Main Challenges Facing Automotive Suppliers

So what exactly does this changing automotive landscape and the evolving expectations of consumers mean for the automotive supply chain?

We have identified three major challenges.

1. Pressure To Reduce Costs

As OEMs face increasing cost pressure from end-buyers, and rising manufacturing costs, they pass some of this burden on to Tier 1 suppliers by imposing strict annual cost-reduction programs, obliging them to absorb inflation, engineering and design costs. This pressure is in turn passed on to Tier 2 and Tier 3 suppliers.

The top cost drivers in the production and sale of an automobile are raw materials (47 percent) and labor (21 percent).8

Fluctuations and increases in raw material costs greatly affect automakers. For suppliers, frequent design changes and customization mean more variety in the number and types of pieces required.

This may result in a lower volume of material orders, which typically means higher purchasing costs per unit.

Rising wages in emerging economies, particularly China, are contributing to increased operational costs. China’s labor costs in the manufacturing sector increased 80 percent between 2010 and 2015.9

Suppliers are also feeling the cost pressure through the automakers’ preference that they locate production facilities and R&D in emerging markets so that they will be closer to assembly plants. With rapidly rising local wages and decreasing availability of skilled talent, this not only poses a cost issue but adds a layer of complexity for suppliers to manage.

2. Increasingly Fierce Competition Among Suppliers

Suppliers also feel pressured by OEM scrutiny of material consumption. In order to ensure that they are getting the best price possible, OEMs require transparency on order data and figures in their agreements with suppliers. This has resulted in pressure on seat suppliers to reduce their material consumption as it represents the largest percentage of the cost, representing, on average, 70 percent of the trim cover. At the same time, material utilization has become more complex due to design and customization trends.

Raw material consumption is so important that some Tier 1 companies are moving to acquire fabric and leather producers in order to increase their control of the value chain.

To meet increasing demands for lower prices while innovating with new textiles, optimizing material consumption is essential and one of the best ways to do this is at the design stage.

3. Greater Production Complexity To Manage

3. Greater Production Complexity To Manage

Consumers want models to be renewed more often and with more variety so they have greater choice. This requires the development and production cycle for car seats and interiors to be much more agile than is currently the case. Complexity is also leading some OEMs to relinquish responsibilities in development, sourcing, and planning. The role of automotive suppliers is expanding beyond being just parts providers.

Carmakers are relying on suppliers to provide them with innovative products that will help differentiate their offer. With the increase in new model launches and more complex designs, OEMs are becoming increasingly dependent on their interior parts suppliers to help them meet this challenge, and are incorporating them into the production development and innovation process.

Suppliers are under increasing pressure to demonstrate that they can deliver the required design, quality, service, and price that can allow an OEM to differentiate their brand.

Competing In A Fast-Moving Environment: Industry 4.0

Competing In A Fast-Moving Environment: Industry 4.0

To address these challenges, companies within the automotive cutting value chain will have to undergo a transformation to a new industrial model based on digitalization, connectivity and automation.

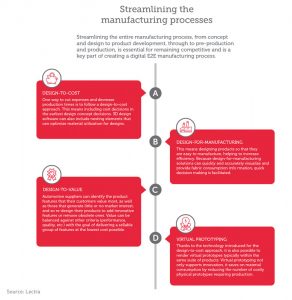

Disruptive digital technologies are emerging that are able to help progressive OEMs and suppliers cope with new market demands. 3D software packages can develop the flat patterns for seat covers directly from 3D models without the need for the frame and foam component to be completed first. This allows OEMs and suppliers to develop the seat cover or material covering for an interior part concurrently with the prototyping of the frame, foam, or plastic components.

Because the digital value chain is based on CAD files and virtual prototyping, with pattern files that can be put into production in hours, patterns can be created directly from 3D Standard Trim Outline (STO) models. They can then be fine-tuned for production, visually simulated for aesthetics, and cut within a few hours to determine the model that will make an interior distinctive to end-users. As part of the process, automated nesting software can optimize material utilization while computer numeric control (CNC) cutting heads can ensure patterns are cut with very high accuracy.

