I

n late December 2003, the Bush administration concluded talks on the Central American

Free Trade Agreement (CAFTA) with Honduras, El Salvador, Nicaragua and Guatemala. The on-line

newspaper Honduras This Week (12/22/03) reported: “[A]t the last minute, Costa Rica withdrew from

the negotiations, meaning the [Costa Ricans] will have to negotiate on their own next year. … The

event is considered by Washington [to be] a step towards the creation of a free trade zone in the

Americas. … It is foreseen that the presidents of the region will sign the agreement in April and

that the White House [will send it] to Congress for [approval] before July, to avoid the process

[being] politicized by the upcoming November 2004 elections.”

Congress granted the president trade promotion authority (TPA), commonly known as fast track

authority, in August 2002. TPA permits the executive to negotiate trade agreements with nations and

submit them to Congress only for an up or down vote; i.e., as is, no changes. Long denied to

President Clinton, TPA has encouraged the current administration to pursue a free trade agenda in

the Western Hemisphere, creating North American Free Trade Agreement (NAFTA)-like preferences with

all Western Hemisphere countries. On Aug. 1, 2002, President Bush announced: “With TPA, we will

open markets to create high-paying jobs and provide new opportunities for America’s farmers and

workers. I thank the House and Senate for passing TPA so that we can work together to advance

America’s free trade agenda [and] promote prosperity in the United States, progress in our

hemisphere and freedom throughout the world.” With the authority in hand, the administration has

focused on opening Central and South American markets, leading to a Free Trade Area of the Americas

(FTAA). Like it or not, the current administration is bent on increased trade. It is combining the

theories that the rising tide lifts all boats and, that manufacturing, in order to be competitive,

needs to chase lowest-wage-cost economies. In so doing, the administration appears determined to

trade manufacturing jobs for increased opportunities for US companies to export technology and

knowledge. “Fair” probably is not in the lexicon; “free” is, and one at a time, jobs in low-wage

industries will be outsourced to countries with lower-labor-cost competitive/advantaged economies.

The steel industry recently learned a harsh lesson. Granted protective tariffs in early

2002, steel promised to upgrade to a world-class industry. The promise probably was hollow

-designed to allow steel producers to dress up poor income statements, balance sheets and stock

prices. The threat of European Union sanctions under World Trade Organization (WTO) rules likely

sandbagged the duties from day one. The results were protective tariffs on steel, and the

elimination of a number of steel industry jobs sacrificed on the political altar of trade.

Objectors to FTAA likely will face the same results.

Given that the political climate favors free trade, and the Senate is expected to endorse

CAFTA, it’s time to look at the region that now is receiving recognition. In order to understand

it, a number of questions need to be answered: How big is it? How big is the textile portion? What

opportunities exist for current North American fiber and fabric manufacturers? Is there a

possibility for fiber expansion as the region “grows,” based on more open trade with the United

States? What is the fiber business in South America? Are labor rates world-competitive? And what

kind of market are we now asked to service and participate in?

The Economies

Just as the United States is not a single, massive economy, South America is not a monolith.

The continent is characterized by both developed and underdeveloped nations, with significant

differences between the areas. Historically, Brazil, Argentina and Chile have been regarded as the

most-developed economies, with conditions in the remaining countries ranging from abject poverty to

verging on developing. It is reported that poverty affects less than 5 percent of the populations

in Chile, Brazil and Argentina, while most of the remaining South American countries face poverty

levels in the 15+ percent arena. This seems to suggest no lack of available labor. Trained and

educated labor is another issue, but it probably is fair to say that with local government

assistance, “trainable in time” is applicable.

Investor confidence in Latin America was dealt a blow by Argentina’s recent economic crisis.

According to worldinformation.com, net external capital flight totaled 18 percent of Argentina’s

gross domestic product. This represented 50 percent of the region’s net capital outflow and had a

disastrous effect on the overall economic performance of the continent. Argentina’s relationships

with Uruguay, Brazil and Chile were injured through common membership in the regional Mercusor

trade bloc. Brazil and Venezuela suffered political unrest – the former through election of a

left-wing president and government, according to worldinformation.com. The latter, Venezuela,

experienced continuing confrontations between the government and opposition forces, which led to

severe cuts in oil output and a lengthy 2002 year-ending general strike.

It is clear that political and currency risks abound in South America. However, are textiles

better off by hunkering down in the United States to be eroded gradually by expanding trade

policies, or should the industry undertake harsher measures, including changes in traditional

business methods? Alliances/ownerships/development consortia are needed. If US firms do not open

South American markets, it is likely that European competitors will lock up the distribution

through NAFTA-like arrangements, most of which will not favor US interests.

