F

lexibility and energy conservation are the megatrends of the textile future, but these

trends must not result in the machinery becoming more expensive.” These are the words of Dr.

Carsten Voigtländer, CEO, Oerlikon Textile GmbH & Co. KG, Germany. In a very open interview,

Textile World

learned how Voigtländer imagines the future.

Over the past few years, Oerlikon’s Textile Division has permanently grown. Voigtländer is a

fourth-generation textile industry employee. His ancestors were weavers and cloth masters. As a

14-year-old schoolboy, he had a summer job with his father; and at 19, he had a traineeship in the

textile machinery industry and first came into contact with Neumag. He studied mechanical

engineering and process engineering, earned a doctorate and began working for Neumag in 1994. Two

years later, he became an authorized officer, and four years later was promoted to a management

position. He began as a development engineer, and eventually built up the engineering department.

From 2000 on, nonwovens were part of this division.

Dr. Carsten Voigtländer

TW

: Your background means the nonwovens activities at Neumag are your own baby?

Voigtländer: Yes, I have represented everything in front of the Administrative

Board so that it came into being. I have carried out all acquisitions and, of course, it’s part of

my job now to handle consolidation. As it’s well-known, Neumag was taken over by Saurer and then by

the Oerlikon Group. I have been in management since 1998, first with Neumag and with Saurer as of

2000, and as CEO of Oerlikon Textile since 2006.

TW

: What convinced you to accept this job?

Voigtländer: This is an interesting question. I find forming things appealing, and

Oerlikon Textile operates in different textile markets – there are many chances to develop further

projects.

TW

: What is your personal challenge?

Voigtländer: The challenge is the fact that the complete textile production moved

to Asia. It is a real challenge as a European enterprise to withstand worldwide competition with

production sites in Europe and Asia. The various business fields and the production in Europe and

Asia are a multifaceted task and require an enormous personal engagement. The shareholders want to

make money, employees want a decent job, customers want outstanding machinery for little money, and

suppliers have to be paid. The attractive part of this story is to form with all these parts one

unique, sound entity.

Complete Supplier

TW:

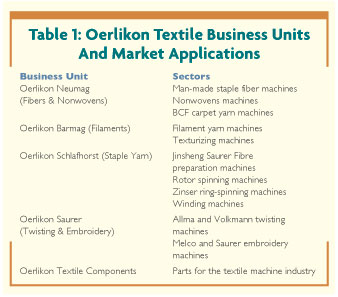

What was the idea behind establishing the group as it is presented today

(See Table 1)? Is it to be a complete supplier primarily?

Voigtländer: Yes, the basic idea is to cover the textile value-added chain. We

cover natural and man-made fibers – either the classic spinning mill with natural fibers or

polymerization and filament production for man-made fibers. Then we have fabric forming with wovens

or knitwear in a multi-stage process, or the direct production of the fabric in a one-step process

to manufacture nonwovens. Barmag stands for man-made fibers, Schlafhorst for cotton and Neumag for

nonwovens. Barmag and Schlafhorst are in yarn formation; and Saurer works in niches such as

twisting and embroidery. We are particularly proud of our fifth area, the component business.

TW

: Have you ever considered completing your product portfolio with a manufacturer of weaving

or knitting machines?

Voigtländer: Of course, it is conceivable to become active in this area. However,

there are areas that are closer to us – for example, fiber preparation or hydroentanglement. But,

if there is an opportunity, in finishing, for example, we might get involved.

TW:

What were the difficulties in establishing the group as it exists today?

Voigtländer: It was the task to unite 10 business units and reduce them to five.

Different cultures had to be brought under one hat. It’s a rethinking in the people’s head. Today

we are selling complete lines and not components of lines only. This organization was favored by

the fact that we achieved a terrific result last year. It is also important that we have maintained

the strong brands like Barmag, Neumag, Schlafhorst and Saurer.

The Oerlikon Neumag nonwovens center

The New Owners

TW:

Have the new Administrative Board or top management had any impact on your work?

Voigtländer: Before the new major shareholders invested, they spent a day with us

in the Textile Division to see what we do. After the management council meeting, a strong

commitment to the group’s structure was communicated to the entire management group. It also was

made clear to us that one thinks not in short terms, but very strategically in long terms.

TW

: These are strong words.

Voigtländer: Right, and this also was heard positively by the employees. We

achieved about 50 percent of the turnover of about 2.7 billion Swiss francs last year in the

textile division. This shows clearly its importance. We have about 8,000 employees out of 19,000

for the group.

TW

: Over and over, there are rumors concerning takeovers. How do you comment on that?

