R

ecent incoming overseas shipment declines can be deceiving. True, the latest textile and

apparel import slippages are seemingly encouraging, and certainly a lot better than the disturbing

advances racked up over the past few years. But for the most part, this drop-off reflects shrinking

US demand for these products rather than any increase in the domestic market share.

While year-to-date incoming shipments, measured on a square-meters-equivalent basis, have

declined about 11 percent over the past 12 months, domestic mill sales of these same products are

off by more than 20 percent. Imports remain a major problem, and the reason is the still-growing

overseas price advantage. The US industry – while continuing to cut costs and streamline operations

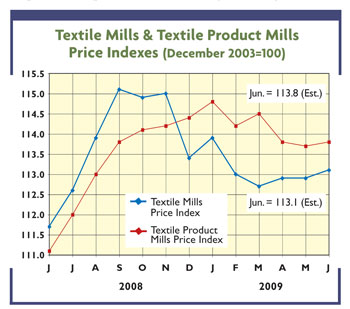

– has been unable to close the import/domestic price gap. For example, quotes on domestically

produced textile lines have shown fractional increases over the past year, in marked contrast to

comparable import tags, which have been steady to a bit lower.

The inescapable conclusion: The foreign price advantage is as big as, or even larger than,

it was a year ago. Even more significantly, consumers have become increasingly price-conscious in

today’s recessionary economy. Indeed, prices have become today’s primary buying determinant. If

there’s any doubt on this score, look at recent domestic sales trends. They show outlets that

specialize in low-cost imported goods still managing to eke out gains in what is clearly a

still-declining overall market.

Some Better News

On a rosier note, the economy continues to show signs of coming out of the biggest nosedive

since the Great Depression. True, some improvement after a year of decline might normally be

expected. But another factor could be Washington’s massive stimulus package, which is finally

beginning to kick in.

Consumer confidence is on the rise. Families are becoming more optimistic about the future

and are showing signs they’re ready to boost spending on textiles and apparel as well as other

goods. Helping prod recovery along is the huge reduction in business inventories, something that

should translate new orders into new production. And further assistance may come from stabilization

in the hard-hit housing sector and a slowly rising stock market – both of which should help recoup

some of the recent losses in family net worth.

Given all the above, gross domestic product (GDP) seems to be bottoming out, with maybe even

some fractional growth possible by late summer or fall. That would be a big swing from the huge

3.5-percent decline in this key yardstick over the past nine months. More importantly, most

economists and business analysts now see the recovery continuing into the next year. Indeed, the

betting is that if all goes according to plan, 2010 GDP could advance by as much as 2 to 2.5

percent.

Improving Profits

The anticipated economic bottoming-out and subsequent turnaround should also have some

positive implications for the industry’s bottom line. New projections by economic consulting firm

Global Insight now call for an earnings rise, both for the basic mill and fabricated textile

product sectors, next year. To be sure, the firm’s new estimates, defined as shipments less raw

material and labor costs, call for quite modest gains – nowhere near those needed to recoup the

huge declines of both 2008 and the current year, but they do represent a turnaround. And this

recovery is expected to continue into 2011 and 2012, when earnings increases are put in the 4- to

6-percent-per-year range.

Global Insight analysts also hold out hope for the apparel industry. While still expected to

be plagued by low-price imports, domestic apparel makers are expected to manage a flattening out in

earnings – hardly a recovery, but a lot better than the recent sharp tumbles.

Finally, a few comments on the role that cost containment will be playing in these modestly

upbeat bottom-line projections. Next year, combined labor and material costs for the overall

textile industry are expected to fall more than the projected slippage in comparable mill

production. The implication: falling unit costs, which over the long run should help narrow this

hard-pressed industry’s still-huge import/ domestic price gap.

July/August 2009