Fiber Consumption

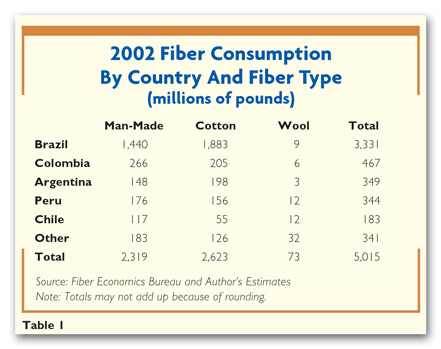

As noted previously in

Textile World

, fiber consumption in the mills of South America totaled slightly more than 5.3 billion

pounds in 2001

(See ”

Fiber’s

Fast Track,”

TW, September 2002). Economic distress in several nations drove down 2002

consumption to approximately 5.1 billion pounds, as political unrest and a hangover from 2000-01

continued to take a toll. Of 2002’s total consumption, approximately 52 percent was cotton, 46

percent was man-made fibers and 2 percent was wool. Since 1993, cotton usage has been level at

approximately 2.6 billion pounds, while man-made fibers enjoyed all the area’s consumption growth,

expanding 37 percent to 2.3 billion pounds in 2002. Per capita use dropped to slightly under 15

pounds for the year as total consumption fell. Considering that US per capita consumption remains

in the 80-pound range, opportunities for growth seem extraordinary. A 20-percent increase in

consumption from 15 to 18 pounds per capita would mean increased continental consumption of almost

1 billion pounds.

Regional fiber consumption mirrors politics. The historical participants – Chile, Venezuela

and Colombia – still are active, but now they are shadowed by major fabric-forming investments in

Argentina and Brazil. Peru, Ecuador and Uruguay bring up the rear with small textile industries.

Virtually all of the fiber consumption decrease in 2002 fell at the lap of Argentina, whose

usage fell 6 percent from 2001 levels – which represented a 33-percent drop in the decade

(See Table 1).

Obviously, Brazil is the 800-pound gorilla in South American fiber consumption. The

importance of cotton is apparent, and the growth potential for man-mades is unstated. The focus is

on apparel to utilize the relatively inexpensive labor available in many South American nations.

However, the future of South American expansion relies heavily upon foreign investment. Despite

defining themselves as industrialized, Argentina, Chile and Brazil do not generate sufficient

investment capital to develop their neighboring states. For example, according to

worldinformation.com, in 2002, “Capital flight and poor external markets combined with increased

political risk [dragged down] the region’s prospects. The GDP of [the area] contracted by 0.5

percent … inflation rose to 12 percent, double that of 2001. … Real wages fell 1.5 percent

while unemployment increased to 9.1 percent. … Non-oil economies were hit further by high oil

prices, leading to a severe deterioration in the region’s … trade. … At the same time, capital

flight saw nearly $40 billion drained out of the regional econom[ies] … leaving [highly

vulnerable economies] little room to manoeuvre [trade] policy.”

The Answer

What are America’s strengths? Investment, ideas and a willingness to take risks. What are

manufacturing America’s weaknesses? High wages vis-à-vis the levels in developing economies,

increasing social costs for employees and the environment, and a government obviously intent on

finalizing the conversion of the economy from a manufacturing base to a knowledge base. Long-term,

these goals likely would result anyway from natural long-term economic forces. NAFTA, the WTO and

CAFTA merely are accelerating the natural trend of industrialized economies to push services and

knowledge at the expense of manufacturing.

Given that public policy is pushing away manufacturing, what is the textile industry to do?

Arguably, NAFTA has been successful in helping Mexico develop a consuming middle class. It appears

that the increasing tide of trade did raise many, if not all, boats. It can be argued that much of

the last five years of restructuring in the US fiber industry was facilitated by Mexican

involvement. If Mexico, with 100 million people, can impact NAFTA that much, imagine what a

consortium of South American textile and fiber manufacturers can do under FTAA, fueled by US

technology and access to capital, as well as access to the US market with garments and made-up

articles assembled by relatively low-wage, currently poverty-stricken workers in the South American

continent.

It is doubtful that CAFTA will pass the Senate with ease. The current political silly season

virtually guarantees a battle over CAFTA. Based on the chastising received from the WTO on steel,

however, it is doubtful the administration will fold. Its stance on trade is too strong, and the

Bush dream of FTAA verges on a legacy accomplishment. Can textiles find partners below the equator?

The US textile industry has a risk-laden history. Can it – will it – investigate spreading the risk

further south to begin the industry’s transformation into a truly global enterprise?

Carly Fiorina, CEO of Hewlett Packard, recently talked of jobs: “There is no job that is

America’s given right. We have to compete for jobs.” Is the textile industry competing for jobs? It

is clear no textile job is a given right; can the odds be improved by investing time and

intellectual and investment capital in a region that is likely to become the next NAFTA-like

incarnation?

March 2004