Voigtländer: Oh well, these are rumors. Such rumors arise again and again in times

of change. There is nothing more to say about it. And as I said, the new owners invest in our group

because they want to earn money with it.

Clear And Simple Structures

TW

: How does one manage such a large group?

Voigtländer

: On the one hand, we have very clear and simple structures – that’s why we have the five

business units. We have a matrix organization that includes a CFO who works for all business units

and a technology manager who cares about synergies in the development area. The employees who

report directly to me, the managers of the five business units, form the management team. This team

meets every four to six weeks. The one thing that shouldn’t be forgotten is commitment to the

company. We have many long-term employees who contribute their share to our success.

Oerlikon Neumag

TW

: Can you comment on the focusing of the single business units? Let’s start with Oerlikon

Neumag.

Voigtländer: The focus is clear – we want to be a complete supplier to the

nonwovens industry. With the acquisition of more or less all technologies, we can practically offer

almost every possible combination of technologies. This strategy has stood for five years, and we

have put together all the components at this time. It is motivation and confirmation for us at the

same time that our competitors pursue the same strategy today. In the future, another consolidation

still follows in the machinery manufacturing for nonwovens. This consolidation already has partly

started or has already been made.

In the carpet sector, Neumag is the market leader with a 70- to 80-percent market share. Our

new machinery in the bulk continuous filament area enjoyed great success at the last ITMA and

already is highly accepted by the customers.

Oerlikon Barmag

TW

: Let’s discuss Barmag. You have eliminated the recycling area of the portfolio?

Voigtländer: This is correct. We concentrate on the textile business. The most

important areas are POY, FDY and fibrillated tapes. We have introduced a new winder that has

already sold 1,000 units. This is the future of Barmag – we want to put a similar product on the

market also for FDY. We are strong in Asia and offer total solutions. Ten years ago, enterprises

like Barmag and Neumag delivered the components to the engineering companies, today we do

everything ourselves. The interface between engineering and mechanical engineering has been dropped

out.

In the mid-range segment, Oerlikon Schlafhorst offers ring- and rotor-spinning machinery

produced predominantly in China.

Oerlikon Schlafhorst, Saurer

TW

: Tell me about Oerlikon Schlafhorst, Oerlikon Saurer and Oerlikon Textile Components.

Voigtländer: At Oerlikon Schlafhorst, we have the complete textile chain to a

large extent. First of all, in cooperation with Trützschler GmbH & Co. KG, we offer a

combination that works excellently. This cooperation mixes fiber preparation from Trützschler, and

all follow-up production stages come from Oerlikon. We offer products in the middle segment in the

area of ring and rotor spinning, which we predominantly produce in China. Our competitors don’t

supply either one or the other component; therefore, we are also very strong in the area of staple

fibers. We already have sold a complete fiber line in Dubai and a whole production line in

Uzbekistan with Trützschler. Many customers are happy today if they can buy a complete line and

don’t have to search for individual components.

Oerlikon Saurer is an unchallenged world market leader in shuttle embroidery. We are at the

forefront of laser cutting and sequin application. Melco, a supplier of single-head embroidery

machines, also is doing well; the decisive step was the move into international markets. We expect

growth in Asia and also in Europe to further increase.

Twisting at Volkmann and Allma is mainly for technical applications such as yarns, tire cord

and other industrial applications. We are world market leaders also in this area. With Volkmann, we

record successes in the carpet sector, but also in the cotton industry. In the whole Saurer

division we are working in niches only, but in almost all the niches, we are market leaders.

The growth at Oerlikon Textile Components has doubled within the past few years. With

acquisitions, it extends not only to the natural fiber area, but also to man-made fibers. We have

turnover of about 300 million Swiss francs in the area of components today. With a high in-house

manufacturing depth, this area is very much a stabilizing factor for us. However, every single

business unit has a spare parts business of its own. Customers also can order parts using the

Internet today. With our own SECOS system via the Internet, we generate about 100 million Swiss

francs.

Research And Development

TW

: What does research and development mean for Oerlikon?

Voigtländer: This is virtually essential. Research and development are the core of

our activity; more than 600 employees are active here. If we thought only about costs and not about

new developments, we would not have any chance in the marketplace. We are a certain size and want

to set trends and be the first that comes onto the market with innovations. Of course, we talk

about cost reduction: However, this is only one side of the coin; new products with the right costs

are in the foreground. The most important projects are the ones through which we bring a new

revolutionary technology to the market. Every business unit is autonomous and has its own research

and development because those employees work directly with the customers and incorporate the latest

requirements into research and development. We have more than 4,000 active patents, with 330 new

registrations last year. Our development budget amounts to more than 100 million Swiss francs per

year.

