The Economy Completes Its Eigth Year Of Expansion And Is Still

Growing

The economy completed its eighth year of expansion in March, and growth continues to be strong.

While most of the latest monthly government reports show a temporary seasonal weakness, overall the

economy was in the fast lane during the first quarter.

Despite a sharp upturn in energy prices, inflation is running below the 2-percent mark and

there are no visible signs for a pickup. This means that the Federal Reserve is likely to leave

short-term rates unchanged in the near future.

Growth in nonfarm jobs rose only 46,000 jobs in March, following an average monthly gain of

276,000 jobs in the previous four months. Construction jobs declined by 47,000 as relatively cold

weather slowed outside activities.

In the first quarter of this year, nonfarm payrolls grew by 560 thousand jobs, and were up

2.2 percent from a year ago.Payrolls for the apparel industry alone are down by 83,000 from a year

ago.

The producer price index for finished goods increased 0.2 percent in March as energy prices

ran up 1.2 percent. Also, consumer prices rose 0.2 percent in March. The core index, which excludes

food and energy, rose just 0.1 percent in March. From a year ago the core inflation was up only 2.1

percent.

Industrial Production Edges Up; Cool Weather Boosts Utility Use;

Housing Starts Drop

Industrial production edged up 0.1 percent in March, after rising 0.3 percent in February.

Cooler temperatures boosted utility output by 1.9 percent in March. Factory output was unchanged

following a 0.3-percent increase in February. During the first quarter industrial output grew just

0.7 percent at annual rate, the slowest rate since the third quarter of 1998.

With the operating rate down to 80.1 percent from 80.3 percent in February and fierce

competition from abroad, manufacturers will have hard time raising prices.

Housing starts eased 1.3 percent in March to 1.77 million units. Despite the drop, housing

starts were only marginally below the 12-year high of 1.82 million reached in January.

Starts for single-family homes were virtually flat in March, while multi-family units tumbled

5.9 percent to 0.365 million. New home building in the first quarter was the highest since the

second quarter of 1986.

Business sales surged 0.9 percent in February, while business inventories responding to

strong demand grew 0.4 percent.

The inventory-to-sales ratio held steady at 1.37, down from 1.38 a year ago and near its

historic low of 1.36. This means there is no undesirable inventory buildup.

Textile Output Falls After Being Up For Three Straight Months

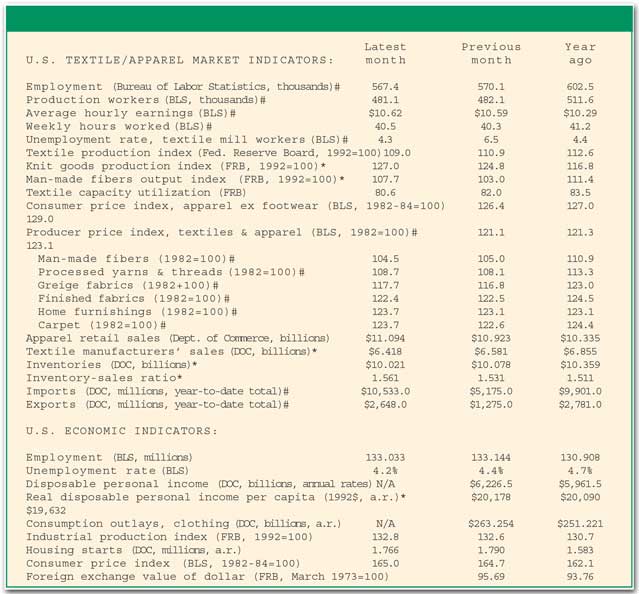

Results for textiles and apparel were mostly negative. Textile output fell 1.7 percent in March

after rising for three consecutive months before. The operating rate for textiles came down to 80.6

from 82.0 in February.

Sales by textile manufacturers dropped 2.5 percent in February, while inventories fell 0.6

percent. Thus, the ratio of inventories-to-sales climbed to 1.56 from 1.53 in January.

The industry’s payrolls were slashed by 0.5 percent in March, following a sharp 1-percent

drop in February. The jobless rate for textile mill workers declined to 4.3 percent.

Retail sales rose for the eighth month in a row in March. Total retail sales rose 0.2 percent

in March, after surging 1.7 percent in February and 1.3 percent in January.

Retail sales in the first quarter shot up 14.9 percent at an annual rate and were up 8.3

percent from a year ago. While favorable weather was a major factor, the burst in consumer spending

has insulated the U.S. economy from recessions abroad.

Producer prices of textiles and apparel declined 0.2 percent in March for the second month in

a row. Prices surged 0.9 percent for carpets; rebounded 0.8 percent for gray fabrics; recovered one

third of the February drop of 1.8 percent for processed yarns and threads; and rose 0.5 percent for

finished fabrics. Finally, prices declined 0.5 percent for synthetic fibers.

May 1999