ITMA 2011 was another phenomenal success. In the style of previous ITMAs, the event was

thoughtfully organized and comprehensive. Given the recent volatility in the economy, expectations

were more reserved. Compared to ITMA 2007, the nonwovens machinery industry appears to have

embraced more fully participation in ITMA — another landmark.

Many visitors came from India, Pakistan, Middle East and Gulf countries, and North and Latin

America. Attendance from Europe and Asia was as expected, with a limited number of Chinese

customers present at the event.

The following discussion is focused on companies that have established themselves as leaders

of the nonwovens industry. Notably, some established leaders in this segment were missing — partly

due to the fact that companies exhibiting at ITMA were primarily focused on the conversion of

staple fibers into nonwovens through carding/crosslapping, pseudo airlaid, and associated bonding

technologies.

Hills Inc. was present, but Hills is more known for its innovations in fiber and

filament equipment and, therefore, is not just a nonwovens machinery supplier.

The nonwovens machinery industry is going through massive changes — reconsolidation together

with product differentiation has resulted in many advanced systems — changes that only benefit

their consumers. More on this later.

Wide-ranging Sector

Today’s segments of the industry include raw material suppliers; roll goods producers;

converters/fabricators of the end-use products; the machinery industry supporting the previous

three categories; auxiliary material suppliers; winding, slitting and packaging equipment makers;

and other segments. Even this segmentation does not offer as clear a picture as one might imagine,

because the picture is further clouded by varying degrees of vertical and horizontal integration in

the industry. Globally, the picture is further complicated by the local market and economic

nuances. In terms of market segments, nonwovens products are used in medical and hygiene,

filtration, wipes, automotive, industrial and interlining — the only segment directly related to

apparel. This segmentation has come about because the industry has looked at itself at the macro

level from two distinct but entirely overlapping perspectives: process technologies and markets.

The two are intimately tied together through overlaps. For example, needlepunching technology is

important to both automotive and geotextile applications. Or, the filtration market is served by

wetlaid, needlepunched and meltblown technologies, among others.

The nonwovens section at ITMA is certainly growing, albeit not fast enough. At ITMA 2011,

many of the major nonwovens equipment suppliers were assembled at the same location. All those

present, however, were showcasing technologies for staple-fiber processing. The ones present were

Andritz Group — comprising

NSC nonwoven (Asselin-Thibeau),

Perfojet and

Küsters;

Autefa Solutions;

Bettarini & Serafini S.r.l. (Bematic);

Bonino Carding Machines S.r.l.;

Cormatex S.r.l.;

DiloGroup;

Groz-Beckert KG; Hills;

Laroche S.A.;

Trützschler Nonwovens GmbH; and others. Among those absent from the show were most

of the spunbond/meltblown machinery and auxiliary machinery suppliers. While the nonwovens sector

had a very significant showing at ITMA 2011, it was still much less significant than expected. ITMA

is dedicated to textile machinery; consequently, the customers walking the show are interested in

textile products. Most nonwovens users and customers are not drawn to ITMA as much. The nonwoven

customer base is rather different, and these customers typically walk their own specific shows,

such as INDEX, IDEA, and ANEX. Those shows, however, are not limited to machinery exhibits only and

include the other industry segments mentioned above.

In North America and Europe, the spunmelt technologies — spunbond and meltblown technologies

and their composites — dominate, while in the rest of the world, the staple-fiber process

technologies dominate. The spunmelt technologies have also become significant in Asia Pacific.

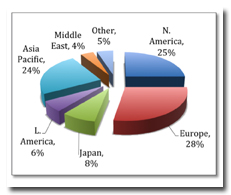

Figure 1 shows the breakdown of the nonwovens roll goods production by region. Note that

Europe, North America and Asia Pacific are almost equal in their market shares and represent more

than 75 percent of world production.

