Eighth Rate Cut Not Likely To Be Last

Evidence from the latest set of economic reports shows the U.S. economy weakened further in

August, and in the aftermath of the terrorists’ attacks, a recession is likely to be already in

progress. On the bright side, consumers keep spending, and the Federal Reserve stepped in with a

one-half-point cut in short-term interest rates. Further rate reductions are likely to follow to

prevent the economy from going into a deep recession.

The jobless rate increased to 4.9 percent in August from 4.5 percent in July. This climb was

the sharpest monthly increase since early in 1995. Nonfarm payrolls declined by 113,000, despite a

gain of 72,000 jobs in the service sector. Since March, total nonfarm employment is down by 323,000

jobs. With factory output down and a declining business investment, manufacturers slashed 141,000

jobs in August, bringing the total losses from a year ago to more than one million jobs.

Manufacturing employment is at its lowest level since 1964 — a sign that the weakness in U.S.

economic activity has turned into a recession.

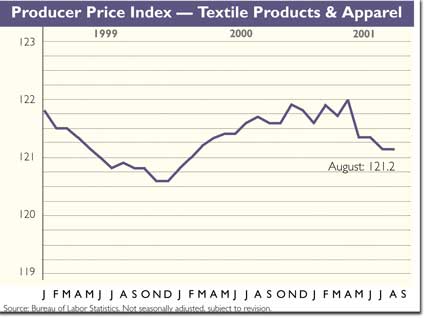

The Producer Price Index for finished goods rose 0.4 percent in August, after dropping 0.9

percent in July. The increase was due to a 1.1-percent rebound in energy prices following a 5.8

percent drop in July. Excluding food and energy, the price index slipped 0.1 percent in August,

after rising 0.1 percent in July.

Consumer Energy Prices Continue Decline

Consumer prices edged up 0.1 percent in August, after falling 0.3 percent in August. Energy

prices fell 1.9 percent in August on top of a 5.6 percent drop in July. Core inflation was up 0.2

percent for the second month in a row.

Industrial production dropped by 0.8 percent in August, after edging down 0.1 percent in

July. July’s figures had raised hopes that manufacturing was on the verge of a rebound. The monthly

decline was the 11th in a row, matching the longest stretch of industrial output weakness, which

occurred in 1960. The operating rate of industrial capacity fell to 76.2 percent from 76.9 percent

in July, the lowest level since July 1983.

With consumer confidence down, new housing construction fell 6.9 percent in August to 1.527

million starts.

The U.S. trade deficit of goods and services narrowed in July to $28.83 billion from $29.07

billion

in June. Both exports and imports declined, reflecting economic conditions in the U.S. and

abroad. Exports fell 2.5 percent to $83.73 billion, while imports came down 2.1 percent to $112.56

billion.

Business sales bounced 0.4 percent in July, after falling 1.5 percent in June. Meanwhile,

business inventories eased 0.4 percent. As a result, the July inventory-to-sales ratio edged down

to 1.42 in July from 1.43 the previous month.

Mixed Results Show Textile Output, Utilization Rate Rebound

Producer prices of textiles and apparel were unchanged in August after edging down 0.1 percent

in July. Prices jumped 1.9 percent for greige fabrics and rose 0.2 percent for home furnishings.

However, prices came down 0.4 percent for processed yarns and threads, fell 0.9 percent for

finished fabrics, declined 1.0 percent for synthetic fibers and dropped 1.3 percent for carpets.

Results for textiles and apparel were mixed. The industry’s payrolls declined 0.2 percent in

August, after falling 1.1 percent in July. The volatile jobless rate for textile mill workers came

down to 8.3 percent from a high of 9.1 percent in July.

Textile output increased 0.8 percent in August, after falling 2.4 percent in July. Output was

13.8 percent below the year ago level. The utilization rate for textiles moved up to 71.6 percent

of capacity from 70.8 percent in July.

Shipments by textile producers declined 0.8 percent in July after rising 1.7 percent in June.

Inventories were pared down by 1.3 percent. As a result, the inventory-to-sales ratio edged down to

1.66 from 1.67.

U.S. retail sales rose 0.3 percent in August, paced by sales gains of 1.2 percent at gasoline

stations, 0.9 percent at building materials and supplies stores and 0.6 percent at department

stores. Sales eased 0.2 percent for motor vehicles and parts and edged down 0.1 percent at

furniture and home furnishings stores. At apparel and accessory stores, sales declined 0.8 percent

in August after rising 1.0 percent in July.

October 2001