T

he US textile industry is alive and well. That’s not to say there still aren’t some

serious problems and question marks – or that any big new demand spurt is just around the corner.

Rather, the point to keep in mind is this: mills have weathered one of their most wrenching

downturns in history – yet textiles still remains a viable, innovative and forward-looking

industry, one that’s likely to edge back into the plus column after five years of decline.

This cautiously optimistic picture is based on more than just wishful thinking. Mills –

after another year of shutdowns, mergers, modernization moves, global partnership pacts and

management reorganizations – are now poised to survive and even prosper in today’s increasingly

competitive marketplace.

Growing emphasis on new fabrics and stylings should help, by keeping consumers in a spending

mode. So should an economy which, while still far from robust, is expected to grow at a respectable

2.5 to 3 percent annual rate over the coming year.

Nor do costs seem to present any insurmountable problems. To be sure, there should be some

small advances in fiber costs, but ample supply will keep such boosts in bounds. Combine this with

solid productivity gains that should pretty much offset relatively modest payroll hikes, and

overall cost pressures seem quite manageable.

On the other hand, prices of mill products will be hard-pressed to show any significant

advances. But tags should be firm enough – when combined with improved strategies, rising volumes

and very modest cost increases – to ensure some improvement in both earnings and margin

performances.

There are some important international uncertainties. Clearly, new Middle East conflict

could change the ground rules. But assuming no big new curveballs, here’s a more detailed look at

what

Textile World

editors – taking their annual trek to the crystal ball – see ahead for the still quite

impressive, close-to-$80 billion mill and mill product industries.

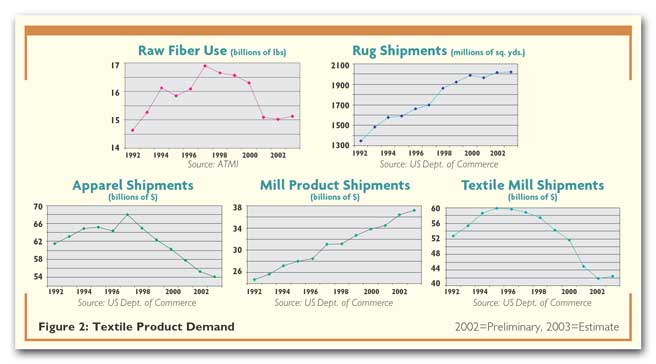

2003 Demand: A slow turnaround will finally push mill shipments (yarns, fabrics,

finishings and others) back into the plus column – with dollar totals expected to advance about 1.5

percent. A slightly larger 2-percent gain is seen for mill products, including automotive, carpets

and home furnishings.

Combined overall shipments will show their first advance since 1997. On a less rosy note,

that would still be some 11 percent under the all-time peak hit during that earlier year.

Inventories: The news is good here. Pipeline holdings have dropped significantly

over the past year – especially in the mill area, though to a lesser extent for textile products.

With these stocks down at near minimum levels, any further declines in key inventory/sales ratios

are likely to be quite small.

This, in turn, suggests that new orders will be met more and more by new production rather

than by drawing down existing stocks. And that’s a key reason, in addition to improving final

demand, why mill and mill product output should be sporting increases over the upcoming months.

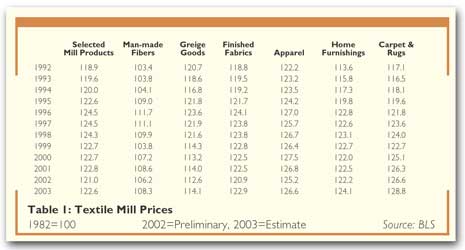

Prices: Increases, as suggested earlier, will be relatively scattered and

generally on the small side. Behind the sluggishness here is a combination of still-high capacity,

strong import competition, downstream pressures from both apparel makers and consumers, and only

limited upside cost increases.

At most, only about a 1-percent increase in overall price averages is anticipated – not

enough to keep these tabs close to 2 percent under the peaks hit back in the 1996 to 1998

period. On the other hand, this projected textile performance doesn’t compare all that badly with

the overall US producer goods average, where hikes are expected to be only in the 1- to 2-percent

range over the upcoming year.