Figure 1

As indicated in the review of ITMA 2007 developments, it has been suggested by many that

spunmelt technologies will continue to grow while carding technology will continue to decline (See

“Nonwovens

Technology: Implications For The Nonwovens Industry,”

Textile World, January/February 2008). Today, this is potentially true with

regard to lightweight disposable products for which spunmelt products can compete favorably with

carded products. There are multi-beam spunbond/meltblown/spunbond machines — six- or seven-beam

machines are common — producing multi-layered composites that weigh between 10 and 20 grams per

square meter (g/m2), with each beam laying down 1 to 2 g/m2. This would be impossible for carding

technologies. Note, however, that recent and continuing advances in high-speed carding technology

will allow this technology to continue to compete in certain markets such as hygiene and other

lightweight products, and the advances in crosslapping technology and higher-weight nonwovens

through chutefeed systems will encourage the use of such technologies for heavier-weight products.

It is believed that the high-speed carding technology and its associated processes are not maturing

technologies that are holding their own. A recent installation of a Trützschler nonwoven card at

the facilities at the Nonwovens Institute at North Carolina State University was successful in

processing as much as 400 kilograms per meter per hour, a rate that competes with the highest

throughputs possible on a spunbond machine.

However, the composite pulp-based airlaid products are finding applications in co-form

process technologies as opposed to stand-alone systems utilizing pulp and latex binders.

The choice of technology is often dictated by the type of product being produced. Nonwovens

offer a very diverse range of products globally. Generally speaking, nonwovens can be broken into

two broad classes: disposable and durable. Durable, as opposed to multi-use, here refers to the

length of time the product is in place and to its life.

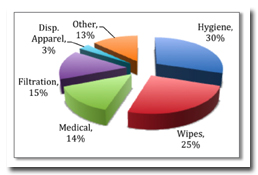

Figure 2 shows the breakdown by market segment for disposable products. The products in these

market segments are quite diverse and unique. In these markets, lightweight medical and hygiene

products make use of spunbond and meltblown technologies significantly. The wipes market, however,

is dominated by staple, carded and hydroentangled products; while the filtration market is rather

broad and is made up of wetlaid glass products, meltblown webs, and carded/crosslapped

needlepunched products.

Figure 2

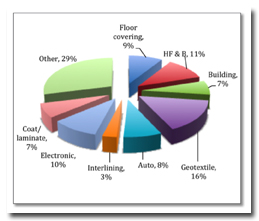

The breakdown for durable nonwovens is given in Figure 3. There, products are not dominated

as much by the spunmelt processes. Here, spunmelt as well as the carding/crosslapping/airlay

technologies are often used to produce innovative solutions.

Figure 3

Industry Consolidation

Starting in the late 1980s and early ’90s, alliances and mergers began to take place within

both the nonwovens and the textile industries. Some took the form of horizontal integration: buyout

of parallel or competing technologies. Some took the form of vertical integration that encouraged

one-stop shopping: the buyer could purchase complete manufacturing lines to produce nonwovens for

specific markets. In the latter case, the machines from different parts of the alliance, merger, or

partnership were better integrated as well. ITMA 2011 will likely be remembered with regard to

mergers and acquisitions.

Trützschler, Germany, with its acquisition of

Fleissner and now

Erko, has become a dominant player in the area of nonwovens. Its own developments

of needlepunching, aircard systems, staple-fiber production and crosslapping equipment as well as

carding technologies capable of dealing with recycled materials are now allowing the group to offer

complete turnkey systems from production to sales and service globally. The only exception is that

Trützschler does not produce calenders for thermal bonding.

Austria-based Andritz’s acquisitions of Perfojet, Küsters, and now Asselin-Thibeau are

allowing the company also to offer complete lines produced in three key regions in Europe. Andritz

Asselin-Thibeau, France; Andritz Perfojet, France, and Andritz Küsters, Germany, together will form

the Nonwoven platform within the Andritz Group. This is going to be a formidable group.

DiloGroup, Germany, has been offering complete systems for some time and continues to be a

major innovator in the field of machinery for forming staple fiber products from hygiene to

industrial.

