A look at the latest software developments in advanced planning systems on display at ITMA 2023.

A look at the latest software developments in advanced planning systems on display at ITMA 2023.

By Dr. Kristin A. Thoney-Barletta

ITMA 2023 featured a wide range of software technologies from companies located throughout the world. Software ran the gamut, but this article focuses primarily on advanced planning and scheduling systems (APS) showcased at ITMA 2023. In contrast to an ITMA review written after the 2019 ITMA show (see “Supply Chain Management Software For Textile Networks,” TW, September/October 2020) that provided an overview of 10 APS systems, this article compares the features of APS systems featured at ITMA 2023, presents developments in those systems over the past two to three years, and provides information on what company representatives feel are the key differentiating factors of their software.

Companies included in this article appeared in ITMA’s Index of Products in category 15.3.2 — “Software systems for Supply Chain Management (SCM) in textile networks” and/or 15.3.3, “Software for Enterprise resource Planning [ERP], Product Lifecycle Management [PLM], and Production Planning and Scheduling [PPS].”

Details Of APS Software Packages

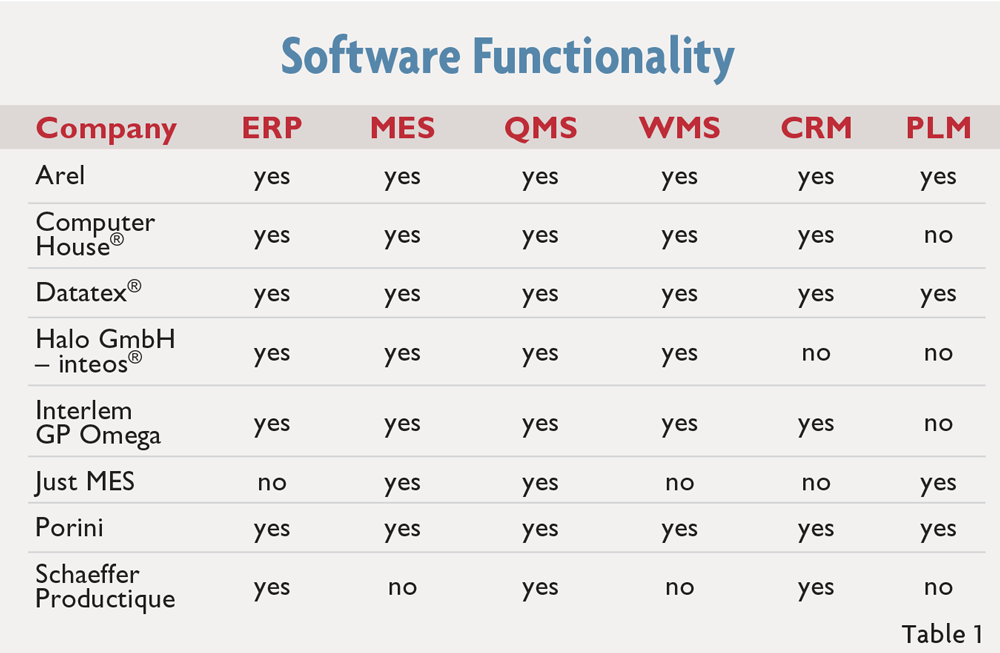

All the software packages discussed here offer the ability to provide detailed capacity planning, and also can generate detailed production schedules to help meet customer due dates and minimize costs over one or more factories. Most of the company representatives who were interviewed considered their company’s software to be an ERP system, a Manufacturing Execution System (MES), a Quality Management System (QMS), a Warehouse Management System (WMS), and a Customer Relationship Management (CRM) system (See Table 1). Only some of the representatives considered the software to be a PLM system. This is not surprising, since PLM systems are designed to manage product development, while APS systems focus on managing production. Only Italy-based Retelit S.p.A., the developer of Just MES manufacturing execution system, did not consider its software to be an ERP system.

