The renewed interest in the potential of increasing domestic manufacturing has been spurred by

studies that indicate that such an increase may not be simply a political dream, but could offer

economic advantages. In 2012, co-author B.J. Hamilton conducted a substantial research project that

sought to examine trends in production costs, to determine if conditions are becoming more

favorable for textile manufacturing in the United States. This is the second installment of a

four-part series of papers created from that research.

The main sources of secondary data utilized in this paper are surveys conducted by the

International Textile Manufacturers Federation (ITMF), Switzerland,. The survey reports include the

ITMF International Production Cost Comparison reports (1991-2010) and the ITMF International

Textile Machinery Shipment Statistics reports (1990-2010).

Yarn Spinning Capacity Data

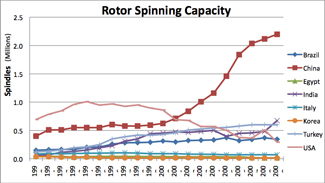

The yearly capacities, in number of spindles, for both ring spinning and rotor spinning are

displayed in Figures 1 and 2. Figure 1 shows that, among the included countries, the United States

had the highest capacity for rotor spinning from 1990 to 2001. After that year, China became the

leader in rotor spinning capacity and continued to increase capacity every year. Meanwhile, US

capacity continued to decline, and in the most recent survey, had less capacity than countries such

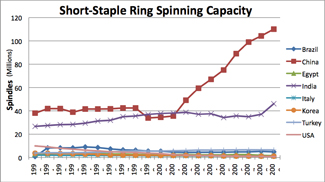

as India and Turkey. Figure 2 shows the yearly short-staple ring spinning capacity for each

country. This graph shows a similar trend of Chinese capacity increasing every year beginning in

2001, and having by far the highest capacity in the most recent survey. These patterns reflect the

phasing out of the World Trade Organization (WTO) safeguards that were in place for China during

this time period.

Figure 1: Country Rotor Spinning Capacities By Year

Data Source: ITMF International Textile Machinery Shipment Statistics (1991-2010)

Click here to view Figure 1 in a new window

Figure 2: Country Short-Staple Ring Spinning Capacity By Year

Data Source: ITMF International Textile Machinery Shipment Statistics (1991-2010)

Click here to view Figure 2 in a new window

Spinning Cost Trends

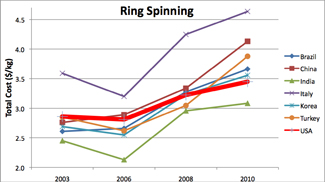

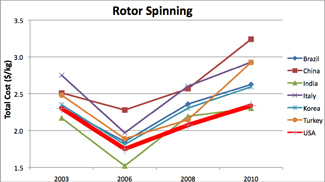

Figures 3 and 4 exhibit the time trends of total spinning costs, including the cost of fiber,

for each participating country in the surveys. In both figures, the United States is highlighted

using a bold red line to show its place among the other countries over this time period. Figure 3

shows that for ring spinning, Italy had the highest cost for the entire time period. The United

States began with the second-highest cost, but over the years was surpassed by four other countries

and ended up having the second-lowest cost per kilogram of yarn. Meanwhile, the cost of ring

spinning in China rose to become the clear second-highest behind only Italy. Figure 4 also shows

the rising cost of making yarn in China, this time for rotor spinning. The United States was

already one of the less expensive countries in 2003, but the gap between it and China widened over

the years. This trend is extremely important to the future of the U.S. textile industry. American

companies already have certain location advantages, and any cost advantage gives U.S. customers

even less reason to import textile products. Opportunity is coming to the United States because

worldwide costs are rising at a faster rate.