Because the digital value chain is based on CAD files and virtual prototyping, with pattern files that can be put into production in hours, patterns can be created directly from 3D Standard Trim Outline (STO) models. They can then be fine-tuned for production, visually simulated for aesthetics, and cut within a few hours to determine the model that will make an interior distinctive to end-users. As part of the process, automated nesting software can optimize material utilization while computer numeric control (CNC) cutting heads can ensure patterns are cut with very high accuracy.

Although the number of fabric seats cut using an automated solution has risen dramatically in the last 15 years, the leather seat market has lagged behind, due partly to the specific constraints of working with leather. Indeed, more than 90 percent of hides that are cut for the automotive industry are still cut using manual die presses.10 Now, however, technology is sufficiently advanced that the automated cutting of leather is also a compelling option. Advances in cloud services will allow further optimization of cutting room performance for each type of manufacturing and material.

Taking the step towards Industry 4.0 with Lectra

France’s Faurecia, one of the world’s leading automotive OEMs, is betting on advanced manufacturing for its operations. In December 2016, its Automotive Seating group renewed a global agreement that makes Lectra the sole supplier of high-ply fabric-cutting solutions to Faurecia. Standardization of the highest-performance cutting system available on the market is one of the key benefits of this longterm partnership.

With 10 years’ experience in the industrial Internet of Things, combined with its expertise in software solutions to automate and optimize the cutting chain, Lectra is in a formidable position to help customers step into this new industrial age.

“More than ever, we have key challenges in terms of flexibility, agility and productivity – producing more while reducing costs. Our fabric and leather cutting processes have become strategic in reaching these goals. Faurecia’s ’digital enterprise’ project is set to transform working practices in virtually every aspect of our organization, and the cutting room, with smart automation and predictive maintenance, is no exception.” – Jean-Luc Tété, Vice-President Comfort & Trim division, Faurecia Automotive Seating.11

Going Digital: The 5 Key Advantages Of A Digital Automotive Cutting Value Chain

Going Digital: The 5 Key Advantages Of A Digital Automotive Cutting Value Chain

1. Material And Cost Savings

Using a design-to-cost approach gives designers the ability to anticipate early, and ultimately control, material cost consumption. But when design ideas are explored and reworked, material consumption is usually only roughly estimated.

By employing modern 3D design software that creates flat patterns, suppliers can accurately estimate material consumption. Working early designs can then be adjusted to fit the target cost. This process allows patterns and cost to be determined working from STO files before foam and frames are delivered. In fact, it reverses the normal development cycle so the ideal cover can be designed, and then the foam and frame can be engineered to fit the cover.

Designers are able to study the material characteristics to detect possible quality issues in advance of manufacturing. These smart software applications can actually help designers determine the most appropriate position for seams to reduce stress and compression to make better fitting and longer lasting seat covers.

Designers can often find material savings as high as 15 percent by reworking the design of seats and their associated patterns, as well as detecting possible quality and build issues at the development stage of an interior.12

Meanwhile, at the cutting stage, nesting software can make sure there is optimal utilization of the fabric or leather hide. This can result in both material and time savings as manual nesting can be a complicated and time-consuming process.

Optimizing the industrial process also means ensuring that production teams are seamlessly provided with accurate technical specifications. A software solution will automatically convert pattern data into sewing plans and assembly instructions. It will also generate all the technical specifications needed for manufacturing, such as bills of material (BOMs), bills of labor (BOLs) and nesting instructions. Quickly delivering such a package to the cutting room not only speeds up the industrialization process, but since all related information is automatically updated when there are any modifications to pattern pieces, it also reduces costly mistakes.

2. Improved Cutting Quality

A well controlled, well maintained CNC system can provide an extremely high level of cut quality, in addition to generating up to 5 percent in material savings.12 Such a system naturally reduces the waste of unnecessary recuts, but another factor to consider is that a high-quality cutter also means less buffer space required around pieces. Hundreds of thousands of dollars per year can be saved by reducing the gap between pieces by just 3 millimeters.

One of the advantages of an automated process is that it can offer consistent quality. This is something that is especially difficult to achieve in a leather cutting room, for example, which might have hundreds of workers evaluating different hides and preparing dies. However, software can optimize the utilization of the patterns on the hide, while at the same time working to optimize the balance of cut parts required for an order, which is a very difficult job to do manually. The accuracy and precision of CNC cutting heads can be very high, achieving accuracy below +/- 1 mm quite easily, even when cutting with no buffer between patterns.