Costs: No sweat here. As noted above, fiber costs for the most part will sport only

minimal gains. This is pretty much confirmed by a recent Global Insight Inc. (formerly Data

Resources Inc.-Wharton Econometric Forecasting Associates [DRI-WEFA]) forecast for the industry’s

material and services input costs. The big economic consulting firm puts the new year’s increase at

only 1.6 percent.

The labor situation is especially encouraging. True, the industry is anticipating a

3-percent or so increase in payroll costs, but this will be cushioned by a near-equal increase in

output per mill hour. As such, unit labor costs should remain relatively unchanged.

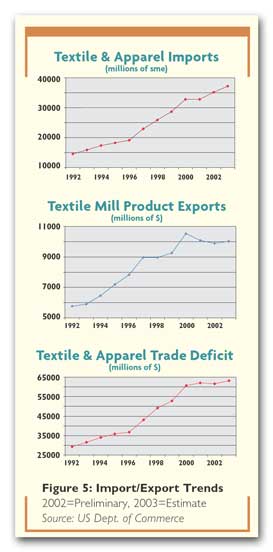

Foreign trade: The past year was somewhat of a disappointment, as estimated imports

on a square meters equivalent (sme) basis rose by a rather impressive 7 percent. That’s in marked

contrast to the nearly unchanged rate of 2001. Another fairly strong gain is seen for 2003 –

probably something in the order of 5 to 6 percent.

Exports are not likely to provide much of an offset, as lackluster overseas growth rates

slow the demand for US-made products. As of now, for example, it’s hard to see much more than a

small 1-percent or so export advance. The result: a further increase in our already huge textile

and apparel trade deficit to more than $63 billion. That’s double the levels prevailing just a

decade ago.

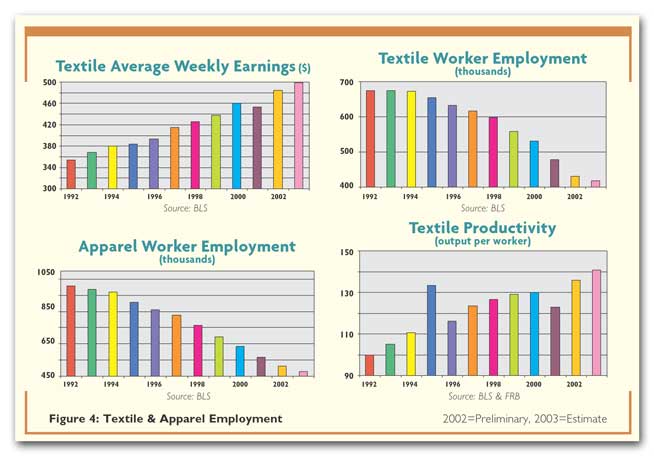

Employment: The combined impact of very modest industry growth and increasing

output per person hour is taking its toll. This past year, for instance, textile jobs dropped by

close to 10 percent. And the new year won’t be all that much better, with worker totals expected to

decline another 3 percent or so.

The drop is equally disturbing in the apparel area. This past year’s 10-percent worker

decline is expected to be followed by another 7-percent dropoff over the next 12 months. Viewed

from a long-term perspective, textile and apparel employment will fall to only around 900,000

workers in 2003 – off more than 45 percent from a decade earlier.

Industry capacity: Disappointing demand has, not surprisingly, forced some

industry contraction. How much shrinkage? Compare a 3+ percent increase in capacity utilization

last year with only a small 2-percent increase in output, and it suggests a 2-percent decline in

capacity or production potential.

This trend should continue as

TW

equations point to further modest drops in available capacity. Combine this with another

small demand gain, and operating rates should move up another two percentage points to near the

78.5 mark. While this is still some 12 to 13 percentage points under the 1994 high, it does point

to progress – albeit slow – toward a better supply-demand balance.