Figure 3: Country Ring Spinning Costs By Year

Data Source: ITMF International Production Cost Comparison (2003-2010)

Click here to view Figure 3 in a new window

Figure 4: Country Rotor Spinning Costs By Year

Data Source: ITMF International Production Cost Comparison (2003-2010)

Click here to view Figure 4 in a new window

Components Of Spinning Cost

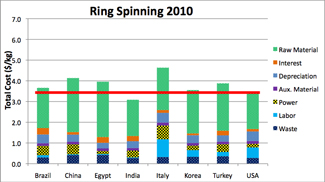

The cost of spinning in each country was further broken down in the surveys into the cost

components of raw material, interest, depreciation, auxiliary material, power, labor and waste.

This breakdown was useful because it allowed for the impact of an increase in a particular cost

driver to be analyzed. For the sake of brevity in this paper, only the results for ring spinning

are shown below, but rotor spinning costs followed similar trends. In fact, according to Hamilton,

the labor component is even less of an issue with rotor spinning compared to ring spinning because

there is a higher degree of automation in rotor spinning.

Figure 5 shows the total cost of ring spinning for each country in 2010, broken into cost

components. A bold red line is placed on the top of the U.S. bar in order to gauge its cost

relative to the other countries. This figure shows that the United States has the second-lowest

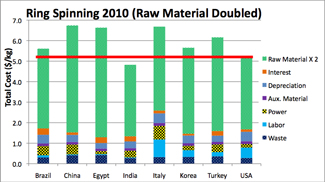

total cost and that raw material is the largest cost driver for each country. Figure 6 shows what

the total cost for each country would become if the raw material cost were doubled, a situation

that has precedence in the 2010-11 elevation of cotton prices. The United States remains the

second-least expensive; however, the gap between it and some of the more expensive countries — such

as China, Egypt, and Italy — has widened, with several of the countries now being a full dollar per

kilogram higher. India has gained a similar advantage and remains less costly than the United

States. Power is another cost component for which a uniform increase might be advantageous to the

United States, This, of course, assumes a uniform global increase in costs; naturally, regional

variations would give slightly different results.

Figure 5: Cost Components Of Ring Spinning

Data Source: ITMF International Production Cost Comparison (2010)

Click here to view Figure 5 in a new window

Figure 6: Cost Components Of Ring Spinning (Raw Material Doubled)

Data Source: ITMF International Production Cost Comparison (2010)

Click here to view Figure 6 in a new window

Conclusions

This paper shows that the United States, while losing worldwide share in yarn production, has

been slowly gaining in global cost competitiveness in both ring and rotor spinning. Additionally,

the cost structure of U.S. yarn spinning provides the opportunity for the United States to benefit

from global increases in fiber prices. This would seem to open up the opportunity for the United

States to reclaim some of its lost manufacturing capacity in the spinning area because the cost of

producing yarns in the United States is lower than for most competitors.This advantage would also

carry with it the benefits of higher quality, shorter time to market and potential for

collaborative arrangements with fabric producers. Recent announcements, such as international

textile company Gildan Activewear Inc.’s plans to build a large new ring-spinning facility in the

United States, seem clearly to support these conclusions.

References

Bethea, A. (2012). “Yarn-spinning facility,170 jobs, headed to Rowan.” The Charlotte

Observer. Dec. 19, 2012. Retrieved from:

http://www.charlotteobserver.com/2012/12/19/3736225/yarn-spinning-facility-170-jobs.html

Hamilton, B.J. (2012). “Short- and Long-Term Opportunities for US Textile Manufacturing.”

PhD Dissertation, North Carolina State University.

ITMF. (1990-2010). International textile machinery shipment statistics.

ITMF. (1991, 1995, 1997, 1999, 2001, 2003, 2006, 2008, 2010). International production cost

comparison: Spinning, texturing, weaving, knitting.

Editor’s note: Brian John Hamilton, Ph.D., is product developer – Domestic Lifestyle at New

Balance Athletic Shoe Inc., Boston. William Oxenham, Ph.D., is Associate Dean, and Kristin Thoney,

Ph.D., is Associate Professor at North Carolina State University’s College of Textiles, Raleigh,

N.C.

April 16, 2013