Overall Impressions, Most Significant Technologies

These three giants of the nonwovens industry are offering technologies that are unrivaled.

For the consumers, this is all good news. Equipped with Germany-based Groz-Beckert’s components

such as needles and jet strips, these turnkey systems are capable of dealing with a wide range of

product needs. The report below will try to bring together the recent developments in these key

nonwovens companies that were present at ITMA.

Trützschler Nonwovens

Trützschler Nonwovens was very prominent at the show. The company now offers a full array of

process technologies for staple-fiber nonwovens including, but not limited to, staple fiber

production, carding, needlepunching, hydroentangling, thru-air thermal bonding and coating. All of

the groups were exhibiting in one stand.

The Trützschler systems have become the industry standard for fiber opening, mixing and

feeding. They are being used throughout the world in conjunction with other equipment such as those

offered by other machinery makers. With its entry into nonwovens, one will expect the same level of

excellence, and Trützschler will be a company to watch over the coming years. The speed with which

this group has managed to develop new machinery to deal with various forms of staple fiber web

production is impressive. The developments are too many to mention, and the ITMA 2007 nonwovens

technology review gave a rather full picture of the company’s various technologies from fiber

opening to web forming. Here, the latest and newest innovations are the focus. The latest

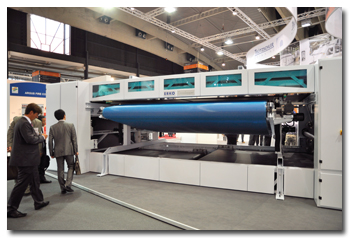

innovation unveiled by Trützschler is the Erko crosslapper EKLB439.

Figure 4: Trützschler Nonwovens’ Erko crosslapper EKLB439

What is new about crosslappers of today compared with the old camelbacks is that increased

requirements for throughput have led to ever-increasing line speeds necessary to be compatible with

the carding speeds available today.

Today, crosslapping lines are operated at the limits of their capacities — limits which are

difficult to be pushed, if at all, with conventional technology. Trützschler’s new system appears

to have overcome these limitations in terms of productivity as well as quality.

The new material guidance allows a reduction in the moving mass of the crosslapper to a

minimum, which results in reduced machine load and increased energy efficiency. The number of belt

and deflection rollers has been reduced from the original nine to now four rollers. This measure

results in significantly less acceleration and brake pipes, which has a positive influence on the

energy balance of the new crosslapper.

Additionally, the elimination of airflow and centrifugal forces now allows the processing of

even difficult materials at high speed.

Another feature is web profiling within the crosslapper. A clearly defined drawing zone,

consisting of a clamping point just before the delivery of the process materials from the layering

belts and the fixation of the process material at the permeable laydown belt, will prevent

undefined drafting zones. This technique reduces or eliminates any disturbances that could

influence the material between the drawing unit upstream of the crosslapper down to the delivery

point at the outlet belt.

The features of the new crosslapper can be summed up as follows:

- A new material guidance system avoids the negative influence of dynamic factors on the

process. - Significant reduction of the oscillating masses results in a lower machine load and less energy

consumption. - Elimination of air masses and increased friction of process materials at machine components and

web laydown enables difficult materials to be processed. - A defined drafting zone results in a higher profiling efficiency exactly at that point where an

adjustment of the web profile is required.

Andritz Group

Andritz’s expansion and acquisition is a major development in the industry, and NSC was

exhibiting separately at ITMA probably because of the timing of its acquisition by Andritz. A major

press conference was held at ITMA to discuss the acquisition. The combined technologies give

Andritz the ability to offer complete turnkey systems for the production of staple nonwovens. While

Andritz does not currently offer spunmelt processing equipment, with its acquisition of Reiter

Perfojet, it can certainly do so if it so desires. NSC’s Excelle® Isoweb® TT card as well as the

A.C.S. Profile crosslappers and the SDV-2 needleloom for velour applications are major. Küsters

calenders are unrivaled.

