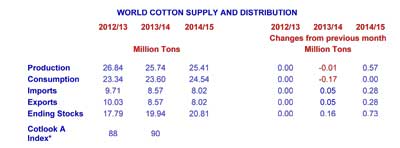

WASHINGTON — February 3, 2014 — In 2010/11, world production exceeded consumption and this trend has continued into this season, though declining production and a slight rise in consumption is closing the gap. In 2013/14, world production is forecast at 25.7 million tons, a decrease of 4% from 2012/13 and 8% from peak production of 28 million tons in 2011/12. This is due principally to lower yields and less area planted with cotton. The world average yield in 2013/14 is forecast at 777 kilograms per hectare, down 2% from last season and world area is forecast at 33.1 million tons, also down 2% from last season.

World cotton mill use is projected up by 1% this season to 23.6 million tons, reversing the downward trend in cotton consumption since 2009/10. World cotton mill use should continue to grow in 2014/15 (by 4%) if the health of the global economy continues to improve. The International Monetary Fund’s latest projections, published in January 2014, indicate world economic growth at 3.7% in 2014, up from 3.0% in 2013 and 3.1% in 2012.

In 2013/14, world ending stocks are forecast to be 19.9 million tons, more than 2 million tons higher than last season. Despite the excess of cotton stock in the world, the Cotlook A Index for January has averaged about 91 cents per pound, up from 85 cents per pound seen in November and early December 2013. This is due in part to China’s cotton policy, which has removed much of the excess cotton from the world market. Given China’s share of world cotton stocks, if it decides to offload its reserve stock onto the world market, price is expected to decrease. At the end of 2013/14, China is expected to hold 58% of world stocks with an expected ending stock of 11.5 million tons.

*The price projection for 2013-14 is based on the ratio of ending stocks to mill use in the world-less-China in 2011-12 (estimate), 2012-13 (estimate) and 2013-14 (projection), and on the ratio of Chinese net imports to world imports in 2012-13 (estimate) and 2013-14 (projection). The price projection is the mid-point of the 95% confidence interval: 82 cents/lb to 101 cents/lb.

Source: International Cotton Advisory Committee