C

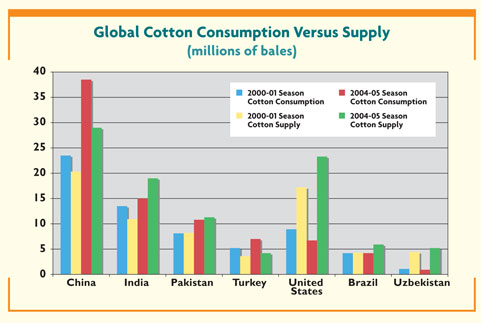

otton data, when analyzed over the five-year time series from the 2000-01 through 2004-05

marketing seasons, illustrate the global shifts in the development of cotton production and the

growth of the textile industry represented by cotton consumption. China, India, Pakistan, Turkey,

the United States and Brazil lead the world in both cotton production and consumption. But

significant markets for consumption, like Indonesia, Thailand, Mexico and Bangladesh, point to

growing usages not supported by domestic production.

In terms of exports, Uzbekistan is second to the United States in global cotton exports. The

Africa Franc Zone, Australia, Syria, Egypt, Turkmenistan, Tajikistan and Kazakhstan are not to be

ignored as significant suppliers some with the potential for developing a domestic consumption

base.

There is much more to the global cotton story than simply matching a country’s cotton

production with its cotton consumption. Cotton shipments span the globe, with cotton traded and

purchased to meet the quality and production needs of industry. Domestic production may not meet

the consumption criteria of a country, and imported cotton may be necessary to meet those demands.

However, growth rates of a country’s supply and consumption of cotton do shed some light on the

shift in both the global business of growing cotton and the global business of textiles.

Increasing consumption rates clearly illustrate the growth in the cotton sector of a

country’s textile industry. Increases in cotton production when there is a lack of domestic

consumption point to a country’s development as an exporter of cotton fiber.

Although some people may assume that a country’s economic development level may influence

whether the country is a cotton supplier or cotton consumer, this is an assumption not

substantiated by the data. Such an assumption is falsely based on the idea that agriculture and

manufacturing do not share at some level in the improvement associated with the development level

of the country. There are efficiencies in the consumption and production of cotton that dictate

activity levels in these separate yet linked industries.

A domestic supply of quality cotton is a competitive advantage for a domestic cotton textile

industry. The market factors facing this consumption, however, can negate that competitive

advantage. This is illustrated by the United States with falling consumption and a developed

country with rising production.

The Top Four

China, India, Pakistan and Turkey collectively consumed 50.3 million 480-pound bales of cotton

in the 2000-01 marketing season, accounting for 54 percent of the total global consumption of 92.3

million bales for the season.

In 2004-05, with total global consumption rising to 108.7 million bales, these same four

countries represented 66 percent — a full two-thirds — of the global consumption of cotton.

On the supply side, China, India, Pakistan and Turkey collectively increased output from 48

percent, or 43 million bales, to 53 percent, or 63.5 million bales, of the total global cotton

supply during the measured period — from the 2000-01 season through the 2004-05 season.

Among these four countries, a roughly 20 million-bale growth in consumption was met with a

roughly equal 20 million-bale growth in supply.

China, China, China…

US Department of Agriculture cotton data reinforce what one might expect about the growth of

China’s cotton consumption in the last five years. From the 2000-01 to the 2004-05 seasons, China’s

cotton consumption increased by 64 percent — from 23.5 million to 38.5 million bales.

In 2000-01, the country exceeded its domestic supply of cotton by 3.2 million bales. By the

end of the 2004-05 season, China out consumed its 29 million-bale domestic supply by 9.5 million

bales.

China is the world’s largest consumer and producer of cotton. Early figures for 2005-06 point

to continued expansion.

India Sees Increases In Consumption And Supply

India, like China, is another high-growth story, but with a twist. From the 2000-01 season

through the 2004-05 season, India increased its cotton consumption by 11 percent — from 13.5

million to 15 million bales.

In domestic supply, India made significant increases during the same five-year period,

increasing domestic supply of cotton by 8.1 million bales — from 10.9 million to 19 million bales —

a 74-percent increase in production.

Pakistan On The Move

Pakistan demonstrated even growth in the production and consumption of cotton. As the worlds

third-largest consumer of cotton, Pakistan increased cotton consumption by 33 percent from 8.1

million to 10.8 million bales from the 2000-01 season through the 2004-05 season.Over the same

period, Pakistan grew domestic production of cotton by 3.1 million bales, from 8.2 million to 11.3

million bales, or 38 percent.

Consumption And Supply Rise In Turkey

Expanding consumption of cotton by 35 percent, from 5.2 million to 7 million bales over the

measured period, Turkey is a net importer of cotton. Even though it increased domestic production

by 17 percent, from 3.6 million to 4.2 million bales, Turkey exceeded domestic supply by 1.6

million bales in 2000-01 and 2.8 million bales in 2004-05.

US Consumption Declines, Supply Increases

As the fifth-largest cotton consumer and the second-largest cotton producer, the United

States has a unique position in the world of cotton. US cotton consumption has fallen by 25

percent, from 8.9 million bales in 2000-01 to 6.7 million bales in 2004-05.

Cotton production in the United States is up over the same period by 35 percent, from 17.2

million bales to 23.3 million bales. Over the measured period, the United States has gone from a

consumption level that represents 52 percent of domestic production to 29 percent of domestic

production. The United States also has shifted from third place in global consumption to fifth,

after Pakistan and Turkey.

Brazil:

Level Consumption, Increasing Supply

Brazil has had level consumption over the measured period, using 4.2 million bales of cotton.

Domestic supply has increased from 4.3 million to 5.9 million bales, so while consumption is flat,

domestic supply has risen 37 percent.

The Future

As economies continue to develop, the rising appetite for consumer goods should bode well for

the future of cotton. Innovations related to both the growth and the consumption of cotton continue

to expand the possibilities for this ancient fiber. Textile manufacturing systems continue to

advance, creating the necessary flexibility to increase quality as well as yield. Textile finishes

show promise in providing consumers with durability, performance and aesthetics, which aid in the

marketing of cotton products and satisfy the demands of a growing marketplace.

March/April 2006