Excelle Isoweb is the inline card solution to obtain good machine direction/cross direction

(MD/CD) strength ratio on final product, even at high speeds greater than 250 m/min. Controlling

the anisotropy is critical in many nonwovens applications. Typically, higher speeds lead to higher

orientation in the machine direction. To control the isotropy at high speeds requires control and

management of the laydown and the web. A radical feature of the Excelle card is that it puts all

the accessory card cleaning systems inside rather than outside the drives and adjustment points.

Operator convenience and accessibility are unparalleled.

A.C.S. is also a high-speed crosslapper. A crosslapper has historically been the bottleneck

in the high-speed production of lapped webs. To overcome this problem lowers the cost of

production. This is a critical development for technical products such as those used in headliners

and for other automotive applications.

Perfojet is the world leader in hydroentangling, and its equipment is well-known for

manufacturing high-quality spunlaced products.

With the acquisition of Perfojet and now Asselin-Thibeau, Andritz can now build on their many

years of experience and the multiple innovations on the different components of a line to make a

first-quality finished product, with optimum aesthetics, performance and fiber yield.

Figure 5: Andritz’s booth at ITMA 2011

On display also was an innovation by Küsters, which has been the world leader in thermal

calendering machinery. At ITMA, Küsters was displaying a 5-meter-wide unit capable of running at

1,250 m/min — another first. This is an incredible achievement and will push the best of spunmelt

machinery to catch up.

DiloGroup

DiloGroup was also very prominent at the show. Dilo has been a major innovator in the area of

process technologies for staple products. A complete review of the various and numerous innovations

by Dilo is included in the 2007 write-up.

One novel innovation is the Clean Card Concept. Along with highest production speeds, fiber

throughput, web regularity and evenness, the efficiency of the carding operation is very relevant

to the economics of a web-forming line. Downtime for product, fiber and color changes will have to

be minimized.

The quick and easy cleaning of a card, however, requires a design that allows immediate

access to all relevant working areas of the unit. Also, a prerequisite is the provision of a strong

and efficient suction system to deal with fiber flow and dust within the housing of the card with

its safeguards, doors and flaps. The card cleaning system is achieved by:

- Internal Suction: Airflow is provided in all areas of the carding compartment. A suction system

provides vacuum to catch the fiber debris and dust particles that have left the carding surfaces of

the rollers. Two ducts, one in the breast and one in the main section, are connected to the central

suction system to provide sufficient airflow within the complete carding compartment. The airflow

is designed in such a way that it allows enough airflow at any point on any roller to help free the

carding surfaces of fiber accumulations. A key and unique feature of the unit is that at the

central suction and filtering station, fibers and dust particles are separated. Fibers are recycled

back to the feeding section to be reprocessed. - Worker and doffer trim suction (Direct Suction System): This trim suction restricts the fiber

coverage of the rollers. Fiber contact with the side frames is avoided. In addition, a new feature

for wrap protection minimizes fiber accumulation and clogging between rollers and side frames. - Internal rim suction (Overflow): Fiber flow between main cylinders and side frames is vented

via radial fins into a suction trough. - Air conditioning: The card compartment is vented with fresh, humidified or conditioned air

supply. This is critical for specialty fibers sensitive to static and dust generation.

Another new development from Dilo is aerodynamic web forming. This is critical when shorter

staple fibers; recycled fiber, or shoddy; various natural fibers such as flax, kenaf, hemp and

cotton; or mineral fibers, particularly glass, are considered. These materials are used in numerous

applications. The automotive industry, for example, uses such products that are subsequently

molded, or those that are used for thermal or acoustical insulation. These types of highloft and

highly voluminous product are also used for insulation in buildings or for waddings and paddings in

garments, upholstery and bedding. Aerodynamic web forming is particularly useful for producing such

products. In addition to web forming by carding and crosslapping, DiloGroup offers two series of

aerodynamic web forming machines:

- the TurboUnit and TurboCard series for fine fiber and the lower weight range with applications

in the medical, hygiene and cosmetic fields; and - the new Fiberlofter series for the medium to higher weight range for universal applications and

for any type of fiber — especially, however, for recycled, natural and mineral fibers.