Meanwhile, to avoid costly errors in the cutting room, suppliers should choose cutting solutions that incorporate anti-error functions, such as blade breakage detection, incorrect drill diameter detection, and corrupted or incomplete cutting files. Blade breakage detection is important because if the operator does not notice the breakage, there is a risk that the conveyor may advance to an uncut marker with potential consequences of loss of time and fabric and risk of head damage. To avoid the risk that an entire batch is rejected, incorrect drill diameter detection is essential. It automatically checks the diameter according to defined marker parameters at every spread and at every tool change.

Belgian automotive supplier ECA recently moved from die presses to an automated leather cutting approach, leading to an immediate efficiency improvement of 10 percent.12

3. Greater Flexibility

A one-size-fits-all approach that doesn’t take into account variations in market size and growth, as well as the diversity of consumer needs, hinders successful growth strategies. Automotive companies must have the ability to adapt their products specifically for different regions, markets and segments. The increasing consumer demand for customization necessitates the ability to provide a greater variety of parts, and produce smaller orders with more frequent deliveries.

Flexibility in operations and processes is necessary to anticipate market changes, keep up with rapidly evolving consumer needs, and adjust production as necessary. The supply chain must also be able to adapt its production processes to support shorter development cycles and the potential for last-minute changes. In order to achieve these objectives, it is necessary to create a digitalized value chain that uses flexible tools and processes based on real-time information.

Using the most innovative technology gives the supply chain the ability to handle the varying demands of customers and to relay the required data across the entire value chain instantaneously. In a context where the ability to accept last-minute orders or changes are a key factor for competitiveness, agility is a must.

Italian tannery and automotive leather interiors supplier Mario Levi implemented automated cutting, subsequently reporting a 20-percent increase in productivity and 3-4-percent increase in hide yield.13

4. Faster Program Start-Up

As mentioned, OEMs and suppliers have traditionally developed seat covers using foam and frames as ‘mannequins’, over which they would drape material to develop patterns. The development of production patterns directly from 3D STO models can greatly increase start-up times time, as engineers no longer have to wait for the foam and frame prototypes before they can begin the design process. According to Lectra, this can save between 2 to 4 weeks, depending on the complexity of the design.

Case Study: Adient

“Being a flexible supplier means we can more easily win contracts. With the fabric-cutting solutions we have today, we can easily go through all of the different options that weren’t available 20 years ago.” — Willy van Looy, Global Director, Advanced Manufacturing Engineering, Cut & Sew Operations, Adient.

To improve its competitive position in a changing market and win new business, automotive seating company Adient — formerly part of Johnson Controls — required a solution that would allow the company to:

— Deliver a wider variety of options

— Meet tight production schedules

— Reduce fabric costs

Automation

Adient’s executive team decided to undertake a highly strategic project to transform its fabric cutting value chain by replacing all the die presses in the company’s European plants with automated CNC cutting equipment.

As early adopters of VectorAuto, Adient was already familiar with the performance and productivity of Lectra’s high-ply, automotive fabric-cutting equipment. To obtain an even higher level of performance, Adient decided to also equip its cutting rooms with VectorAuto iX9®, Lectra’s latest top of-the-line fabric cutting solution. The iX9 expands upon the capabilities of the previous generation; its high-performance cutting head and the ability to cut during conveyer advance guarantee even higher throughput. Lean-compliant poka yoke and visual management systems, such as automatic drill diameter identification and video-assisted spread position control, further maximize production output and efficiency.

Partnership

As well as introducing state-of-the-art equipment, Adient was also seeking a flexible partner that would understand the company’s unique challenges. “A transformation project of this size requires a significant investment in time and money,” recalls Willy van Looy. “We needed a stable partner that we knew would be with us over the long term and would have the financial capability to scale up the production when needed. The open and transparent collaboration between our teams fostered a sharing of expertise, experience, and best practices that was instrumental in the success of this project.”

Responsiveness

With the help of Lectra’s expertise and technology, Adient now has a more agile cutting platform that helps it to maintain its position as a market leader and supports its worldwide business growth strategy. As the complexity of car seat manufacturing continues to increase, with the introduction of new materials and material embellishments, Adient can efficiently respond to customer needs and requests, change quickly from one platform to another, manage product change processes more accurately and easily adapt to customers’ planning processes.