Market Situation

TW

: How successful was the past year for Oerlikon Textile?

Voigtländer: 2007 was the best year in the company’s history. Turnover amounted to

2.7 billion Swiss francs. We are now experiencing a downturn after the upswing of the recent years

in all markets. In the first quarter of 2008, we had an incoming order drop of about 35 percent.

There are machinery manufacturers with incoming order drops of up to 90 percent. This leads to

violent drops in turnover. But everybody has known for decades that the textile industry always

works in cycles. The crash is simply very extreme this time.

TW

: Why do you think this happened in such a big way this time? Is it the financial crisis in

the United States?

Voigtländer: Well, this is connected to that fact only a little bit. You can’t put

the blame on this situation only – that would be too simple. If one has a look at Asia, great

overcapacities were built up in China within the last few years. Gross national product growth was

gigantic, with 11.4-percent growth in 2007. The government wants to slow down the growth to 8

percent now and is doing it. We see clear difficulties at the financing of our customers’ projects.

We then have high oil and cotton prices; this means our customers no longer earn so much money. The

losses were appropriately large. And what are you doing if you have losses? One does not invest any

more. And this has an extreme effect on investment goods. It is not that no money is there – the

projects are just delayed.

Of course, another problem is the exchange rate with the US dollar. Then, we have a

tremendous social reversal in China underway: Environmental protection and factories acts have been

established. Chinese workers are entitled to a contract of employment and to have a vacation now,

too. All these measures and circumstances enormously increase the expenses of our customers.

Through this, production becomes less attractive; the exports decline and make the problems even

bigger.

The boom in Turkey with rotor spinning is over, too. We see extreme investment restraint also

in India. This means that all three large markets – China, India and Turkey – have slowed. The sum

of all influences simply hits everybody. Of course, there are niches here and there, but nothing

that strong.

TW

: And how long do you think this situation will last?

Voigtländer: We are rather sure that we will have similar low volumes in 2009.

However, we assume that it will get better as of 2010, but of course, everything is now looking

into the crystal ball. There are still some companies that invest counter-cyclically, and this

always results in some changes somewhere. Such a downturn, however, is a chance for strong

enterprises. On the one hand, another consolidation of the market is occurring; and on the other

hand, the suppliers of cheap machinery have great problems – for example, in China. Customers don’t

want cheap machinery anymore. They want to produce the best product. We are convinced that certain

suppliers that produce, pardon the expression, bad machinery, will be in big trouble. And now, we

are at the start again: In difficult times you watch even more carefully expenses, flexibility and

quality. In this direction exactly, Oerlikon has moved for years, and we think that we can improve

our performance further in turnover and market share.

Megatrends

TW:

And in the near future, how do you see the development of textile machinery production?

Voigtländer: It is certain that the textile world market will further increase.

The population increases, and, thus, also the need for textiles. And, if one has a look at

countries like China and India, the domestic need is massive.

TW

: What is at the forefront of development?

Voigtländer: At first, flexibility and energy savings. Of course, one must not

forget the development of the costs. We hope to stay on the level with costs, but to increase

quality and productivity and reduce energy consumption.

TW

: Do you see the same chances in the future for all business units in the group?

Voigtländer: Of course, the markets are different, and so are the chances. Some

develop faster, and others must gain market share. Let’s take natural and man-made fibers: Cotton,

for example, is in competition with food; therefore, acreages are restricted. Food will always be

the first priority; clothing is next. Therefore, we do not expect cotton acreage to climb. The need

for clothing is here, so the need for man-made fibers will further grow. That’s why we are further

active in the group in both natural and man-made fibers. Apart from that, the direct production of

one textile substrate, nonwovens, will further develop strongly. The future belongs to nonwovens.

TW

: If you compare the requirements of the market with those of five years ago, where do you

see the greatest differences?

Voigtländer: The cost spiral always moves down further, and the requirements

increase at the same time. Every year, prices drop about 2 percent. This means we have to drop

permanently on the expenditure side in development and purchase to compensate for these prices.

Cost management is of outstanding importance. We say textile management is cost management. Whoever

does not have its costs under control will not survive. The market will further change. At the end

of the day, only big groups will survive and some highly specialized niche suppliers, whether these

are Europeans or Asians. There are already Asian enterprises that have bought companies in Europe –

in the machine tool area, for example. In conclusion, just a few companies will be left to play an

important role in the textile machinery market, and we will certainly be one of them.

July/August 2008