Dilo is also the world leader for needlepunching. A complete review of its innovations in

needlepunching is included in the ITMA 2007 report. These innovations will likely lead to new

products that will potentially compete with some products currently produced by hydroentangling.

Watch for lightweight needlepunched products.

Groz-Beckert

Groz-Beckert was also quite prominent at ITMA, and exhibited a number of key technologies for

both felting and hydroentangling. The company also is known for its leadership position in

supplying key components to the knitting, weaving and felting industries.

Groz-Beckert is known as the world leader for needles for needlepunching. The company,

however, is a latecomer to the world of hydroentangling jet strips. But, in the short period it has

been involved with this segment, it has established its leadership there as well. Its jet strips

are known for their long service life.

A typical jet strip may have as many as 1,600 to 2,000 orifices per meter. The quality of

each orifice is critical to the quality of the final product. Defects in orifices can result in

streaks in the final fabric. Zero defect is a requirement for these types of products.

The Groz-Beckert jet strip combines long service life with unmatched quality, leading to

uniform product quality. The durability is achieved by providing resistant surfaces controlling the

wear at the edge of the capillaries. Consequently, the orifices retain their edge sharpness for

longer periods. More importantly, this longer life results in better and more consistent products

over the life of the jet strips.

Groz-Beckert also displayed the Groz-Beckert NeedleMaster, a complete system designed for

more efficient, reliable needle board handling. These major innovations were reported fully back in

2007. In brief however, the basis of the system is a semi-automatic device for the insertion and

removal of needles in needle boards. This unit is going to become more and more of a necessity with

the ever-increasing trend toward using higher-density needle boards. Dilo offers needle boards with

as many as 20,000 needles per meter. A 3-meter-wide, four-board needle loom will require 240,000

needles. Preparation of these boards manually is time-consuming. Further, the consistency with

which a board is built will be reflected in the product quality. With critical applications such as

automotive headliners and the like requiring zero-defect products, the NeedleMaster will be a key

player. The ergonomically designed and CE-compliant components make for fast, reliable and timely

needle board handling.

Figure 6: Groz-Beckert’s NeedleMaster unit

Other Exhibitors

Among other exhibitors, one would note Bonino, Italy; Laroche, France; Cormatex, Italy;

Bematic, Italy; and others offering highloft nonwovens production system using airlaid and/or

chutefeed systems unique for recycled and natural fiber nonwovens utilizing fibers that cannot be

easily handled by carding. Cormatex as well as Bematic exhibited their simple chutefeed systems

processing a variety of recycled fibers at the show. Automotive, building, home furnishing and

geotextiles are areas that would likely be targeted. The challenge for these technologies will be

competing with aerodynamic cards offered now by industry giants such as Dilo, Trützschler and

Andritz Asselin-Thibeau. This is an interesting area to watch. With sustainability becoming a

global issue, watch for further developments in this area. The limiting factor today remains the

lower basis weights achievable on such systems. With the technology being improved continuously,

the anticipation is that the boundaries will be pushed and newer products will appear between now

and the next ITMA.

Hills, West Melbourne, Fla., was the only company present that is involved in the spunmelt

sector. Hills is well-known for its bicomponent fiber technology, and earlier reports have covered

its contributions fully. Hills began offering both meltblown and spunbond equipment some years

back, and its spinbeam and bicomponent/multicomponent technology has been used together in systems

offered by Reifenhäuser Reicofil & Co. KG, Germany, and others.

It is unfortunate that this report does not deal with the spunmelt technologies because they

were not present at ITMA. The spunmelt technology is also one to watch. Many technical textiles

products are anticipated that will be created using these technologies. This perhaps will form the

topic of a separate discussion in the future.

TW‘s ITMA technology coverage will continue in the March/April 2012 issue with

reviews of the flat knitting and quality control/textile testing sectors; with further coverage in

subsequent issues.

January/February 2012