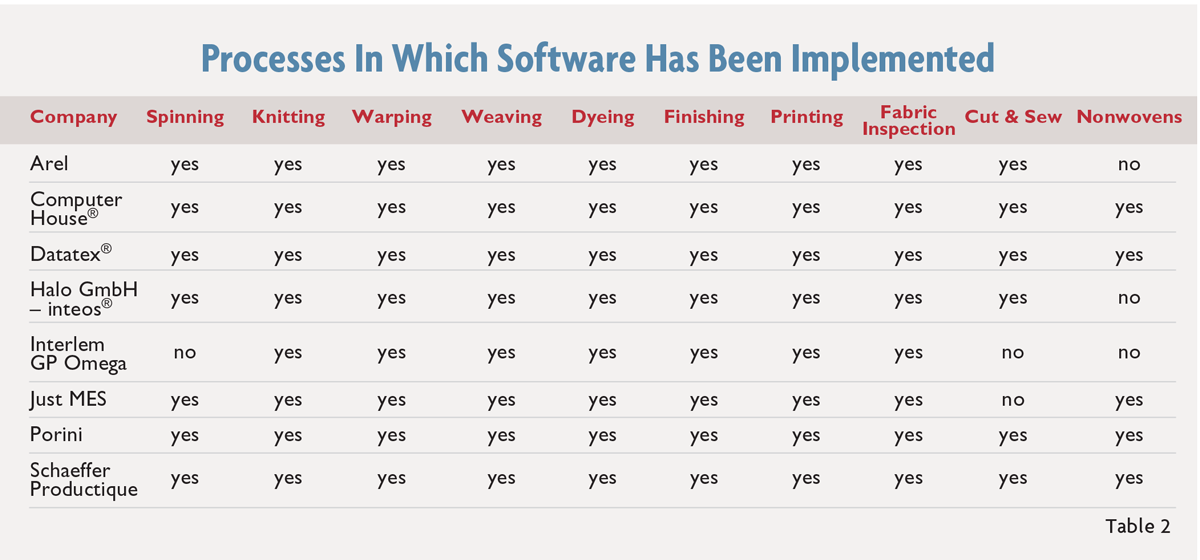

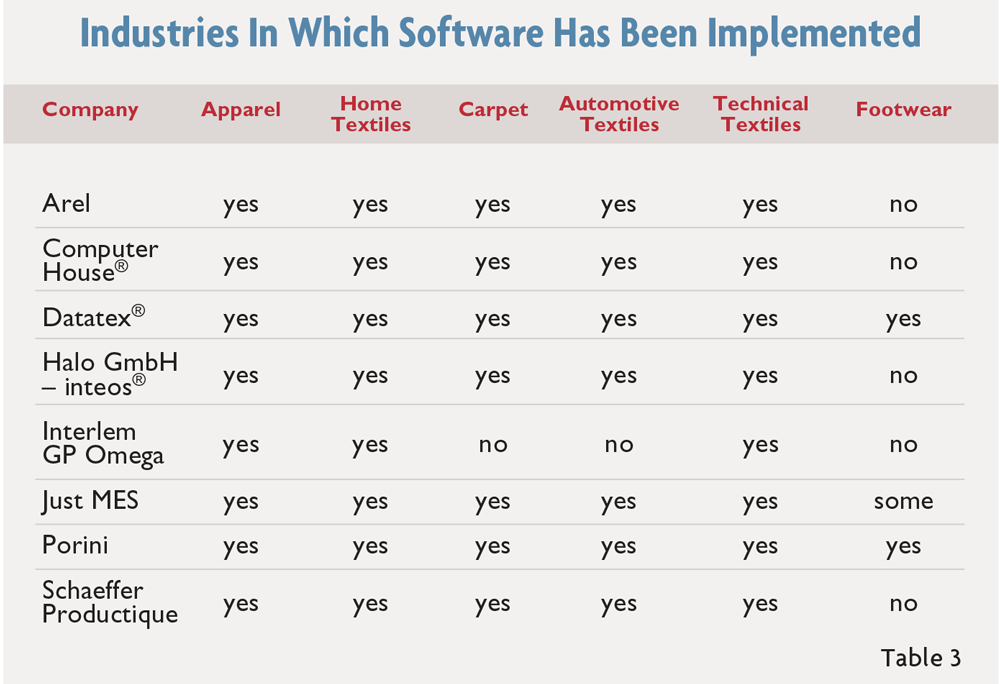

Company representatives also were asked about the types of textiles processes and industries in which their software package is implemented. Table 2 displays the process results, while Table 3 reveals the findings regarding the industries. The tables show that all of the software systems have been implemented in a wide range of processes and industries. Software was least commonly implemented in nonwovens processes and footwear.

To provide information about system capability updates since the article from ITMA 2019 was published, the company representatives were asked what changes and additions were incorporated into their software over the past two to three years. Company representatives were also asked what differentiates their software from that of their competitors and what their customers tell them about why they chose their software over alternatives. The answers to these questions follow. The sections are grouped by the primary regions in which the software is implemented to allow the reader to focus on the regions in which they are most interested in APS software implementation.

Austria, Germany, Switzerland

Halo GmbH – inteos®, Germany: Klaus Kreutzberg of Kreutzberg Consulting, a Halo Business Partner, said that new features of inteos include the ability to control machines with mobile devices. A primary differentiator of inteos compared to its competitors is that inteos can track all materials used and can therefore sup-port the identification of an optimized reuse of the raw material. Kreutzberg says that customers choose inteos because Halo knows how a textile company thinks, helps to analyze its customer’s process and can customize its software if required.

France And Other Parts Of Europe

Schaeffer Productique, France: Olivier Heitz, technical manager, said that the latest version of Schaeffer Productique is fully Web-based, there is now workflow to manage fashion, and artificial intelligence has been added into the ability to change the scheduling rules. Key company differentiators include Schaeffer Productique’s ability to communicate about textiles and that the software is already used in textile factories. Heitz said that customers choose Schaeffer Productique because the company speaks the same language as most of its customers — French and German — and employs many textile engineers.

Italy

