L

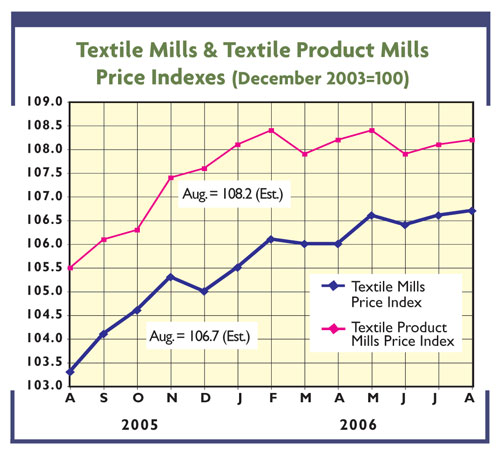

atest government price data indicate domestic and import price trends may be heading in

somewhat different directions. Since the end of last year, domestic quotes for both basic textiles

and more highly fabricated mill products have remained pretty much unchanged. Not so, however, in

the import sector, where new price indexes introduced this past year indicate incoming prices for

basic textiles and textile mill products have increased 3.5 percent and 1.5 percent, respectively,

since last December. More importantly, these trends are expected to persist through the remainder

of the year. If nothing else, this suggests the US-foreign textile price gap isn’t getting any

worse and even may be narrowing a bit. Moreover, it’s another sign the American textile industry is

still globally competitive.

Demand Trends Are Mixed, Too

The basically uneven activity pattern of the first half of the year also is continuing as

the current quarter draws to a close. Based on the latest available numbers, more highly fabricated

textile mill products like carpets, home furnishings and industrial products are still pretty much

holding their own — with year-to-date figures showing dollar shipments running better than 3

percent ahead of comparable 2005 levels. That’s a pretty encouraging sign, given today’s

competition from China and other foreign suppliers. However, the situation for more basic textile

products like yarns and fabrics is a lot less upbeat. Year-to-date dollar shipments in this sector

are down by more than 10 percent when compared to a year earlier. And if you factor in the

scattered price increases that occurred in late 2005, volume declines could be a bit more

precipitous.

The Impact On Employment

These changing demand trends are also affecting overall domestic textile industry job

totals. Employment in the more highly fabricated textile product sector hasn’t been doing all that

badly. The number of domestic workers employed here is down by only a small 2 percent when compared

to one year ago.

On the other hand, losses in the basic mill sector have been far more troublesome — with the

workforce in this sector declining by more than 10 percent over the past 12 months. Combine these

two key textile sectors, and employment totals are off by about 6.5 percent over the same 12-month

period. Again, that’s not all that bad, given that industry productivity has increased by about 3

percent over the same period. If nothing else, it reinforces the contention that textiles are still

an important component of the US economy.

New National Council of Textile Organization (NCTO) figures would seem to back this up —

with the Washington-based group estimating there still are nearly 1 million workers employed in

textiles and related fields. NCTO further adds the industry still contributes $60 billion to US

gross domestic product and $16 billion to overall US export totals.

Trade Developments

Another piece of upbeat news — this time on the import front: Washington lawmakers have

okayed a bill that would increase the use of American trouser and pocket fabrics going into apparel

made in the Central America-Dominican Republic Free Trade Agreement (CAFTA-DR) region. To be sure,

this is hardly earthshaking news. On the other hand, it’s a move in the right direction. More

importantly, it suggests the administration and Congress are finally working to make CAFTA-DR a

success.

And this can’t be underestimated, for the CAFTA-DR region is the second-largest market for

US yarns and fabrics — with the US textile industry exporting more than $4 billion in textiles and

apparel to Central America. Also, apparel imported into the United States from CAFTA-DR countries

has on average more than 70-percent US content. That’s in sharp contrast to apparel imported from

China, where the US fabric content is less than 1 percent. Another encouraging trade sign is the

lack of any big increase in overall US textile and apparel imports, which for the year to date

continues to run only 2 percent above comparable 2005 levels — a big improvement over 2005’s hefty

10-percent jump.

September/October 2006