By Jim Phillips, Yarn Market Editor

By Jim Phillips, Yarn Market Editor

For the past several years, the negotiation of the Trans-Pacific Partnership (TPP) free-trade agreement hung over the collective head of U.S. yarn spinners like the mythological sword of Damocles. As the sword of King Dionysius hung over the head of Damocles, suspended by the single hair from the tail of a horse, the courtier became intimately acquainted with the sense of foreboding spun by such a precarious position.

And so it has been for yarn spinners, wondering if enough protection would be built into the TPP — a yarn-forward rule, chief among other items — to keep apparel-producing giant Vietnam from disrupting the U.S. market with a flood of apparel fashioned from yarn manufactured in non-TPP member country China. As one spinner noted before details of the agreement were released: “If Vietnam is allowed to enter the TPP without a yarn-forward rule, it would be devastating for the U.S. industry. It would give China almost unlimited access to the U.S. market — without China having to abide by any of the provisions of the TPP.”

Fortunately, U.S. negotiators held firm, crafting an agreement that organizations within the textile industry say allows the domestic industry to compete fairly. At its winter meeting in February, the Board of Directors of the American Fiber Manufacturers Association (AFMA) voted to formally support the TPP, the final text of which was signed by member nations on Feb. 4, 2016, in Auckland, New Zealand. “AFMA’s Board recognized the special care given to fiber producer’s analysis and advice by United States Trade Representative Michael Froman and his team across more than five years of intense and complicated multi-country negotiations,” the AFMA noted in a news release. “Inclusion in the final TPP text of the yarn-forward textile rule of origin so critical to U.S. fiber and yarn producers underpins our endorsement.”

In January, the National Council of Textile Organizations (NCTO) gave its blessings. In a news release, NCTO said: “On January 20, 2016, the [NCTO] voted to formally support the [TPP] free trade agreement. The decision to support TPP came after an exhaustive analysis determined that NCTO’s principle objectives were met as part of the finalized terms of the agreement. These objectives include:

- A strong yarn-forward rule of origin for the vast majority of textile and apparel products.

- Reasonable, multi-year tariff phase-outs for sensitive textile and apparel products.

- Terms that provided for the stability of the Western Hemisphere textile and apparel production chain.”

Exports Versus Imports

Much has been said over the past three decades about the flood of imports and the impact on the U.S. industry. And in 2015, that deficit continued. According to figures from the U.S. Department of Commerce Office of Textiles and Apparel (OTEXA), total textile and apparel imports in 2015 totaled just over $126 billion — $50 billion of which was from China — while total textile and apparel exports amounted to just under $24 billion.

This significant deficit, however, does not apply to the yarn industry. In 2015, total yarn imports accounted for $3.8 billion, while exports were more than $4.9 billion. NAFTA nations were the largest beneficiaries of U.S. yarn exports, with product shipped to Mexico valued at $665 million, and to Canada, $420 million. China was the largest importer, at $828 million. In 2013 and 2014, the OTEXA data reveals the trade surplus for yarns was even greater: $5.1 billion in exports in 2013 versus $3.7 billion in imports; $5.2 billion in 2014 versus $3.8 billion in imports. Note: the data accounts for the value of products and does not represent volume of goods imported or exported.

Fabric exports have been relatively equivalent to imports year-to-year since 2013, the data shows. However, it is commonly known the apparel trade picture is entirely different and represents the most significant portion of lost opportunity for U.S. manufacturers in every segment of the industry. In 2015, the U.S. exported only $6.8 billion of apparel while importing nearly $88 billion. Of the import value, China accounted for $32 billion, with the next largest importer, The Association of Southeast Asian Nations — Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam — accounting for almost $21 billion.

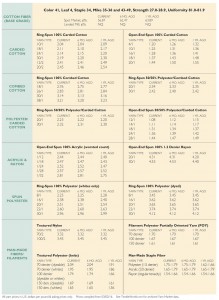

Click to view current yarn prices as a pdf

Click to view current yarn prices as a pdf

March/April 2016