Terror Attacks Contribute To Economic Woes

The latest economic reports indicate a faltering U.S. economy that slid into recession in the

third quarter of this year. The unprecedented, vicious terrorist attacks on September 11

accelerated the downfall, as consumer anxiety rose and normal spending patterns were disrupted.

With increased security, consumer confidence is likely to be restored in the near future, and the

economy will rebound. Nonetheless, a recession is now unavoidable as consumer spending weakens

further due to widespread employment losses and the slashing of business capital spending budgets

continues.

In September, the U.S. economy lost 199,000 non-farm jobs, the largest decline since February

1991. The loss included 93,000 factory jobs. September 11 events had minimal impact on employment

counts due to timing and the underlying assumptions. The impact on payrolls will be more evident in

October’s results. The September jobless rate was unchanged at 4.9 percent.

The Producer Price Index for finished goods rose 0.4 percent in September. Energy prices

jumped 0.9 percent, while food prices rose 0.2 percent. Excluding food and energy, the price index

was up 0.3 percent.

Consumer prices increased 0.4 percent in August, largely driven by apparel and energy costs.

Energy costs soared 2.6 percent. The core inflation rose 0.2 percent.

Trade Deficit Narrows

The U.S. trade deficit of goods and services narrowed in August to $27.11 billion from $29.17

billion in July and was the lowest level in 19 months. Exports — led by industrial supplies;

automotive products; and food, feeds and beverages — rose by 1.0 percent to $84.46 billion. Imports

declined 1.1 percent to $111.57 billion. Industrial production fell 1.0 percent in September. This

was the 12th consecutive monthly decline. Factory output fell 1.1 percent.

In the third quarter, industrial output plunged 6.2 percent at an annual rate, on top of

declines of 4.4 percent in the second quarter and 6.8 percent in the first quarter. Output fell

across all industries except for motor vehicles and parts, and lumber and products.

The operating rate of industrial capacity dipped to 75.5 percent in September and was the

lowest since June of 1983.

Housing starts rose 1.7 percent in September to an annual rate of 1.574 million units, but

declined 7.0 percent at an annual rate in the third quarter. Single-family units rose 0.6 percent

to 1.268 million.

Business sales edged up 0.1 percent

in August, while business inventories were drawn down 0.1 percent — the smallest drop in seven

months and a positive sign. As a result, the August inventory-to-sales ratio was left intact at

1.42.

Textile Mill Jobless Rates Decline Despite Job Cuts

Textile and apparel payrolls fell 0.9 percent in September, but the volatile jobless rate for

textile mill workers eased to 7.3 percent from 8.2 percent in August.

Textile output decreased 0.9 percent in September and tumbled 14.4 percent at an annual rate

in the third quarter — off 14.5 percent from a year ago. The utilization rate for textiles dropped

to 71.0 percent of capacity.

Shipments by textile producers declined 1.5 percent in August, while inventories were reduced

by 0.5 percent, causing the inventory-to-sales ratio to move up to 1.68 from 1.66.

Retail and food services sales collapsed 2.4 percent in September, as consumers avoided the

shopping malls after the terrorist attacks, while motor vehicle sales slumped 4.6 percent.

Excluding autos, retail sales were down 2.1 percent. Sales were up 3.0 percent at gasoline

stations, 0.8 percent at health and personal care stores and 0.4 percent at food and beverage

stores. Sales fell 0.4 percent for general merchandise, 1.5 percent for furniture and home

furnishings, 2.2 percent for building materials and hardware, and 5.9 percent for apparel and

accessories.

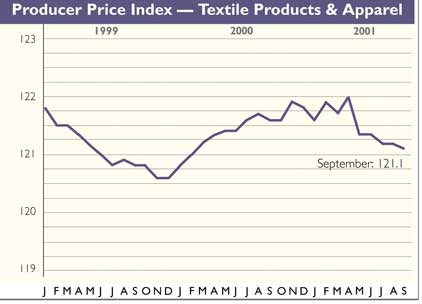

Producer prices of textiles and apparel edged down 0.1 percent in September. Prices rebounded

0.7 percent for synthetic fibers and 0.2 percent for finished fabrics. Prices retreated 0.7 percent

for greige fabrics, 0.4 percent for processed yarns and threads, 0.3 percent for carpets and 0.2

percent for home furnishings.

November 2001