Meanwhile, the use of CNC systems can also decrease program start-up times. Die cavities can take anywhere from 6 to 14 weeks to produce and deliver, as they often have to be reworked until they are correct. The cost of retooling is also high, with a new set of dies costing upwards of €1m to produce.14 Using an automated cutting process can significantly reduce production time, increase efficiency, and reduce retooling costs.

5. Reduced Risk To Operators

A cutting room can be staffed by hundreds of people. Each operator working on a manual press cutting table lifts an average of 1.5 to 2 tons of steel per day, often while leaning over plastic die boards more than 3 meters wide. Reaching the center of a hide with a heavy cavity in hand is no easy feat. With an automated leather cutter, lifting dies is no longer necessary. What’s more, an integrated conveyor system simplifies hide loading and offloading. This can help reduce the risk of injury to operators in the cutting room, providing a safer working environment.

Conclusion

The pace of change in the automotive industry will continue unabated, at least for the foreseeable future. Those suppliers who are unwilling or unable to change will not survive. Those who respond with agility and innovation stand to profit with larger deals as the current market grows.

To ensure a place in the automotive industry of tomorrow, suppliers must evaluate their longterm strategic priorities. The ability to streamline processes, optimize performance and plan for production flexibility is essential as cost pressure, focus on fabric innovation and consumption, and increased competition between suppliers will remain firmly embedded features in the automotive supplier’s landscape.

With a digitalized automotive cutting value chain, suppliers will best equip themselves to navigate the future landscape in which product development time takes mere weeks, design options are explored virtually in 3D to eliminate production of multiple prototypes, and quality remains consistently high.

References:

1 Automotive News, 21 November 2015, ‘Lear’s ‘smart’ bid to revolutionize the car seat.’ Available at: http://www.autonews.com/article/20151221/OEM06/312219938/lears-smart-bid-to-revolutionize-the-car-seat. Accessed January 2017.

2 Vauxhall Press Room, 7 November 2012, ‘Vauxhall’s Adam Breaks Mould – Over a Million Times’. Available at: http://media.vauxhall.co.uk/media/gb/en/vauxhall/news.detail.html/content/Pages/news/gb/en/2012/vauxhall/07_11_vauxhall_adam_mould.html. Accessed January 2017.

3 Lectra Internal Data. Date of Preparation January 2017.

4 IHS Markit, 2016, ‘Foresight Reigns …Protecting Margins Amid Plateauing Markets, Stiffer Regulations and Shifting Supply Chains.’ Accessed January 2017.

5 Wards Auto, 21 May 2014, ‘Autonomous Vehicle Interiors Offer Opportunities for Differentiation, Innovation.’ Available at: http://wardsauto.com/suppliers/autonomous-vehicle-interiors-offer-opportunitiesdifferentiation-innovation. Accessed January 2017

6 JD Power, 25 August 2016, ‘Seats Critical to Vehicle Experience, Customer Loyalty, J.D. Power Study Finds.’ Available at: http://www.jdpower.com/press-releases/jd-power-2016-seat-quality-and-satisfactionstudy. Accessed January 2017.

7 Markets and Markets, October 2016, ‘Composite Materials Market for Automotive by Material Type.’ Available at: http://www.marketsandmarkets.com/Market-Reports/automotive-composite-materialsmarket-6114278.html. Accessed January 2017.

8 Market Realist, 5 Feb 2015, ‘Raw materials – the biggest cost driver in the auto industry.’ Available at: http://marketrealist.com/2015/02/raw-materials-biggest-cost-driver-auto-industry/. Accessed January 2017.

9 Trading Economics, January 2017, ‘China Average Yearly Wages In Manufacturing.’ Available at: http://www.tradingeconomics.com/china/wages-in-manufacturing. Accessed January 2017.

10 Lectra Internal Data. Date of Preparation January 2017.

11 Faurecia, ‘The digital enterprise initiative.’ Available at: http://www.faurecia.com/en/about-us/partner-of-choice/digital-enterprise-initiative. Accessed April 2017.

12 Lectra Internal Data. Date of Preparation January 2017.

13 Lectra Internal Data. Date of Preparation January 2017.

14 Lectra Internal Data. Date of Preparation January 2017.

Source: Lectra