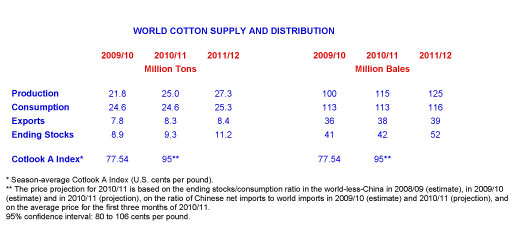

Despite the strong projected global economic growth, cotton mill use is expected to remain stable

at 24.6 million tons in 2010/11 due to limited available supplies and high prices. Global cotton

stocks fell by 25% in 2009/10 to 8.9 million tons, the smallest in seven seasons. Ending stocks are

projected to increase to 9.3 million tons in 2010/11. However, this hides disparate geographic

trends: stocks are expected to decline in most countries of the Northern Hemisphere and to increase

in the Southern Hemisphere due to an expected bumper crop. The global stocks-to-use ratio could

increase from 36% in 2009/10 to 38% in 2010/11, still well below the ten-year average (48%).

International cotton prices have risen steeply since the beginning of this season. The

average Cotlook A Index over the first four months of the season is 120 cents per pound, almost

twice as high as the average over the same period last year. It is also well above the current ICAC

2010/11 season-average projection of 95 cents per pound. The ICAC Secretariat encourages an

awareness of the confidence interval around each forecast, rather than an exclusive focus on the

point estimate. It also acknowledges that in the current environment of volatility, the ICAC price

model may be less relevant than in other seasons.

Cotton prices rose much faster than polyester prices over the last few months. This has

already resulted in some shifts in fiber blends at the spinning level, to the benefit of polyester.

The share of cotton in global fiber use, estimated at 36.5% in 2009, will likely continue to

decline in 2010 and 2011.

Posted December 7, 2010

Source: ICAC