Computer House S.r.l., Italy: Paolo Langé, engineer at Computer House, said that Computer House® has added artificial intelligence into its software, including new functions to provide better production plans. Computer House’s experience over the past 30 years is what differentiates it from competitors. Langé said customers choose its software because Computer House continually improves its product and shares implementation of new features requested by one customer with other customers. In addition, Computer House is always willing to listen to its customers and react to customer requests.

Interlem GP Omega, Italy: CEO Andrea Picone said that Interlem GP Omega is now a completely Web-based software. It uses a new scheduling system called Net@Pro, in partnership with another company, and Interlem GP Omega also includes a new ERP version. In addition, a new Gantt chart-based procedure helps detect the source of problems. Picone believes that Interlem GP Omega’s scheduling is better than that of its competitors. The lower price and flexibility of Interlem GP Omega’s solution are other reasons he thinks that their customers choose Interlem GP Omega.

Worldwide

AREL, Australia: According to Michael Sakowicz, project manager, Arel has added business intelligence into its software, which allows companies to better meet a company’s key performance indicators. The strategy of how Arel works — taking a template and customizing it to the customer’s processes and business — is what differentiates it from competitors. Sakowicz believes that its customers choose Arel over alternatives because it can quickly change the software in reaction to the customer’s needs.

Datatex®, a global company with offices in Alpharetta, Ga.: Shannon McCarthy, head of Business Development & Administration Americas, said that Datatex® has updated its user interface, and its ERP module now has some finite capacity planning and scheduling. Datatex now also offers a finance module and a mobile sales app. Key differentiators of Datatex include strong scheduling, excellent transferability, and bottom up and actual costing. In addition, there is fairly limited customization in Datatex implementations because the software has so much functionality and this makes it easier to upgrade customer’s software with new releases. McCarthy believes that customers choose Datatex because it is proven, the company knows their customers’ manufacturing processes, and the software looks modern and is modern.

