Unlike at any other time in recent memory, the global cotton market is caught in a tug-of-war

between opposing factors that increases price risk exposure, and threatens to keep fiber demand

deferred and supply chains disrupted. These two issues are simultaneously pushing and pulling the

cotton market, displacing market leaders, turning former competitors into customers, and shifting

sourcing patterns in unexpected directions. To be sure, myriad factors are at play. But two

overriding factors of policy and fundamentals are overshadowing the rest and are worthy of a

review.

Market Fundamentals From A Demand Perspective

Following last year’s unprecedented roller-coaster surge and collapse in global cotton

prices, once-bitten textile mills are twice shy in their current use of the fiber. Whether hesitant

to book more than the thinnest of coverage for immediate need or hesitant to shift back to

cotton-rich blends because of any price disparity with man-mades, mills worldwide generally remain

timid to use as much cotton as readily as in the past. Presently, the U.S. Department of

Agriculture (USDA) expects global cotton use will only reach 106.3 million bales this marketing

year, well below the 123.9 million-bale record set just a few years ago. What’s more, concern over

a deceleration in global economic growth this year is applying more brakes to prospects for world

cotton mill demand, suggesting the cotton use target may shrink even further in coming months.

Also following last year’s unprecedented roller-coaster surge and collapse in global cotton

prices, the global supply chain witnessed a gradual progression of price pressure moving

sequentially across the supply chain, from fiber to yarn spinners to knitters and weavers to

apparel manufacturers, and ultimately to the store shelf. This evolution of price pressure reached

U.S. shoppers earlier this year, when retail apparel prices surged 5.8 percent year-over-year, the

fastest jump in more than two decades. While retail apparel prices are still higher than a year

ago, evidence in the United States and other key retail markets suggests this price pressure is

exiting the supply chain. The impact on apparel is that, while the dollar value of garment sales in

the United States is set to expand impressively this year, the volume of garments sold is likely to

expand at a tepid pace. A similar trend is occurring in different retail markets around the world.

As a result, weak growth in global consumer demand for clothing is stalling demand growth across

the global supply chain. On balance, whether from a macro perspective or from a consumer

perspective, global demand for cotton remains soft and the medium-term price outlook is tipped to

the downside.

Market Fundamentals From A Supply Perspective

With cotton prices at such lofty levels last year when Northern Hemisphere producers were

making planting decisions, it comes as little surprise that cotton acreage soared and the world

cotton harvest jumped to a record. But with demand increasingly on the defensive and global supply

at a record high, market fundamentals turned increasingly loose. The USDA forecasts the global

stocks-to-use ratio will hit a record in 2012-13 for the second straight year, contributing

fundamental pressure to drag prices lower.

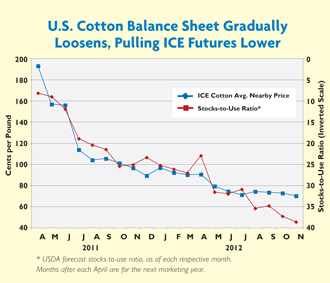

This trend is particularly evident in the U.S. market. Over the last year and a half,

monthly average nearby cotton futures on the Intercontinental Exchange (ICE) sank from more than 90

cents per pound to roughly 70 cents per pound. This gradual erosion happened as U.S. market

fundamentals loosened. That is, the marketing-year stocks-to-use ratio forecast each month over

this period gradually expanded, weighing on prices. Still, near-term prospects hint that more

loosening may be in store for the balance sheet, keeping upside potential for domestic prices

contained.

Then Along Comes Policy

Another consequence of the 2011 spike and collapse in global cotton prices was China’s

reintroduction of price controls. As the world’s largest cotton producer, consumer, and importer,

China can skew the global cotton market, and this past year was no exception. Just over a year ago,

as Chinese cotton prices were plunging in tandem with global prices, the Chinese government

reinstituted its Reserve procurement mechanism, a scheme designed to stanch the hemorrhaging in

price. The plan is nothing new to China, but the volume bought for the State Reserve was

unprecedented. By buying a record 3.1 million metric tons (14.2 million bales) of domestic cotton

from October 2011 to March 2012 at a preset price of 19,800 yuan per metric ton ($1.42 per pound),

the China National Cotton Reserves Corp. (CNCRC) was effective as never before in stopping the

plunge in domestic prices. This move also contributed to easing the price collapse in other

markets, including the United States.

Yet, to encourage local farmers to plant cotton this past spring, the CNCRC announced in

March a plan to procure even more new-crop supplies this autumn at 20,400 yuan per metric ton

($1.48 per pound). Since beginning the latest round of procurement for the Reserve in September,

another 2.2 million metric tons (10.3 million bales) of new-crop supply has effectively been taken

off the local market. This pace of procurement is well ahead of the volume during last year’s

record-setting procurement period, hinting that the government may buy even more cotton this

season.

While Chinese farmers praise the policy move, struggling domestic mills complain of thin

supplies on the cash market, prompting many to source yarn from foreign spinners – an ironic

consequence of policy for the world’s largest spinner. But in spite of what looks to be an earlier

crop than last year, precious little of this crop is available at reasonable prices to domestic

mills. Chinese mills complain much of the new-crop supply is being procured for the State Reserve

at elevated prices, with little available for industry. After consuming 51 million bales just a few

years ago, Chinese mills may use 35 million or less this year, a plunge unmatched worldwide.

The aggressive purchases for the State Reserve the last two seasons are causing some unusual

and unexpected repercussions across the global fiber and textile supply chain. For one, Chinese

mills priced out of the domestic market began aggressively sourcing foreign cottons. Already the

world’s largest cotton importer, China more than doubled its appetite for foreign cotton in 2011-12

to an unprecedented 24.5 million bales. By comparison, 2011-12 shipments to Bangladesh, the world’s

number-two importer, were less than 3.2 million bales. Understandably, this sudden demand caused

cotton exports from India to Australia to Brazil to surge to record levels.

Still, the policy move caused China to boost cotton yarn imports to a record level as well.

Over the first nine months of 2012, cotton yarn shipped into China is up 74.6 percent from the same

period last year to a dizzying 1.1 million metric tons. At this rate, Chinese imports of cotton

yarn in 2012 are virtually certain to soar to an uncharted high. Spinners across the subcontinent

and Southeast Asia that once lost global share to China are now gleefully selling unprecedented

volumes of yarn to this newfound market, as Chinese textile manufacturers attempt to avoid the

policy impact of paying prohibitively high domestic cotton and yarn prices.

On balance, the irresistible force of easing global fundamentals is pitted against the

immovable object of a set procurement price for cotton procured for the State Reserve, with the

market sandwiched between the two. Global cotton prices are likely to remain range-bound until

China’s procurement plan fully runs its course later this winter. But relatively cheap cotton and

higher prices for key competitor crops portend a large decline in Northern Hemisphere cotton

plantings in the spring, hinting at a firmer price scenario for the fiber emerging early next year.

Editor’s note: Gary Raines is chief economist and managing editor of the Globecot News Network,

now the Fibers & Textiles division of INTL-FCStone Inc., Nashville, Tenn. Eric Scholler is a

Charlotte-based independent economic analyst for the cotton market.

November/December 2012