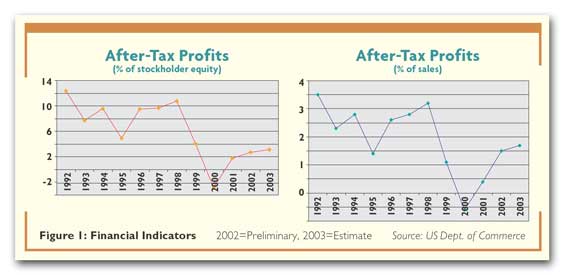

Profits and earnings: Earnings finally seem to be bottoming out. One thing’s for

sure, there’s little to suggest a repeat of 2000, when mills reported a disastrous loss of nearly

$356 million. This past year, for example, the industry managed to eke out a profit of just over

$300 million – a figure that should edge up to $325 million in 2003. But that’s still a far cry

from the $2 billion peak hit back in 1998.

Margins are following a similar pattern, with after-tax profits per dollar of sales and as a

percent of stockholders equity expected to approach 2 and 3 percent, respectively, this year. While

hardly nirvana, it’s again a lot better than some of the negative numbers reported over the past

few years.

Beyond 2003: Looking beyond the current year becomes a little more uncertain –

particularly as 2005, when all import quotas are eliminated, approaches. But at this stage of the

game, the prognosis remains moderately encouraging.

To be sure, the output losses of recent years will never be recouped as we continue to move

into a single global market. On the other hand, all the steps taken and in the process of being

taken, do seem to assure a viable, though smaller, industry.

Global Insight, for example, sees mills holding their own or maybe even eking out fractional

gains through the foreseeable future – enough to push gross operating profits up to $15 billion by

the end of the current decade – some 15 percent above this year’s estimated level.

Uncle Sam’s analysts would seem to agree. Indeed, they’re even more optimistic. More to the

point: a recent Bureau of Labor Statistics (BLS) projection calls for average annual textile output

increases of 1 percent over the 2000-2010 period.

And if you zero in on some of the subsectors, the BLS outlook is even rosier. Knitting mill

output over the decade, for example, is expected to be up 1.7 percent annually. Carpets, meantime,

are targeted to grow at an almost-as-encouraging 1.3-percent annual pace.

New Products, Processes

Much of this longer-term optimism is based on the ever-growing number of new offerings that

will be hitting the market in the years ahead. Indeed, this is something that has already been

bearing fruit – with innovative new fibers and fabrics even now buoying demand in many different

areas.

One of the most successful of these has been the positive consumer response to the

introduction of wrinkle-free fabrics for shirts. And this is something that’s still being worked

on. Witness, for example, new fabrics that are chemically treated to prevent the puckering of

pockets, cuffs and plackets.

But that’s only the tip of the iceberg. Coming off the drawing board are finer-micron wools,

improved yarns, and more colors and patterns – all designed to spur demand. Equally significant are

creative new blends, as well as older ones with unique new looks, including more washable,

water-resistant and soft-stretch offerings.

Some of the biggest firms are at the forefront of these moves. DuPont, Wilmington, Del.,

recently announced a commitment to introduce 25 new fiber products within the next five years –

with five of these targeted for the current year.

The company also has teamed up with Levi Strauss to produce Lycra®-blend jeans. DuPont also

is working on clothes that can be detected by global positioning satellites.

In another area, Celanese Acetate, Charlotte, and KoSa, Houston, are working together to

develop fabrics made with stretch polyester in the fill and acetate in the warp. Included will be

many sateens, twills and plain weaves.

Then there’s Nano-Tex LLC, Greensboro (51-percent-owned by Burlington Industries), which has

launched a chemical process that adds “nanowhiskers” to fabrics, rendering them wrinkle- and

stain-resistant. The company also has developed activewear fabrics that disperse and dry sweat.

Last, but not least, there are “way out” materials that incorporate battery-operated heat

panels and small control units that let the wearer warm up, or cool down the garment. There are

also new thermal insulations that automatically store and release heat in response to skin

temperatures.

To be sure, not all of the above developments will be blockbusters. But they all emphasize

the industry’s new approach – one designed to improve offerings and thereby strengthen bottom-line

performance.

