By Ehsan Soltani

United States apparel imports surged by 81 percent, increasing from $64 billion in 2000 to $116 billion in 2022, while total goods imports grew by 168 percent. The share of apparel from total imports declined from 5.1 to 3.4 percent during this period. Notably, the share of knitted apparel from total woven and knitted apparels rose from 45 percent in 2000 to 58 percent in 2022, indicating an increased preference for more casual apparel imports with lower prices.

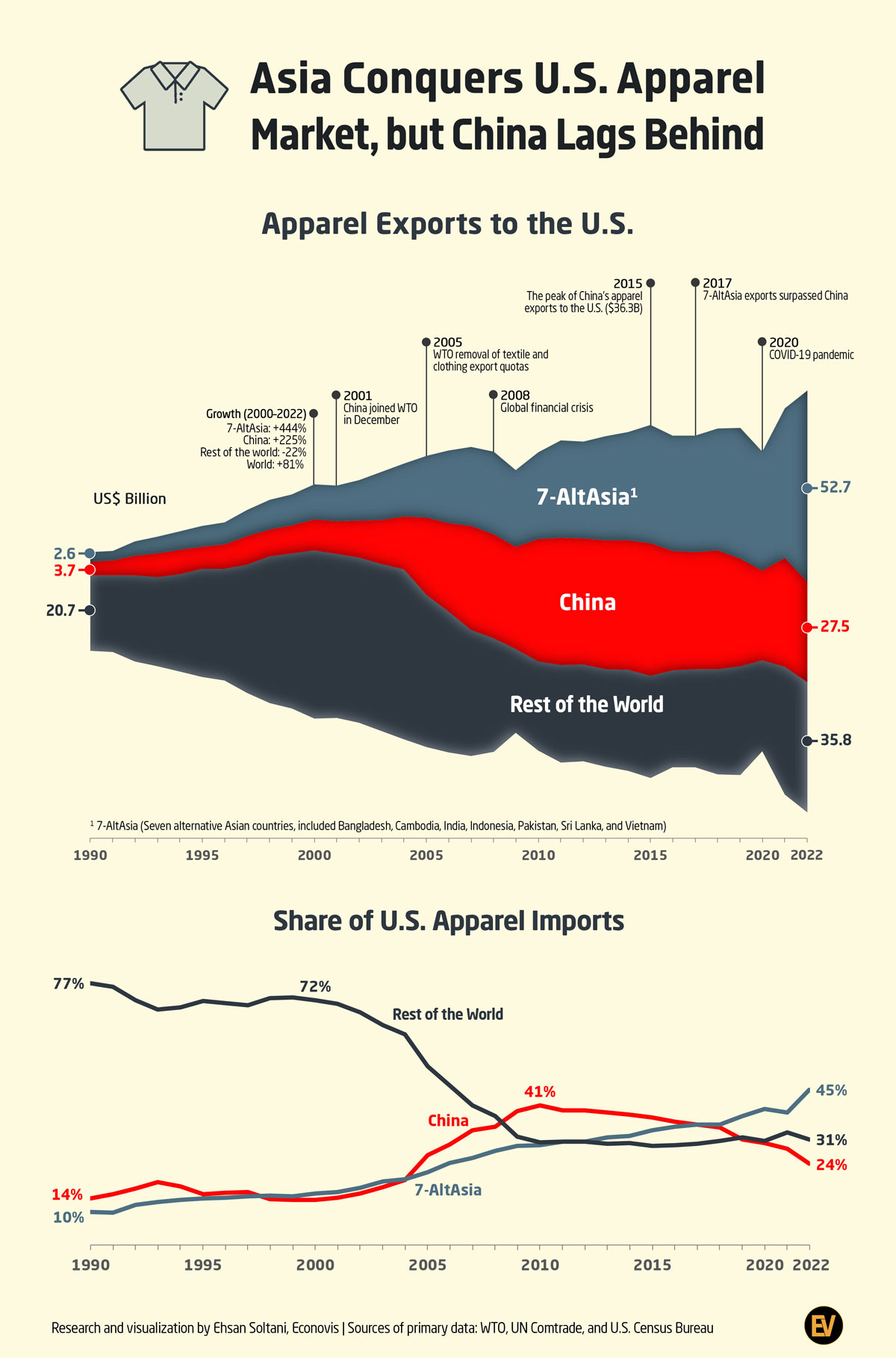

From 1995 to 2000, the share of the world, excluding China and seven Altasia countries — Bangladesh, Cambodia, India, Indonesia, Pakistan, Sri Lanka, and Vietnam — in total U.S. apparel imports was around 72 percent. This dominance was attributed to import quotas that protected the U.S. market from cheap Asian exporters.

Two significant turning points unfolded in the 2000s. China joined the World Trade Organization (WTO) in December 2001, and more importantly, from January 2005, quotas on textile and apparel exports were eliminated, marking the removal of all quantitative restrictions on imports from WTO members under the Multi-Fiber Arrangement (MFA), which had been in place for more than four decades.

Apparel exports from the world — excluding China and the seven Altasia countries, which amounted to approximately $46 billion from 2000 to 2004 — experienced a notable decline, falling to $24.6 billion in 2010. In contrast, China’s exports surged by 133 percent, while the seven Altasia countries witnessed a 64-percent increase from 2004 to 2010. As a result, the share of the world, excluding China and the seven Altasia countries, in total United States apparel imports was halved, remaining at around 30 percent throughout the 2010s.

China’s apparel exports to the United States peaked at $36.3 billion in 2015. From 2015 to 2022, China’s apparel exports to the United States decreased by 24 percent, and the seven Altasia countries increased by 62 percent. As a result, China’s share of total U.S. apparel imports dropped from 37.4 percent to 23.7 percent.

In 2022, the seven Altasia countries, with a total export value of $52.7 billion, constituted 45 percent of United States apparel imports. Notably, Vietnam and Bangladesh, with apparel exports amounting to $19.5 billion and $10.3 billion, respectively, surpassed China, whose exports stood at $27.5 billion. Furthermore, India, Indonesia, and Cambodia recorded apparel exports of $6.3 billion, $6.2 billion, and $4.8 billion in 2022, respectively.

The production and export of textiles and clothing played a central role in generating export revenue and fostering economic development in China. Until the mid-2010s, textiles and clothing constituted the primary source of export revenue for China. Notably, textiles and clothing still hold significance for the Chinese economy, with a trade surplus share of 16 percent and 35 percent of total manufacturing and goods exports, respectively, in 2022. However, the apparel share from China’s total goods exports gradually decreased from 20.1 percent in 1993 to 5.1 percent in 2022. Due to industrial and economic development, demographic changes, and a more than threefold increase in labor costs compared to the seven Altasia countries, these nations are poised to gain a larger share in the United States market, while China’s share is expected to continue declining in the future.

Editor’s Note: Ehsan Soltani is with West Lebanon, N.H.-based Econovis LLC

January 31, 2024