As the Rupp Report mentioned last week, the annual PCI Fibres Conference 2013 took place November

7-8, 2013, in Hong Kong. The event was an unlimited source of important information concerning the

global fiber and textile industry. As mentioned in the last report, “more information about this

conference will be available soon.” And here it is.

Water Shortage

One of the key future issues for the planet and its inhabitants is water. Based on a

forecast of the World Health Organization (WHO), the global population will further grow. India,

for example, will overtake China in some 10 to 20 years’ time, with an estimated 1.5 billion

people. This growth will further tighten the global supply of drinking water and also the supply of

water to be used for industrial purposes such as dyeing and finishing.

Legions of clever people are searching to find solutions for these imminent problems. The

textile industry also is challenged to provide solutions for its part in this sometimes vicious

circle. Ajay Sardana, assistant vice president and head of Global Customers & Market

Intelligence, from the India-based Aditya Birla Group, presented a possible solution for spun-dyed

viscose fibers to reduce water consumption, and, of course, effluent.

Sardana began his speech by saying that the textile industry is among the largest users of

chemicals and it is a highly water-intensive industry. He also proclaimed that the textile industry

is estimated to use more water than any other industry “and almost all water is heavily polluted.”

And, don’t forget, dyeing and finishing accounts for 80 percent of textile industry wastewater.

A Possible Solution

Sardana presented the idea of producing so-called spun shades — a process that conserves

water, lowers wet processing costs, and produces yarns with even colors and in a wide range of

colors. The registered brand name for the yarns is SpunShades. The pigment applied for the dyeing

is added to the viscose solution prior to the spinning of the staple fibers. Sardana claimed that

the fibers are very colorful and have a high fastness. After five years of trials, the colors still

have the same appearance. This pigment dyeing technology is said to eliminate the need for

subsequent dyeing of gray fibers. It should avoid environmental pollution at the customer’s plant

and provide high shade uniformity. The dyeing process is Azo-free, and the yarns carry the

Oeko-Tex® Standard 100 certification from BTTG Manchester.

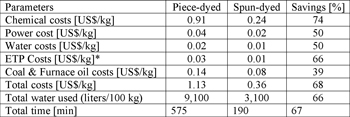

Sardana presented an interesting table showing all the process savings from using SpunShades

Viscose:

* Exchange Traded Products (ETP) total ownership costs can be divided between internal costs

related to the product and external costs.

Having in mind that cellulosic fibers play an even more important role in the future for the

global fiber consumption, this idea can be a possible solution to reduce water consumption and

wastewater.

India — A Giant …

After presenting this idea, Sardana gave a short but impressive overview of the Indian

textile industry. Indian textile and apparel exports have grown at a compound annual growth rate

(CAGR) of 10 percent from 2005 up until 2012. Most of this growth was generated by increased fiber

exports. Fiber exports only grew at a CAGR of 37 percent, and for yarns, it was a healthy 13

percent. On the other hand, India is still not able to export large quantities of finished apparel.

This fact was confirmed by Sardana’s figures, which show only a CAGR of 9 percent from 2005 to

2012.

The Indian textile industry, with 35 million employed people and a global market share of 4

percent, is a major player among the industry sectors of the country, generating 4 percent of the

national gross domestic product and accounting for 14 percent of Indian manufacturing. Its exports

of textiles and apparel are worth US$33 billion, which is the equivalent of 12 percent of the

country’s total exports.

… With Promising Opportunities …

The United States, the European Union and the United Arab Emirates are the biggest importers

of Indian apparel. Their combined share is 78 percent of total exports.

Sardana also gave an interesting insight about India’s competitors. China is the biggest

competitor in terms of textile products. However, he mentioned that the increasing unavailability

and rising costs of labor in China have created opportunities for other Asian apparel manufacturers

and exporters. On the other hand, Bangladesh, Vietnam and Sri Lanka focus mainly on apparel

products on a small scale. “These countries lack backward integration, unlike India,” he added.

Sardana is convinced that India is well-prepared to take its piece of the cake.

And he added some advice for his fellow citizens, that “India should increase its share in

apparel products and focus more on converting fibers, yarns and fabrics within the country rather

than focusing in exports of intermediate products.”

… And Ambitious Targets

The Indian textile industry is looking toward 2022 with ambitious goals to reach a turnover

of US$127 billion. To achieve this ambitious target, the industry needs to build a strong and

vibrant textile industry, which is technologically advanced and competitive on an international

level. Furthermore, it must generate large-scale employment through the entire production chain and

overcome its shortage of skilled workers. This goal also requires a more value-added and vertical

integration in the textile industry to enhance India’s global market share, which will result in

accelerated growth of textile exports from India.

Sardana is convinced that his country has huge potential to grow and prosper. However,

increasing competition from Asian neighbors, its limited infrastructure and the fragmented industry

structure are big challenges to overcome.

More information about this conference is still to come.

November 19, 2013