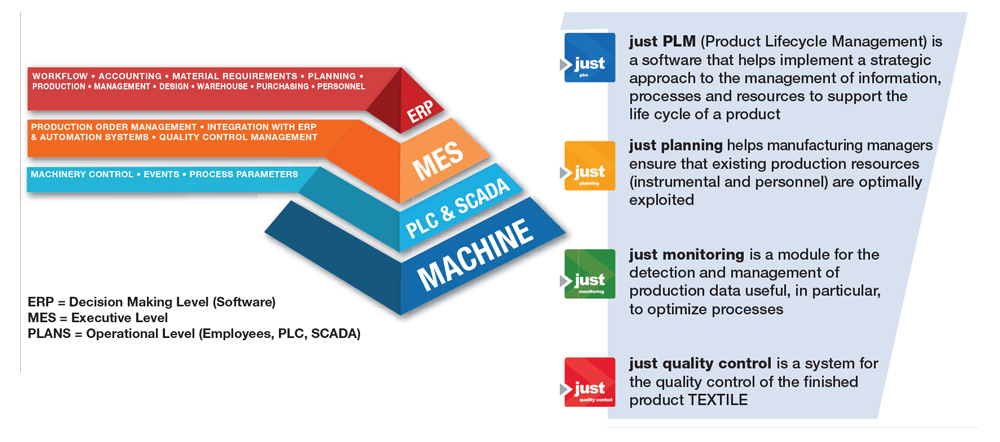

Just MES, Italy: Just MES used to be owned by Up Solutions, but now is owned by the Retelit Group. Lucrezia Rivetti, sales back office specialist, said that Just MES has added automatic planning capability and now includes machine learning algorithms to help companies analyze their processes. Differentiators of Just MES over its competitors include lower cost, ease of use and implementation, and that it is ERP independent. Rivetti said that customers appreciate that they do not have to explain textile processes to Just MES contacts at the Retelit Group because these contacts are very experienced with textile operations.

Porini S.r.l., Italy: Thorsten Steiert, a consultant at b4dynamics— an IT/ERP consulting company that works with Porini — said that Porini offers a complete system. Key differentiators are that Porini is based on the Microsoft Dynamics 365 system, it has cloud functionality, and when new features are added to the Microsoft system, Porini also can offer these capabilities. Steiert believes that customers choose Porini since it works with all kinds of textiles and textile processes and is very flexible.

Conclusions

There have been many changes to APS software over the past two to three years. Some company representatives said that its software now includes some mobile device capabilities. A few companies said that its software is now fully Web-based. Several mentioned that they have included artificial intelligence and business intelligence within their software solution.

With regards to factors that differentiate the software and why representatives believe customers choose their software over their competitors, many highlighted their company’s knowledge of textile process. In addition, many representatives also emphasized that its system has been developed to be used with textile processes, which means less cus-tomization is required. These advantages speak to why a textile company might want to choose an APS system that focuses on the textile industry rather than a general APS system.

APS company representatives also mentioned many other differentia-tors and reasons customers choose its system. Better scheduling was mentioned by a few representatives, as was lower cost. Some discussed cultural factors, like language knowledge or competency of area business practices. However, the reason most commonly given by company repre-sentatives was its responsiveness to customer requests.

Choosing the correct APS system is difficult. This paper provides a high-level comparison of potential options to help textile companies begin to narrow down possibilities.

Editor’s Note: Editor’s Note: Dr. Kristin A. Thoney Barletta is professor, associ-ate head & director of Undergraduate Programs in the Textile and Apparel, Technology and Management Depart-ment at NC State’s Wilson College of Textiles. This article was adapted for TTWW from a paper by Dr. Barletta pub-lished in the NC State Wilson College of Textiles’ Journal of Textile and Apparel, Technology and Management (JTATM).

January/February 2024