T

T

he euro is the new currency that fuels economic growth by making it as easy to do

business across Europe’s national borders as it is across the United States. Thus, it provides a

sales and marketing tool the likes of which has never been seen before, whether selling, buying or

investing.

To understand the euro you must know some basics about its history, how it works and why.

Armed with this knowledge it will be easy for your company to take advantage of it in Europe.

Dealing in euros as the medium of exchange makes doing business easier and convenient because the

euro places you in a fair, if not favorable competitive position against your U.S. and foreign

competitors.

What Is The Euro?

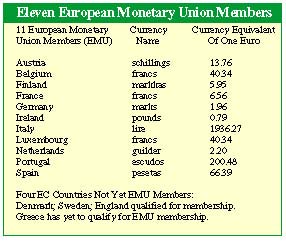

The euro arrived January 1, 1999. To

date, 11 of the 15 European Union (EU) countries have joined the European Monetary Union (EMU).

Switzerland, who is not an EU member, is adopting the euro as its second currency. Cuba has

switched from a dollar-denominated economy to a euro-denominated economy. These acts provide

optimism for the euro’s future.

In Cuba’s case, however, the reason is unusual. Since the U.S. embargo, much of the business

Cuba did with the United States shifted to Europe, so it makes sense for Cuba to be euro

denominated.

EMU members may use their national currencies as well as the euro, but all bank transactions

are exchanged to or from euros. But on December 31, 2002, national currencies will be consigned to

history and the euro will be the only medium of exchange for all EMU members.

Bank’s foreign currency operating expenses will be cut about 90 percent in 2002, and for

companies who deal in EMU currencies, they can reap all the benefits now.

How The Euro Works

Until 1999, hidden in the exchange

rate and fees were premiums of 3 to 8 percent. However, by 2003 there will be one conversion fee in

the EMU.

The euro works because each of its members’ currency exchange rates are fixed permanently to

the currencies of all the other members. Even though the EMU comprises 11 of the 15 EU nations

fixed currency values are the mechanism that allows the euro to be traded across EMU borders with

no change in value. Therefore, there is a zero exchange rate risk when dealing across EMU

borders.

EMU Membership

In 1998 the EU took certain steps so

that the Czech Republic, Hungary and Poland might be accepted into the Union within a few years.

In 1999, the EMU enacted a capped annual budget of $92 billian through 2006. Therefore, if

any or all of these states are admitted to the EU knowing their EMU membership costs in advance

helps them prepare to meet the EMU criteria.

In early 1998, both Denmark’s and Sweden’s publics, by small margins, voted against joining

the EMU. But a 9.5-mile tunnel, overland rail and vehicle bridge which connects the two markets was

almost finished. Sweden, whose economy is much larger than Denmark’s, would, for the first time,

have easy access to Europe’s mainland and its markets. Today the majority of voters in both

countries appear to have swung in favor of the EMU, and the consensus is that they will join the

EMU by 2003 latest.

In spring 1999, England announced it would probably join the EMUby 2002 (after their

national elections).

By September 1999, British Foreign Secretary Robin Cook, addressing a group of executives in

Tokyo, said that the euro is already bringing new strength to EMU’s economies and lauded the euro

as a positive economic force. Normally, nobody would pay much attention to Cook’s remarks but the

euro has become a political issue between the Labor and Conservative Parties. Part of the problem

is that interest rates in England are about double those in the EMU.

A few English towns are experimenting with the use of the euro, and it is now believed that

the consuming public has come around to believing that the euro will be a good thing for England.

Most internationalists believe that England has little choice and must join the EMU to remain

competitive.

On September 5, 1999, Greece, which has been working hard to meet the criteria, announced it

would apply for EMU membership in March 2000, for EMU approval in June. Greece’s inflation rate for

July was 2.1 percent and its annualized inflation rate might be low enough by this March. There are

internal political issues that might come into play which could cause Greece to withdraw its

application for EMU membership.

The Long Road

To appreciate how difficult and long

the road to Euroland was we must go back to 1946. Winston Churchill, England’s famous Prime

Minister, envisioned a United States of Europe as it began recovering from the devastation of World

War II.

Together with a few of Europe’s leaders, he realized that each country’s economy could not

sustain itself independently against each other’s, nor could they stand up to the economic might of

the United States. Churchill’s dream crawled and clawed its way to become the 15-nation EU which

conceived, implemented and established the euro.

In the late 1940s, Belgium, the Netherlands and Luxemburg formed the first European Common

Market. As a result of the Treaty of Rome (1957), France and Italy joined and the “Benelux” became

the “Common Market.” As its membership grew, the name changed to the European Economic Community

(EEC).

The euro, even though four EU countries have yet to join the EMU, is backed by the 15 EU

currencies. (Many continue to refer to the euro as the euro dollar. The euro is the euro and the

euro dollar is something different.)

In 1986, the EU took a gigantic step and agreed that all member nations would be internally

duty free by 1993. This act gave the European textile industry a boost by broadening its markets on

the continent.

In 1991, the Maastricht (Holland) Treaty formed the European Monetary Union and the European

Central Bank (ECB) over which political leaders have no say.

Further, it provides that one currency must be implemented by January 1, 1999 for EU members

who meet EMU membership criteria.

In 1995, the first try failed, but the Treaty of Cannes put a new plan together. Every

detail of the EMU had to be approved by all not later than May 1998.

Modern Miracle

Imagine the more than 2,000 matters

the myriad of sub-committees had to deal with and have ratified so the euro could arrive on time.

It boggles the mind to think of 15 independent national legislatures, with their internal politics

and national pride, could achieve unanimity and that 11 nations would opt to join the EMU.

The Maastricht Treaty, which put

teeth into the EMU, was worked out by Europe’s industrial powerhouses — Germany, France, Italy and

England — without consulting any of their other EU partners. Yet eight more nations joined while

England did not.

The ECB operates with complete independence and every EMU member’s central bank relinquished

its powers to control ECB policies even though ECB decisions might directly affect their nation’s

economies. In effect, national central banks, which act like the Federal Reserve Bank, made

themselves subservient to the ECB, which establishes interest rates, protects currency, etc.

Every rule and act relating to the EMU had to be unanimously ratified by all 15 EU members

by May 1998.

The euro arrived on January 1, 1999 and though the permanent exchange rates equaled a value

of 1.00 = $1.05 it opened at $1.17 and fluctuated between $1.14 and $1.18 for a few weeks.

Afterwards, it fluctuated between $1.04 and $1.09 through October 1999. There were a few days when

it dipped to about $1.02.

Though the euro’s performance has been less than what had been expected, optimism about the

future of the euro as the powerhouse that drives business has not waned.

There is little room for doubt that the euro is a sales and profit driver, something U.S.

textile companies sorely need.

EMU Requirements

1) A nation’s budget deficit may not

exceed 3 percent* of Gross Domestic Product (GDP).

2) As of January 1, 1999, inflation cannot exceed 2.7 percent*. The formula that determines

the rate follows: the inflation rate for any member may not be more than 1.5-percent higher than

the average inflation rate of the three member countries with the lowest rates of inflation.

3) Long-term interest rates may not exceed 7.8 percent*. Formula: Long-term interest rates

may not exceed 2 percent of the average inflation rate of the three member nations with the lowest

inflation rates.

4) Total outstanding government debt must not exceed 60 percent* of GDP or working towards

this target.

5) A member nation’s currency should have remained within normal fluctuation margins for at

least two years before the decision is made to join the EMU. This is an over simplification of a

highly complex matter.

*based on 1997 performance — Rates may change annually.

January 2000