Productivity And Employment Trends

All the innovations and breakthroughs just alluded to, however, are just one part of today’s

industry survival strategy. Equally important is the need to continually beef up efficiency.

And here, too, mills seem to be racking up a pretty impressive record. If there’s any doubt

on this score, take a look at the Textile Productivity chart in Figure 4, which traces productivity

advances over the past decade. Output per textile worker has jumped close to 36 percent over the

past 10 years – the equivalent of a 3-percent compounded annual rate of increase.

And there’s every indication this rate of gain will continue.

TW

predictions, for example, put the 2003 gain at near 3 percent.

Go beyond the current year, and the prognosis is equally upbeat. Specifically, the

previously alluded to 1-percent annual gain in output projected by BLS analysts over the current

decade is accompanied by predictions of further declines in textile employment.

Indeed, compare the employment slippage with the increase in production, and you end up with

something approaching 4-percent annual increases in worker efficiency over the 2000-2010 period.

That’s equal to or even better than the all-US-industry average.

Factors behind this continuing productivity trend aren’t too hard to find. Still impressive,

albeit somewhat diminished, spending on new, more sophisticated plants and equipment can’t be

underestimated. Not only does this cut costs, but it also helps put mills on the cutting edge,

allowing for the production of new high-tech engineered fabrics – products that were virtually

unheard of a few short years ago.

More savvy use of capital spending dollars may also be playing a role in efficiency gains.

Mill men are taking a much more hard-headed approach to investment outlays. With capital spending

budgets tight, they’re concentrating on squeezing even more out of the investments they’ve already

made. In a sense, the emphasis is on spending better rather than spending more.

All this, when combined with only fractional gains in demand, is making for a continuing

shrinkage in the textile workforce. This year, mill employment is targeted to drop down to less

than 420,000. That’s a 38-percent-drop from just 10 years earlier.

And employee declines are even more precipitous in the apparel sphere. Thus, this year’s

estimated less-than-480,000 total represents an eye-opening 51-percent slide from a decade earlier.

What it all boils down to is a smaller, leaner and more efficient operation. It’s a “must”

strategy, as both the textile and apparel sectors move to stay viable in today’s rapidly changing

business climate.

Import And Export Trends

Trade is another area undergoing constant change. Behind all this: a volatile and still

somewhat uncertain world market, in which ground rules remain as “iffy” as ever.

Some of the big issues now are: new exchange rate changes and their effect on prices;

ability to open foreign markets to US textile exports; US mill ability to integrate production and

sales in a one-world market; and stricter enforcement of trade laws.

Further out into the future, there is the uncertainty of what happens two years from now,

when virtually all quotas are eliminated for World Trade Organization (WTO) countries. Of

particular concern is the potential influx of still more Chinese exports.

This latter point is clearly something to watch. Not only is China capable of flooding the

world with low-cost textiles and apparel, but that nation also could be a problem in high-end

products, too, as Chinese expertise and management sophistication approaches or even tops that of

other world producers.

Then there’s the move towards a Free Trade Area of the Americas (FTAA). Also targeted for

2005, it would call for the eventual elimination of tariffs and non-tariff barriers among countries

in the Western Hemisphere.

Coming back to the nearer term, the new year’s import total of textiles and apparel on a sme

basis is almost sure to show another gain. True, there won’t be a resumption of the double-digit

gains reported over the 1997-2000 period. But it’s hard to see how another meaningful advance to

more than 37 billion square meters (m2) can be avoided.

The new Trade Act passed in 2002 also will bear close watching. Among other things, it

increases the potential for duty-free apparel made from African fabric and yarn, knit apparel made

from Caribbean fabric and imports from the Andean nations.

Nor can any meaningful import offset be expected on the US export side, as lackluster

overseas economies dampen overseas demand for US fabrics and garments. In any case, combine this

disappointing export demand with still-rising imports, and a further increase in the already huge

textile and apparel trade deficit seems virtually unavoidable.

On a more upbeat trade note, textiles should continue to fare better than apparel over the

coming years, as domestic mills increasingly send fabrics to overseas locations for cut-and-sew

operations – and then send the finished garments back to US retailers for sale.

Costs Stay Under Control

The overall cost prognosis isn’t all that bad either. To be sure, over recent months there

has been some creep-up in cotton fibers into the 45+ cent range. But that’s a far cry from the

peaks of just a few years back.

True, the new year could see some fractional further advances for the natural fiber. But

they won’t be catastrophic, as a good US 2002-03 crop combined with another fairly large world crop

assures an adequate or even more-than-adequate supply.

One demand question mark, however, is the extent of new Chinese buying. There’s some talk

that the big Far Eastern cotton consumer may initiate some substantial purchasing later on in the

year.

Man-made fiber tags also are expected to remain within bounds. One reason is this past

year’s big jump in global capacity. World potential at last report, for example, was put at 12.8

billion pounds. That’s a big 24-percent jump over year-earlier estimates. Given this capacity

overhang,

TW

forecasts call for only about a 2-percent price increase over the new year. That’s not nearly

enough to bring these quotes back up to the peaks prevailing in the late 1990s.

But there’s a caveat here. These price estimates might have to be raised despite today’s

global capacity glut. It all centers around petroleum feedstocks for these fibers. Should Middle

East problems spark an oil price spike, then there could be repercussions both on petrochemicals

and, ultimately, on man-made fiber tags.

Meantime, the outlook for the other big textile cost area – labor – remains fairly upbeat.

Forecasts calling for continuing pay restraint can be made with more than a fair amount of

confidence. And, as detailed earlier, the combination of only modest payroll increases combined

with strong productivity gains would seem to pretty much guarantee little or no upward pressure on

unit labor costs.

New Global Insight forecasts suggest that this labor and fiber cost restraint will continue

through the remainder of the decade. The consulting firm’s predictions call for overall input costs

of the industry to advance only about 1 percent per year on average through this extended period.

A Blueprint For The Future

But not everything will be coming up roses. True, the textile industry will most certainly

survive and even prosper, but it will take a lot of imagination and effort. Put another way: the

key to survival in today’s competitive marketplace – flexibility, innovation, cooperation and

globalization – will be more important than ever.

All this, in turn, will imply increasing attention to such critical areas as cycle time;

communications with both suppliers and customers; quality control; inventory management; and

product differentiation, including the development of niche markets.

Differentiation and new product developments are now pretty much industry “musts.” They’re

the kind of approaches that not only beef up the demand curve, but also point the way out of

today’s price-cutting morass.

And these ideas can work with basic established fabrics, as well as with brand-new ones.

Take, for example, denim, where constructions with unique washes, as well as more interesting

fashions, are not only moving well, but are showing more resistance to downward buyer price

pressures.

No matter how low US commodity textile prices go, they’ll still be higher than those quoted

in Asia and other areas of the developing world. As one fiber executive observes, “It’s suicide

today to place all your eggs in the commodity basket. The more you differentiate, the better off

you’re likely to be.”

The Congressional Textile Caucus could play a major role in leveling the international trade

playing field. The group is expected to concentrate in such key areas as the speed of textile quota

removal, illegal transshipments, global market access and assistance to displaced domestic textile

workers.

But perhaps the most significant need in today’s competitive climate is for more cooperation

among firms operating up and down the textile and apparel production and distribution lines.

Upstream, for example, there’s clearly a need for more communication and planning between

mills and fiber makers. Not only should this include increased mill dependence on fiber companies

for development work, but also closer liaison between the two to come up with new fabrics, blends

and variations.

Traveling further downstream, there’s the inevitable trend toward more and more global

cooperation and control, all the way down to finished garments and other products.

There are endless variations on how all this can be accomplished. One Burlington executive

describes how his company has in a very real sense reinvented itself. He details how the firm – by

supplying both the management and technical expertise, but not the ownership – will be

masterminding a global network of fabric and apparel operations.

In any case, textiles have become a whole new ball game. As still another top mill executive

sums it all up: the only strategy for survival is supply chain management – with the ultimate goal

of delivering the right products at the right time and at the right price to both retailers and the

ultimate US consumer.

January 2003